A sports stock worth buying? Catapult Group (CAT.ASX)

Plus: Buffett sells, Smith buys, PPI declines

Stock in focus: Catapult Group (CAT.ASX)

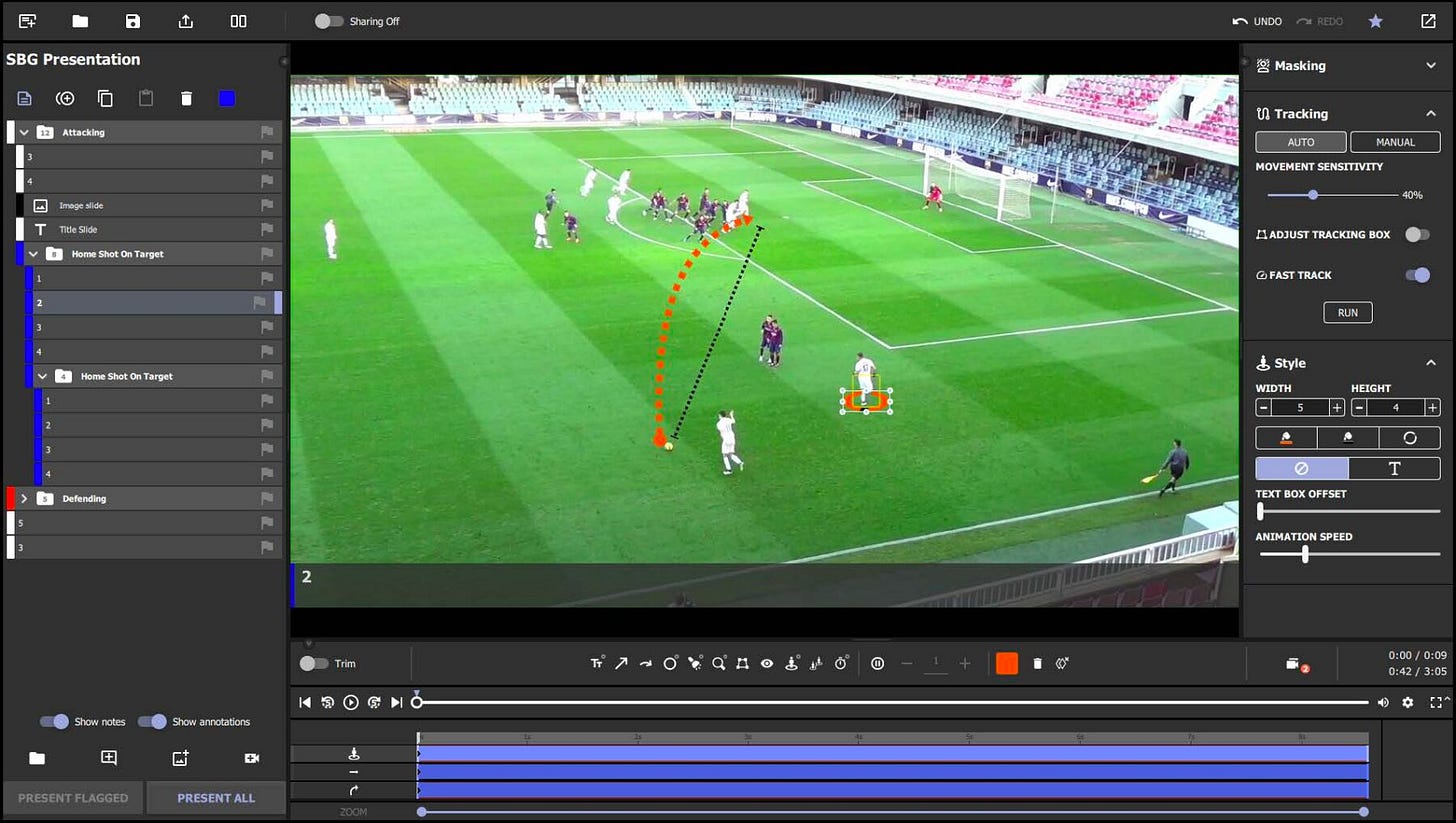

This came across our desk recently and we think it’s worth adding in smalls. What do Manchester United, Formula One and the Golden State Warriors have in common? They all use Catapult — software which allows sports teams to monitor athletes, analyse game footage (in real-time and after), and process every piece of data that is generated. Remember Money Ball? This is like Money Ball for the modern age. Used by 2,300 teams and listed on the ASX.

In terms of numbers — Nearly US$16m cash flow> H1FY23 (pre capex) & US$11m> H2FY23. Trading at $275mn — small market cap which we think leaves it open to a PE bid. ARR of $79.7mn (+20.6% YoY). Trading at 10x pre-capex cash flow, growing +20% per year, low churn rate (3.6%). Presentation here.

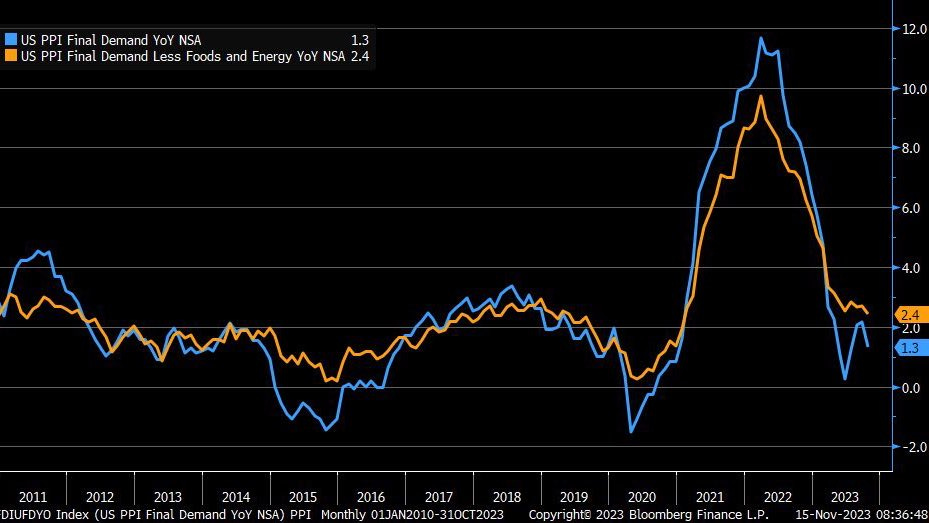

Macro — PPI declines

US PPI declined the most since April 2020 — -0.5% vs 0.1% expected MoM, YoY: 1.3% vs 1.9% expected — we read this as a soft sign that deflation is starting to be felt, but it’s bearish in terms of production — production is softening.

NZ/AUS

A2 Milk — Flat after its ASM. EBITDA margins mainly flat, but mgmt’s warning on China is hardly music to our ears. Trading at about 20x NPAT. No use crying over spilt milk…

EBOS — In a trading halt after press speculation that the company is engage in a transaction with Greencross, the Aussie healthcare provider — we say “engage” because at a $3.5bn valuation (Greencross’ 2022 valuation) makes it a bit of a big target — EBOS is valued at $7bn. We like EBOS, we like the mgmt, and we like buying it at these levels (after the trading halt!)

Infratil — No news is good news — 1H24 doesn’t tell us anything we don’t know. Group guidance lifted to $820-850mn. Continues to trade in the $10.00 range — “fair” value.

BlackPearl — Noting CEO Nick Lissette has ceased to have a substantial holding, after the co’s recent cap raise diluted his ownership from 6.90% to 4.70%.

It’s 13F season — sharpen your pencils

It’s 13f season — where fund managers disclose to the SEC what they’ve been buying and selling. We’ll start with Buffett’s Berkshire. Tl;dr — Buffett is sitting on a massive pile of cash (yielding +5.00%, remember) and he sold a lot of stuff - General Motors, J&J, Proctor and Gamble & UPS. Berkshire trimmed positions in Amazon, Chevron and HP. Berkshire now has $157 billion dollars of cold hard American dollars. Ye-haw.

Noting Fundsmith (we love Terry Smith — be still my beating heart) has added small positions in McDonald’s, Marriott, Dominos, and Home Depot. We’re buy rated on all three that we cover (MCD, DPZ, HD) and no view on Marriott. Smith has often said that one of his biggest regrets was selling out of Dominos — nice to see him jump back in.

Changes to our global model portfolio: Up +.5.51% YTD, paltry because i) we didn’t go heavy enough on tech and ii) our Manchester United arbitrage play didn’t work out. You live, you learn…sometimes slowly. Our Activision Blizzard arbitrage more than made up for our MANU losses, but nobody is patting themselves on the back for merely treading water). Cut our tech exposure almost totally (predictably, Alphabet, Amazon, Microsoft and Adobe lead the portfolio in gains) and added to Dominos, Exor, Diageo, Booking Holdings, Christian Dior and Estee Lauder. New positions: Robertet, L’Oreal, Churchill Downs, Liberty Media Formula One. Top holdings are Christian Dior SE, Manchester United, Dominos Pizza, Exor N.V, L’Oreal. We have to agree with fundie Nick Train who said of the MANU sales process — an “extraordinarily convoluted and lengthy process”