NZ/AUS

Nada in NZ. Precious little in Aus. Quiet day — go play some golf and get away from the computer screen. Get some fresh air in you. Buy some Infratil, and go to the links. Lots more bidders in the arena for RAK… DUR in Aus is about 1.21…

Housing

I told you guys this isn’t going to be a housing newsletter — I write about stocks! And occasionally I write about the macro implications of New Zealand’s unique set of tax laws and incentives, which has created a real estate market distorted from reality. But a few people sent me articles like this one , where ANZ says — breathlessly — that maybe you should be the best frands of the banks and get a 6 month mortgage because rates will drop next year! Perhaps earlier than expected!

“While there are never any guarantees, confidence is growing that the peak in mortgage rates is behind us and that they will fall over coming quarters as wholesale rates drift lower. That lends itself to borrowers fixing a portion of debt for a shorter term now, with a plan to re-fix again once rates have fallen”

The catch is two innocent little words within that quote — wholesale rates — NZ banks are infamously slow at passing on wholesale rates to the consumer. They want to have their cake and eat it too — get a mortgage with us now (please!) but also, we will pass on rates — I don’t know — whenever! Who is checking! Who cares!

Here’s the other thing — shipping rates.

This is the other reason I think that we’re not going to see interest rates be cut until late next year. Shipping rates and freight forwarding rates are only going up in cost — and accelerating rapidly. This was one of the precursors and drivers of inflation last time around; I expect it to be the same this time around too. And you know, people are still spending — the RBNZ frustratingly only releases CPI information quarterly (why!) but a hot inflation print across the ditch is hardly reassuring. You can conduct your own on the ground research: go into a pub or restaurant or Soul Bar, and you’ll find people are still ordering the $15 beers and $25 cocktails.

Here is an article in NBR about steel order books being down 40%. Bubbles always pop.

France

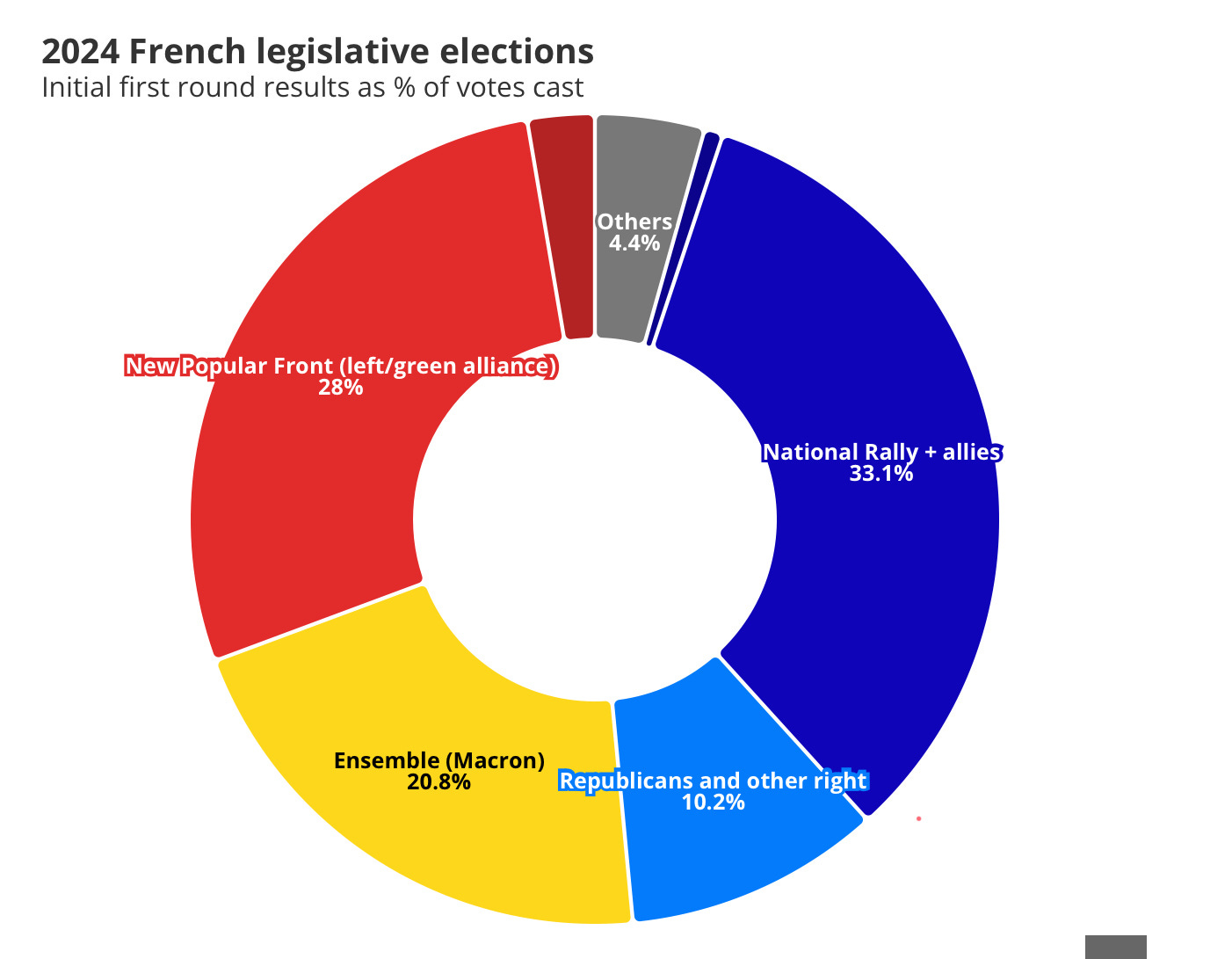

Ok I said I am not writing a macro newsletter — but I lied — today only, folks. France held its first round of elections and Le Pen’s “far right” party really trounced it.

Nobody should be surprised here — if you have been to France recently you will notice two truths — i) everyone hates the Paris Olympics, which are about as badly organised as a NZ government department organising a piss-up, and ii) everybody hates Macron. Macron is, in some ways, the last bastion of failed neoliberalism — Rishi “my parents didn’t have Sky TV” Sunak is on his way out in the UK, Biden is a trainwreck in the US, and the legacy of Ardern’s government is mixed to say the least. It’s no surprise that Le Pen’s party took the lion’s share of votes in the first round.

Remember though, this is the first round, and National Rally (NR) needs an absolute majority to make change — otherwise, Macron remains as a force of Veto until his term expires. Hung parliament, in other words — ineffective and neutered.

Differential on Europe stocks vs the French index is about 6.00% — this is a wide gap — and in my mind a “gimme” — if you want to do the Druckenmiller “big brain” trade (when Argentina’s new axe-wielding president got in, he just bought the five most liquid ADRs. So I mean, you could just buy the French index and forget about the rest. If you were a little more quality oriented, you could buy Remy, Pernod, and LVMH. But really — the trade is the differential — markets are pricing in either a right or left wing majority, when I think the result will actually be a neutered parliament given Macron’s powers as president. Trade at your own risk, etc.

Barry Diller

You might say to me: Barry Diller is still alive?! He is, he’s 82, and he’s…making a bid for Paramount?!

Regular readers of this newsletter will recall that I have been chronicling this transaction forever — it feels like forever! The story goes — Shari owns Paramount, Paramount needs to be sold, and there’s been no end of suitors — the most prominent being, of course, David Ellison, son of Larry.

Now Diller’s IAC is looking at acquiring Shari’s holding company, National Amusements. This doesn’t mean a lot — a lot of people have made bids for the company — but it would be a symbolic victory for Diller, who was first made head of Paramount at the age of 32, and then made a bid for the co in the 90s — he was outbid by Shari’s father, Sumner.

I should explain IAC a bit more, too — IAC is unique in that it acts as a whale that consumes a company and then vomits it up in the form of a sale or spin-off at some point in the future. The value of IAC is always very approximate, and subject to fluctuation, because there’s always some kind of transaction happening — it’s sum of the parts investing but the parts are always at risk at being thrown up into the wide open stock market. It owned Match.com, the Tinder owner, before spinning it off, and also owned Expedia, the travel site.

Here is a graphic that non exhaustively details some of the deals IAC has been involved with.

There’s a few things that should be on there that aren’t — for instance, Diller’s continued funding of The Daily Beast (when was The Daily Beast still relevant?!) — while it’s barely a line item, it underscores that IAC is really Diller’s company, and he likes The Daily Beast, so it will continue. This is ironically a bit like how Sumner Redstone ran Paramount, except Diller is possibly the smartest 82 year old in tech — while his contemporaries, like Redstone, were still playing in the field of old media (or buying MySpace like Rupert Murdoch, ha ha), Diller was busy buying TripAdvisor, incubating Tinder — I mean, he’s impressive — as is Joey Levin, his protege and CEO.

IAC trades at a perpetual discount because of its always-moving book of investments, and the fact that it is Diller’s personal playground — this is a little like John Malone, whose web of “Liberty” stocks easily befuddles most. The other honourable mention here is Bill Foley, who has connections to NZ via Foley family wines. Foley’s empire of deal making is baffling. It puts Malone and Diller to shame!

Anyway, look — that’s a tangent. But how cool — I wish I could make that many deals as shrewdly as Bill Foley! I take the Buffett and Munger approach to IAC, though — too complicated, move on. It’s a great vehicle to make Diller and co rich(er), just as Malone’s cos mostly benefit him and Bill Foley’s benefit him. Nothing wrong with that. It’s an old school version of deal-making that is little practiced in NZ. It’s the equivalent of Ricky Jay’s slight-of-hand with a card deck. I admire it!

IAC buying Paramount makes a lot of sense, though. Diller has wanted it forever. He’s an adept runner of media — remember, under him Paramount was the studio. Here’s Diller in ‘94, quoted in the “failing” New York Times

When did Barry Diller finally let go of the dream he had been nursing for so long to merge his company with Paramount Communications and oust an old rival while he was at it? In an interview, a prickly Mr. Diller would not say. "I don't want to get into any of that," he said from QVC Network Inc.'s offices in West Chester, Pa. "It's history."

Redstone eventually bought Paramount for $10bn — remember that Paramount now — including Viacom, CBS, etc — trades just a hair under $7bn. So maybe Diller was right to wait. Only took a decade or two.

Let’s take a moment to consider the value destruction which can be wrought in the stock market — Paramount, the studio, was an asset worth $10bn in 1994. Now it is worth — I don’t know — a couple of billion, maybe?? Depends on who you ask?

I hope — truly — that Diller gets to buy Paramount, because that would just be so delicious — he wanted the asset in the 90s; the managed the studio in the 70s; he will finally get it at the ripe old age of 82! It’s too good. Succession could never. This whole thing is a drama about Shari, the “no. 1 eldest boy” of Sumner Redstone, trying to live up to her dad (and failing), and also trying to hock off her holding company, National Amusements — a company, I remind you, that has i) a lot of ageing cinemas and ii) debt personally owed to Byron Trott, Warren Buffett’s favourite banker.

As I’ve said before — there’s a lot of things that preclude a deal happening. Class B holders of Paramount stock need to be happy — that was a condition partially satisfied by David Ellison’s offer, but it took money away from Shari.

Diller is a strange one. I can imagine him buying NA, not recapitalising any of Paramount save for debt, and running it as a holding company owned by another holding company (IAC). The class B shareholder thing — like Manchester United and Ratcliffe’s buyout — may be put into the “too hard” basket. I can also imagine him buying it and hocking off CBS to say, Jeff Zucker — Diller is likely after the studio asset. CBS is still worth a bit — but like all of “old media”, how much it is worth depends on who you ask.

Anyway, here is a picture taken by Warhol of Diller and his wife, DvF, in the 70s.