I am the Head of Macro

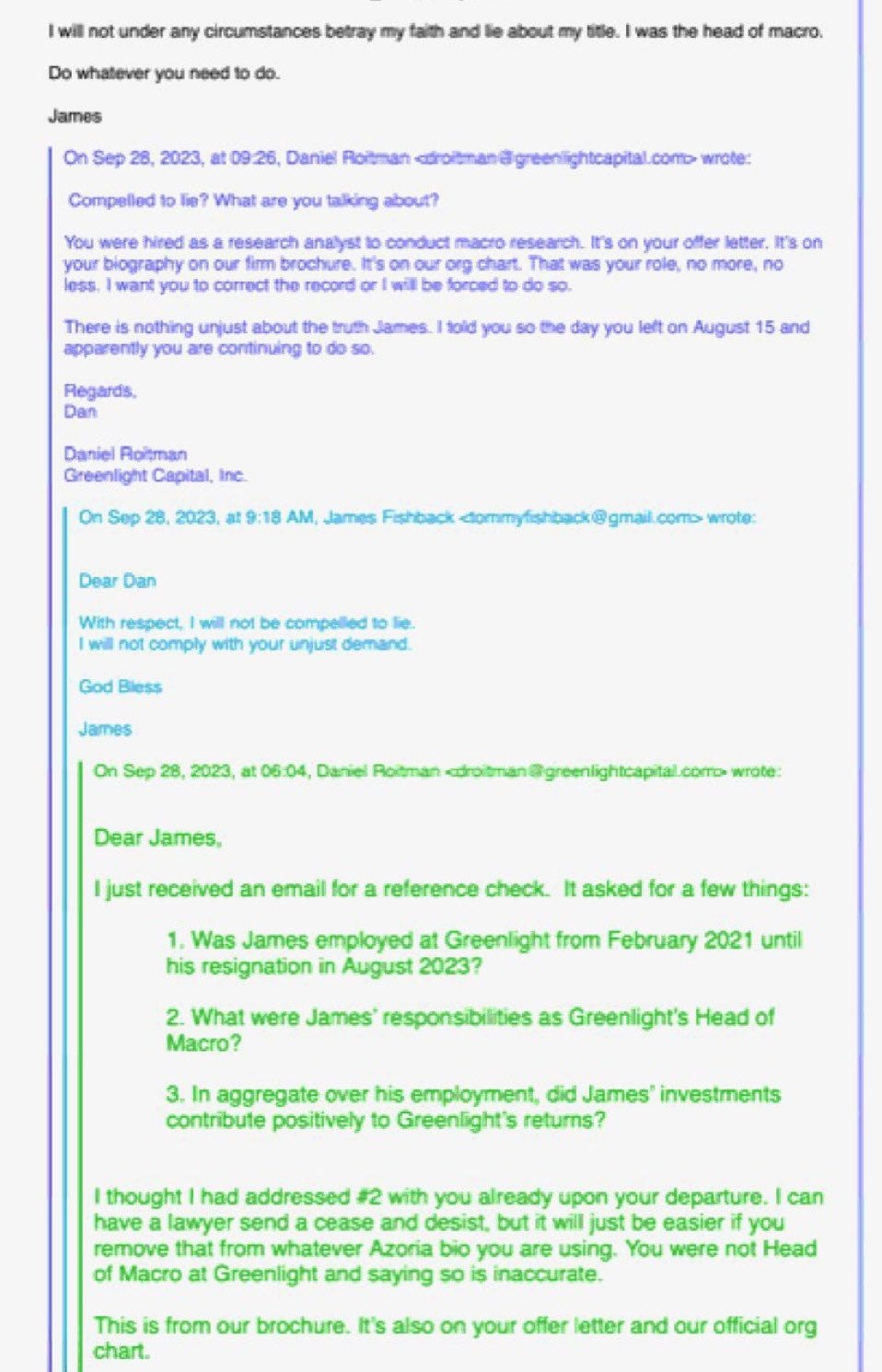

Imagine you go to a fund and you work for them for a while. Maybe you are doing macro stuff, I don’t know. You work the job and then you leave and start advertising yourself as “the former head of macro at ___”. No problem, right? If you were the head of macro, then advertising yourself as the former head of macro isn’t a big deal. But hold on a second — maybe your ex-employer actually doesn’t want you to do this. We can speculate on reasons as to why but for whatever reason your ex-employer doesn’t want you to promote yourself as the head of macro. In fact, your boss has gone as far as to issue cease and desist letters to podcasts that advertise you as the former head of macro. This actually happened last week, and it’s what I’ve spent my weekend watching with morbid curiosity. Former Greenlight employee James Fishback is literally going through this right now. Here’s the first thread, between Fishback and Dan Roitman, who’s the COO at Greenlight

God bless!

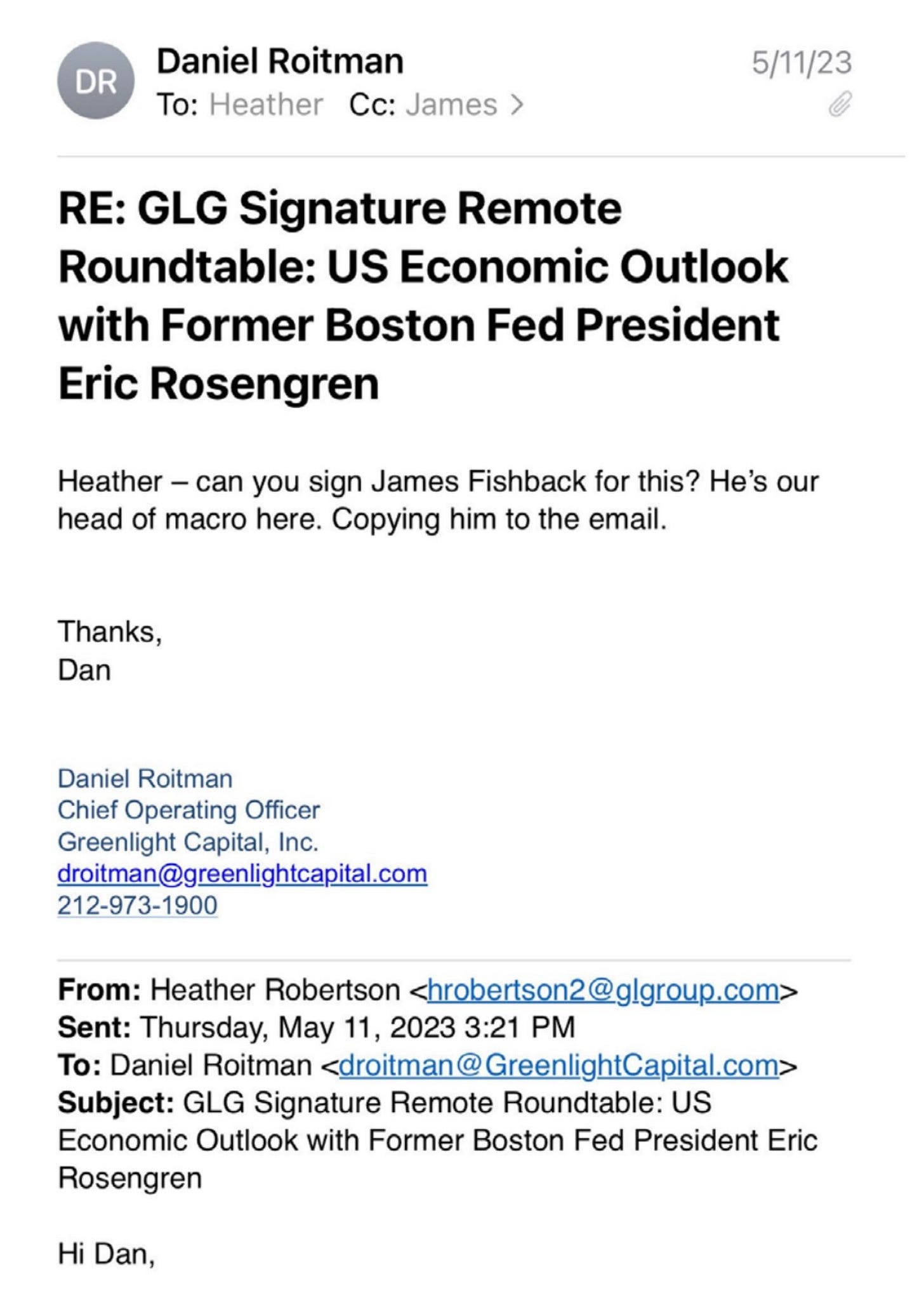

It gets better, though. Here is an email from Roitman where he appears to refer to Fishback as the “head of macro”:

OK? I mean, sure. Is he the head of macro or no? At this point, I’m confused. But it gets better — the OG pharma bro steps in from the sidelines with this little gem:

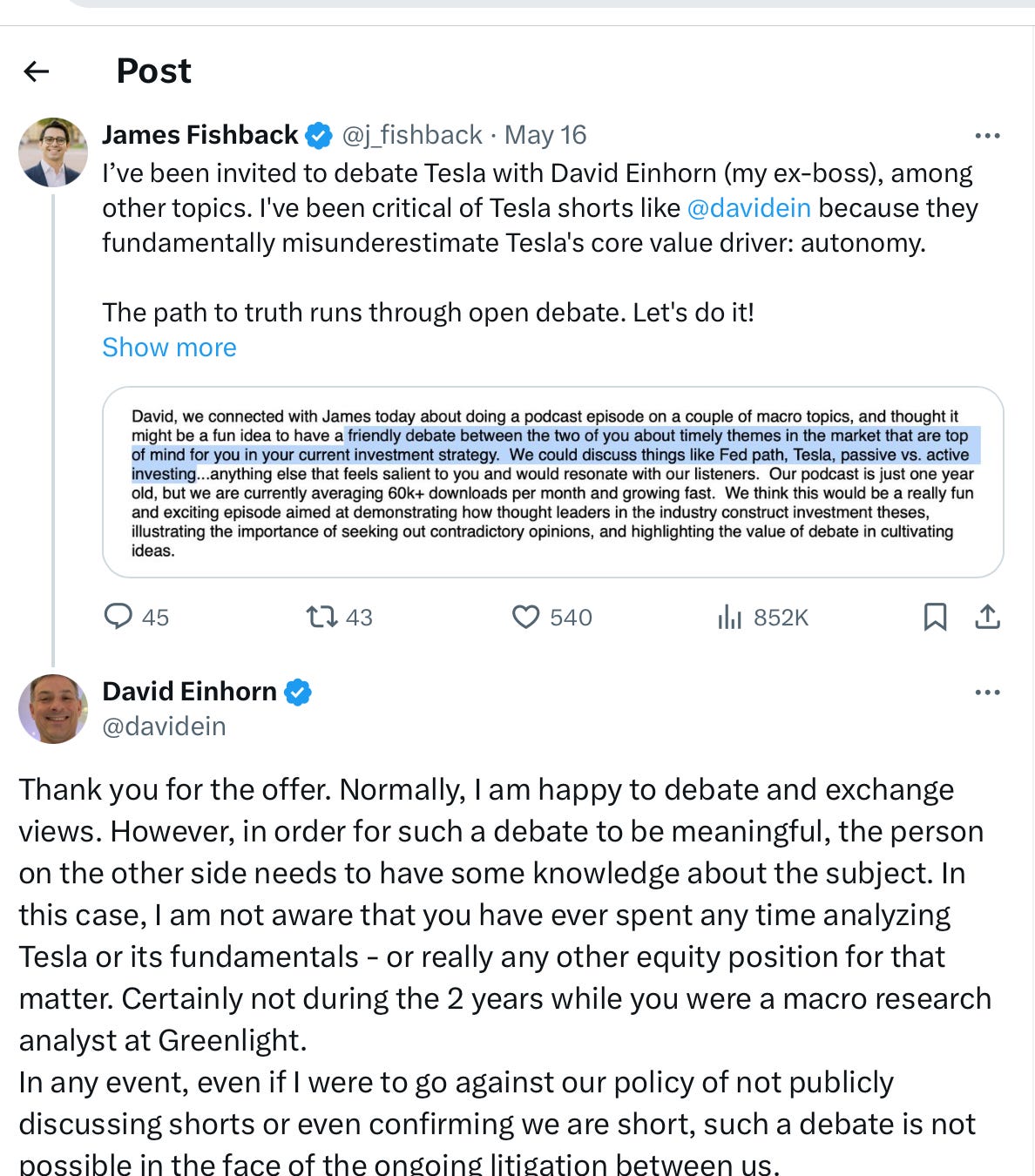

This sort of lends more credence to the “head of macro” thing. Citi is a legit bank and this is a real conference (and also, what does pharma bro have to gain here??). Anyway, finally you have Einhorn himself (the head of Greenlight) replying where Fishback offers to debate Einhorn on what else, but Tesla.

This feels like the most hedge fund thing ever — debating over “head of macro”, a title, and specifically a title of a job that Fishback has left (also, hilariously, both Greenlight and Fishback keep doubling down on their respective claims — “macro research analyst”; “ head of research”, etc). I don’t know, you guys. Maybe we’re in a simulation.

We are in a simulation pt II

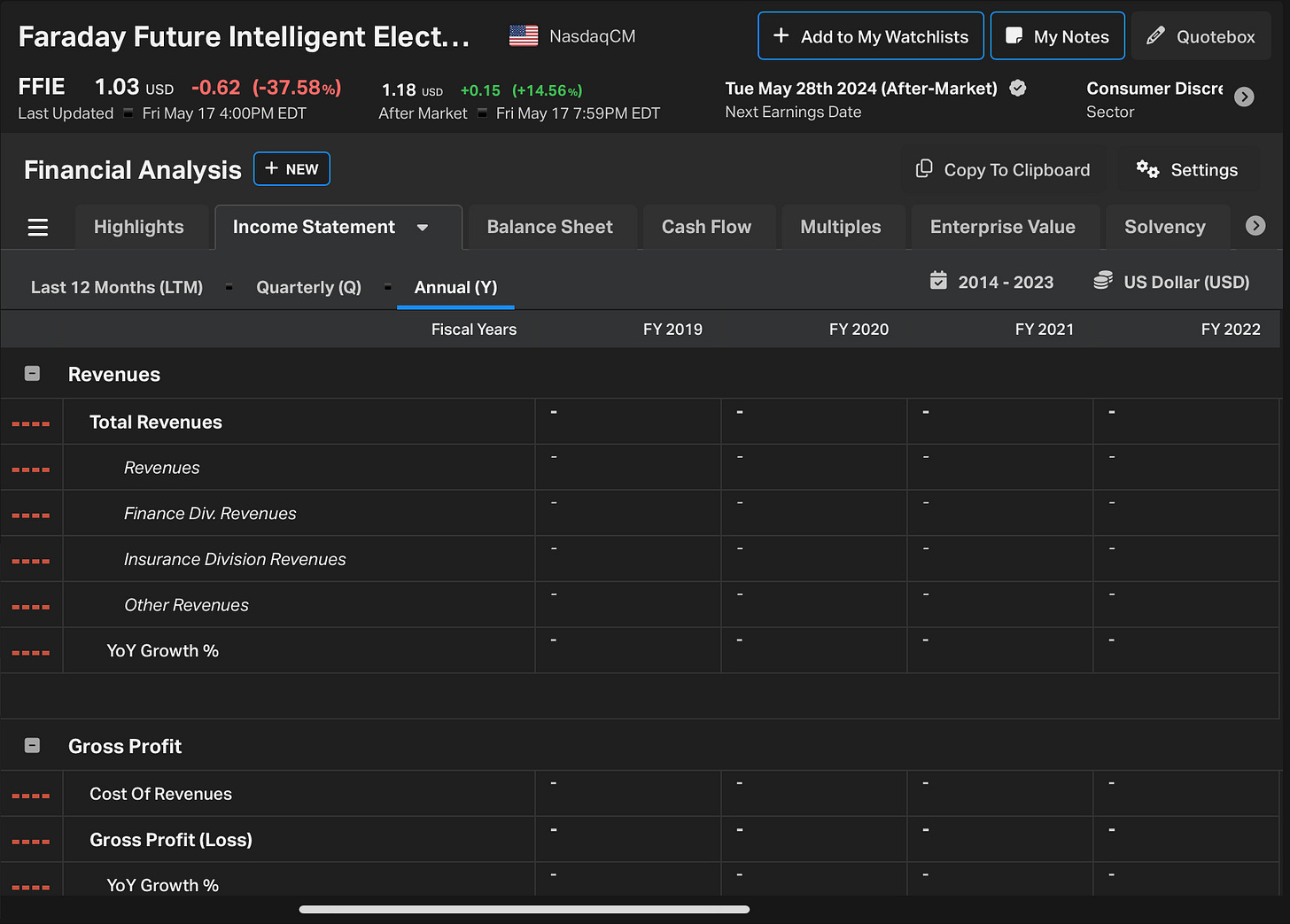

I don’t want to talk too much about Roaring Kitty because it isn’t that interesting, but I do want to talk about Faraday Future (FFIE) (not to be confused with the store for well-heeled ladies in Parnell), an awful stock that has not yet produced a car to market. NASDAQ wants to delist the stock as it had been trading under 10c for ten consecutive days. Also, the company failed to file a form 10-k on time (their annual report). TBH you are probably not missing out on much given their revenues look like this:

Anyway, we shorted a little of it last week — no revenue, in a dud area (EVs), burning money. Then a bunch of people from Reddit bid the thing up — at one point it went from 0.10 to $3.00 (I wasn’t sleeping well for a couple of days). I felt like I was back in 2021 with a clutch of Midwest American gas station workers bidding the thing up. We’re currently sitting flat on the position as the bottom rapidly fell out of the thing — from $3.00 to $1.00 in one day.

I want to share with you the nonsense statement about Faraday — it’s their own company description — maybe you can harness some of the learnings within it:

Faraday Future is the pioneer of the Ultimate AI TechLuxury ultra spire market in the intelligent EV era, and the disruptor of the traditional ultra-luxury car civilization epitomized by Ferrari and Maybach. FF is not just an EV company, but also a software-driven intelligent internet company. Ultimately FF aims to become a User Company by offering a shared intelligent mobility ecosystem. FF remains dedicated to advancing electric vehicle technology to meet the evolving needs and preferences of users worldwide, driven by a pursuit of intelligent and AI-driven mobility.

Things happen

Nick Grayston resigned from The Warehouse — Rebecca at Businessdesk got the scoop first, back in 2020, where she reported for The Spinoff on McKinsey and fellow “experts” charging the Warehouse a fortune for its trademark “agile” programmes. My question now is whether the Chair follows suit…after all, the board empowered Grayston to go on his wild goose chase…

Duratec released an updated guidance — FY24 EBITDA narrowed to $46-48mn, while delays to some expected projects mean that margins will err on the higher end. Tenders book increased to $1.47bn from $1.02bn, while order book decreased north of $10mn to $377mn. Stock dropped on news then came back. It’s a “nothing to see here” update — not concerned either way.

Shares in embattled casino Star surged after the hotel and casino operator confirmed an approach from Hard Rock Cafe (yes, they still exist). Speaking of casinos, our very own Sky City settled with AUSTRAC for $67mn Aussie dollaradoos.

I’ve been a bit more active on Twitter and am already regretting it — I can feel my brain melting into goo. There's a lot of value guys who are into Hello Fresh, the meal kit provider. It’s down 74% YTD. My two cents — the margins are always going to be razor thin, the TAM is small and shrinking, the quality of produce is poor and the Ready-to-Eat (RTE) segment is a red herring…who really wants low-quality hospital meals?

Fashion Corner

Richemont stock surged +6% on the back of strong results (CHF is a core holding in both our model portfolios and portfolios we advise). Cartier and Van Cleef powered ahead (~33% operating margins) - total sales up +3% YoY (though total group operating margin fell 190 bps to 23.3%). I’m expecting some kind of deal with Yoox/Net-a-Porter to eventuate at some point — YNAP is refered to as “discontinued operations” in the report (booking a 1.5bn euro loss). Likely buyers are MyTheresa. Watch sales were down -3% and that operating margin is nowhere near as convincing (+15%) — I think this indicates the watch “bubble” is starting to deflate a little — as I’ve said previously, what I see occurring in the watch space is smaller profiles and more discrete faces (i.e. the Cartier Tank). Alaia continues to fire on all cylinders for the co but the rest of Richemont's houses are a bit meh — can anybody really say that Chloe is “relevant”? Montblanc and Dunhill are standard bearers but they are hardly exciting. AZ Factory, once run by the legendary Alber Elbaz, is a snooze-fest. None of this matters given the dominanceAZ Factory of Cartier and Van Cleef. A lot of insiders would love to see a sale or merger (it’s fashion-adjacent bankers favourite hobby) but I don’t see it happening while Rupert controls the company — too much ego. Noting that Van Cleef’s Nicolas Bos has been elevated to group CEO for all of Richemont (for a while there was no CEO, effectively making it J Rupert’s fifedom) — Bos is a smart operator and has grown Van Cleef well (go to Prego or Soul on a Friday and spot all the Van Cleef bracelets…)