FX

Volatile EURCHF … as long as gold stays elevated we see CHF continuing to outperform given ze Swiss bank’s large amounts of gold.

NZ & Across the ditch

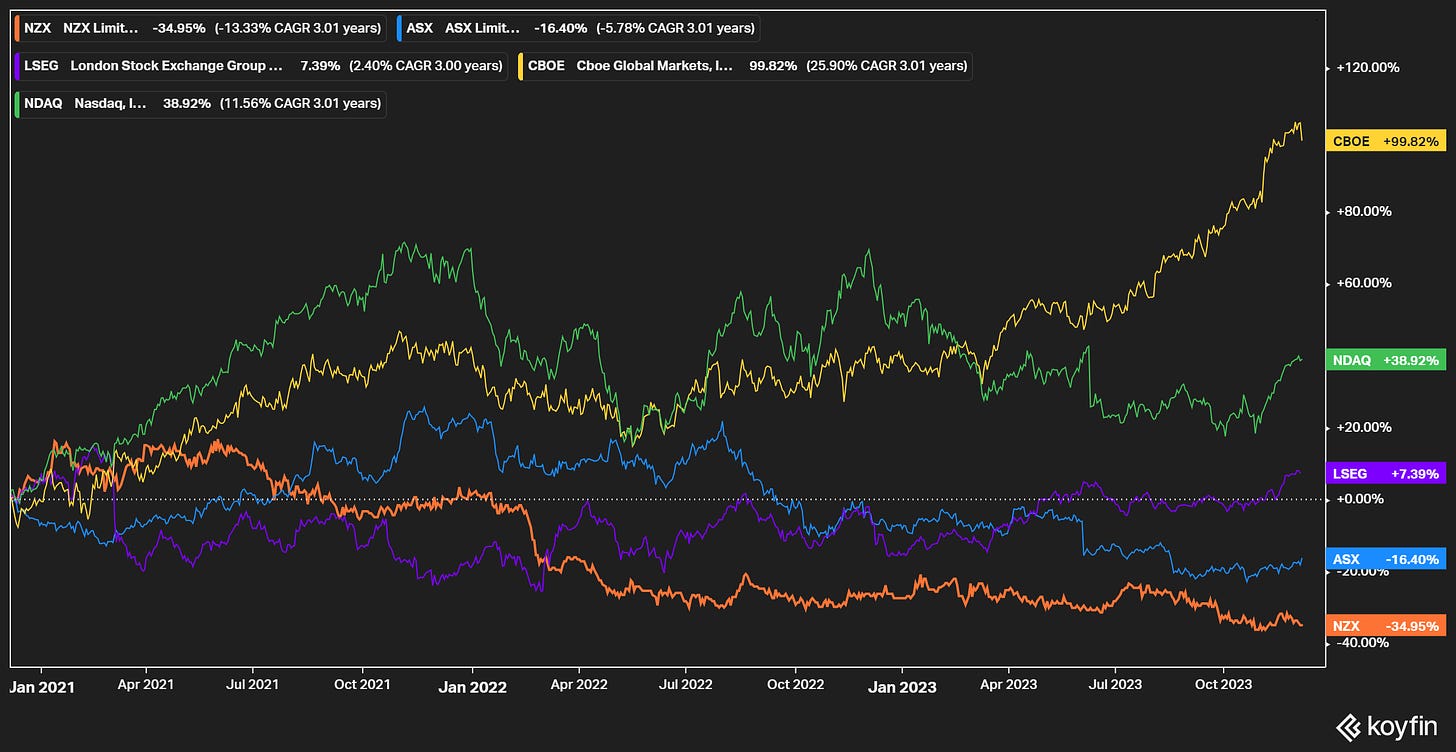

NZX - Craigs sees the NZX as undervalued — SOTP valuation ranges from $1.23 - $1.39. Values SmartShares/Wealth biz at 66c with the remainder being the exchange. We think the valuation for SmartShares is a little low — valuing below 2% of FUM, citing multiple compression. SS has default KiwiSaver status which we think should value the whole kit and caboodle at +2% (2.5% of FUM is our working assumption). Craigs are overweight, while Forbars have it as an outperform. Retaining buy — it’s our current hobby horse and we think the stock being re-rated is a question of not ‘if’ but ‘when’. As we have noted before, the NZX has lagged peers in performance for some time…we think it is due for a re-rate.

This sporting life — Sky TV (SKT) increasing their sports package to 11% to $42 per month from February. We still don’t like the stock. When cos only lever is increasing price it’s a bad sign. They co increased prices for both entertainment and sport only a few months ago. Neutral because it’s so ‘cheap’, but it’s a melting icecube, boy…

Chemist Warehouse — Listed co Sigma Healthcare is heading towards reverse listing the privately owned Chemist Warehouse — raising about $350mn for the deal. Not much of a surprise — Sigma took EBOS’ Chemist Warehouse contract a few months ago. If the deal goes ahead it’ll form a goliath in the space…

Mainfreight — back at $70 after sitting at $57 a month ago. We wrote it was a buy then…still like it…Don Braid is the best operator in the space — more managers should model themselves on him. Price target $75. Quoting from an old article on why we like the co so much…

But don't say "headquarters" around Mr Braid. It's a dirty word at Mainfreight – along with memo, staff, offices, closed doors, budgets, named executive car parks and more than one big table in staff cafeterias.

AKL restaurant power rankings — Extremely niche but Beau has to take the top spot for us…great steak & sauce Diane. Origine’s parfait with Sauternes is lux-on-lux, while Gilt is still our go-to for a power lunch (we’re lazy and it is close). Honorable shout out to The Don (it’s where business deals are done) and Eden Noodles (my nakesake…).

Intl.

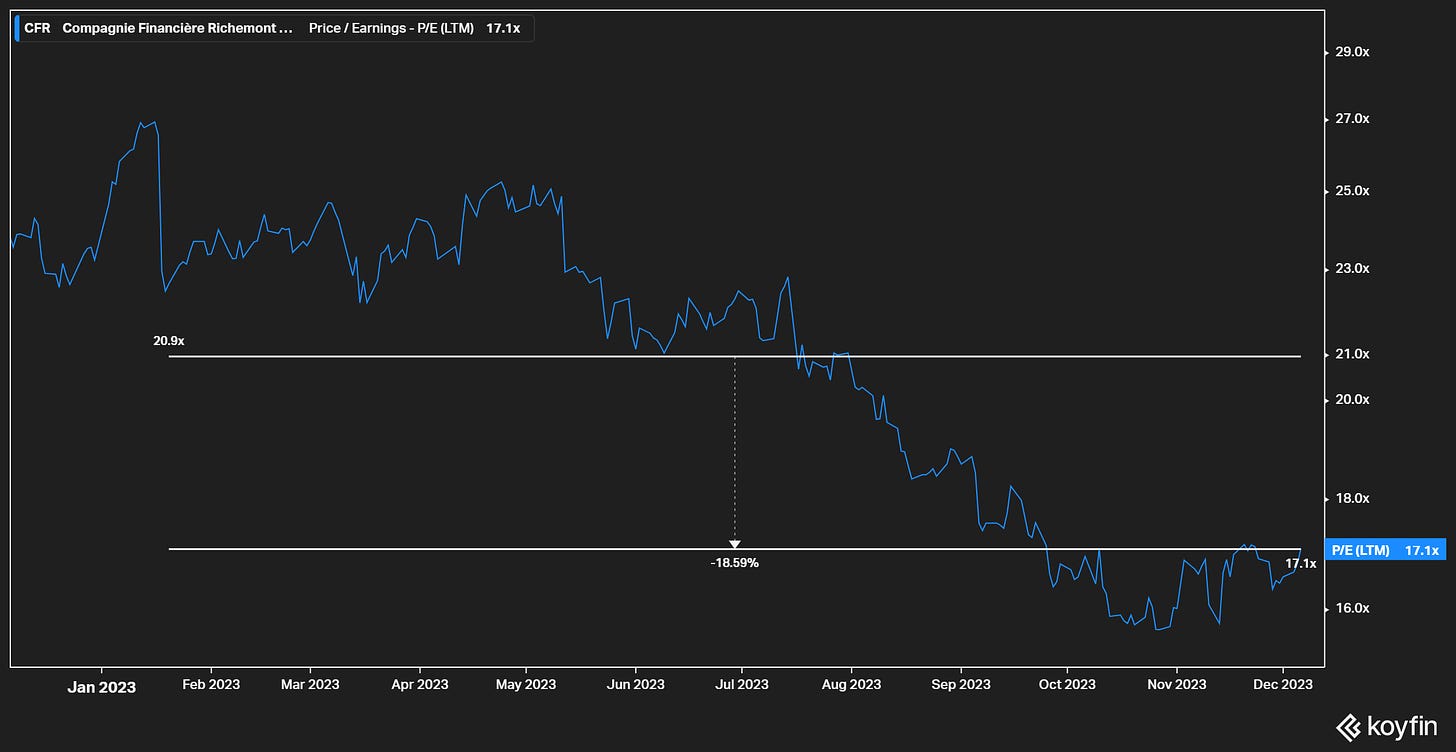

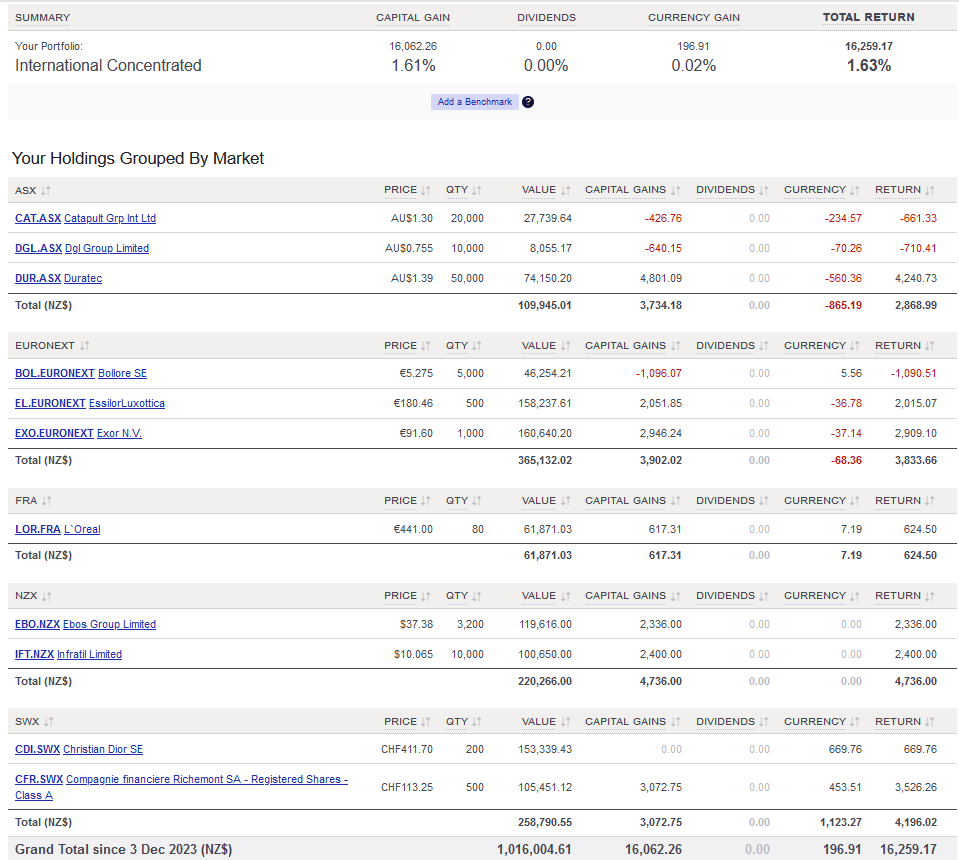

New model portfolio — International Concentrated — inception was Monday. Our highest conviction ideas, mostly internationally, with a dash of Aussie and NZ for good measure. Catapult does sports tech and licenses its tech to Manchester City, Formula One, etc…write-up we did on it here if you missed it. DLG we’ve harped on about enough to you, while Duratec does maintenance on long-lived assets. Richemont is new one — they own Cartier — it is trading at a ~18% discount on an earnings basis. We like luxury as a thematic — hard to ‘buy’ history and the 1% are still spending (back to Gilt — tables are always full — like getting a table at Dorsia!)

Richemont — trading at a discount…

Not as smooth as Tennessee whiskey…or, “The Karenpocalypse”

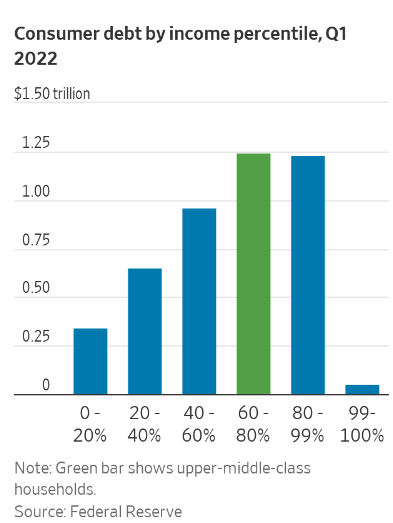

Brown-Forman stock declined 10% today — people are drinking less whiskey. The co famously makes Jack Daniels. Net sales for the six months increased 2% (1% organically) while whiskey sales declined 2%. Quite a change from recent thematics where the co was seeing double digit growth. We think it’s part of a broader theme — the middle class is being priced out — let’s call it “The Karenpocalypse” — there’s no money left after mortgage payments, etc…lower socio-economic demographics likely don’t have a mortgage, while the rich continue to do well. Upper-middle class companies are likely to be the ones who see their margins and sales squeezed as a result. By way of example:

Companies likely to do poorly due to “The Karenpocalypse”

Coach (TPR), Lululemon (LULU), Steve Madden (SHOO), Brown-Forman (BFB) etc.

Companies likely to do well because the middle class are trading down

Dollar General (DG), McDonald’s MCD), Dominos Pizza (DPZ), Costco (COST).

A fun trade might be — short the “Karen” companies (this list is not definitive by any means) and long the “trading down” companies. This isn’t financial advice. But it seems like a kind of obvious theme. Here’s a chart from a WSJ last year…

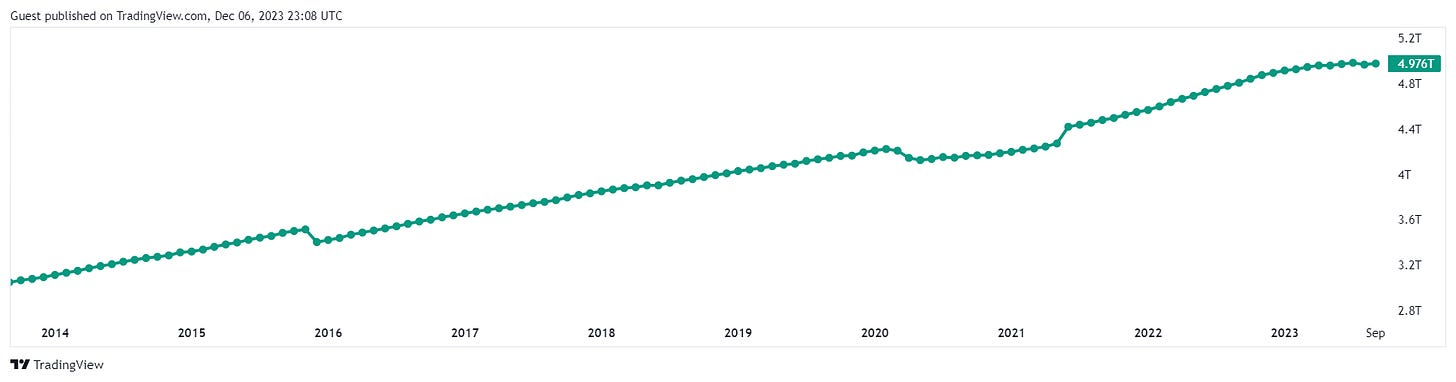

And here is total US consumer credit owned & securitised…

It’s not a good look! If you consider those ever-growing interest payments on mortgages (and still higher for longer…yada yada) the overall read-through is fairly bad.

We still like Brown-Forman, as we like Diageo and we like companies like them — their IP is incredibly strong and they still make billions of dollars in sales (you don’t say “bourbon and Coke”, you say “a Jack and Coke”). Buying Brown-Forman close to Pandemic lows doesn’t feel stupid to us. We’re less sanguine on the prospects of straight consumer companies…though our market research indicates Lululemon is still being bought by the bucketload…

One way to do this — if you are a believer in the Karenpocalypse — would be to long quality debt - short junk debt. It worked well during the start of Covid & the GFC.