AUD moves south | Ray Dalio's "radical honesty"| Three stock ideas

FX

The AU tumbling heading into a volatile weekend, as support holds at the 0.6350 level. The Aussie bulls are getting pushed aside as flows continue to hold strong into the greenback following FED chat Powell's well-delivered hawkish comments. Data from the US continued to support a DXY rally as jobless claims climbed to its highest level since mid-April, investors now turn their attention to the Michigan Consumer Sentiment survey heading into the week close. China sneezing continuously could also pierce the Aussie Dollar immunity heading into the year end. Should markets close above support 0.6350, we could see consolidation on the pair between 0.64000 and 0.6350 as an established short term range, however, technicals are firmly pointing south, implicating a break of 0.350 leading into next support target at 0.63190.

Arts & Letters

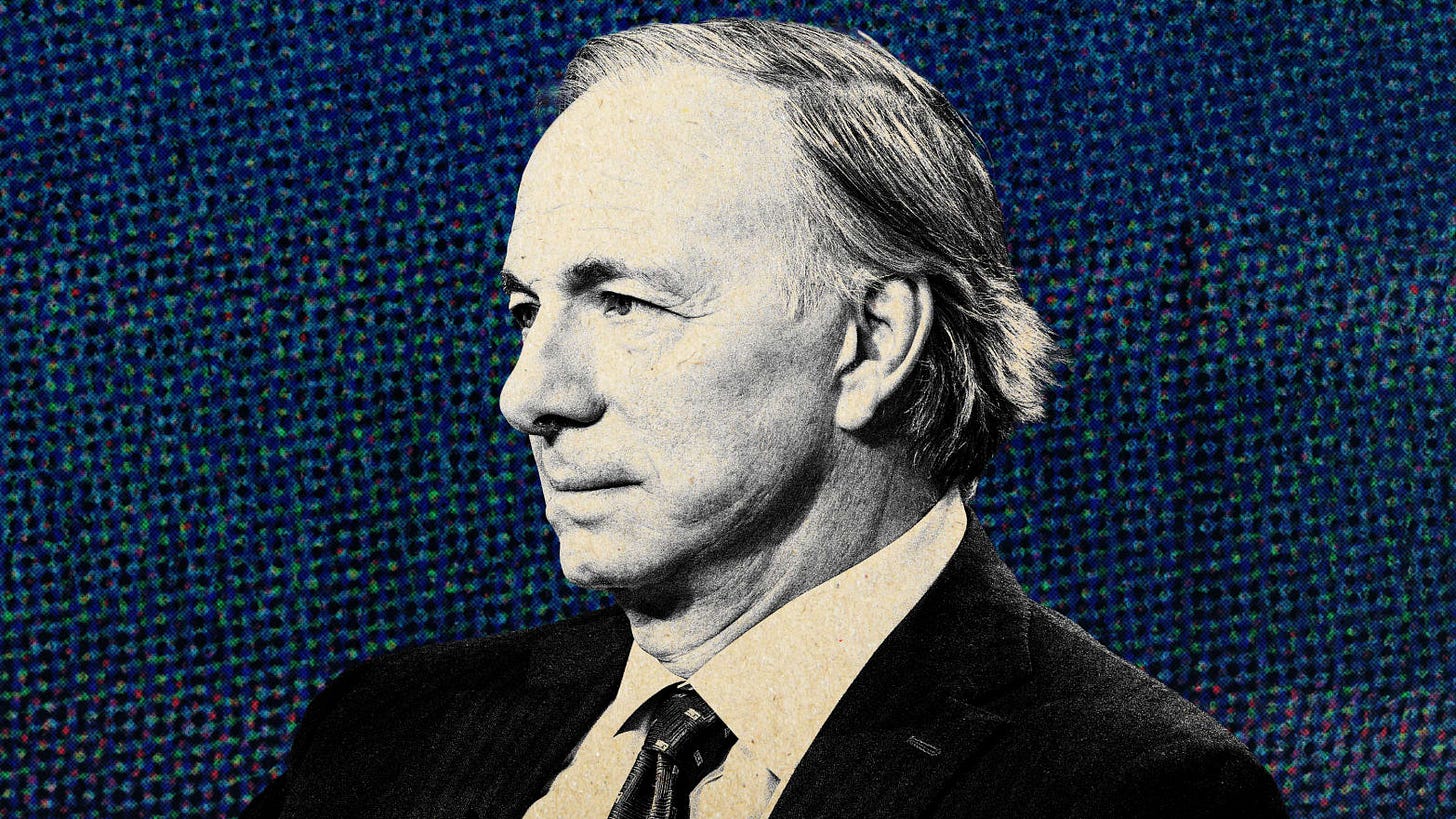

Ray Dalio’s ‘radical honesty’ > Good review of “The Fund”, a new book exploring the unorthodox and sometimes dysfunctional culture of Bridgewater, founded by self-styled “Philosopher King” Ray Dalio. Dalio makes employees break down:

It’s hard to say what is the most jaw-dropping moment. Perhaps it is when Dalio is described as berating a pregnant protégée in front of the whole senior management team until she breaks down weeping (and shares a video of it with the entire firm)

And gets involved with cafeteria food, and whiteboards:

Dalio at one point personally gets involved with complaints over the cafeteria food and doggedly hounds an unfortunate facilities manager, who later becomes unwell. There’s a six-week inquest into the state of whiteboards. Another time, Dalio orchestrates an extensive investigation to find out who left some errant pee next to a urinal.

Dalio is worth 15 billion dollars and Bridgewater looks after $128bn. Just for context. But, you know, whiteboards.

NZ/AUS

Metro Performance Glass > noting director Mark Eglinton has resigned. Masfen and co made a bid for the company earlier this year, and we’re wondering if they make an improved offer as weak trading conditions bite across the building sector. We were at the AGM earlier this yr — thought mgmt had a lot to improve upon and a takeover is the best the company could hope for at this point.

Mainfreight > we know you’re probably sick of hearing about it, but the stock rallied +8.00% after reporting a better-than-expected result. Trading at 21x earnings, ahead of peers (DSV 18x, FRW 19x) and deservedly so — you pay a premium for good mgmt. We still think there’s room to move, if you are patient.

Allbirds > we love the shoes, but the stock — not sure much. Trading at 72 cents. Down almost 80% YTD. The company was once valued at +$1bn, now it is worth very little. Losses for the FY +$100mn, more than double its losses the year previous. The company’s strategy to expand into yoga mats, pants, etc didn’t work. Bricks and mortar is expensive. We don’t see any value here. Falling knife.

My Food Bag > Habour/Jarden keeps selling down its holding in the meal kit company, taking its stake down to 5.00%. Saturated market, low margins…we wouldn’t touch the stock with a ten-foot barge pole.

Three stock ideas:

DGL (ASX) > DGL is very boring. They do chemical manufacturing, storage and transport. They are trading at 6x EBITDA. People need chemicals and they need to be stored somewhere. DGL is a serial acquirer - they eat up smaller companies that do the same thing. Their stock price is depressed because of increased interest costs, while margin pressures are coming from the cost of inputs. Trading at ~75c, we think it is worth $1.20.

Churchill Downs (CHDN) > They own the Kentucky Derby. They also own a lot of wagering operations and casinos, but we view their primary asset as the Derby & the associated brand — that history can’t be replicated; it’s an irreplaceable asset. Trading at 23x earnings, grown topline revenue at 15% over the last 5 years.

Liberty Media Corporation Series A Liberty Formula One > we talked a little bit about John Malone y’day with Warner Brothers, but he also controls Liberty Media via a complex stock structure; one of the assets they own is Formula One. We take the same view as we do with Churchill Downs — Formula One is a irreplaceable asset that is hard to replicate. They own the entire sports franchise. It’s like owning all of rugby. Worth quoting the excellent Nick Sleep on why we see value in owning a franchise, from his reasoning for owning International Speedway, the owner of NASCAR:

Until quite recently motor racing has been a very fragmented sport: sanctioning bodies have tended to splinter into rival factions which form their own leagues, and the racetracks have developed on an ad hoc basis (some were originally perimeter roads to local airstrips) and remained under family ownership. Formula One with its dominant sanctioning body and almost totalitarian leadership under Bernie Ecclestone is both the exception, and due to its huge commercial success, the benchmark. International Speedway has grown through building and buying circuits throughout the south east and more recently elsewhere in the US. But the real prize from consolidation is that the firm has substantially improved its bargaining position with the broadcasting companies. Instead of their being more tracks and sanctioning bodies than media buyers, the tables have now been reversed.