Saw Augustin Hadelich play on thurs night with the NZSO — he played that great old warhorse, the Tchaikovsky violin concerto — he played well I think, albeit the first movement suffered from a couple of hiccups (I couldn't help but wonder how much the NZSO had rehearsed with him). Tchaikovsky is so emblematic of the violin as a 19th century weapon — here is the violinist; here is the orchestra — perhaps only the Brahms violin concerto rivals it in stature. Was a pleasure to watch. Sibelius’ The Oceanides was played too — always a glory to hear a gong in full flight. I always find going to the orchestra an interesting experience in NZ. People dress up (I do not), and there’s a certain latent colonial ennui to it all — I am forever reminding people that what we call “classical” was the popular form of the day … it was no different from going to a Taylor Swift concert. The NZSO excelled when they remembered this (the 3rd movement of the Tchaikovsky, for instance).

Lots to get through — NZ earnings have almost been and gone. Restaurant Brands looks like it is stabilising a bit (people love their KFC) and MOVE had a shitter of a result that new CEO Paul Millward is going to have a hell of a time reversing (I believe in him, but I’m glad I’m not in the driver’s seat there…happy to be a passenger princess on this. Stk can be had for 26 cents today…for the brave). NZ Rural Land company had a solid result…noting that CPI-linked rent increases are making their way across the land portfolio. Hard year for Foley Wines, with case sales down 4% and export case sales down -6%. Salient point here re: oversupply of Sav Blanc … and is a good read-through to over comps (i.e. Treasury in Quassie, etc):

“It became very evident that there was a significant over supply of Marlborough Sauvignon Blanc resulting in deep discounting. The strategy we adopted was to remain focused on selling packaged wine through the channels established and assisting the retailers with additional promotional funding to keep the brands in the forefront of consumers’ minds,” said Turnbull.

I don’t think Foley would agree with Mae West — sometimes too much of a good thing is not wonderful.

Biggest news out of NZ (though not much of a surprise to some, I suspect) is Adamantem/Tindall still out there hunting for The Warehouse…Tindall wants his baby back. I think there’s a good chance this does get done — as it is, the Warehouse is a kind of zombie-fied living dead of retail. Gotta get back to its roots.

The Dollar General Bottom Dollar Trade

Here’s the main thing I’m thinking about, though. Dollar General fell around 32% today. Not long ago Dollar General was the doyen of Twitter — especially the “compounder bros” — it has more stores than Walmart and is present in towns too small to have a Walmart; it serves as the defacto general store for these small towns, of which there are many. For a long time Dollar General was a good stock, and it’s something I’ve always thought about owning (I was thinking about it a few days ago, actually…thank god I didn’t buy some).

It fell because Dollar General’s management were like — well, the consumer is squoze. We’re in a recession even though the tech bros out in Cali will tell you otherwise. Some quotes from the earnings call that are particularly relevant:

…I would tell you that it appears to us very strongly that, one, this lower end consumer continues to be very much financially strapped especially as it relates to her ability to feed her family [sic]”

I want to provide some additional context around what we're seeing and hearing from our customers. The majority of them state that they feel worse off financially than they were 6 months ago as higher prices, softer employment levels and increased borrowing costs have negatively impacted low-income consumer sentiment. As a result, our core customer who contributes approximately 60% of our overall sales comes predominantly from households earning less than $35,000 annually. Inflation has continued to negatively impact these households with more than 60% claiming they have had to sacrifice on purchasing basic necessities due to the higher cost of those items, in addition to paying more for expenses such as rent, utilities and health care.

More of our customers report that they are now resorting to using credit cards for basic household needs and approximately 30% have at least 1 credit card that has reached its limit. And in our latest survey, 25% of our customers surveyed noted they anticipated missing a bill payment in the next 6 months.

Folks, this is a recession. DG’s consumer base is, for lack of a better word, screwed.

What happens in a recession is dominoes start to fall one by one. At first you see those who can’t make payments fall over — think back to the GFC, it was those who couldn't make mortgage payments who were foreclosed on. We’re not talking about houses here; we’re talking about people who can’t afford groceries and are putting it on a credit card.

When those dominoes start to fall over it affects everything else. A lot of “private credit” is 2nd and 3rd tier loans linked to things like car loans, hire finance for TVs, etc. This starts to fall over too. That then starts to eat into the fortunes of those who either invest in things like private credit or run it. You then start to see the middle class trade down — they are not buying from Farro; they’re buying from Pak n Save. And on it goes. Eventually the whole thing collapses.

The question here, from a macro perspective, is where does it stop? JPow can cut rates and start to stimulate things, a little. But there’s still those who are locked into credit cards, mortgages, debt, and so on. This the issue with modern day-QE-based central bank policy— those at the top of the equation tend to do well because the immediate effect of lowered interest rates flows onto them. Those with mortgages feel the effects in the medium term. And those who have neither capital nor secured debt end up at the bottom of the heap. That’s DG’s customer, and that’s why I’m not rushing yet to buy shares (if there's another 50% off on the px, then of course…that’s a different proposition).

The big picture here is that if we are going into a recession then equities are clearly overvalued, by and large. Borrowing this chart from the always excellent Crescat Capital. The Russell 1000 growth index is trading well above its average price to book value (i.e. the value of its market cap divided by its assets) — and also well above its elevated levels during the internet bubble.

But hold on, caller — this time is different, right?? Right??? Check this out…

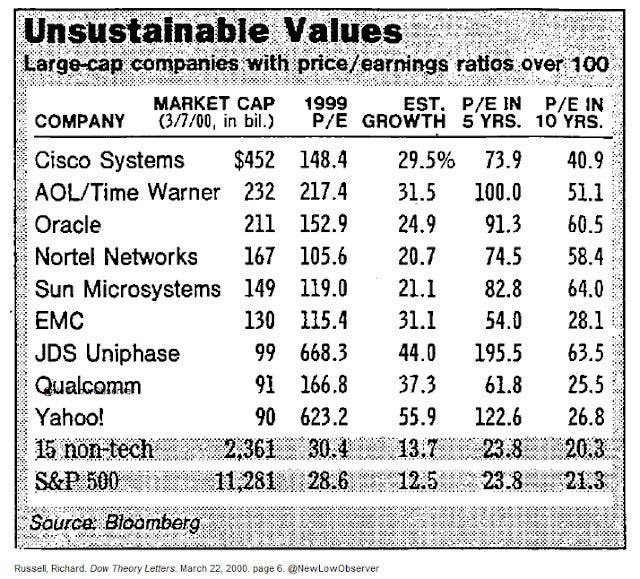

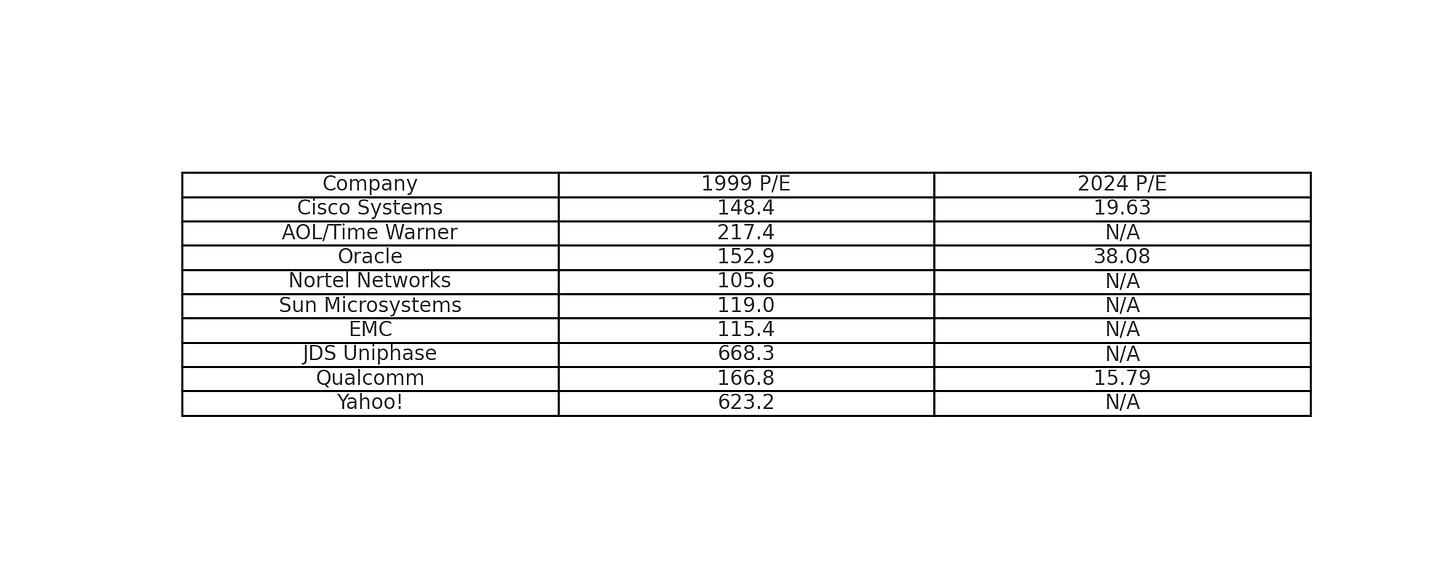

The bulk of these companies have either been subsumed or lost to memory. Here is their current P/E ratios:

Nortel went bankrupt, EMC was acquired by Dell, etc. The remaining listeds make sobering reading — Cisco trades around 19x earnings, Oracle trades at 38c, and Qualcomm at 15x. I keep saying this but…

Price is what you pay value is what you get, mmmmkay?

Lately I keep thinking about Buffett’s comments on not selling Coca Cola at 50x earnings (“great company, ‘stupid’ price”). Other than the obvious tech stocks, there’s a bunch of ‘quality’ that is trading at +40x earnings (I ran a quick screen — your Nvidias and Amazons are there, but also Eli Lilly, my beloved CostCo, Ferrari, etc).

The great news is that for people who don’t have zillions of dollars like Buffett, there are still interesting opportunities out there (at a glance — American Express, Christian Dior, Kering, John Deere…)

& now for something else: The strange case of Tiny, inc

There is this guy called Andrew Wilkinson. He’s quite well known on “the internet” and by “the internet” I mean twitter dot com. If you google him, you’ll find a bunch of interviews in this vein:

Here are a few facts about Wilkinson and Tiny:

There are a lot of interviews and press where he is declared a “billionaire” (he is not the case — currently Tiny stock trades at $1.51, and is worth about $282mn).

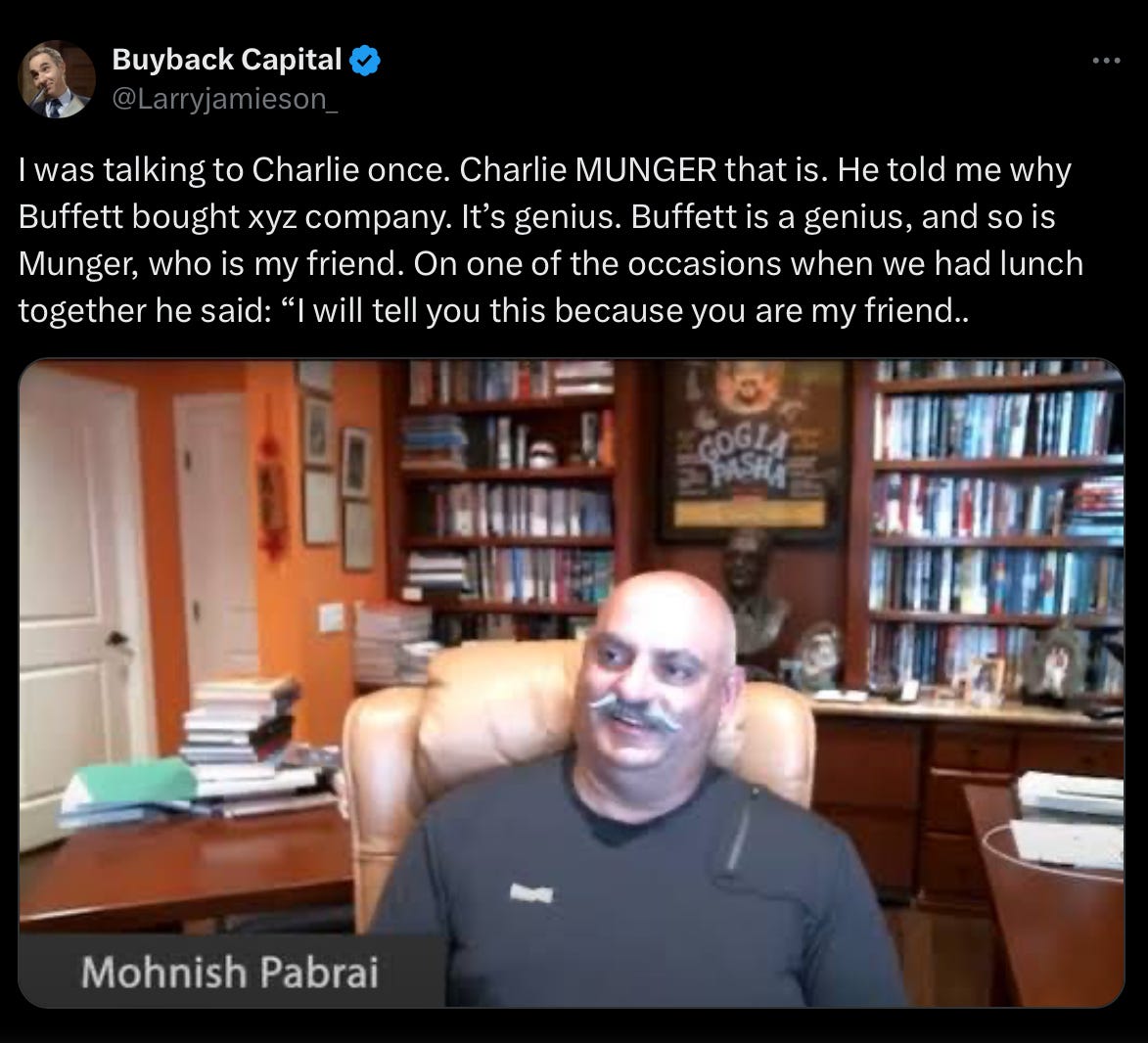

There are conflicting accounts of his famed meeting with Charlie Munger. Here’s a breakdown.

Wilkinson writes letters that lean heavily on the Charlie Munger/Buffett-trope. He says “EBITDA is bullshit” even though their annual reports heavily rely on EBITDA.

Tiny buys businesses that are web-based.

This is all good and weird and kind of whatever — I mean, everyone likes to lean in on their relationship with Charlie Munger. This is another trope, which is often leaned in on heavily by those who had lunch with him a few times.

Here’s where it gets weirder. Tiny, Wilkinson’s company, reported $46mn of EBITDA in 2023. They use step-up accounting for an acquisition, which means they add in about $42mn of non-cash. If you strip out the non-cash items, you get about $7.9mn of EBITDA. With net debt of $81mn (and adding in $20mn of cash they raised on their last equity offering) their net debt to EBITDA ratio is about 1.93. But if you remove $42mn in non-cash, you get a net debt to EBITDA ratio of around 11.28x.

But wait — it gets weirder. There’s a lot of goodwill (and intangibles) on the balance sheet. Goodwill is not a real thing and intangibles are iffy too. If you strip out those, you get net tangible assets of -$100mn.

I don’t get it. Do you?