NZ

Warehouse — I continue to think a bid will be made for this — Stephen wants his baby back.

AoFrio — I also continue to think this is a sitting duck at 12c per share (more on that below).

SKY — I’ve had a small position in Sky TV for a little while. My thesis is pretty simple — Sky TV has valuable sports rights, people pay for sports rights, eventually someone will come in and buy it. But in the weekend I was watching Industry, the greatest TV show in the world (the latest episode, focusing solely on Rishi, is a masterpiece in tension). I watched it on Neon. Neon has ads now. Did you know this? I did not!

Why Neon has ads is beyond me — you pay $20 per month for the service anyway. Competitors like Netflix and Disney Plus do not have ads. Neon is obviously not a serious competitor in the streaming space given the ads.

Nobody wants to watch an ad for toilet cleaner before watching a show. Please, Sky, make it stop.

Sharesies — Raising another $5mn, per NBR. I’ve been really impressed with the platform’s acquisition of Orchestra as well as their win of the Fonterra business from the NZX (also noting their insurance business integration, with Cove.)

Hallensteins — Some brokers are upgrading this but I am not very convinced. Do any of the brokers recommending it actually shop at Hallensteins or Glassons? I’d hazard a guess it might clash with their Hermes ties…

Aus/NZ portfolio thoughts

More thoughts on Aus and NZ portfolio — Thanks for all your feedback on our good portfolio performance. We don’t take it for granted. Some stray thoughts I had percolating while in bed this morning as my sleeping pill wore off.

NZ stocks are mostly about revaluation — if you want a “set and forget” portfolio for NZ, just buy Mainfreight, EBOS and Infratil and go on holiday. You’ll likely do perfectly fine. But the beauty of the NZ market is largely found within the locus of mispriced stocks — Arvida was mispriced for a long time because we insist on valuing our retirement stocks on their non-cash property gains rather than i) the ever-growing number of grey-haired retirees in NZ and ii) the cash flows associated with the occupants of said homes and iii) the impact of reselling said rights to homes (Oceania remains on the platter…just sayin’).

You can also take AoFrio as an example of the NZ market’s remarkably biopolar approach towards valuing a company. A few months ago the company traded in the 6 cent zone. Now it trades at 12 cents (a 100% gain). Either the company has suddenly become double as valuable, or it was mispriced significantly. This kind of thing happens all the time and is largely due to the statistically small size of many NZ companies that come with limited liquidity. For the small investor, it’s the gift that keeps on giving.

Australia, too, has some companies that are woefully mispriced. DGL trades cheap on any metric you throw at it. Its CEO, Simon, hardly is a paragon of public relations. Nor is their core business warm and fuzzy. If you look through Buffett’s early partnership letters he was constantly finding “cigar butts” trading very cheaply — DGL is a “cigar butt” that has plenty of puff left in it… it just might be a full cigar.

Put another way, DGL trades at 0.3x price to sales (for every dollar of sales, you pay just 30 cents); it trades around 0.67x enterprise value to revenue, and it trades at 8x price to earnings (for every dollar of net profit, you pay $8 to acquire those future cash flows).

This is, obviously, ridiculously cheap. Keen observers of the order book will also notice there’s a large order sitting around 48c, giving credence that someone (institutional?) thinks it cheap too. There’s also a catch, though — it may be months or years before the value of DGL is reflected by Mr. Market. Patience is a virtue, etc.

One of the things I was most surprised about by the Aus portfolio is Westpac’s contribution. I don’t think banks should trade like growth stocks — they are well overvalued in Aussieland, I think, perhaps because they have an aura of invincibility. I’ll be cutting our Westpac position — if the value of a company causes you to have cognitive dissonance, it’s time to re-think.

World

New York Fashion Week is on, though it’s a blink and you’ll miss it affair. The biggest news, probably, is that Rihanna is back in the spotlight (sources tell me she has had two babies — well done, Riri). The problem is the clothes and designers at NYFW — it’s largely an irrelevancy. The only bright spot was Alaia, which felt fun and slightly sportswear-inspired (I was reminded of Francisco Costa’s collections for Calvin Klein during the 2000s). The duvet-like dresses made me smile, while the more commercial looks felt very much of the moment.

But — A decade ago NYFW was vital and important — now it feels snore-inducing. This begs a bigger question — who buys NYFW?

To be clear: fash week is not for sale, officially. But Ari Emanuel is taking Endeavour private, and Endeavour owns WME, which has the license to operate fashion week. Endeavour is one of those strange companies that should’ve worked on public markets but didn’t (it owns WWE, UFC, William Morris…) — Silver Lake announced it was taking it private in April this year. WME’s license to operate NYFW is marginal — it doesn’t make a difference to the bottom line, really.

But who’d buy it? Backstage beauty coverage used to be a big industry; now TikTok and YouTube have supplanted that. FY also used to be a marketing opportunity — it was PR for brands and houses — now a lot of that has shifted off the runway and the return on investment in negligible.

We saw this with NZFW too, of course. I went last year to a couple of events — it just didn’t have “it”. There was nothing inspiring or exciting about the whole affair — it felt self-indulgent and like a lot of has-beens reassuring each other they are relevant.

WME also owns IMG, the modeling agency; The Wall Group, which reps fashion stylists, makeup artists, etc, and Art + Commerce, which looks after photographers and creative directors. Those are profitable. Likely WME/Ari hold onto these — but the value proposition for NYFW is increasingly thin.

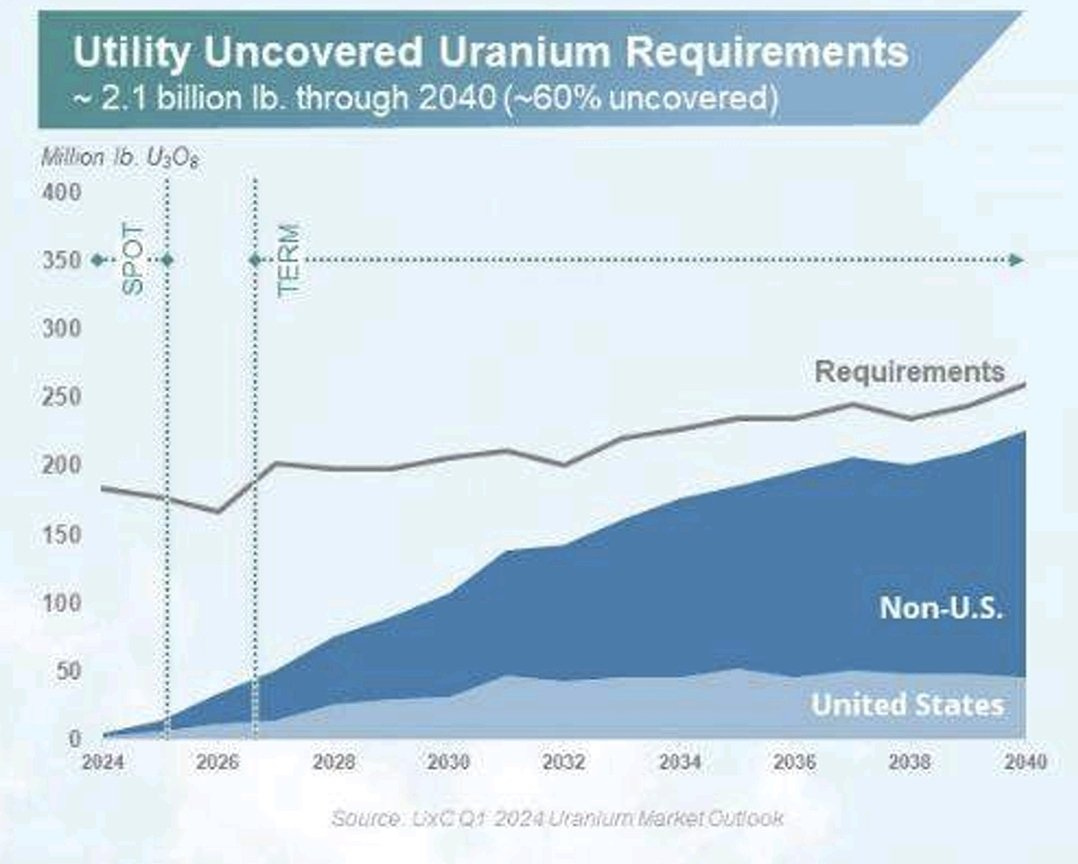

Uranium — via Twitter. Note the chronic lack of supply…