NBIOs (non-binding indicative offers) - Which directors sit on the boards?

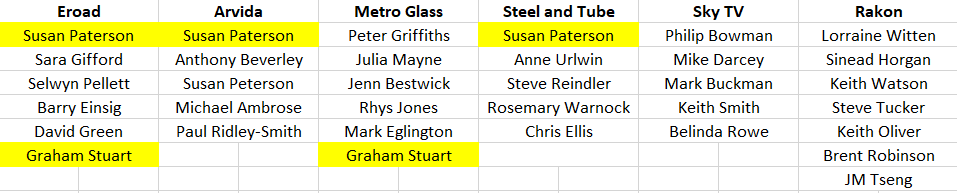

Yesterday I wrote about multiple NBIOs that have been rebuffed the boards of the respective companies. I thought it might be interesting to look at the composition of the boards at each company at the time of NBIO. See below. Where a director has sat at multiple boards I have highlighted their name.

Eroad, Arvida, Metro, Sky TV and Rakon were all NBIOs from last year (of course RAK is still in play). Steel and Tube received an NBIO in 2018.

All the companies which rebuffed the NBIO offer are today trading at significant discounts to the premium the companies were offered, while Rakon is still negotiating.

Aussie

Duratec is bouncing back after what was a few heavy days of selling (as I wrote, I suspect the liquidation of the First Sentier funds were the catalyst for the sell-off). Think it’s worth +$1.25 with room for potential re-rating. Could be worth $1.50 or more if order book increases. Trading at 11x earnings — get in while its cheap if you didn’t get in at $1.00 when I suggested it was “interesting”…

Droneshield is continuing to trade well — rights offer was oversubscribed by a whole lot — $40mn of applications vs. $15mn of desired capital. We did some digging on other ASX defense stocks and basically we don’t like any of the others — all very capex heavy and/or have a vague path forward (one company’s website had numbers for people who had retired long ago! We spoke to a nice gentleman who was well retired and probably was about to go and play some bowls at the RSA).

Banks — MQG, ANZ, WBC or; Buffett and Buybacks

All disappointing. ANZ has announced a share buyback of $2bn in spite of profits declining 7%. Typical example of prevailing wisdom — BUY BACK STOCK MAKE STOCK GO UP BRRRR.

Example — Apple — $110bn buyback announced this quarter. At the end of 2023 Apple had spent $658bn on buybacks over the last decade…this brings it to $768bn (you could buy Infratil 141.993333333 times over with that cash). Of course — stock go up because there is less stock. But Apple’s actually topline has been noticeably stagnant the last few quarters — less people are buying iPhones, and there’s been no revolutionary products since the death of Steve Jobs. Buybacks have fueled the stock price.

Buffett recently reduced Berkshire’s Apple holding by ~22%. Apple’s been a great holding for Berkshire. But I think it is interesting to note the parallels between the mechanics of Buffett’s failed IBM investment (he entered in 2011 and exited in 2017) and his successful Apple investment. By 2014 IBM had spent $138bn on buybacks and dividends ($100bn on buybacks, $38bn on dividends). It had only spent $59bn on capex during the same 14 year period. Obviously this led to the collapse of IBM’s once powerful business — technology moves fast. Buffett was a huge fan of these buybacks, and actually liked the idea of the stock price languishing. From his 2011 letter:

If IBM’s stock price averages, say, $200 during the period, the company will acquire 250 million shares for its $50 billion,” he wrote. “There would consequently be 910 million shares outstanding, and we would own about 7% of the company. If the stock conversely sells for an average of $300 during the five-year period, IBM will acquire only 167 million shares. That would leave about 990 million shares outstanding after five years, of which we would own 6.5%.

Currently IBM has 914.7 million shares outstanding and trades at $168 per share — over a decade on from 2011.

Eventually, of course, Buffett divested because IBM’s financial engineering could not disguise their shrinking business. I do not think Apple has a shrinking business. But it is interesting to think that the mechanism of buybacks has been something Buffett has endorsed and cheered for in both companies. At Apple it worked because they have a great product. But maybe — just maybe — Apple will need to come up with some new products rather than a rehash of the iPhone and Apple watch. The real mechanism behind Buffett’s Apple gains isn’t a rapid increase in sales but financial engineering.

Fashion Corner

Per Bloomberg LVMH has appointed advisers to sell Marc Jacobs. JP Morgan advising. It’s not the first time Arnault has sold off brands. He’s previously sold off Christian Lacroix (“it’s Lacroix darling, Lacroix!”), his stake in Kors, etc. I’m surprised — Jacobs was responsible for a bunch of good Louis Vuitton collections and at one time his name all over the culture (“Marc by Marc”, etc). I’m still leery of it and won’t believe it until there’s more solid info. What’s to be gained by selling the brand? Marc Jacobs is then effectively free to go over to rivals — who wants that!

Hedi — seeing lots of fashion folk speculate that Hedi Slimane will leave Celine and go over to Chanel. Chanel sorely needs a new designer. The point of Lagerfeld wasn’t that was good but that he embraced the zeitgeist. I don’t know what the new Chanel collections are trying to say. Do anyone? Still — I don’t see Hedi jumping anytime soon. Slimane is the same wherever he goes — at Dior Homme, YSL and Celine he has espoused an almost unchanged idea of what the kids call “indie sleeze” — cigarettes and leather and sin.

Oh, Lina — I forgot to write you about the FTC’s Lina Khan taking the Tapestry-Capri merger to task — the merger was agreed to last year. Both companies make products nobody cares about: Coach, Michael Kors, etc. Khan’s suit hilariously alleges the merger will allow the new entity to control the “mid priced American handbag market”. You know — the Coach handbag that probably is sitting in the back of your mother’s closet. It’s a weak argument and I think the best take here is that Khan doesn’t actually expect to win, she’s just effectively adding in a new synthetic transaction cost (litigation) in a bid to scare off future mergers.

Capri does own Versace, but in reality it’s a very small part of the puzzle. It’s the MID PRICED AMERICAN HANDBACK MARKET FOR WOMEN NAMED CAROL FROM OHIO AND ASHBURTON that Khan is after — and that’s why the suit is destined to fail — they’re just commodities, folks.

Met Gala — zzz

I don’t know what this year’s theme was for the Met Gala and I don’t really care — the last few years have been mediocre at best and prove the celebrities have no taste. I watch it anyway, though, to see what designers clothe whom. Bottom line — a lot of Kering houses represented here — Lana del Ray wore McQueen, Nicole Kidman wore Balenciaga, etc. No doubt FPH is happy about that — as are long-suffering Kering shareholders. Here are a couple of looks. The first lady is dressed in Margiela — I think her name is Zendeya? I don’t know.

You also have Ed Sheran who dressed like a Sir Les Patterson impersonator.