Long luxury — Love this chart from BOF. What are you going to buy the 1%er who has everything? Jewelry, perhaps. When I was in Paris there were lines for Cartier and I browsed at ultra-high-end Graff (even with my Brunello scarf and Yohji coat they looked at me suspiciously, like I might rob the place — sadly my burglary skills are not up to scratch after sustaining injuries during my days captaining the high school rugby team). Especially long Richemont (CHF) which owns Cartier and Van Cleef…CHF is a ~11% weighting in our intl high conviction portfolio. Continue to see good buying of LVMH stk (MC). Essentially Yoox-Net-a-Porter is counted as a non-entity now — they need to sell it to someone — but who would be a willing buyer of a constantly loss making business…? Perhaps Sports Direct owner Mike Ashley … he just bought loss-making Matches Fashion — wouldn’t be surprised to see the beer-loving Brit on the hunt for more to annex to his retail empire.

NZ

RAK — Still playing the “waiting game” on this one with very little information disclosed by the board. We think the board & shareholders ought to take up the offer — $1.70 is a good premium to the pre-offer stk px (traded at ~62c before takeover). The reality of the NZ market is that it will always undervalue small technology companies — especially ones that are too small for the NZX50.

Fletcher’s woes — Ballooning costs on the Auckland Wonderfulness Convention Centre (or whatever it’s called) and a carpark in Wellington means the co. is spending another $180mn on the projects. We took FBU out of our model portfolio last week and we see the construction sector bottoming out...

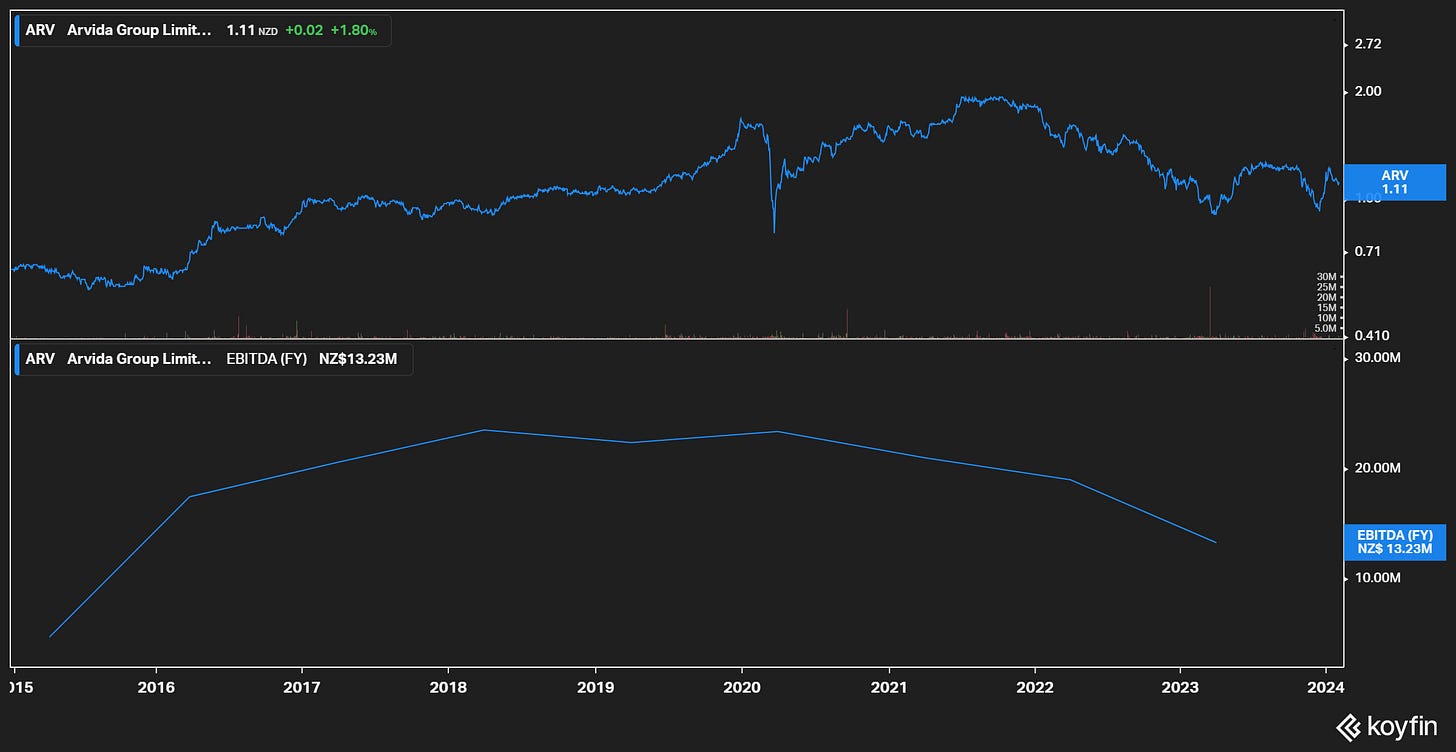

ARV (Arvida) — Rejected an offer out-of-hand last year at $1.70 per share (I know, same as RAK takeover price - coincidence can be funny). In our view the board did shareholders a disservice by rejecting the proposal out of hand without considering the offer fully. As per the release:

After careful consideration, the Board determined to not engage with the proposal on the basis that the amount offered of NZ$1.70 per share was not in the best interests of its shareholders, as it meaningfully undervalued Arvida’s intrinsic value. Arvida informed the suitor that it did not wish to engage further on that proposal. Arvida has no reason to believe the unsolicited proposal will proceed any further.

The NBIO was confidential when received. Ordinarily the receipt of a proposal at such an early and highly conditional stage would not require disclosure. However, Arvida has become aware that the existence of the approach may be known by some shareholders, so is confirming the status of the approach to ensure that all shareholders are fully informed.

The stk hasn’t traded at $1.70 since the start of 2022 while EBITDA has been flat — board should’ve considered the offer more carefully — when you write “…not in the best interests of its shareholders, as it meaningfully undervalued Arvida’s intrinsic value” — then perhaps the operative word is shareholders and they should be the ones to decide whether it undervalues Arvida’s “intrinsic” value.

We’re starting to get interested in the stk…perhaps the board should reconsider??

Oh, Synlait — Had a caller today inquiring as to their bonds, which currently have a coupon rate of 24%…my response, edited for vulgarity, was “I’d rather stick my hand down an insinkerator”.

Best news of the year — Uncle Bob is back.

Across the ditch

Last week I wrote that we’re adding a bit of Lynas to our Aussie model portfolio and reiterated it as a buy — logic is — Andrew Forrest and Gina Rinehart are investing heavily in lithium; they’re not idiots; it’s not going away. During the weekend Lynas confirmed there has been talks between themselves and MP Materials — would create the biggest non-Chinese producer of rare earths. We’re for the merger and continue to be buy rated on the thing — while there’s a sell-off of lithium & rare earths makes sense to combine the two heavyweights — it’d consolidate the bulk of ex-China supply. We all love to play Monopoly…

A little speccy for you — Droneshield ltd — DRO.ASX — they make technology which counters weaponized drones. Have contracts with Lockheed Martin, the US Military, etc…note ex-ANZ and Woodside chair Charles Goode owns about ~3.50% of the co. The geopolitical climate continues to be fraught, and we think DRO is a direct beneficiary of warfare which is increasingly unmanned. No view but we think it’s interesting…

It’s Taylor’s economy and we’re just living in it.

I’ll never understand Tay Tay’s music — maybe your daughters do — but her shows in Melb & Syd are expected to bring in $140 million or so to the Australian economy. And let’s not forget about the sequin economy:

ShowPo, an online clothing retailer, now has an “Eras Tour Edit” for customers. “We have outfits for each ‘era’,” said Ms Lu, “but the most popular styles are anything with sequins, sparkles and tassles.

Well, naturally.

UMG recently pulled its music from TikTok — that includes Tay Tay’s catalogue — and things are getting nasty:

In a sign of how far relations have soured, the two companies traded barbs publicly in the past few days. TikTok described Universal’s move as “greedy” and “self-serving” while Universal accused the Chinese social media group of “bullying”.

This is a long way from UMG CEO Lucian Grainge’s treatment of Spotify founder Daniel Ek, who put off renegotiating UMG’s deal with Spotify while Ek was expecting a baby. But TikTok is not Spotify — it’s the next phase in the streaming ball game — continue to watch with interest.

Paramount

I have talked your ear off about Paramount and make no apologies for that — Byron Trott is advising controlling owner Shari Redstone (i.e. Warren Buffett’s favourite banker — and Buffett hates bankers) — i.e. there is a deal to be done, though how the deal is done remains a giant question mark over the heads of Hollywood’s botoxed and bedazzled glitterati. There’s three players in the running. Zaz over at WBD, Larry Ellison’s son David, and Byron Allen, the comic-turned-owner-of-the-weather-channel (for real). Byron’s bid is ~$14.3bn plus Paramount’s $15bn debt load, so $30bn in total.

The problem is he won’t tell anyone — and I mean anyone — where the money is coming from. Allen doesn’t have a mega-rich daddy like David, nor does he have a company the size of WBD with the implied backing of John Malone, etc. Not a serious bidder. Likely Ellison buys the co — but as we have written before, Buffett is Paramount’s biggest common equity holder — buying via Shari’s holding co National Amusement’s and bypassing stockholders who wouldn’t see any deal moolah would be a bad move — Trott and Buffet are tight…he’s not going to screw him over…our major question mark with the deal is Buffett could potentially end up with a lot of preferred stock or take on Paramount’s debt (with that guarantee of converting the equity to preferred). He did a lot of “good deals” which benefitted Berkshire disproportionately during the GFC. But the kicker here is that perhaps Ellison, if he is the eventual buyer, doesn’t need Buffett’s money — father Larry has plenty of his own.

Briefly noted — Farewell La Fuente, we hardly knew you — farewell to the oft-frequented downtown Mezcal bar, which has closed its doors for the last time…

How IAG was the Lex Greensill Vortex — link.

Who were the Swans? A deep dive into Truman Capote’s best frenemies — link.