It ain't much but it's honest work: Impairments at FBU and Warners

FBU — Fletchers selling Tradelink ($188mn, $160mn upfront cash payment) — sold to the Colburns, highly reclusive family in ‘Murica. Remember there’s already a $122mn write-down on Tradelink (recorded by FBU in Feb) … add in a non-cash impairment of A$32.5mn and $54mn non-cash loss when the transaction is completed in full in 2026…as par for the course with Fletcher, they’re first at the wrong end…

Per Forbes on the Colburns:

Not one for the spotlight, Richard told the Los Angeles Times in 1998 that he learned a simple lesson from his father: "Fools' names and fools' faces often appear in public places."

Nevermind — I will continue to appear in public places.

Gentrack — Noting Regal has sold down, no longer is an SPH. End of the rally? Has been a great stock… I caught it too late…

Guzman y Gomez — Cribbed from today’s AFR. You have to laugh.

Back in January, Inghams director Tim Longstaff objected to plans lodged by Guzman y Gomez – the Mexican fast food chain that listed in June with furious debate about its valuation – to open a major store in Mosman, in Sydney’s affluent north.

“Mosman is not a 24-hour destination, this will attract riff-raff,” his objection reads.

Riff raff!

Du Val — This sordid saga continues … NBR reports that the brain trust behind the collapsed property group planned on listing on the NZX at $1.2bn (?!). Again — you have to laugh, otherwise what would you do?

The Starbucks Hot Coffee Trade

Starbucks used to be a great story that was taught in every half decent business school (quasi-founder led, scalable, etc) — but then things started to come unstuck around Covid. China sales slowed down, domestic competitors over there became more popular, and the ever-popular method of boosting sales by increasing prices (“squoozing the consumer”) started to run into consumer opposition.

Quasi—founder Howard Schultz came back for a bit, then he selected Laxman Narasimhan to become new CEO — which was a terrible decision. Laxman presided over a half job Bob turnaround at Reckitt, which is still in a state of flux (they made the ill-advised decision to buy an infant formula business in China some years ago and are still dealing with the fallout from that). I don’t know what Schultz was doing, hiring Laxman! I don’t know if he did either — he wrote a highly critical post of SBUX on his LinkedIn in early May, post the company’s earnings call.

Over the past five days, I have been asked by people inside and outside the company for my thoughts on what should be done. I have emphasized that the company’s fix needs to begin at home: U.S. operations are the primary reason for the company’s fall from grace. The stores require a maniacal focus on the customer experience, through the eyes of a merchant. The answer does not lie in data, but in the stores.

Senior leaders—including board members—need to spend more time with those who wear the green apron. One of their first actions should be to reinvent the mobile ordering and payment platform—which Starbucks pioneered—to once again make it the uplifting experience it was designed to be. The go-to-market strategy needs to be overhauled and elevated with coffee-forward innovation that inspires partners, and creates differentiation in the marketplace, reinforcing the company’s premium position. Through it all, focus on being experiential, not transactional. [emphasis mine]

There is so much in this that is true — we rely on data too much, I think — it is so seductive — quantifiable little numbers that tell us this product is selling well, and this one is not, and so on. I actually hate data quite a lot — it only tells us the result of something, not the why. Maybe the mocha-ginger-thanksgiving-mega Frappuccino is selling well! But why? Data is not going to tell us that. You need to be in store to find that out!

N.b this is why Nick Grayston at The Warehouse was such a failure — he relied on data and McKinsey — death knell.

The second thing I think is important is the green apron bit — management that hides in an ivory tower does so at their own risk. If you’re a retailer, you need to know what is happening on the floor! Duh!

Anyway — now Starbucks has two activists, Elliot and Starboard. Elliot is the McDonald’s of activism — they have so many activist positions I can’t take count ‘em all. Starboard, lately, tends to follow Elliot wherever they go (I recall both Elliot and Starboard got onto Salesforce, too). This is good — they need an activist.

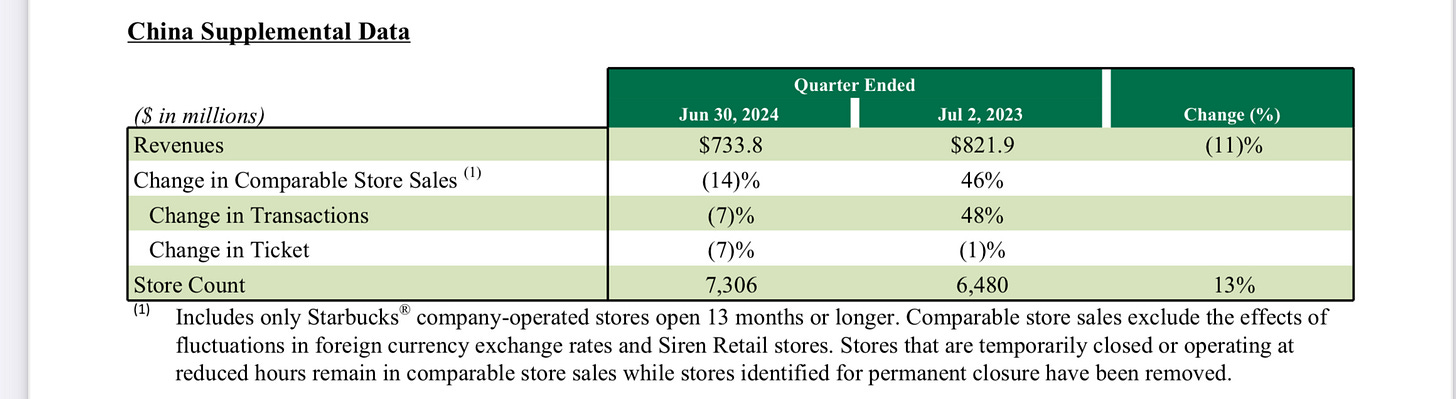

Schultz diagnoses the problem pretty well above. But he neglects China (perhaps because China was his brainchild). Those results are, uh, not great —

That’s a 14% deceleration — it’s a little better than Luckin’ Coffee’s 20% deceleration, but it still isn’t great. Luckin’ is Starbucks’ main competitor in China.

Could it be that China is drinking less coffee? Or … could it be that the Chinese consumer, too, is squoze?

Here is the good news. The average cost of building a Starbucks in the US is around $700k. The average volume per store is around $1.55mn. EBITDA tends to run at 30% on a per store basis. The payback period is around a year and a half. Consider this compared to say, a Taco Bell — $1.2mn to build, $1.7mn in revenue, and EBITDA margins of 26%. Starbucks continues to be a highly efficient operation.

If you buy Starbucks today you get a company at 20x earnings, with +$1.0bn of customer deposits (“rewards”) waiting to be spent on coffee, and a highly efficient model to boot. It is compelling, especially when you are buying the thing at a five year low (as I’m always saying … you make all your money in the buying).

The fact that Elliot and Starboard are involved makes it more compelling — you need activist shareholders to push for change and efficiency … Elliot are the best at this.

On a more macro level, it’s worth remembering that the consumer is squoze every which way — and will be until real wages increase and interest rates go down. Ain’t happening yet, sunshine.

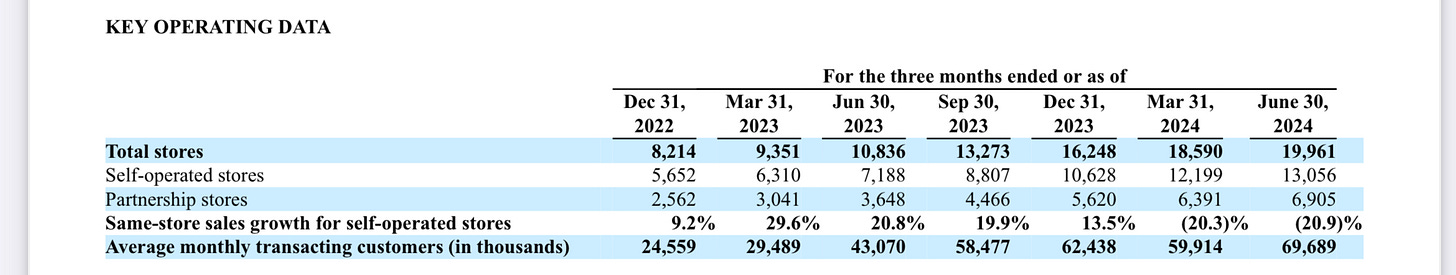

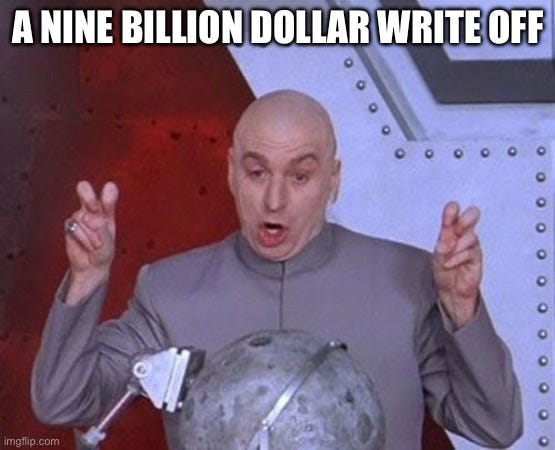

WBD — Oooh boy, bad earnings here. $9bn write-off on the linear TV networks (makes Fletcher looks like a walk in the park). You can buy the stock for $7! Remember it IPO’d at something like $12, and back then Zaz valued WarnerMedia at something like $100bn. Now the whole enterprise trades just north of $17 billion.

Now, if you were a corporate raider, you might say ok — this is a good time to buy i) CNN, ii) Warner Brothers, iii) HBO, iv) Discovery TV, etc, and v) all the associated property. And maybe you would go — ok, I’ll buy that! It’s cheap. If you are Disney you probably buy it and eat it up — yum yum.

But the thing is cheap for a reason. The studio division saw “adjusted” EBITDA down 31%, while free cash flow fell 43% (!). In terms of Zaz-adjusted EBITDA (i.e. delululand EBITDA), it came in at 10.2% billion, versus Zaz’s own goal of $14bn. Holy cow.

If you like buying steaming piles of hot mess, maybe this is an interesting one to buy. I’m not saying you should. But clearly all these assets — even with debt — are worth more than what the market currently will pay for them. And yet, like Paramount, it’s the melting iceberg situation — an iceberg is only worth as much as it is while it is still an iceberg; otherwise it tends to be a puddle of water, and no good to anyone.