Has Buffett lost his touch?

Was sent this by a mate — link — it’s a solid piece in The Economist and makes a few good points (namely that Buffett’s cash pile and portfolio is so yuge that he is limited in what he can do).

I thought I’d extend my response here, because it’s an interesting question.

Prophecies of Buffett’s demise seem to happen every decade or so (usually just before, or after, a crash). Here's one from 2009. There’s always a contingent of people who secretly hope for Buffett’s downfall — normally the passive index bros — and every decade or so you get a bunch of articles that ask if the old man has lost his touch.

In the 1990s there were plenty — as the tech bubble was in full swing there were a good number of articles that talked about Buffett’s underperformance, etc. The irrational exuberance of a bubble brings this out in people. People like to imagine — just a little — that maybe, just maybe, their nonsense stocks at overinflated valuations suddenly make sense (they never make sense, of course).

Berkshire's investable universe is, realistically, about 100 companies worldwide -- that is, companies that would move the dial on Berkshire's enormous equity portfolio. Among those there are very few I can image Buffett buying or taking a meaningful stake in. Here’s a sample.

Buffett already owns Apple (less than he used to). He obviously owns Berkshire, though the decision to repurchase stock isn't a bad one. Among the others — Visa? (Or down the list, Mastercard?) — there’s the issue of being a whale in a sea of elephants. May we all be so successful that we have the problem that Warren has!

Given that, I think it's perfectly rational to keep a large cash hoard when there are no good opportunities. He's earning ~5% on the pile. 5% on a pile that is almost $300bn is an enormous amount of money — scale, baby.

Here’s the second thing. Buffett is a shrewd operator and can be brutal to deal with -- it's a popular misconception that he only buys equities (it’s an even more popular misconception that he only buys ‘wonderful companies at a good price’ … his early partnership in the 50s was buying “cigar butts”, while in the 90s he purchased silver by the truckload). Buffett is a shark — a kind of grandfatherly loan shark, in lieu of the government, on very favourable terms for himself and Berkshire shareholders. In 2008 he leant out money on very favourable terms to companies that sorely needed it -- mostly via being issued preferred stock. In 2001 he was even more brutal — per Slate:

The one-year loan carries an interest rate of 19.824 percent. In addition, Williams committed to pay a “deferred set up fee”—a charge that the company must pay if the company assets underlying the loan are sold, or even if they are not—of at least 15 percent of the loan, or $135 million. Add it up, and Williams will be paying nearly 35 percent in interest and charges for a one-year loan."

I suspect, if a recession occurs again (I think it's likely), Buffett will engage in similar tactics — he carries with him the balance of a bank and the reputation of America’s grandfather.

Recession, wha?

Here’s Constellation, the giant US beer and wine maker —

The company on Tuesday said the noncash goodwill impairment charge of between $1.5 billion and $2.5 billion would hit results in the second quarter. It cut its full year per-share earnings outlook to between $3.05 and $7.92, down sharply from prior expectations of between $14.63 and $14.93.

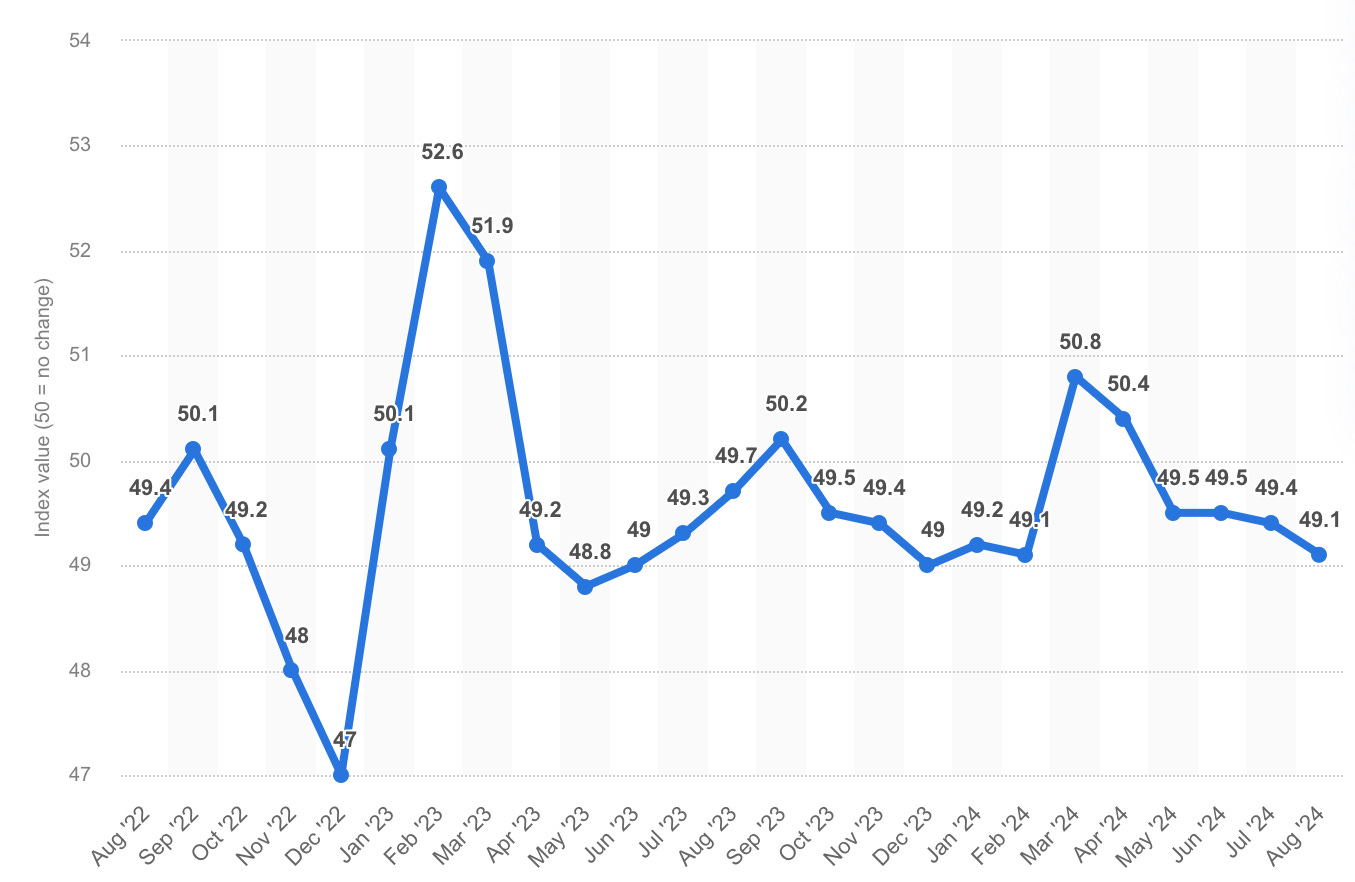

And here’s China PMI, fresh of the press (N.b, we shorted a little China 50 on the news…not advice I am just an idiot at a keyboard).

And here’s both the Shiller P/E and gold/S&P 500…

I don’t know, you guys — to quote the immortal David Berman (RIP), “But someone's gotta say it, hell / I mean, things have not been going well”.

NZ

MOVE — Paul Millward commended as CEO of the logistics firm — I admire how he went about turning around 2 Cheap Cars. Lots to turn around…

IFT — Airtrunk … $23.5bn (Aus) for the data centre juggernaut (crazy money!). Think of the read-through for Infratil’s CDC’s… I have hesitations about the value of data centres in total… probably would be trimming some NextDC here…

NZX — Woeful set of metrics here for the exchange proper. The company makes money on the SmartShares business, of course, but the exchange? Woeful.

Aus

Airtrunk Airtrunk Airtrunk. Did I mention, Airtrunk?Also, Airtrunk.

Did enjoy this piece about the messy Pratt family debacle, though.

World

Nvidia, etc, but who cares, really? More interesting is embattled Burberry bringing over a new CMO from also-embattled Gucci. Link. I suspect Burberry will be taken out before long — it’s a zombie company on the LSE at this point… it’s value is its IP, but it’s got a decade plus of winding back its ill-thought out strategy to fix.

Lululemon — cut our position. Losing faith in the athleisure trend.