Karens got upset they couldn't buy a Birkin | Rakon watch day 108

Bubble watch —

Uh oh.

Does this remind you of ‘22 where people will still buying NFTs and things? I mean … what is the value of a platform where people are only interested in one bonkers person rather than many. I don’t know! I can’t answer that! Is it worth billions of dollars? Again — I don’t know. Twitter/X is owned by one bonkers dude and Truth Social is partially owned by some other bonkers dude. Maybe I am in the wrong industry.

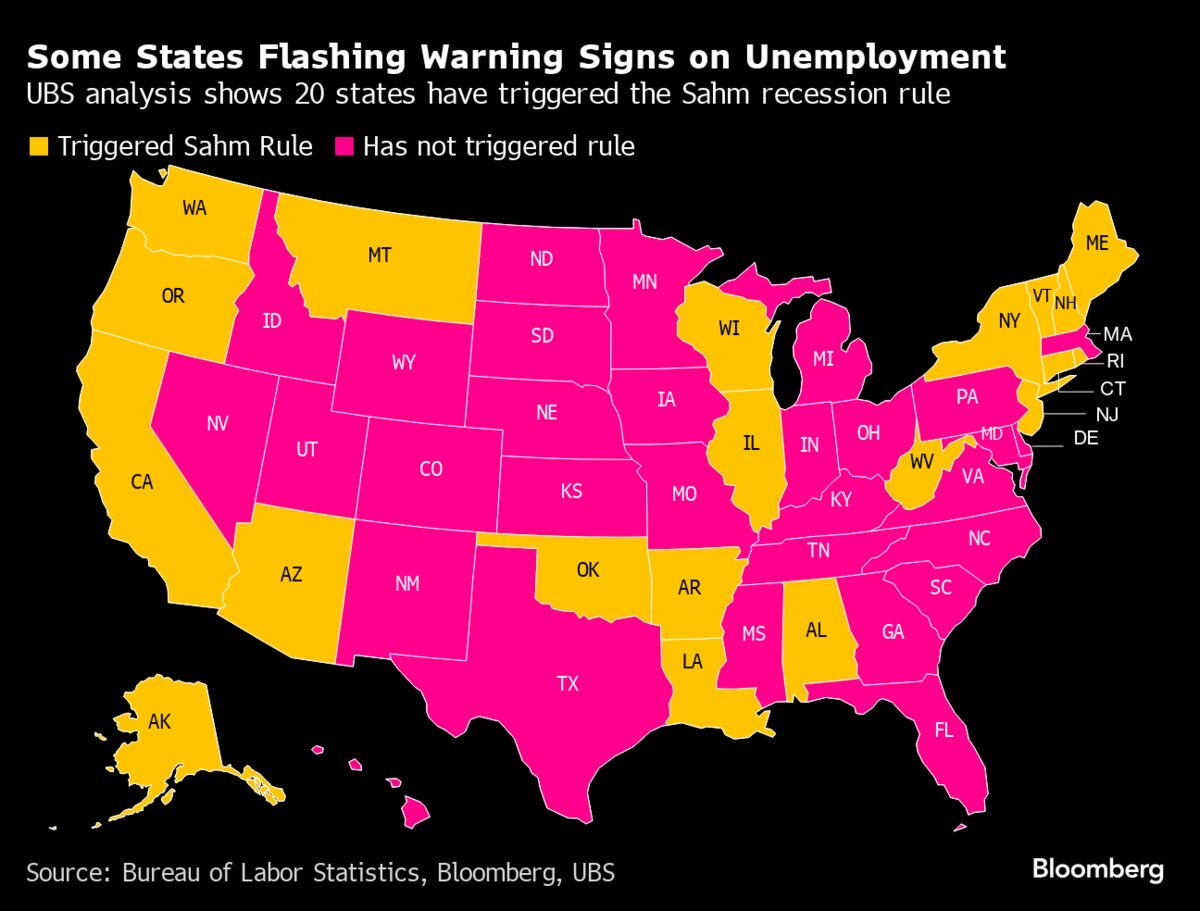

Meanwhile — here’s a map of the US of A — a visual of states (20 — count ‘em) that are starting to trigger Sahm Rule (when 3m moving average of unemployment rate rises by 0.5 percentage points or more relative to its low during previous 12 months). But shiny crypto go brr right??

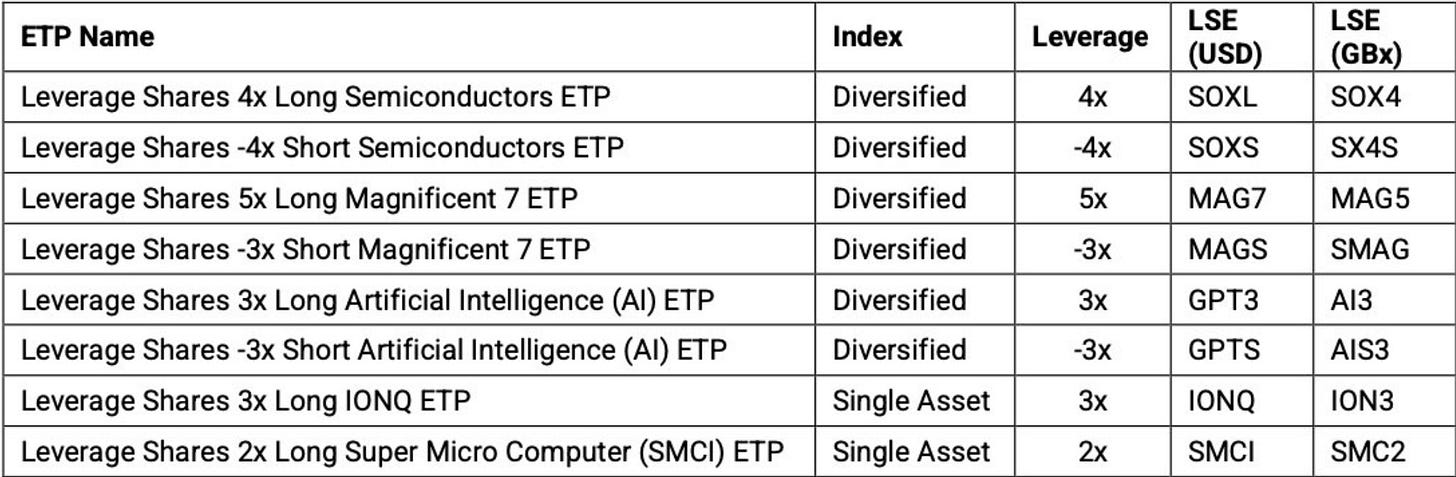

It is OK though guys — you can leverage semi-conductor ETFs at 4x. Bubble who?

Hermes Lawsuit — seeing lots of Americans get all breathless and excited that there’s a lawsuit against the company — some people weren’t allowed to buy a Birkin so they got very upset and Did A Lawsuit. How very American! The rights of the upper middle class who want Birkins must be respected. It’s a human right! Birkins for Karens!

Anyway, the gist of the lawsuit is that Hermes breached section 2 of the Sherman Act by coercing the buyer to purchase ancillary products (i.e. scarves, shoes, etc). I don’t know — it’s not like these people are being denied access to water unless they first purchase a subscription to magic Joe Rogan mushrooms first or something. It’s not like they are being forced to buy a Birkin. The Hermes sales advisors (SAs) are not holding guns to their heads! The potential buyers of a Birkin are doing it entirely of their own volition. Rarely if ever a Hermes SA will say — buy x, x and x and then I will offer you a Birkin. Sure, everyone knows that’s the deal, but it isn’t stated. It’s the exact same model as Rolex or Ferrari. And again — nobody is holding a gun to the head of the dudes buying a Rolex. I have a very limited amount of sympathy here (none).

Does the case have legs? I mean — it’s a “floodgates” type case. Implicitly most high luxury is on a spend-first-then-be-offered basis — a Birkin is no different. There’s also the question of desirability — the complainants need to prove that those “auxiliary” items aren’t actually desirable at all. This might be hard to prove given that fakes of Hermes scarves and sandals proliferate the internet and dodgy street corners. If they weren’t so desirable surely nobody would desire a fake. There’s also the issue of market power — the lawsuit alleges Hermes has a near-monopolistic control of the market — which leaves out secondary sellers who sell second-hand Birkins. Anyone can go online and buy a Birkin — at a markup. But we’re talking about affluent consumers here — it’s not a markup for a need, it’s a markup for a Birkin.

Tl;dr — Karens want Birkins. They’re American, so they’re suing. USA! USA! USA

Rakon watch — day 108 (I think?) and no announcement to market. I emailed their PR flack last week and he wrote a response that could induce a coma:

Hi Eden

I hope you are doing well. Thanks for your email.

The Rakon board is mindful of, and pays close attention to, its continuous disclosure obligations to release material information (including any information relating to the indicative proposal announced in December 2023, to the extent it is material information) to the market (subject to the provisions of the Listing Rules). Rakon is committed to keeping shareholders informed in accordance with those obligations.

Thanks

I am always doing well but I know what would make me do even better — if Rakon was more communicative with shareholders. Just a thought.

Trade Window — cap raise time! Another $2.2mn please. I don’t really understand what they do. Logistics blah blah. I like Mainfreight because it makes money and I understand it. Call me boring.

Delululemon

Oy vey, is the Karenpocalypse coming or what?! I wrote about it here and wrote:

A fun trade might be — short the “Karen” companies (this list is not definitive by any means) and long the “trading down” companies. This isn’t financial advice. But it seems like a kind of obvious theme.

Lululemon — maker of leggings to Ponsonby mums everywhere — reported good earnings but warned of a weaker FY outlook (EPS of $14.00 per share vs. $14.13…big deal) as the US consumer tightens their respective belts. Shares are down +15%, which feels like a classic case of overselling — has the business model changed? Not particularly. We prefer it at a discount but still think we’re going to see more weakness from the US consumer…interest rates remain high and COVID savings are all spend…where is Karen going to find the pennies to buy another pair of leggings to wear to coffee with her friends?! Trading at a 30x multiple…still a little expensive for me.

Over in Aussie

Droneshield — 72c per share as of writing. Perennial favourite Duratec ~$1.10 per share (it hit highs of +$1.70 so, you know, nice work if you can get it).

Things we’ve been reading

The best skin-care trick is being rich — (“try this one crazy trick at home”). The Atlantic — link.

Anals of the ghoulish — New Yorker article about Julien’s, the auctioneer of celebrity items (they sold Capote’s ashes, looked at selling the bed Michael Jackson died in, Freddy Mercuar’s moustache comb). While the rest of the auction market has seen a drop in spending, the celebrity market keeps going up. Link.

Renzo Rosso (owner of Diesel and Margiela) on his mini-empire and a potential IPO. FT — link.

Minority Report — Shocking indictment of NZ’s ability to detain mentally venerable people without trial. RNZ - link here.