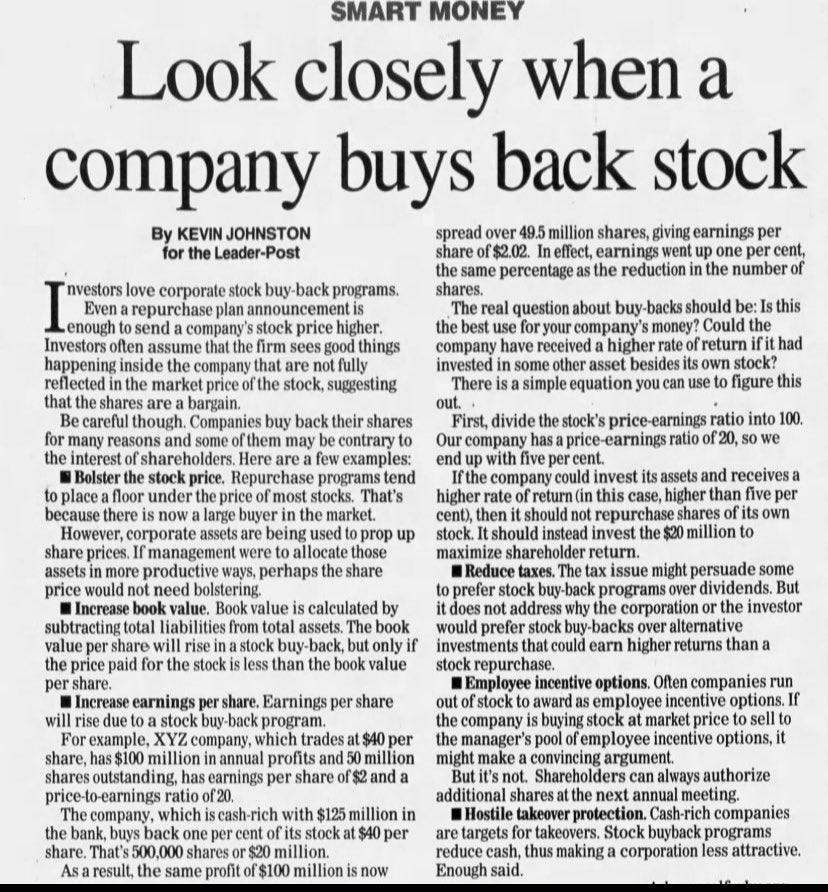

To think on — buybacks — (thinking of Apple’s recent $110bn buyback and IBM’s buybacks back in the day…)

NZ

Very little happening in NZ — it’s like watching paint dry. I think Metro Performance Glass is likely to be a takeover target — trading at 7 and a half cents whereas Masfen and co offered 18c for it last year (another example of a rebuffed NBIO that should’ve been given another look! Am waiting for a reply from MPG’s chair — will publish here — I asked him what the board’s thoughts are re the NBIO now). They are looking at a $15mn cap raise. Surely Masfen and co will come back to the table with a new offer — the dreaded sale of the Aussie business is off the cards — if I were in the market for this co (I am not) I would take it off the market and recapitalise the co. $35mn of MPG’s assets are intangibles — i.e. fairy dust — discount those and the book value of MPG is about $35/36mn — i.e trading at 0.5x book.

RAK — The big seller for this appears to have left the building. Back at 97c. Results mid-month. I keep telling you — a takeover for $1.70 represents a +70% gain on your investment. Nothing is ever certain, etc.

ARV — I emailed all the companies that have rebuffed NBIO offers and asked for comment (who says I’m not fair and balanced??). I got a stock-standard answer from Arvida’s chair, published below:

The offer Arvida received last September was an indicative non-binding highly conditional bid provided to us on a strictly confidential basis. The bidding party stated that it required the approach to be kept confidential, proposed that the sale transaction be implemented via a scheme of arrangement and did not otherwise present the offer to shareholders for consideration or acceptance.

The early indicative nature and conditionality of the bid meant that it would not ordinarily be disclosable however we became aware that some investors had potentially become aware of the approach and made an immediate call to inform the wider market about it. Following our announcement, we engaged with our major shareholders and the broking community on the process the Board had followed regarding the bid and to explain our response. While we obtained quite extensive valuation and financial advice about the offer, you will appreciate that for commercial reasons we did not release any information about value at that time and would have been foolish to do so. Had the offer advanced to a level where the Board believed it should be put to shareholders for consideration, a variety of valuation and related information would have been provided as part of any formal proposal put forward for consideration.

ARV is trading at 99c today. Takeover offer was $1.70. I have been on this hobby horse about NBIOs for a few days now — you can make your own opinion about whether an offer which is a +71% premium to ARV’s current valuation is a good offer or not.

I am often amused by what “valuation advice” companies receive that allow them to rebuff a NBIO that is often against the economic interests of shareholders. The gap between the mysterious “valuation advice” and what the market will pay is often as wide as the gap between Australia and NZ.

One bourbon, one scotch, one beer

Wrote some of this in an email to a client earlier today, and I thought I will share the gist of it with you because it’s where my thinking is at lately. But first I would like to ask you a question: would you be interested in buying into an industry that has been a habit of human beings since the time of the Romans, if not earlier? If I told you this industry is trading at lows not seen in a long time, would you be even more interested?

Liquor companies — obviously. Humanity has had a predilection for booze forever. I’ve been spending a lot of time recently thinking about liquor companies — Brown Forman, Diageo, Pernod Ricard, etc. They’re all severely sold off. Pernod is trading at five year lows, as is Brown-Forman. All their so-called “COVID” gains have been erased. They continue to operate with extremely high returns on invested capital, high profit margins, and their respective products dominate cultural consciousness and consumption. See charts below from our best analyst, Lachlan —

They have sold off due to overstocked inventories and selling less stock, though I think this is overblown – Brown-Forman’s sales only declined 1% YoY last quarter. The reality is their sales are relatively flat. Most of the sell-off is sentiment based – alcohol isn’t hot, sexy, or AI. People think gen Z are going to consume less alcohol. That may be so, but I figure the boomers, gen X and millennials will continue to consume alcohol in copious quantities while Gen Z’s abstinence from “the sauce” is a lot less than one might think – in 2002, 20% of US college students abstained from alcohol. Last year estimates put that at 28%. If we go further into that, there’s 69mn Gen Z in the US — that’s 19mn who aren’t drinking. There’s 72mn millenials in the US, and 20% of them don’t drink, so that’s 14mn and a half or so who aren’t drinking. The inversion of that is 108mn Gen Z and millennials who are drinking.

I also think it is worth thinking about millennials, because they are 1.8bn of the world’s population; they are expected to be the biggest demographic in the workforce until at least the mid 2040s. That’s a lot of earnings power and capacity. They outnumber all other generations in the US so far. Millennials are one of the biggest drinking demographics – they drove a +12% increase in alcohol consumption post-covid. So, I figure if this increasingly wealthy generation continues to have increased spending capacity, a % of that is going to be spent on premium and super-premium spirits. There is a correlation between increased spending power and increased consumption (see below).

Why spirits?

Spirits went through a long dark tea-time of the soul. In 1890 they accounted for about 29% of all alcohol consumption (woo!) then came prohibition.

I think there is a meaningful opportunity for these companies to re-rate to their median earnings multiples. By 1929 that consumption had dwindled to just 12%. By the 50s it had only increased a paltry 1% to 13% or so. But by the 80s (car phones! It’s hip to be square!) that consumption was 16%; by the 2010s it was 23%. It took a century for liquor habits to change. If we are getting all cyclical (why not?) maybe we can estimate that we’ll hit the 29% figure in a few years. Hopefully the government doesn’t come back with prohibition — then we’re in trouble.

Part of that change is due to consumer sentiment – beer is carby, etc; wine has become bifurcated into cheap rot you buy to watch The Chase to or very nice Bordeaux first growths you buy to show off and “appreciate”. i.e. there’s no middle. Spirits are an affordable luxury – you can buy some good single malt for less the price of a small car.

Brown-Forman has traded at consistently high multiples because of the predictability of its earnings stream (like CostCo, its traded at +40x) – it is now trading around 24x earnings.

Pernod typically trades around 25x earnings. It’s trading at about 17x now. You’re buying it around the lower end of its earning multiple over the last decade.

Thesis is simple. People still keep drinking. Companies re-rate. There’s a huge margin of safety, given they are trading at +50% off their median earnings multiples. That gives me of plenty of rope to hang myself with if I am wrong — as Keynes always used to be saying — I’d rather be vaguely right than precisely wrong.

Two things my old boss used to tell me: all the money is made in the buying. And, price is what you pay, value is what you get. It has taken me forever to learn (I am a slow learner). These companies may well be an example of both rules being followed — holy heck. Either I am wrong and people stop consuming alcohol in droves (possible? What would Leo Molloy say?) or people continue to consume and these companies continue to do well as a result. As Dorothy Parker said — candy is dandy but liquor is quicker.

Vale Steve Albini

Not investment related. RIP to Steve Albini — my favourite producer. Produced The Pixies, Nirvana, PJ Harvey, and more… Good interview here.