Outliers aren’t the rule — but the illusion is

Divide. A word that can be used to describe a lot at the moment. This is a newsletter on the economy, so let’s start there.

It’s the age of the K-shaped economy, where the wealth distribution gap grows wider by the day.

While many households are struggling with rent, oversized mortgages, and school fees, a privileged few are living la vida loca — booking cruises, ticking off holidays, and jumping on podcasts to reveal their ‘wealth hack’ to financial freedom. For them, it’s a discretionary-spend dream. For everyone else, it feels like the baseline has shifted to something impossible to match.

We see the same phenomenon playing out in capital markets. A small group of mega-cap stocks now dominate the S&P 500 to a degree rarely seen historically. By early 2025, the top 10 companies in the S&P 500 made up nearly 40% of the index. By comparison, historically (from about 1880 to 2010) the top 10 stocks averaged only about 24% of the index’s market cap. Capital flows are concentrating into fewer and fewer names, amplifying their influence while leaving a long tail of companies that drift quietly into irrelevance.

Part of the issue is how the modern economy operates. We live in an age where speed, scale and attention dominate. Not long ago, businesses needed a generation to go global. Today, platforms like TikTok, Canva, or Uber scale to hundreds of millions of users in just a few years. These are “winner-takes-most” markets, where a handful of players capture extraordinary gains while latecomers barely get a foothold. With distribution costs collapsing and markets opening instantly, expectations of fast wealth creation have become normalised. If companies can scale overnight, the question many people quietly ask is: why can’t individuals do the same? That mindset, and the disappointment when reality intrudes, is the trap.

Take OnlyFans as an example. It looks like the ultimate “get rich quick” story, a democratised platform where anyone can monetise their following. But as with anything, the divide is brutal. The top 0.1% of creators capture 76% of all revenue, while the average content producers earn just $150 – $180 a month. The dazzling outliers dominate the headlines; the median reality is sobering.

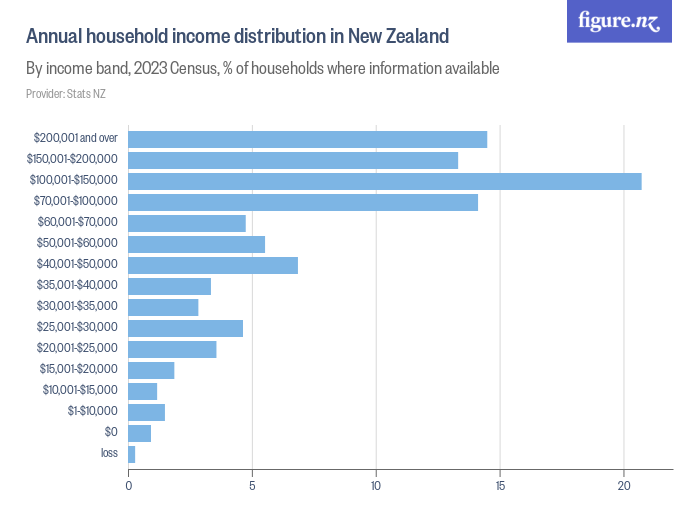

This mirrors the wealth conversation everywhere. A fraction of winners receives disproportionate gains, while the majority sit within the fat middle of the normal distribution. Most of us, regardless of what our mothers think, are in that middle band. The Pareto principle plays out again and again – 20% reap 80% of the rewards.

The divide, then, is not just between rich and poor. It’s also between perception and reality, between headline stories and the statistical truth. Social media amplifies the outliers, pushing us to believe the lived experience of a very small minority is par for course. Meanwhile, capital markets themselves are becoming more concentrated, handing even greater influence to a handful of giants while a growing graveyard of companies quietly falls away.

Perhaps the real ‘wealth hack’, then, isn’t in finding a shortcut to the top 1%, rather it’s in refusing to live as if we’re already there. To stop ‘keeping up with the Joneses’ and start making peace with the median.

From the desk of IGB