"I must not buy at IPO' -- on Puig | Rakon watch day one million?

Home & Away

RAK watch day ??? — I have lost count of the days I have been waiting on Rakon. Great piece in BD today on the trials and tribulations of the stock and its vexed NBIO - link. I have a hard time thinking of a foreign country that has companies that are so oblique on their process — the FT or AFR are all over this — Street Talk first reported the alleged acquirer in RAK’s case. Given NZX disclosure rules the company must report if negotiations have failed, we presume negotiations are ongoing. Quoting Buffett on those “Jewish treasury bills” — “Give a man a fish and you will feed him for a day. Teach a man to arbitrage and you will feed him forever”

Below — rumored acquirer Skyworks’ reference manual (it has the catchy title of “Si55xx, Si540x, and Si536x Recommended XTAL, XO, VCXO, TCXO, and OCXO Reference Manual” — really gets you going). Note how often RAK is used as a supplier. As dreaded consultants say — “synergies”.

URNM — The US, in their external wisdom, banned imports of Russian uranium. I don’t need to tell you how short sighted this is when Russia produces about 8% of the world’s uranium. Back of envelope math tells me that URNM’s deficit just increased +8% which should push prices up more, as US miners race to get their plants online. Very bullish on this because it is a simple case of supply and demand — even with more mines going online we won’t see the deficit addressed until 2028 (speaking of nuclear — I just finished watching Fallout, set in a nuclear wasteland — was leery of a video game-based TV series, and I hate zombies — but if you want something mindless to watch it’s perfectly bingeable). Note deficit in uranium demand below

BAP — Bapcor stock down 20% y’day (‘struth!). I have a tendency to pick up cigar butts…I can’t help it; my mother hauled my to garage sales when I was young and I have never quite stopped looking for bargains. Bapcor does aftermarket autoparts. On the face of it this thing feels like a “gimmie” — trading at 15x earnings given revised NPAT ($97mn). Talked to “one of our guys” and he said that the co is trying very hard to poach more market share. But I don’t like its former CEO saying he should’ve sold a long time ago -

A former chief executive of automotive parts group Bapcor says it is “disappointing in the extreme” to see the company in turmoil and the board, which lost its incoming CEO with two days’ notice, was to blame.

Darryl Abotomey, who left Bapcor in late 2021 after an acrimonious falling out with the board and chairwoman Margie Haseltine, said he regretted not selling his shares as he feared a substantial slump in value once a trading update comes out on Thursday.

“I should have sold a long time ago,” he said. He still owns a $6 million stake.

If that’s not stomach churning, I don’t know what is. My goal this year is to be more like Charlie Munger and Bob Jones, and to that extent I am getting better at saying “no”. This is a “no” — a hard no. Obviously macro read-through here is awful; people are spending less. Talk to any business owner and they will tell you they are in a world of pain (ok, Sherlock).

THL — stk is halted as the co expects to announce a “material change” to earnings. My guess is interest cost has gone up given rising debt levels. See BAP above. Autos not exactly hot. Will take a wait and see approach here — if trades at enough of a discount it could be of interest — campervan rentals are gangbusters. I hate to sound like a pessimist: it’s all going to get worse before it gets better (“soft landing” who??)

Puig comes to town

Normally when you are a Billionaire Dynasty In Europe what you do is give it to your kids, and then your kids give it to their kids and everyone gets some Loro Piana walks. This usually goes badly, because entitled and spoiled trust fund babies often don’t have any concept of the real world (if I had a management academy I would have everyone work at least a year in a bar or a kitchen doing the grunt work: loading the dishwasher, being a glassie, dealing with drunks or chefs with a temper. I would also have them go to the WINZ office and apply for a benefit at least once. Living in a world of private jets does nobody good).

It doesn’t always go badly! Arnault at LVMH has trained his children well. They have been raised in different aspects of the business and have been promoted based on merit — Frédéric and Delphine are my picks to succeed daddy; Delphine has been raised to board level at LVMH while Frédéric revived Tag Heuer, which was previously a moribund watch brand popular with middle aged Walmart managers in Ohio. Frédéric is now the CEO of the entire LVMH watch division — again a difficult role, as nobody is getting all moon-eyed over a Hublot. It’s gone fairly well at Hermes, too, and Exor — though noting that Exor’s fortunes are largely due to John Elkann, who is a capital allocator of the first order.

But look — family succession does not always go well. The Varderbilts, the Gettys, The Astors, etc… history is strewn with delinquents who have burned money hand over fist (look at poor old Barbara Hutton, who was heir to the giant Woolworths fortune. By the end of her life she was near-bankrupt). So here is Marc Puig, chair of the family-owned luxury empire that makes its IPO on Friday (sticker price — 14bn EUR). Marc has different ideas. He doesn’t want his children involved int he company at all. He’s the third generation — his children are the fourth. Says Marc:

"Difficulties can arise…the search for leadership, a lack of understanding, a loss of passion”. His solution is “self-disempowerment” — having more non-family members than family members on the board. All very nice to say (feel good fuzzies for the paper) but Puig is IPO’ing with a dual-class structure and floating very little — the family still maintains control via that dual class structure (like our friend Shari over at Paramount). Bah humbug, in other words.

IPO values Puig at 30x earnings (14bn, c.465mn NPAT). I learned my lesson about participating in IPOs with Doc Martens (write your lines, Eden — I must not buy at IPO, I must not buy at IPO, I must not buy at IPO). You can buy Kering at 14x earnings and CDI (holding co for LVMH) at 20x (disclosure: I own both stocks and am buying more Kering on weakness). Why pay a premium?

Puig’s IPO is already oversubscribed. I don’t think many analysts realise how much Puig overpaid for Barbara Sturm. Puig paid $240mn for 60% of the co — a $400mn valuation. Puig will buy the rest at a later date for the old M&A gem — either 5x rev or Puig’s public multiple — whichever is higher. Net sales at Strum were roughly $69mn, so that’s a lower valuation than the implied multiple ($345mn). Strum is targeting sales of $115mn for 2024 — that’s a tall order for a sluggish beauty market.

I don’t like Strum because the product is no good. It isn’t particularly science-based. Strum’s medical qualifications are murky — she has a medical certificate from Germany, per her lawyer. That doesn’t matter because Strum’s “vampire facials” (the client’s blood was added to a custom cream for the client — i.e. Kim K) earned the brand a degree of clout. But still — the market for luxury skincare is more crowded than it ever was — Augustinus Bader sells its “rich skin cream” at Mecca for $493. La Mer saw sales grow double digits YoY (skeptical of La Mer too). How many people are going to buy an anti-aging serum at Mecca for $900? More to the point — how many people are going to buy serums that have dupes selling for much less; and also don’t always have science behind them?

To wit — the active ingredients in Strum’s hyaluronic serum are i) hyaluronic Acid and ii) purslane extract. It is around $500 NZD. You can buy the same thing with the same active ingredients for about $20 from Estée Lauder owned The Ordinary.

I realise I am hyper-focusing on just one Puig brand. They have others - Charlotte Tilbury and Byredo for $1bn each. Charlotte Tilbury contributes the most to Puig’s make-up division, though they don’t disclose numbers by brand (773mn EUR for make-up, and 62mn EUR profit — given the bulk of that is from Tilbury it wasn’t a bad purchase).

Suspicious of the aw-shucks approach (dual class structure!) and the valuation is too much. Pass.

More Shari

I don’t know, you guys — David son of Lar’s exclusive window for negations to buy National Amusements closes soon, and it seems like a pretty bad deal for shareholders? Under the terms Shari would get around $2bn to buy NAI and Ellison would inject another $3bn into the recapitalised Paramount. This, of course, prioritises Shari above everyone else and is no guarantee that ordinary Paramount shareholders will get much. Paramount stock is up 13% on the back of $26bn offer from Apollo and Sony. There’s also no guarantee that this will happen — sure, a lawsuit will no doubt happen if Paramount is sold to Ellison, but it’s clear that Ellison is Shari’s preferred buyer.

Shari prefers the Ellison deal because it keeps Paramount as Paramount — remember not that long ago the empire that Sumner built was An Important American Business. Ego is a heady drug. If it’s sold to Sony the studio becomes just another set of assets. Le shrug. Of course, Bob Bakish has just been, uh, exited from Paramount (so much for being a yes man! Look what it gets you — only a hundred million or so).

Berkshire after Buffett

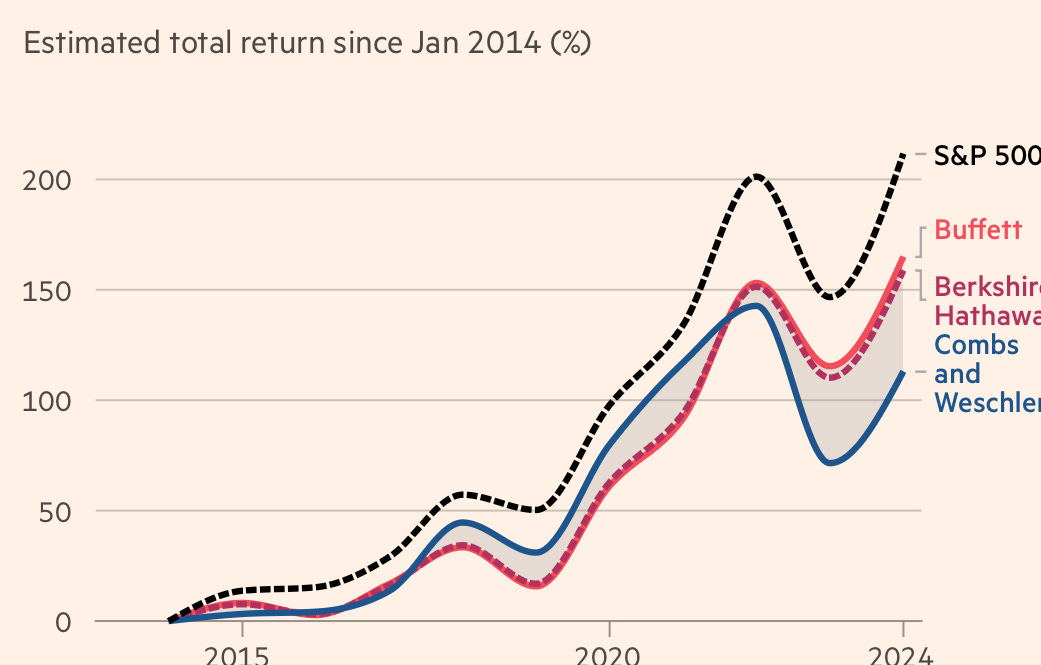

Long-ish piece in the FT on Berkshire after Buffett (assuming he dies — nothing in life is certain). Estimates the underperformance of his two stock picking protégés, Todd and Ted. They were dragged down by Paramount and John Malone’s various entities and underperformed daddy Buffett. I’m reminded of when Fritz Kreisler heard Heifetz play — “We might as well take our fiddles and break them across our knees.".

Stuff I am buying

I am buying Diageo, Brown Forman and Pernod Ricard. The reason is very simple. They all operate extremely strong franchises and have strong pricing power given their brand strength and ubiquity. They are trading at either 5 or 10 year lows. Their earnings multiples are well short of where they normally trade — i.e. Pernod is 17x when it usually trades +25x. It is usual for strong franchises to re-rate when business improves. In the meantime, the businesses continue to earn strong cash flows and command strong margins. They all make liquor. I prefer liquor to beer and wine, as the margins are typically greater. Either the world stops drinking or they continue to be good businesses for the foreseeable future. It is very boring — I just figure people will keep drinking Johnny Walker, Jack Daniel’s, Jameson’s, etc. Yes I know Zoomers are drinking less. But I can assure you — as someone who lives in the city — that there are plenty of Gen Z drinking (and the boomers continue to drink, and do Gen X — just pop into Soul one night and you will see a dozen badly dressed people in polyester). Do your own research.

Stuff I am reading

NY Mag — Can Joanna Coles Tame the Daily Beast?

New Yorker — Is Hunterbrook Media A News Outlet or a Hedge Fund?