It's not all Gucci | Queen Street Bets is the new Wall Street Bets

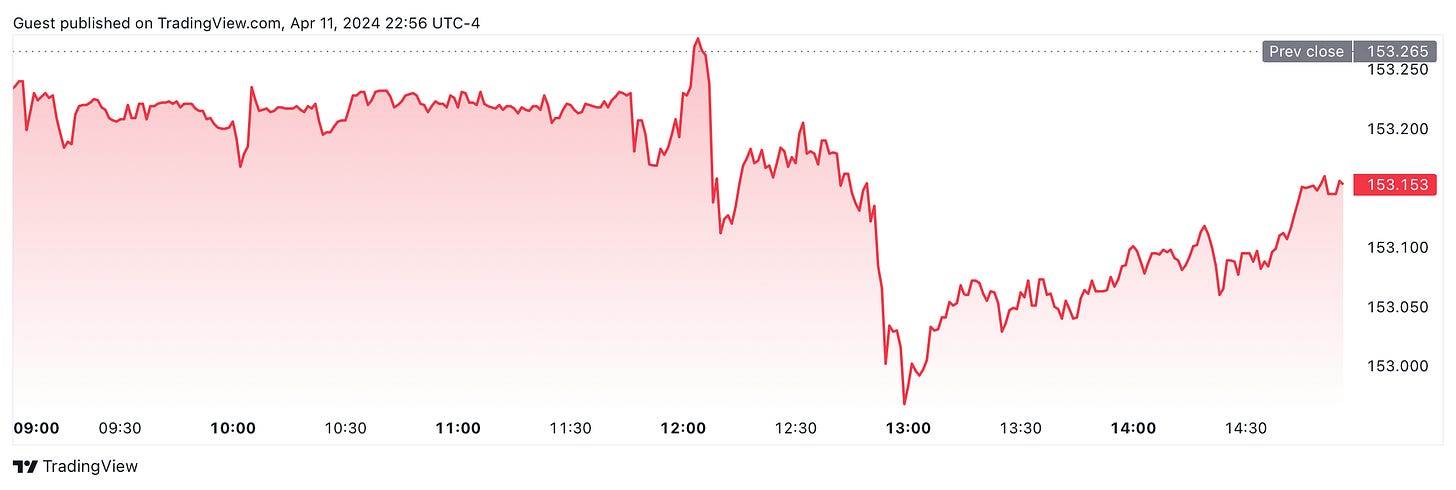

USD/JPY

Looks toppy…expect it to revert…on the equity side, this makes yen even cheaper which is a lovely opportunity to buy some of those Japanese stocks we all like…Nintendo, Suntory, all that…I am just saying! We all like Nintendo (I have not played a video game since 1986).

NZX — Noting continued support for the stk at the 1.10-1.14 range — the ASM is next week and we are advising stockholders to vote against resolution four, which is a +38% increase to the director’s fee pool. See below:

4. That the annual remuneration payable to each director of NZX Limited be set at $88,000, the Chair’s annual remuneration be set at $166,000, with the Chair of the Audit & Risk Committee to receive an additional annual fee of $15,000, the Chairs of each of the Clearing, Human Resources & Remuneration and Technology Committees to receive an additional annual fee of $10,000, for any NZX Directors who are appointed to the board of NZX Regulation Limited to receive an additional annual fee of $20,000 and for any non-executive Directors appointed to the board of NZX Wealth Technologies Limited to receive an annual fee of $20,000, all with effect from 1 July 2024.

New Zealand has a culture of “professional directors” who add very little value. We note the NZX’s stock price has barely moved since 2016 and is well off 2020 highs of +$2.00. We don’t believe in rewarding mediocrity.

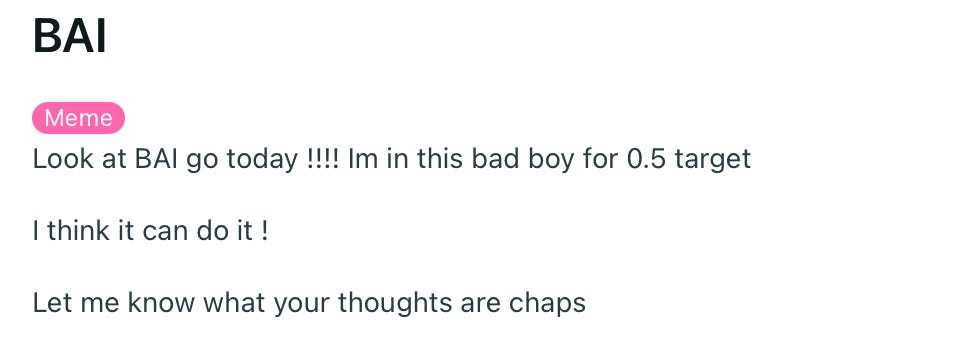

Queen St Bets — I mean, sure. Maybe the NZX should use a new metric — “had its first meme stock”. Check out these:

Let me know your thoughts, CHAPS.

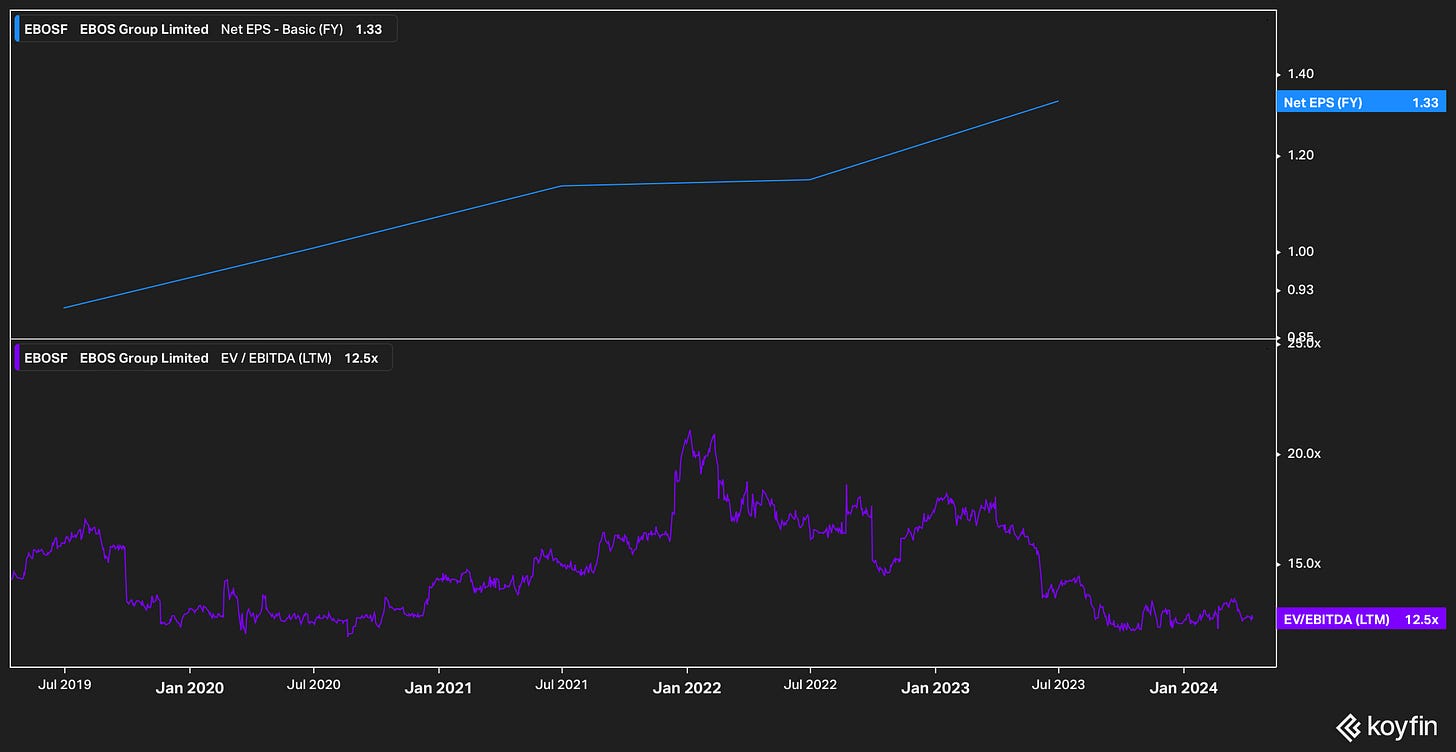

EBOS — Everybody is worried about whether this thing drops out of the MSCI NZ Standard index. People smarter than me reckon it’s not likely. There’s a lot of negative sentiment around this stock (Chemist Warehouse, MSCI) and I think a lot of that ignores the fundamentals of the business … look below, at the EPS growth and EV/EBITDA (trading pretty dirty…near 2020 lows). Seems like a “gimme”…Chemist Warehouse contract margins were very slim and nothing fundamental about the business has changed…

Next DC — Cap raise time — raising about $1.32bn to build more data centres. Next DC has been a mainstay of our Aussie portfolio a long time — has done very well. Might it be time to trim? We like Next DC/Infratil as ways to participate in “AI” and the never-ending increase of demand for data… worth pointing out that our proprietary data suggests that those data centres should be filled quite quickly…data in, data out…

More cap raises…! Ava Risk Group. Raising a much smaller $3mn (small pennies…hardly purchases dinner at Soul these days). We’ve kept an eye on this stock and think it plays into one of the bigger themes we keep seeing — corporate security. Ava conducts business in three areas — I) biometrics, ii) fibre optic intrusion detection (think protecting your oil refinery, or what have you) iii) external detection solutions. It’s a very small stock — 28.6mn revenue and 1.3mn EBITDA. One to keep an eye on…

Cettire — I don’t understand how a third-party luxury clothing retailer became a darling of the ASX for a while when all the other competitors are either broke (Matches, FarFetch) or being kept afloat by Richemont (Net-a-porter/Yoox). There are exceptions, of course — Canadian retailer Ssense has been mooted as a potential IPO candidate or acquirer of some of these “zombie” businesses, but a lot of that feels like talk between bored investment bankers — Mike Ashley bought Matches and then quickly put it in the “too hard” basket. There’s just so little to be gained by owning or selling an online retailer selling high-end goods — where’s the experience? Where’s the cloying sales associates? Where’s the dinners and parties? Richemont and co learned the hard way that a website is a website is a website. Anyway — Cettire saw sales revenue grow +88% to $191mn. Market was unconvinced — stock is down 6%. I mean, look — I don’t know how much this thing is worth. If you’re playing in the luxury space, why not just go straight from mother’s milk — the source? I.e Hermes, LVMH, etc.

Send me a lifeline, Gucci

You know that we have a number of highly secretive proprietary data gathering methods here at BlackBull Research. For instance, walking down that indictment upon Auckland’s failing infrastructure, Queen St. Check out Gucci above — *cricket noises*.

There’s nobody there.

Not a soul.

The Louboutin store next to it, incidentally, is also quiet — every time I walk past there are two nice girls in there manning the shop and nobody else. I guess red bottom soles aren’t selling like they used to…

But back to Gucci — they are in a pickle and so is its parent company, Kering. Kering had a short golden period where everyone was wearing Gucci and Balenciaga. Well, boy, long gone are those days — Gucci’s new designer, Sabato, is fine, and by fine I mean deeply unexciting — sleek, anonymous designs that would be fine for a decent air hostess uniform. But it’s not exactly capturing the zeitgeist. Kering has been working hard at fixing this. They just poached Stefano Cantino from LVMH — he was one of their PR and comms supremos — he is now Gucci’s deputy CEO. I don’t often hear about a deputy CEO very often and I wonder if Cantino is closer to running the show than the title suggests — he ran communications and events at Louis Vuitton, arguably a large part of the reason the brand remains relevant. Kering trades at 14x earnings (compare this to 26x for LVMH)…it’s a wide discount and I’m starting to wonder if the discount will close at some point…multiple re-rating from 14x - 20x could be quite the catalyst.