Farfetch's stock price was a bit too Farfetched | RBNZ stays at 5.5%

plus: Sky City, ATM and FPH

Orr’s game of chicken

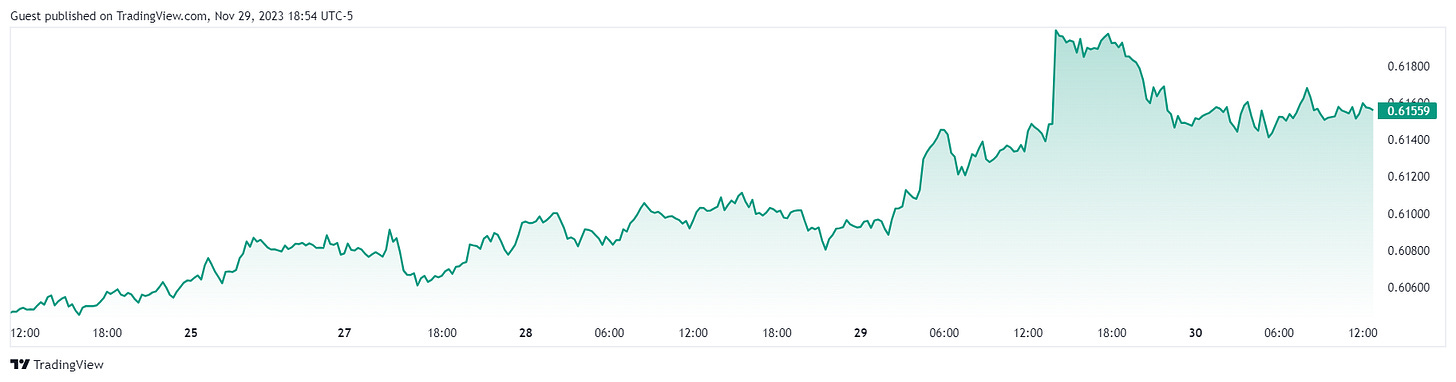

Fightin’ words from RBNZ gov’r Adrian Orr y’day — higher for longer on interest rates. NZD appreciated +1.00%. See NZDUSD below. We think going long high beta currencies (NZD, AUD) against the greenback could be a good short-term trade, though we are skeptical of the USD wrecking ball stopping anytime soon…we think going short makes sense next year as we expect the RBNZ to cut…

More to the point, we thought that Orr erred a little too harsh — even though inflation is sticky we think consumers are starting to feel the pinch (our decline in Black Friday sales, etc…) and we are not optimistic on housing, despite the ‘fake news’ from the Herald — interest rates are rolling over and people will be feeling the pain…

Bottom line — Still expect rate cuts late next year.

NZ

FPH - Fisher and Paykel Healthcare reported in-line results, NPAT of $107mn - slightly ahead of guidance. Still not loving it — hospital new apps consumables revenue was below expectations…gross margins 100bps ahead of expectations. A “relief rally” that might not have much steam…retaining hold.

SKC - Sky City just received a ruling in favour of the casino in its carpark stoush with Macquarie. Case centered around valuations from the car park, which ranged from end of 2019 - 2022. Looks likely that repurchase will be ~$185mn. We’re starting to feel like Sky City is ‘good value’ though it trades like what it is…a sin stock…buy at your own risk.

WCO - ~$20mn of revenue and loss of $1mn. Stripping out one-time expenses loss is more like $300k. Roll-up is going well…but like all roll-ups, we are waiting to see when it’s cash-positive and cap raises stop…

BPG - BlackPearl Group reported a $2.2mn loss for the HY. ARR grew 221%. Their presentation included the phrase “profitability is inevitable”. Surely music to the ears of shareholders…

ATM - Major brokers continue to upgrade this thing. We don’t see it. Birth rate in China is not growing enough to drive sales, and the Synlait situation is messy. 17x earnings (fwd) is still a lot to pay for a commodity.

Ports of Auckland — seeing reports that Wayne Brown wants to sell the ports…it is an open secret that DP World would be open to buying a lease…we do not see it happening. The port union is very strong and economic case for selling or leasing is poor. Short term thinking.

AUS

Anchorage Capital Partners is believed to be weighing a purchase of New Zealand radio broadcaster and outdoor advertiser MediaWorks ahead of its attempted acquisition of Southern Cross Media Group assets. MediaWorks is owned by Oaktree Capital Management and Sydney-based Quadrant Private Equity. Made a hefty +$9mn loss this yr…and a $110mn write-down…just goes to show there is a buyer for everything…

Barenjoey (struth, mate) has launched a $45mn block trade of Cettire, the fashion drop shipper. The seller is Cat Rock Capital, who are the second-largest shareholder in the retailer. Which leads us to Farfetch…

Farfetch’s stock price fell (far)…

Charts! Highly professional arrow is ours. From +$21bn at the height of the pandemic to $342mn now…that’s a painful story. Farfetch, like Cettire, is an online fashion retailer. During the pandemic they boomed. The CEO and founder, José Neves, was hailed as a kind of wunderkind. Here’s a 2021 headline:

What happened? Well — putting out an announcement like this doesn’t help:

Being like — hey guys, we’re going to not give you any guidance and please don’t rely on anything we said earlier; also we’re not, uh, going to tell you our results — has that effect. It fell 53% in one day. Partially it’s a symptom of always being the middlemen — if you’re a luxury company (like LVMH) you’re probably still doing quite well. If you’re merely a retailer, your margins are thin, and you are relying on people to come to you rather than directly buying from the source. Richemont, which owns Cartier, is a major shareholder in Farfetch. Are they going to come to the rescue? Uh, not really — they said this:

“Richemont would like to remind its shareholders that it has no financial obligations towards Farfetch and notes that it does not envisage lending or investing into [the company],” the Swiss group said.

That’s the corporate equivalent of “bye, Felicia”. So, no help there from “daddy” Richemont. Incidentally, Farfetch was going to buy Yoox-Net-a-porter from Richemont in exchange for shares in Farfetch. Yoox-NAP is their main competitor (it also loses money). Back when the deal was announced the 64.2 million shares in FTCH were worth about $640mn (it’s rough math, don’t shoot me). Now it’s worth about ~$60mn. And yet Richemont might end up being happy with the deal anyway — they get rid of a money losing asset from their balance sheet and company, and Farfetch becomes a kind of fashion Frankenstein’s monster, with a lot of liabilities and a big problem to solve.

Still, Neves may take the whole thing private. That was reported in the media earlier this week — it may make sense. The value of the company, for an ordinary investor, is nil — but a PE-backed deal where the co is taken private — with the promise of Yoox-NAP — may be of value to a PE firm that has deep pockets and patience.

In other fashion news, Golden Goose is being listed by Permia (they previously floated Doc Martens, Chlöe Swarbrick’s favoured brand of footwear). Likely to float at 15x EBITDA. Docs were floated at 20x and now trades around 6x — we have learnt the hard way that niche shoe brands rarely go as promised…I stupidly was bullish on Docs (‘how could I be wrong?’ I thought — there are Doc wearers everywhere) and the market taught me a hard lesson. Ironically, Docs is probably ‘value’ now…a lesson to never buy near IPO…PE is always just looking for a pay day. If you stroll past Prego on a Saturday you are likely to see many Ponsonby mums clad in their distressed Golden Goose shoes. That doesn’t mean you should buy them.