My favourite Big Financial Crime case of the last few years is probably that of Bill Hwang, who owned portions of very boring companies, like Paramount (then Viacom) and then managed to blow it all up, mostly by convincing each broker he had shares of X company at another broker, therefore it was fine and dandy to use those shares at another broker as collateral to buy more shares in X. Hwang did own shares, of course, but the magnifying effect of this whole thing meant that he was essentially operating a pretty standard fund at leverage, which meant that when it all collapsed (and it did), he lost about $8bn in the course of a week and banks (like Credit Suisse) took losses of up to $5bn. Anyway — Hwang just was sentenced to 18 years in jail.

Of course, because Hwang was buying so much of various boring stocks that he pumped them up. If I was to buy $1,000,000 USD of Hong Kong Shanghai Hotels Ltd (which we talked about this week), I’d pump up the stock a lot because there’s such a thin float there. I mean, Hwang pumped up the boring stocks he was buying a lot more because he was pumping billions into them, and having multiple brokerages bid for them. The hilarious thing is that people doing this with shitcoins all the time — the ethos of a lot of crypto pump and dumps — rockets, diamond hands, etc! But Hwang did this with normal, boring stocks — the kind of you might expect an 8-12% return from annually, and then he leveraged them. He didn’t even live lavishly! Dude lived in a modest house and went to church. He just leveraged — a lot (St. Munger — the things that stuff you up — liquor, ladies and leverage).

Oh, Estee —

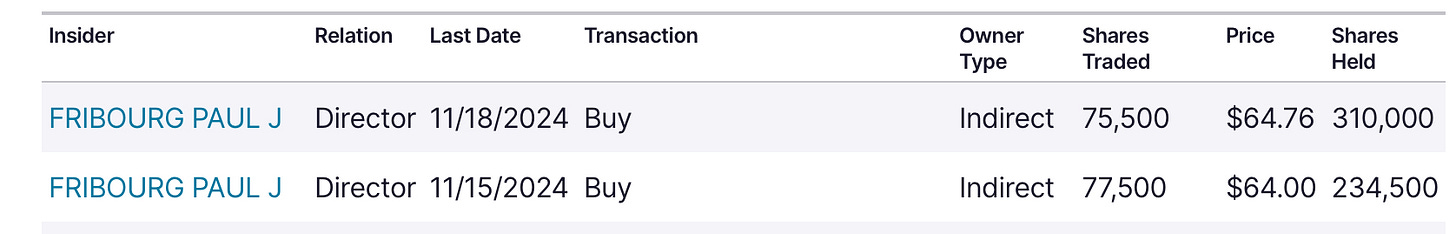

We talk a lot about Estée Lauder here — the once-great beauty giant that’s stumbled in recent years (crucially, I think they missed the current wave of tweens obsessed with skincare — we’re talking about tweens who go to Mecca and buy Drunk Elephant, etc). Here’s an interesting piece of insider buying of ~$10mn worth of shares.

I think you have to ask yourself the question — if a director of the co is spending $10mn of his own money on the stock — then what does he see that I don’t see?

More insiders — Simon Henry & DGL

Overlord of DGL Simon Henry recently spent a good chunk of his own cash buying more DGL stock. You will recall that DGL was savaged by the “woke mafia” a few years ago for tasteless comments he made about Nadia Lim and My Food Bag (nevermind that MFB is a rubbish company…). Since then DGL has sort of been a pariah of the ASX, trading for sometimes around a third of book value.

I do not think DGL is the greatest company in the world. I do, however, think that it is worth more than 1/3rd - 1/2 of book value. DGL makes around $466mn of revenue, of which net income is $14.3mn. Its book value is roughly double its market cap. And from y’day’s meeting, others think there is value present as well — the chair noted there had been takeover offers, but the board wasn’t interested. But still — obviously, if there’s takeover offers, then that speaks to the current undervaluation of the stock (and the cash-generating power of the franchise).

Two issues, though — 1) Henry controls +50% of the stock. It won’t be sold unless he wants to sell and 2) The stock has around 2% institutional ownership, and this will likely persist given how deeply un-ESG the company is (nevermind that ESG is nonsense).

Is GEICO that great?

Buffettheads regularly froth at the mouth at the thought of the insurance company GEICO, and for good reason — it’s been a compounding machine for Berkshire for years and Buffett has cannily used the “float” an insurance company provides as essentially a way to leverage without paying interest (I’ve said it before — Buffett is an operator, not a kindly old grandfather).

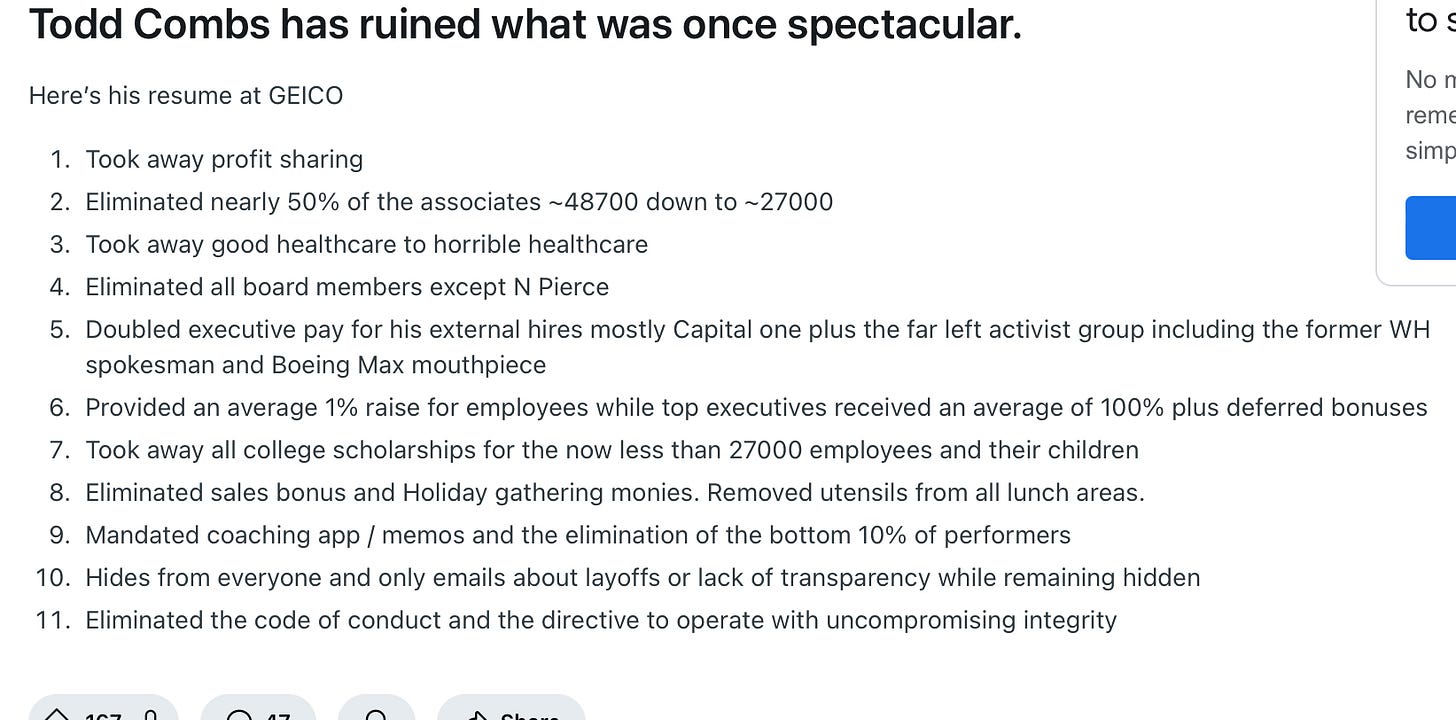

He appointed Todd Combs and Ted Weshler to run a portion of the Berkshire portfolio (how they’ve done is the subject of debate…) and Todd also became CEO of GEICO in 2020. I saw this by chance — but wow — people do not like Todd Combs. Here’s an example, from r/Geico

Point 1) and 8) worry me the most — Berkshire ought to be the home of “show me the incentive and I’ll show you the outcome”.

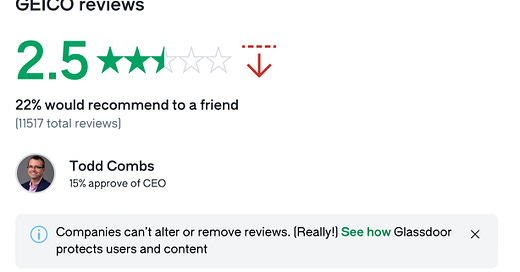

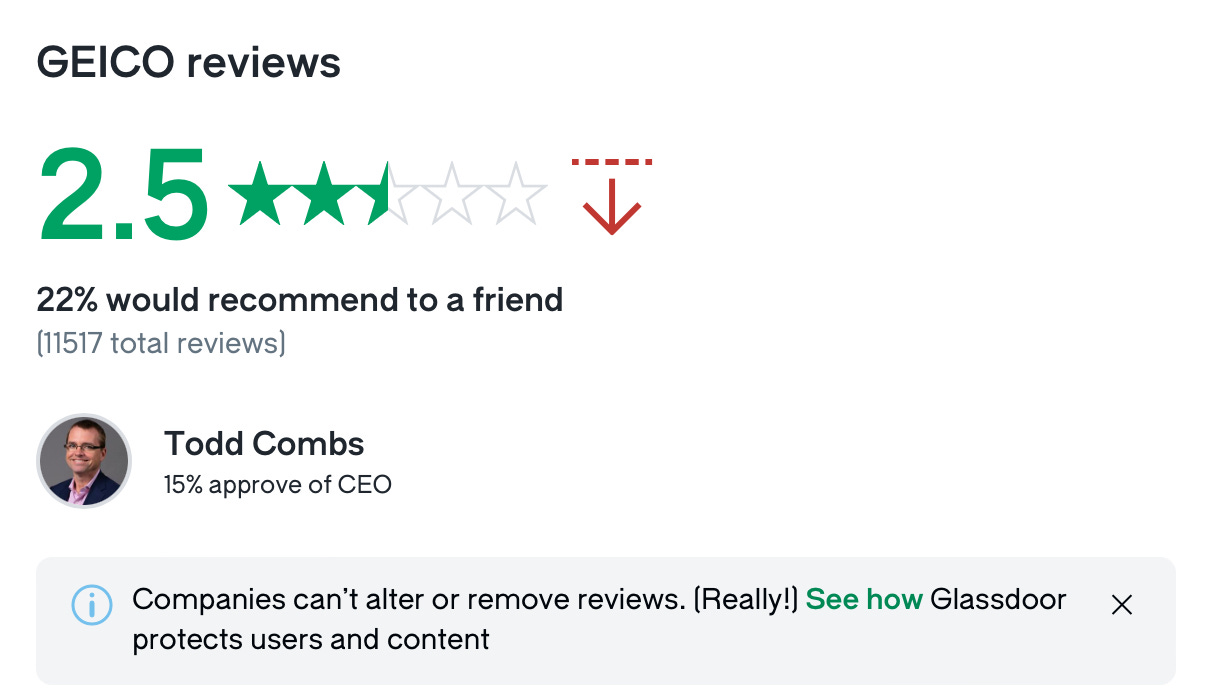

It gets worse. Combs is one of the lowest-rated CEOs on Glassdoor:

When I woke up this morning I did not know this, and now I do. There are countless reviews of Combs, and of the “new” GEICO. None are flattering. When I say none, I mean zero.

It’s a reality check — not all roses in the world of the (Berk) shire.

Abroad…

The Jake Paul/Netflix thing — Anyone watching the broadcast on Saturday would’ve noticed the fight glitching out just before the “big event” began. Nevermind the actual thing — Paul is obviously a prat of a show pony and Tyson is well past it — the implications go further. If Netflix is to continue its live events/sports ambitions (say, the SuperBowl), then an event glitching before millions of eyes is a serious issue.

On the other hand — 60 million people did tune in. That’s a serious challenge to the dominant hegemony of ESPN/WBD/etc, and one the networks will need to think about combatting if they’re to stay relevant.

The bigger question, I guess, is what is the actual value of traditional media in this brave new world. It’s one we’ve been asking for ages but it continues to get more urgent. Sky TV here in NZ has down an admirable job (I hate to admit it) of maintaining a viable business, and the cable operators — and smaller trad media companies (WBD, etc) — do still make money. Only problem is, those cashflows are slowly melting — traditional linear TV is dying a slow death, and the advertisers are shifting away from the format. The question is i) how slow does the ice melt and ii) how quickly can the old media adapt to the new. Note Comcast spinning off its cable assets…but again, how much is that melting ice-cube worth?

Savor — Just in case you needed a reminder we’re in a recession, a bad six months for the hospo giant — $25.6mn of revenue vs. $29mn for the comparable previous period. Long story short — recession. This is unavoidable and it is already here.

Finance minister — RMac has a good summary of why Nicolas Willis is mediocre at her job. Link. By way of example, I sometimes dabble in the high net worth immigration space. By “dabble” I mean observe with interest. There are very few incentives for anyone with money to move to NZ and invest in it. If you’re not attracting capital, and you’re not growing capital by incentivising your citizens, then what are you doing?