Credit card pulse —

One of the things Dylan, our resident TA whiz, does well is very detailed analysis that would make a Harvard Business School boffin blush. Here’s today’s:

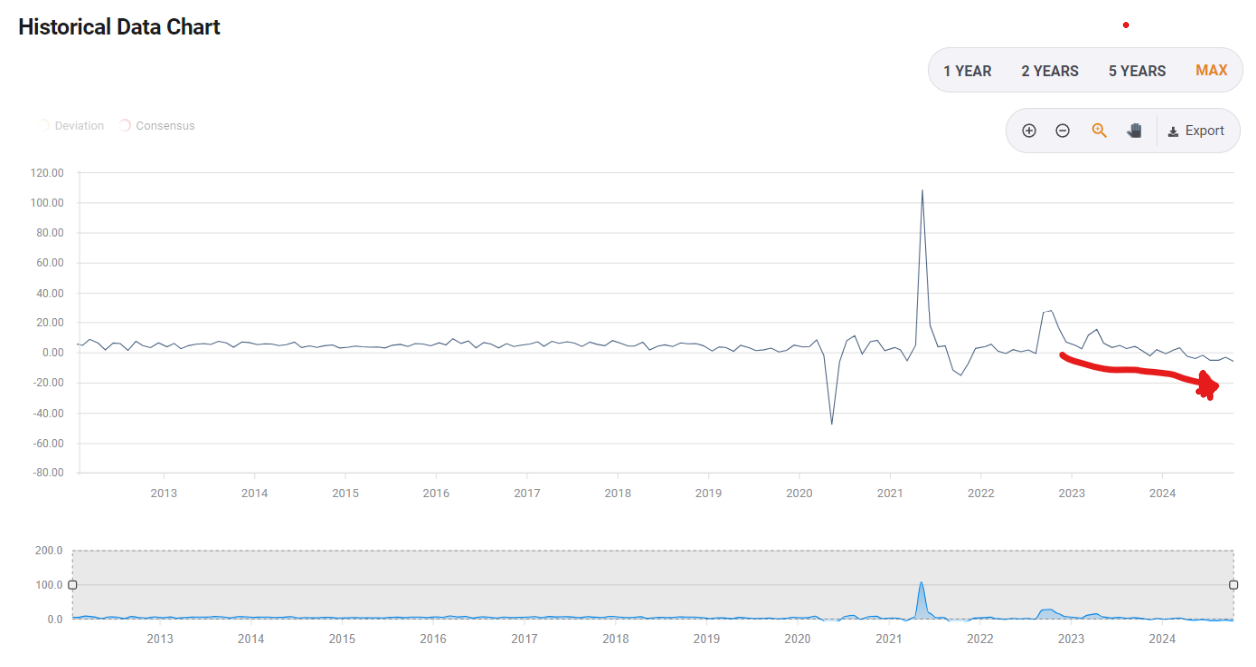

You will note the red line indicates “bad things happen here”. The chart is of credit card spending, year on year. The “cadence” of it (you’ll note people with MBAs like to say “cadence”) is downward, albeit softly.

Dealmakers —

I am quoting this wholesale from the good folks at NBR. Note Andrew Barclay, who advised on the Rakon deal. Note he sez ‘…some of which appear to have not been fully played out [sic]’. Rakon does itself no favours with how it communicates to investors but ultimately they are a company grossly undervalued by the market that is likely to be “taken out” sooner or later (disclosure: I hold RAK stock).

Of course, the bigger picture is — NZX capital markets don’t work, so it’s bargain hunting field for private equity or anyone with a fat chequebook. You have many “sitting ducks”. Including RAK.

More Dealmakers — noting Justin Queale has headed from the “great vampire squid” (Goldmans) to our friends at Craigs. What deals will be made there? We wait in anticipation…

Housing Feedback —

Lots of feedback from yesterday’s mail. Most people said that there needs to be a capital gains tax on property. Incentive > outcome.

Potentia — Good piece here from Rebecca on PE outfit Potentia’s flop of an attempt on Vista (rather like coming out with knives in the face, full-frontal — so typically Aussie!). MYOB Chair Peter James is out of the running for the board — i.e. a Potentia ally out of the running.

UPDATE: Per Street Talk

A fracas has broken out at Potentia Capital, one of the country’s most active investors in technology and tech-enabled businesses, with high-profile partner Tim Reed expected to step back from the firm.

Tim Reed previously was the CEO of MYOB. Coincidence…?

More from ST:

However, multiple sources have told Street Talk that Gray and Reed are no longer on speaking terms. “It’s pretty toxic in there. They’re [Reed and Gray] are tied together because of their carry, but there’s no doubt the two are headed in different directions,” one source said.

Perhaps Vista can rest easy? Tres scandal!

Incentive > outcome

From today’s Times —

London-based Dragoneye, which conducts independent research for short-seller investors, has raised the question of whether Smith & Nephew has inappropriately deferred its costs and failed to adequately account for its stock write-offs.

Dragoneye calculates that these accounting techniques have inflated Smith & Nephew’s trading profit margin, which was 17.5 per cent last year, by 1.7 percentage points. Forty per cent of the annual bonus payable to chief executive Deepak Nath is tied to Smith & Nephew’s profitability.

Show me the incentive and I will show you the outcome… (I know next to nothing about Smith and Nephew, but I can tell you that deferring costs for too long is never a good thing…)

Banned words

I seem to republish this once a year in one way or another — it should be mandatory reading for all wannabe corporates (imagine wanting to be corporate!). Terry Smith’s list of banned words. Link. The more a company uses them the more they should be under suspicion. Some of my favourites:

Another category is words which are used when a much simpler word exists in an effort to sound profound. You will often hear management and investment analysts talking about granular data or granularity. Detail is a perfectly good word. Other examples are:

Circle back: in a discussion or management meeting you will sometimes be told that you will “circle back” to a topic later. Why we have to “circle” is beyond me. Why not just go back or even return.

Momentarily: we are sometimes told, mainly by Americans, that something will occur “momentarily”. They mean soon.

Reach out: if someone tells you they are “Reaching out” to you, you might ask how this is different to or better than contacting you.