You have to admire the chutzpah of Allan Gray, the fund manager. They just upped their stake in Fletchers to 17% (link). Secretly, in my brain, I think of Allan Gray like this.

INT. ALLAN GRAY OFFICES, a team of analysts sit at their desks, furiously typing on their Bloomberg terminals. There is a bin full of discarded Gomez e Guzman burritos, their contents long gone. CNBC plays in the background. The SPECIAL RED ALLAN GRAY telephone lights up, and a portfolio manager rushes to answer it.

Portfolio manager: This is Allan Gray speaking

NZ stock market: You won’t believe it, but one of the most badly run companies on the NZX has gotten even cheaper!

Portfolio manager: Holy smokes. That’s the best news I’ve heard since my daughter Tortellini’s birth. What company?? I’ll get the suitcases full of money ready.

NZ stock market: The company is called Fletcher Building. Fle-tech-er Build-ing.

Portfolio manager: Great. Why is it so cheap?

NZ stock market: Well, this is kind of awkward, but they’ve, uh, you know — they’ve written off hundreds of millions in losses and have ongoing ligation in Australia and…

Portfolio manager: Say no more. I love it. Take my money!!

Then, I imagine Fletcher’s stock price going down even more and a cap raise being announced (which they previously denied).

INT. ALLAN GRAY OFFICES, MIDNIGHT.

NZ stock market (well, actually, Jarden, who oversaw the cap raise): Listen, Allan, you’re not going to believe this, but we’re doing a cap raise…

Allan Gray: You crazy bastards, I’m in!

I mean, I’m joking you guys — I’m joking. Obviously equity funds do not work like this, unless you are Stanley Druckenmiller and you see that there is a new chainsaw-wielding president who is extreme free market, and you just go, OK, let’s buy the most liquid stocks. I’m not joking!

The reason for buying large Argentine stocks is that we have paid attention to the capitalist reform of the current government…We bought the five most liquid ones [sic]

I don’t have to remind you that Druck is, basically, an “absolute legend”.

Anyway — Allan Gray actually published analysis of Fletchers in 2022, where they explained why they thought FBU was undervalued. It’s uh, sobering reading given that Fletchers now trades around half that.

Their “fair value” also makes sobering reading. Their downside is around 27% (in 2022). The downside, actually, to date, is around 65% or more. What happened? Construction cost overruns were a lot more, there were write-offs, there’s litigation, it has all been well reported…

The reason I write this is it shows just how hard it is to do an analysis of a “falling knife” — you could be kind of right in the long term — but that isn’t going to make you money. It also shows how a large firm like Allan Gray didn’t think about the downside enough — you always need to be thinking “am I a total idiot?” (I think it doesn’t matter if you are a large firm or a small firm, but, you know — look at who rushed to invest in the travesty of My Food Bag — most of those were well-staffed firms with large teams).

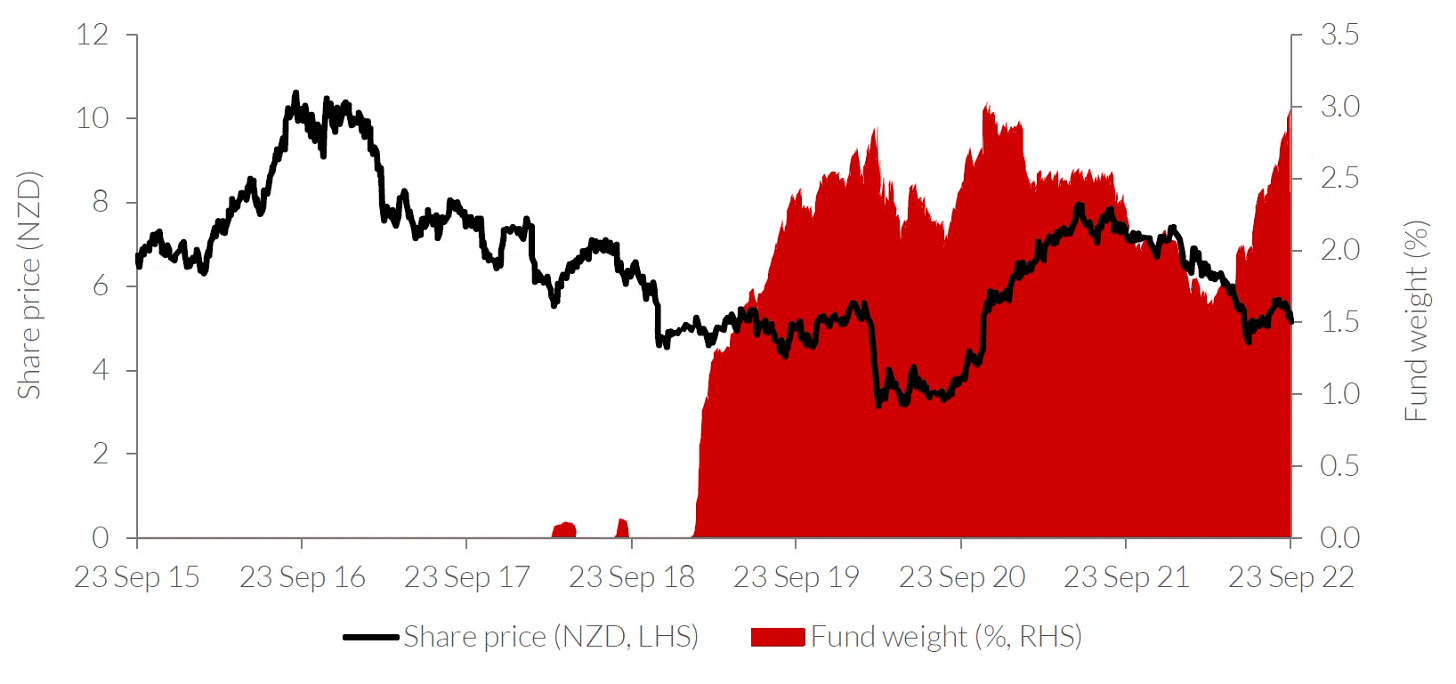

But going back to the falling knife thing — Fletcher Building has been a falling knife for a long time. See my detailed analysis below:

The thing with a falling knives is that they can keep falling — and keep falling for a long time. Also, when you look through Allan Gray’s portfolio (per Bloomberg), you can see just how much they like “the down and dirty!”

Would I want to own KMD (they own Kathmandu and Ripcurl — I’m not sure who buys that), Ansell or Downer? Also, SkyCity? I mean — probably not! But Allan Gray is lapping that up!

Now I would like to talk to you about one of my failures, Doc Martens. Look at that falling knife! It would’ve fallen through your hand, and your foot, and straight down to hell!

I have ruminated on Docs a lot. I think it’s a lot more honorable to talk about your failures. What went wrong with Docs? Basically, incompetent management, too much debt due to their private equity owners Permira saddling them up with it, and a botched plan to expand to the US.

It’s a falling knife. And it taught me to never trust a private equity listing on a public market without first letting the air seep out of the bag (again — My Food Bag is a good example of this, as was Olaplex). But hold on a second — Docs does actually make money. Per Bloomberg:

Docs trades at around 540 million quid. EBIT had shrunk due to an increased net debt load. Assuming debt is paid down, it’s not beyond the realms of possibility for EBIT to hit mid-150 quid by 2027. The important thing is they sell about the same amount of shoes. People still buy Docs.

If you have a company that generates x amount of revenue (about 800mn quid or so) and sells about the same amount of shoes, the issue is not the product. The issue is, actually, the debt load and the management (I don’t want to be too mean to Kenny Wilson, the outgoing CEO — it’s mostly Permira’s fault).

I am starting to wonder if something I have often talked about a failure is now cheap enough that it’s a buy. It almost looks like a distressed situation. It has become ignored by the UK market.

My assumptions are the following:

Docs keep selling, because people keep buying Docs.

Management can reduce the debt load

Management can become even slightly more competent

Permira are motivated to maintain their ~38% stake and actually find value for their investors in it (surely they can’t be happy with a ~87% drawdown since listing)

On a peer basis, Doc Martens trades well below its comps…

Is it a falling knife? Or does it get taken out by say, L Catterton or the like? Or am I being an idiot again? (it wouldn’t be the first time).

Should we be thinking about Spark on the NZX. Someone is shorting it as hard as they can.