We’ve been talking a lot about Estée Lauder here this week — and we’ve covered the general shape of why it went from market darling to market dog. Things just get worse for the family-controlled firm, though! Their earnings call today was a particular bloodbath in a day where the entire market was a bloodbath — stock is down 20% on the day. Just remember what that means — the company is worth (in the eyes of Mr. Market) 20% less than it was the day before. Consider also that EL used to trade just north of $320 per share. You can now pick it up at $68 a share. It’s a brutal shift in fortunes. The last decade’s gains have been eroded. If you had purchased shares 5 years ago you would be 68% poorer for your efforts.

In the same decade revenue has grown about $5bn, and EBITDA margins have been eroded from 20% to 18%. The big issue, though, is earnings per share — that’s round-tripped from two dollars and a bit to two dollars and a bit. The market is disappointed. We are not amused.

A timeline of acquisitions

Imagine you are the Lauder family. You are blue bloods at this point (not WASPs, mind you — but you own a place in the Hamptons and Connecticut). You have enormous charitable obligations (the Lauders have donated hundreds of millions over the years). You likely finance a lot of that via stock sales or borrowing against your stock (there is a popular fallacy that billionaires just have money in giant vaults, like Scrooge McDuck). If you are the Lauders, you are going to be pissed.

Now, a couple more data points — the last two remaining family members, Jane and William Lauder, have stepped down from being involved in the business (William was Exec Chairman, Jane was Chief Data Officer). As you know, I’m a big fan of family-led and controlled businesses — often family members, who are passionate about the legacy and business they are custodians of — have a longer-term view and make better decisions. So it’s interesting (and a bit sad) to see the exit of the two Lauders.

That’s the issue, though — Estée Lauder herself founded a wonderful business. She was a business genius who took her first fragrance (Youth Dew) from selling 50,000 bottles a year to 150 million by 1984. William and Jane are the third generation of the family. I have spent a lot of time observing family-led businesses that work and those that don’t work. Often the third generation is make-or-break. Some, like Edgar Bronfman Jr, essentially end up ruining the business (Bronfman famously ruined the liquor giant Seagrams in pursuit of his ego). Other third generation family members, like Exor’s John Elkann, end up being unbelievably good stewards of their family’s legacy — Exor today has a capital allocation record on par with Buffett or Tom Murphy (to be fair, Elkann is actually the 5th generation — his Grandfather Gianni Agnelli was the third, if you’re counting back to when the family founded Fiat. But who’s counting?).

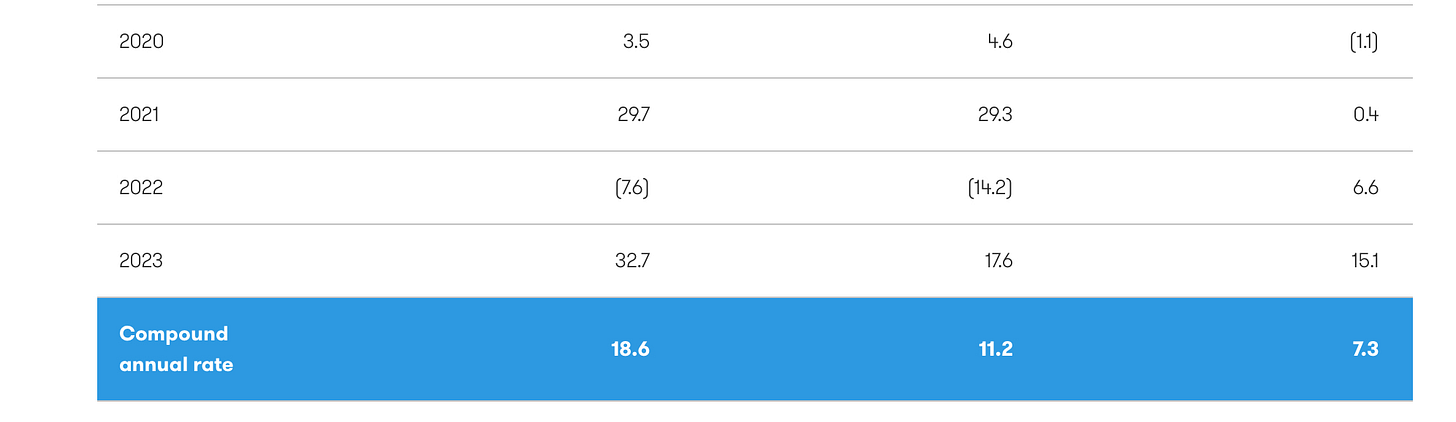

At Exor, Elkann has compounded NAV (net asset value) at a rate of +18% since 2009. That’s an exceptional result. Obviously, Estee Lauder’s results are well below that.

Exor NV - NAV

It is easy to say there needs to be more Elkanns and less Bronfmans in family businesses. It is a lot harder in practice. Part of it, I suspect, is just the genetic lottery — one exceptional founder is special; it’s a dice roll to anticipate whether your children, grandchild, and great grandchildren are as exceptional. Obviously the family tree grows exponentially, too — more dice-rolls, more chance of someone suited to running a perpetual business (consider the way Arnault has raised his children for the LVMH crown — they have all been trained from sweeping the floor upwards — and have run business units independent of each other and been trained by his trusted execs. Contrast that with Succession and the Murdoch dynasty, which is a case study in how not to train your children up).

This is to say there is an element of luck involved here, as well as plain old simple good training. It’s hard to know whether William or Jane Lauder were up to scratch at EL, but ultimately the sword falls upon outgoing-CEO Fabrizio Freda’s head. Freda grew the business during the “boom years”, but he’s also responsible for letting it slack in more recent memory — that’s also incumbent upon the board of EL, who let it happen.

A side note — boards seem to be doing this often, don’t you think? I can’t help but think of the recent Spark results (Tim H has a good column in today’s NBR about this), and the hare-brained board that let Spark end up becoming some kind of bucket shop. Or Fletcher Building; or Sky City. The AFR had a good piece last weekend about how the chair of Qantas let Alan Joyce run rings around him and ruin the reputation of the once respected airline. It seems to be happening a lot, and while no doubt all these boards met the institute of director’s “capability matrix”, well — their actual capability is perhaps somewhat deficient.

Back to Estée Lauder. There is a new CEO coming in — and a few wonder if this is enough. He’s an insider, not an outsider. He’s been swimming in the same water as Freda. Is it enough?

If you’re a Estée Lauder shareholder (bag holder) (I am) (I bought more today) you can find a small amount of solace in knowing that you're aligned with a likely very pissed off controlling family. They’re not going to want to see the stock go lower. That’s their money — and legacy — that is being eroded.

Lauder missed the last decade. That much is clear. Beauty has moved on and a lot of their brands have become “mom” brands — they feel a little moribund (thankfully not all their brands have missed the boat). They don’t need to miss the next decade.

Finally — let’s think about the chance of a bid down here (or an activist). If I were Elliot I’d be looking at buying a chunk of shares and throwing my weight around (likely you’d have the family on your side — a rarity in things like this). The stock is trading at a 12 year low. Sharks will be circling — blood in the water.

But here’s what might be more interesting — why doesn’t Kering buy it? Kering is similarly family controlled and has had a rotten time. It has a market cap of about 28bn EUR, while Lauder has a market cap of 24bn (USD). Kering has been quietly expanding its beauty division (the co bought Creed recently, the boutique fragrance maker). L’Oreal cannot buy Estee — it would be shot down by anti-trust before you can say “tall poppy”. But Kering? A fashion conglomerate? I can see that happening — just perhaps.