Disney Disney Disney

It’s been a minute, eh? In the meantime Disney finally answered our prayers and offered us some kind of strategy — in less polite terms, it was CEO Bob Iger telling Nelson “the smiling crocodile” Peltz to bugger off. Peltz has been at Iger’s heels for almost a year now — his assessment of Disney was correct — too woke, Marvel drained to the point where “blood from a rock” fits, and the Disney+ rollout was sort of a all-hands lollyscramble where nobody had any kind of strategy in place. Peltz didn’t have any good answers, of course (“fire people”, “make my friend CEO”). He was just stirring the pot and part of me wonders if he was hoping, secretly, that his frenemy Iger had an answer.

Well, voila — here comes Disney’s earnings. $1.22 vs. 99 cents, streaming losses were cut by about $300mn the quarter previous, and they expect free cash flow to be ~$8bn FY24, and we love that. Remember how much shred-daddy Jeff Bezos loves free cash flow?

“Our ultimate financial measure is free cash flow…”

— Jeff Bezos in a letter to Amazon shareholders, 2004

Wait, were you listening? Free cash flow, baby, straight from Daddy Bezos’ mouth1:

So, bravo, Iger — Peltz doesn’t have a lot to sulk about now. Stock price is ~$108.39 as of writing, previous stock price had languished in the $80-90 zone like a tardy school boy put into the corner wearing a dunce cap; now things look like they might turnaround. But here’s the big news —

Disney bought a $1.5bn stake in Epic Games

I am too old to play games — the last time I played games was with Voltaire, and when was that, 1770? But Epic makes Fortnite, which your children probably play, and they recently won a seminal lawsuit against Google’s monopolistic actions in the Google Play store, which sets the stage for a retrial of Epic’s lawsuit against Apple. The investment is a smart move because it aligns the Disneyverse with an already very successful games developer — it’s embedding Disney, Marvel, Star Wars, etc, into the next generation’s minds.

And — ready for it — gasp — Taylor Swift

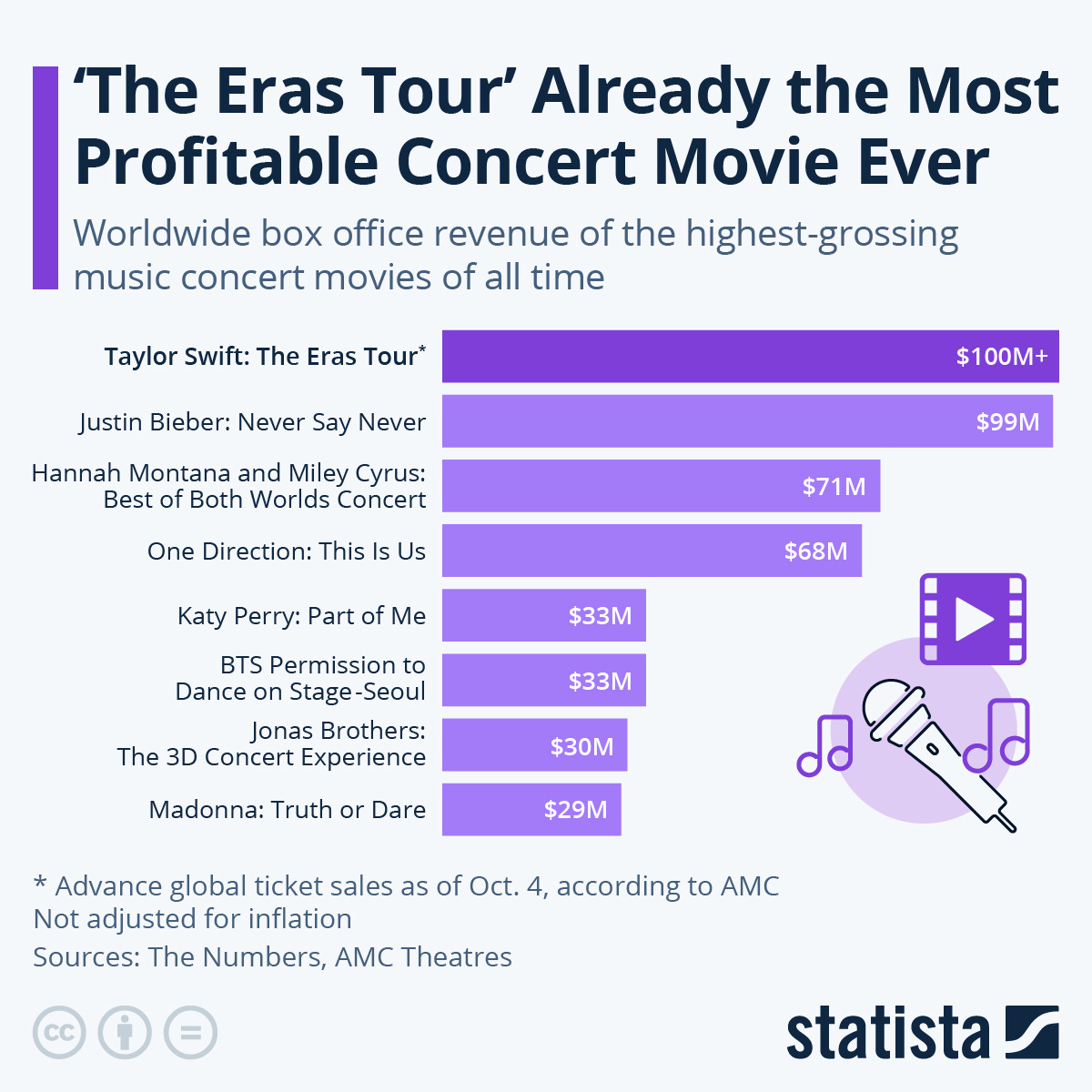

I’ve been writing about how it’s Taylor’s economy and we’re just living in it and I know half of you think I’m joking and the other half have daughters who are obsessed with her. Maybe you are a Swiftie. This is a shame free zone. Personally I prefer morbidly depressing music like the Mountain Goats or Bob Dylan with the occasional bit of LCD Soundsystem, but that’s just me. Point is - Disney+ secured the streaming rights to Taylor’s sellout, record-breaking “Eras” tour. Just to remind you, the “Eras” film is the highest-grossing concert film ever:

And here’s a number — the contribution to GDP of the “Eras” tour is estimated to be somewhere north of $5bn2 (US).

So, Swiftanomics are real and they’re here to stay. Other points to note — reinstating a .30c divvy per share and embarking on a $3bn buyback program. All things we love.

Iger was a little vague as to the integration of ESPN+FOX+WBD Sportsball Mega Channel, which is code for “we haven’t hammered it out yet”. We’re hopeful. Continue to be long Disney — our biggest question is when will they next have a hit movie? That’s key…

NZ

Arvida — Continue to see attractive buying for Arvida (ARV)…it is trading at a big discount to its NTA of $2.00.

NZX — Continue to see attractive buying at $1.05…that includes an almost ~$11bn FUM business and a wealth tech business we see as breaking-even FY24…

A builder’s work is never done — Valentine’s resignation? — CEO Ross Taylor will “consider” his position at Fletcher’s come results on Weds (Weds is Valentine’s day, please send me all your red, red roses…). Fletcher’s have had a terrible run of it — trading near COVID-lows). Some is management-related, other things are out of the co’s control — we are near the bottom of the building cycle.

And here’s Du Val group being “technically” insolvent last year — I mean, when your firm’s liabilities of $210 million exceeds its $188.6m in assets by $21.4m — that’s “technically” insolvency. Du Val is currently trying to convince investors in its fixed-income property funds to convert that debt to equity (equity of a co. that would presumably be listed on the NZX — in my non-legal and non-financial opinion, I think there is a greater likelihood that I be made King of the South Island). If you would like to learn more about Du Val, their founder does offer a “Masterclass”...presented without comment…link here… I would not be signing up for it…

Aussie

IPO hopefuls — now and then — UBS’ list of hopefuls include Guzman Y Gomez and Mason Stevens. Then there’s CrossBet Holdings and Crimson Education. There’s even suggestion that Mr. Hart’s Rank Group may list. There’s more than we can list — as for the NZX — what listings have they on their books?? A rhetorical question…

Droneshield (DRO.ASX) — Trading at 65 cents; at one point last week was trading at 60 cents. They make anti-drone technology. We note the company continues to offer compelling technology in an increasingly fraught geo-political climate. There’s a small amount of DRO in our Aussie model portfolio; follows the Soros maxim — invest first, investigate later (would appendix that with cut your losses quickly if you’re wrong and don’t be stubborn).

CSL — “Nothing but heartbreak” — results for a blockbuster drug, AEGIS-II came up short after results from phase 3 from the trial of the drug disappointed. Stock down 5%. We still like buying it here — those results are disappointing but a lot of negativity is already priced into CSL’s stock price given Ozempic. We’re still leery of Ozempic — there are already some lawsuits in the mix and we don’t think the drug’s negatives are fully known…

International pastures

Kering — falls short — does it have what it takes?

The Gucci owner saw revenue decline 4%, with Gucci’s sales declining 6% for FY23. YSL did no better — sales down 4%. Nothing to get excited about — even “quiet luxury” brand Bottega Venetta saw sales down 5%. Total net margin of ~15%. We wonder if François-Henri Pinault has All Along the Watchtower playing through his head as he sees rivals do better and better

“There must be some way out of here,” said the joker to the thief

“There’s too much confusion, I can’t get no relief

I mean — Hermès saw growth of 21% for FY23 and a net margin of 32%. LVMH had a net margin of ~19% and 9% growth, and Richemont saw 11% growth for the 9 months ended 31 Dec ‘23. Kering is being outplayed by all its rivals and Pinault is away somewhere in Hollywood buying CAA. There’s a lot of catching up to do.

Or let me tell you a story: I was in Paris recently and the Kering stores were empty. Don’t believe me? I made a TikTok (hello, fellow kids) (I’m wearing Brunello and Yohji, the glasses are Persol — made by EssilorLuxottica, a component of our high-conviction portfolio, as is Brunello, of course).

I’ve written before and I’ll write again — John Galliano’s show for Margiela was the closest thing we’ve come to a “fashion moment” this decade. Remember when you first saw Kate Moss? It reminded me of that. Kering has a lot of resources, and has Demna, who has probably been the most important voice in fashion the last five years…— he still has plenty in the tank, but fashion is fickle…there is a lot of rebuilding to be done…and the times, they are a-changin’

About those changes to our model portfolios…

Probably the most interesting are those small changes — we bought Snapchat because it’s doubled topline growth from $2.5bn — $4.6bn (2020 - 2023) — and we haven’t seen the impact of ~10% headcuts (how many people there have been employed with “ESG Officer” in the title who sit around playing foosball all day?). Assuming R&D spending is cut as well, we think the company could make a profit — probably see it as a $17.00 stock trading at $11.00. Oversold…

L’Oreal — We moved to L’Oreal and trimmed Estee Lauder because L’Oreal “gets” it (they just bought Aesop) while EL has lost its way somewhat. L’Oreal just saw operating profit rise 9.2% to 8.14bn EUR. We love what bossman Nicolas Hieronimus has to say

“when times are tough and gloomy…people need beauty”.

Amen, brother.

We don’t doubt EL will eventually recover but it’s been quarter after quarter of bad news — they’re a multi-billion dollar company that is starting to sound like a NZ small cap “oh, next year will be better sir…”

Anyway, L’Oreal predicted a slowdown to pre-Covid level which feels realistic to us.

More fashion — Tod’s going private with L Catterton (who owns most of L Catterton? That’d be Daddy Arnault, at LVMH…smart man). It’s a game of acquisition at this point — a couple of years ago I was bright eyed and bushy tailed and believed Ferragamo could be acquired — an unnamed correspondent working at an unnamed asset manager that manages several hundred billion wrote me the Ferragamo family members don’t get along and the idea of going private is null and void. So, when playing acquisition roulette, keep that in mind…

Leslie’s — not fashion at all — cool in the pool

Leslie’s sells pool chemicals and it’s a stock I’ve tracked for a while. Our model portfolio averaged into it at $6.010 per share and it is currently trading at $7.70 per share. Anyway, L Catterton (yes, the same one as above) took it public and it’s sort of been on a slump down to the bottom from ~$20.00 a share to ~$6.00 a share. Anyway, it’s grown topline revenues pretty well until “the great middle class spending recession” and we felt the stock looked a little oversold. See chart on revenue below. The thing with having a pool is that you need chemicals for it. Otherwise the pool will go green, and frogs will arrive, and it will be a pond — and while that is perfectly charming, it is probably not what your guests would like to swim in.

Will likely flick this stock on at some point — we see the “middle class recession” as getting worse whilst the 1%ers continue to spend; would rather deploy the capital into Richemont or something higher quality.

Money can’t buy taste, but he’s not wrong about FCF

https://en.wikipedia.org/wiki/Impact_of_the_Eras_Tour#:~:text=The%20tour's%20economic%20valuation%20was,high%20as%20%2480%20billion%20globally.