NZ

Enjoyed this piece from Patt on the Todd family’s woes — no divvy this year — how will one afford Krug??

Spark — sold rest of stake in tower biz. Now it’s just another telco with shockingly bad service. Yes it’s cheap.

NZX — Noting some reforms from Andrew Bayly re listing rules and KiwiSaver — all much ado about nothing, really, because there’s bugger all liquidity on the NZX and smaller firms historically do poorly by listing on there (think of the persistent discount many of the small caps…). Also, accessing the NZX offshore is difficult (none of the major overseas brokers offer it). Still — one should be hopeful — right??

Nada else — everyone on holiday. And without further ado, I present…

The BBR best restaurants of the year (AKL edition)

Gilt — Atmosphere always great — like the great NY restaurants of y’day, you don’t really go there for the food.

Lillian — The bread! The pate!

Alma — I always forget about it, and then I remember how good it is.

The Don — Simple, honest, good, consistent.

Blue Breeze Inn — Again, an oldie but a goodie. No, it’s not cutting edge. And no, it’s never going to be “hip”. And that’s why it’s good.

OBar — Dylan told me to put this here. The chicken.

The worst…

Oak room. I unfortunately went there on “curry club” day. The curry was grey, unappetising, and resembled the gruel Oliver Twist begged for.

Paris Butter — Good food at times, but awful wine service and wholly overpriced for what it is — pretentious, full-of-itself, dull. Pretensions of being a Michelin star place but very “provincial” and a bit clumsy.

In’tl

Top of mind — Adobe earnings coming in strong — $4.81 EPS vs ~4.60 expected, but stock down on a soft outlook — obviously the headline is (fear of an) AI planet — I think fears are largely misplaced — Adobe’s incorporating AI tools well but end of day Photoshop, indesign etc are industry standard for a reason. Adobe down 13% today…

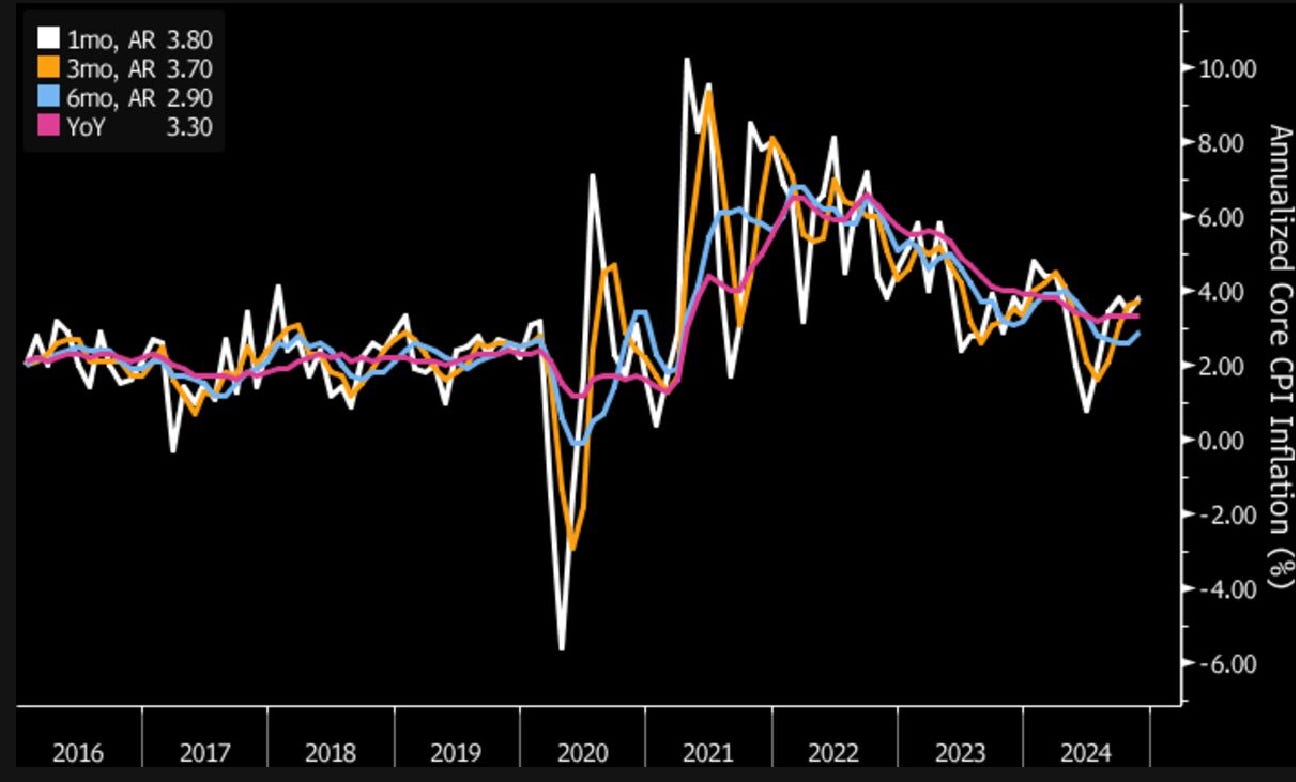

CPI — likely another Fed cut coming up, but note that core CPI remains sticky. My fear (and I know I’m in the minority) is that sticky core + tariffs lead to a stagflationary environment, like the 70s. At least the music was good.

Hermes family office investing in insurer Albingia — stake being sold by PE firm Eurazeo. Interesting move away from fashion — I always follow what Chanel’s family office, Mousse Partners, invests in (their latest notable investment is a stake in the Olsen twin’s label The Row, but otherwise they tend to go the VC route).

Also thinking about the break-up of Bolloré’s Vivendi empire — Louis Hachette Group (publishing) will be spun off on the Euronext, Canal+ will float in London, and Havas, the advertising group, will float in Amsterdam. Why Bollore has to be always so complicated is beyond me, but obviously this should unlock value for shareholders. My preference is owning Bollore SE, which owns the family’s stake in Vivendi and tends to trade at a SOTP discount. (Andrew Brown has a great piece on the sprawling Bollore empire).

Not everyone wants to list on the LSE, though — here’s Revolut saying “no thanks!” to the LSE — stamp duty + less liquidity (paging the NZX, anyone?). Of course, on the other hand, that’s why there’s plenty more value on the LSE — because nobody wants to go there.

Chanel’s new broom

It’s been a hot minute since Chanel had a good designer — Lagerfeld has been dead for a bit, and Chanel’s collections (while still selling) had all the charm of a TJ Maxx discount section. Now Matthieu Blazy has been appointed to Chanel — a loss for Kering’s Bottega, where he formerly worked (Bottega is one of the few bright spots for Kering — Blazy’s thoughtful, nuanced designs proved a hit and that’s been reflected in sales, which have consistently grown for Kering at a time where Gucci revenue has plunged).

My feeling is it’s the right move for Chanel — Blazy understands how to work with a brand’s visual grammar while keeping track of the zeitgeist — of course, he’s not Lagerfeld (nobody is) and to expect the same is ridiculous. But it feels like the right choice — Blazy comes at a time where the house needs reinvigoration and relevancy.

Bottega’s hired Louise Trotter as Blazy’s replacement. I had no idea who Trotter is, so had to look up — she’s currently the designer at Paris label Carven — reminds me of late 90s Jil Sander… like Blazy it’s nuanced, thoughtful work — clothes for women to wear, rather than magazine spreads.

Kering still trades down and dirty. I still stubbornly think it’s good value here… oversold, and I suspect smaller houses — like Bottega! — will continue to grow and eventually sit alongside Gucci in terms of revenue.

A few grapefruit strongs at the Don are always a good time.