Every market cycle (i.e. a bull market) there’s a point where “alternatives” becomes an asset class, and you get dubious whisky clubs and art marketed as an investment class and fine wine, antiques, and so on. There’s a fairly obvious explanation for this: bull markets mean more money, which means more money to be spent on other asset classes.

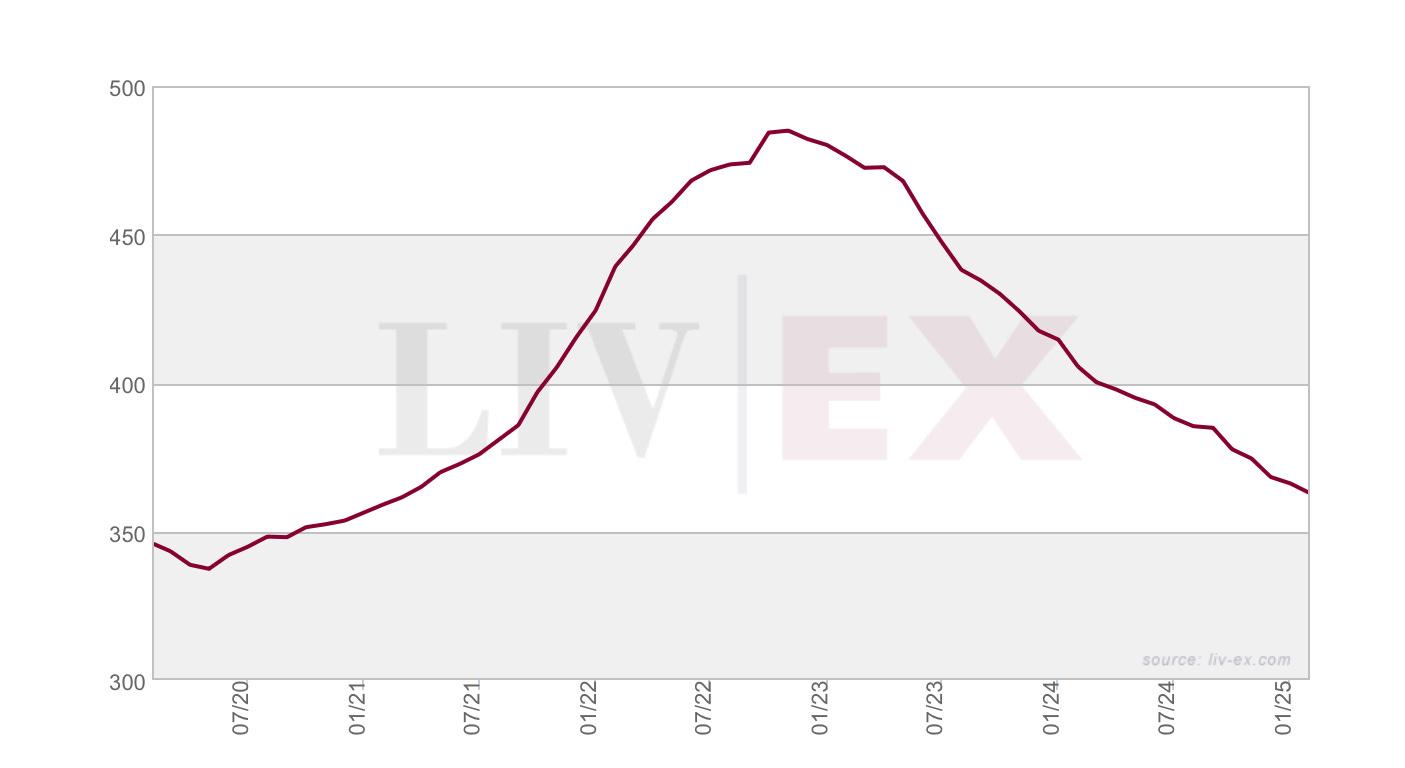

How are they doing, then? I mean — not so good. Here’s the Liv-ex Fine Wine 1000:

As I discussed in a footnote y’day, you see a surge (a lot driven by China) and then a decline to ~2021 prices.

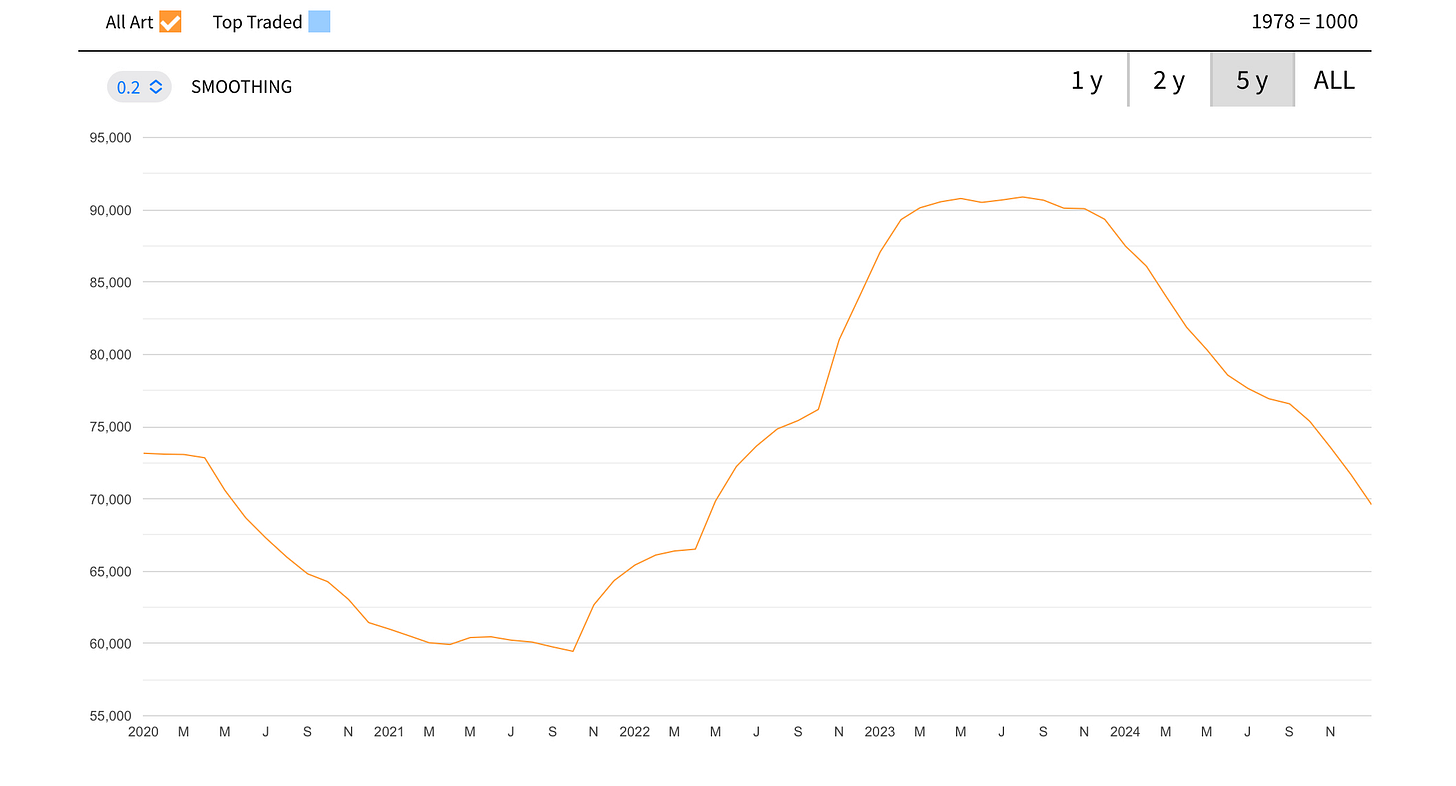

Here’s the Art Market Research indice, which is composed of a bunch of auction results from the major art auction houses:

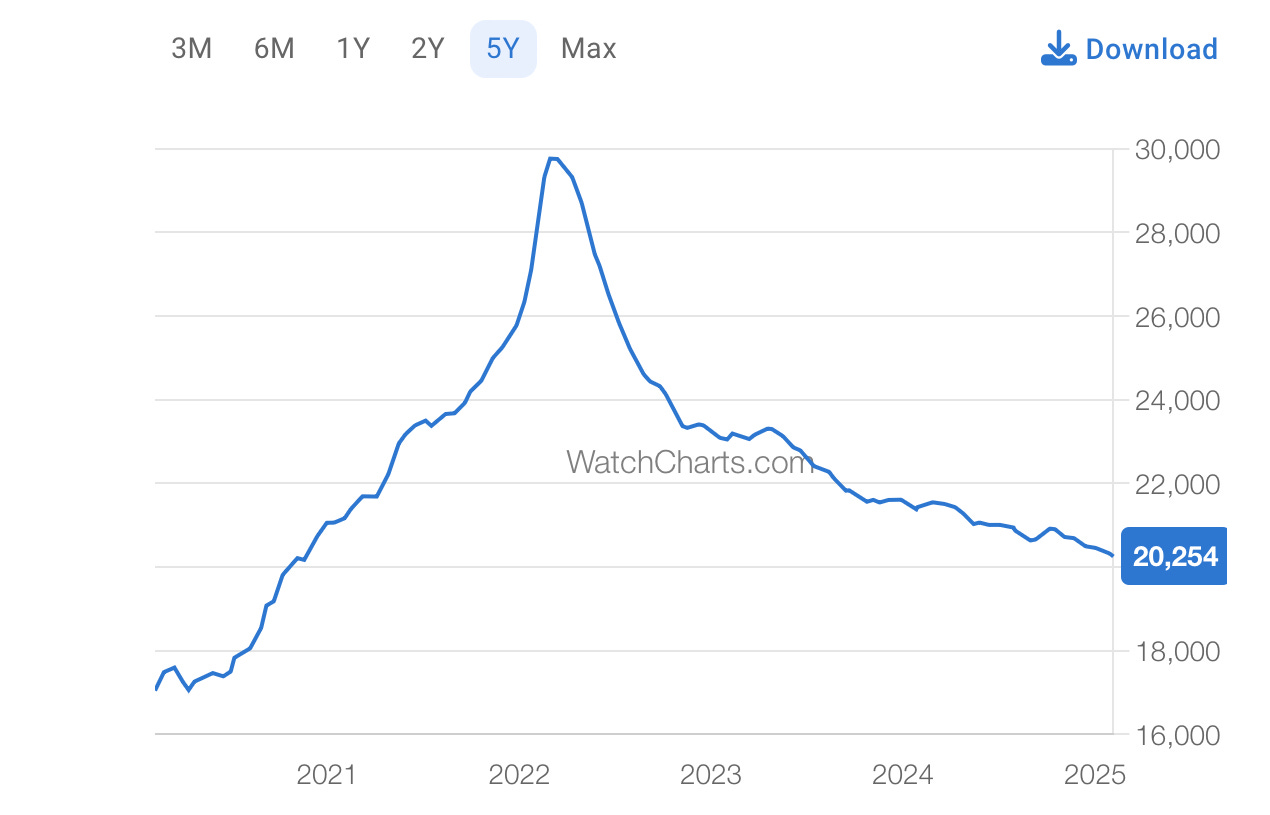

Rolexes? Sure — here’s the Rolex index, from watch charts dot com:

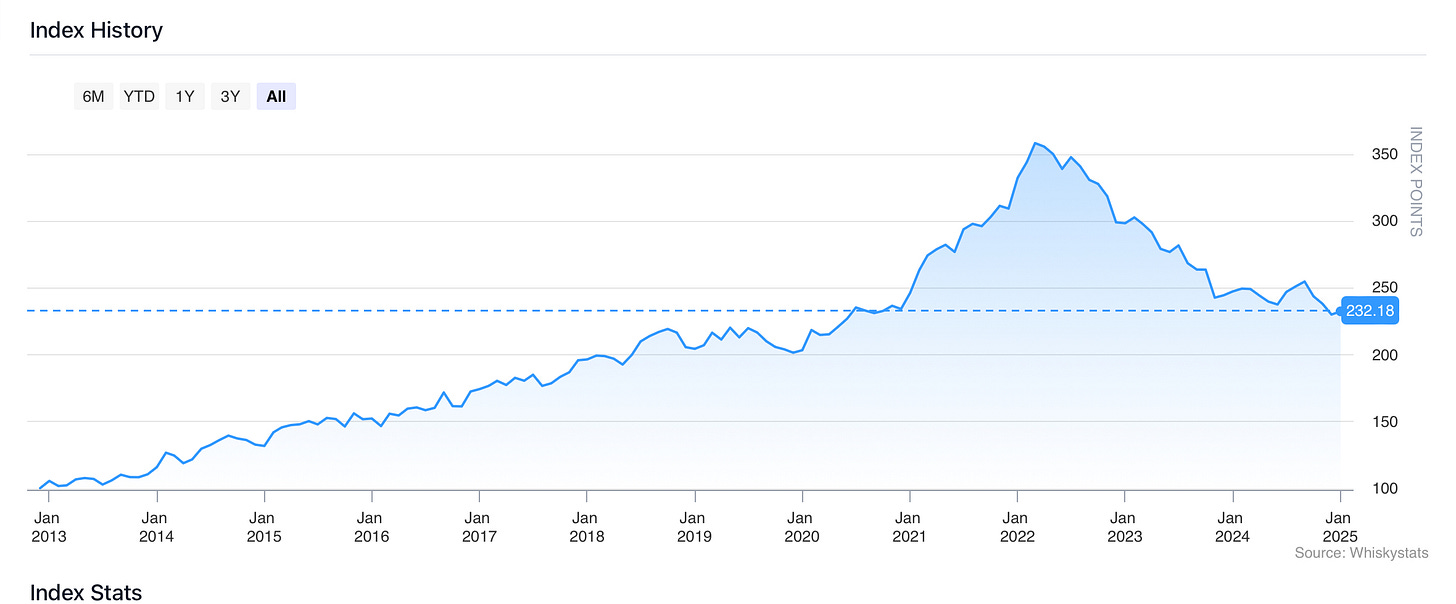

Whisky? Sure — here’s the whiskystats index of the 100 most traded whiskys:

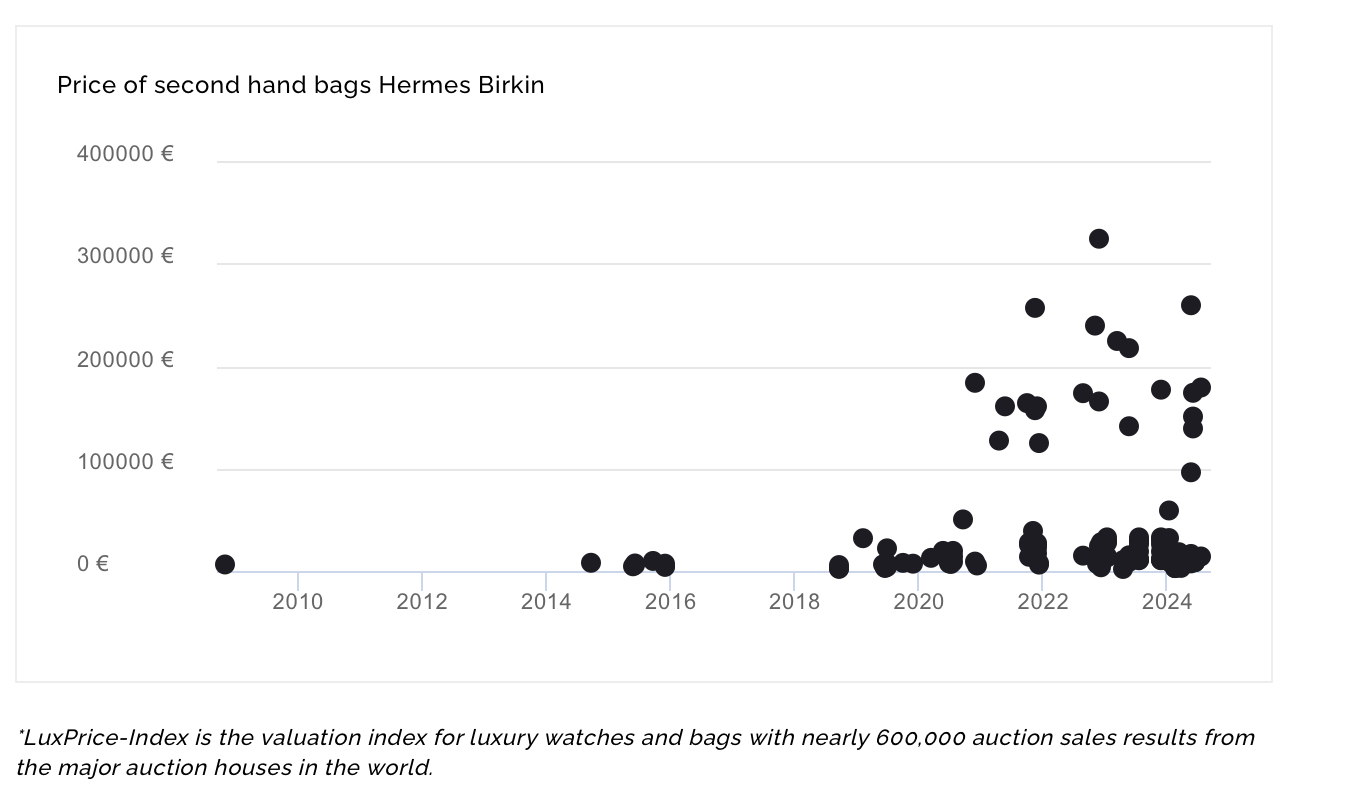

If you’re reading all this and looking at this the picture isn’t that pretty — I mean; it’s not awful, you’re not going to go out at buy a Rolex or Lafite for $10, but it also (to my untrained eyes) suggests some kind of slump, or at best, a plateau. Of course, Hermes Birkins still tend to go for about the same price — though even then there’s a little bit of a slump at the top end:

History doesn’t repeat but it rhymes, etc — if the big money isn’t paying as big money for these kind of assets, it signals to me that either i) they have found elsewhere to put their money or ii) there is less money to go around and be spent on these kind of assets.

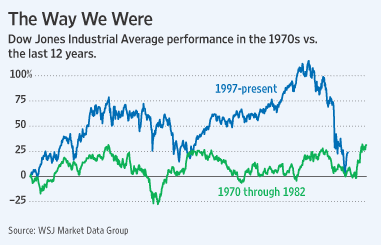

Typically in a recession “alternative” assets have a lull (there’s exceptions — art did well in 2008, for ex.) My thinking goes that this acts as a bellweather for what’s to come — not a recession, perhaps, but my fear is what I’ve been saying for a while now — stagflation.

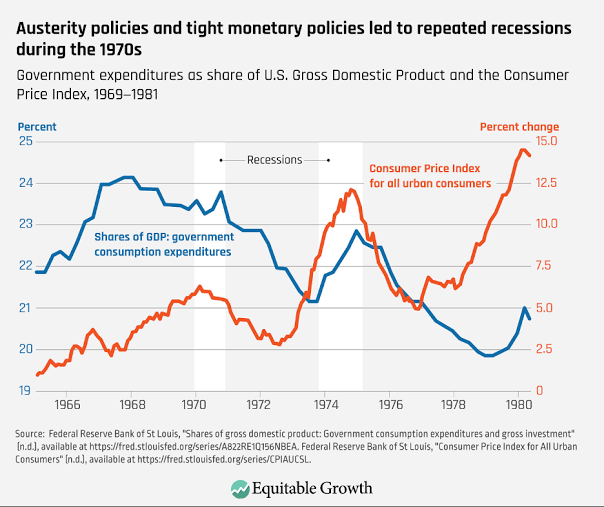

Stagflation!

Stagflation happened in the 70s and we’ve talked about that. The causes were not the same as now. The likely cause of stagflation this time around is — you guessed it — Trump tariffs.

Tariffs are a fairly whacky way for a government to make money. A 25% tariff on goods (whether it’s steel, on a country, on cars, etc) ends up costing both the consumer and the customer more. I talked to a fellow who is a big buyer for a liquor store in Chicago — his main concern? Tariffs. “They'll be passed straight on to our customers”.

But you’d be naive to think that tariffs will be a one-way street — if the US imposes tariffs on China, for example, you can bet your bottom dollar that China will impose tariffs right back on them. I can’t understand why people are so excited about Musk and his DOGE stuff, or Trump bringing back plastic straws, or whatever — the most important thing in a capitalist economy is the value of its currency, particularly when it is the world’s reserve currency.

In short, 25% tariffs mean a 25% increase in the cost of goods, which likely will result in inflation above the Fed’s 2-3% target band. That went terribly in the 70s.

Gold, oil, staples (think Kenvue, etc), and commodities did well during the 1970s. Obviously, gold is on another bull run. “Back to the future”?