Few things today — most interesting to me is NZME (owner of the Herald) lowering its guidance to the lower end of $57 - $61mn (EBITDA). Paltry 1% advertising growth YoY. I think it’s interesting to compare the Herald to Stuff — it feels like Stuff is leading the pack when it comes to innovating (Paddy “this is the news” Gower is all over TikTok). But you know, NZME has the Hosk! The Hosk, people!

In speccy stock land (remember, it’s speccy, and I am just a monkey at a keyboard), Titomic (TTT) continues to appeal … at least for a personal account. Trump trade. Still loving Duratec. Think DGL has more room to run…think of what happens when interest rates are cut.

Internationally, noting this — Jane Lauder called for her cousin William’s ouster at Estée Lauder — now of course both Jane and William aren’t working for the co. I have written about family business dynamics a lot recently — I am starting to wonder if these guys look for a cash out or some kind of liquidity event. There’s a lot to fix over at distrestee, and perhaps a nice big wad of billions would be just what the doctor ordered.

And now for the main event… booze

Regular readers will know that I spend a lot of time thinking about booze. It can be ineffably romantic and utterly utilitarian. The booze industry is currently in a kind of flop era (is that what the kids say?) — there’s a bunch of reasons for this, but they are, mostly, i) alcohol consumption is on the decline globally and ii) we are in a recessionary climate where the consumer has less money to spend on consumables. There’s other reasons, too, of course — most producers overstocked during Covid, and in general, consumer attitudes have changed in the last decade — you can see it in the rise (and rise) of RTDs, which I find about as appealing as a fork through the eye.

Talk a look at the various major alcohol stocks. Diageo trades around 17x earnings, whereas Pernod trades around 19x. Brown-Forman trades around 19x, too, while Laurent-Perrier trades at an astonishing 9x earnings.

To put this into perspective, this is anywhere from a 25 - 50% discount from historical P/E ratios. You’d think the entire world had gone sober, or perhaps we’d entered a new period of prohibition!

P/E is a really crude ratio, but I like it because it’s a nice heuristic to imagine what a business costs if it never made another penny more each year than it does now. I like historical P/E ratios — especially for older companies — because you get an idea of what the market is usually prepared to pay for it. If the average P/E a company trades for has declined so very rapidly that’s either a warning sign or a sign of irrationality.

In the case of alcohol, it’s a little bit of both. The problem with multi-nationals who operate all over the world is that you’re opening yourself up to a lot of errors (consider Michael Hill or The Warehouse’s disastrous forays into foreign territory). Put simply, there are more variables to mess up. I wonder what Diageo head office knows about New Zealand, or what Pernod head office knows about Omaha, Nebraska. On the other hand, you have a lot of local businesses — in whatever territory — who can move faster and adapt to change in a prompt manner, because they’re small and see what their customers like. It's a double edged sword — on one hand, you own some iconic brands (Jack Daniel’s…Guinness, etc). On the other, by the time that information gets to head office and is filtered through goodness knows how many entities, it’s probably too late.

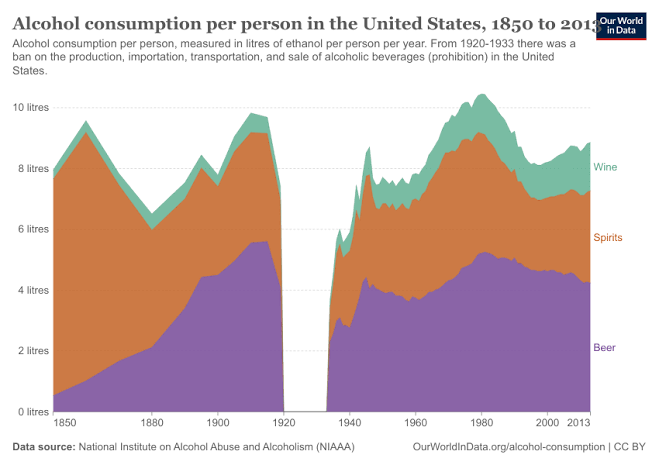

I was thinking about businesses that manage to avoid this pitfall. Two seem obvious to me — Costco and McDonald’s. Both have systems so draconian and strict that you get the same quality everywhere. But alcohol is not like this — consumer tastes are fickle. Whereas a cheeseburger will always be a cheeseburger, the drink d’jour will change from one generation to the next. The following chart is a useful illustration of changing consumer attitudes — it ebbs and flows.

During the early 19th century, spirits dominated. Beer eventually caught on while spirit consumption experienced a comparative decline.

But do you know what strikes me most about this chart? Alcohol consumption did not go to zero.

I guess the question you need to ask yourself is — is the margin of error so great with alcohol companies that you can throw darts at a board of them and make money?

Here is the criteria I think about:

These things are trading at historic lows

I make the bold assumption that people will continue to drink, albeit the industry may only grow in the low double digits per year.

These things are so cheap on both a multiple basis and historic basis that even if I am wrong, I’ve given myself a lot of rope to be wrong with.

I mean — do your own research! But it’s interesting, isn’t it? If you stroll through the Viaduct on a fine day, you will note that sobriety is hardly the order of the day. If you happened to be around during the Melbourne cup, you’ll notice that the champagne and cheap Prosecco flowed freely. If you are bold enough to make the assumption that people will continue to drink alcohol, as they have done for centuries, then you can assume Jack Daniel’s and its cohorts will continue to sell.

This is not a particularly brilliant or smart assumption, and it’s a dull as dishwater idea. I think that is fabulous — no, there is no AI. No, it’s not a “Trump trade”. It’s just assumption people will continue to drink booze. That’s it. That’s the idea.

Other things

I really enjoyed this piece about a Hermes heir’s missing fortune. Link.

I also enjoyed this letter from Horizon Kinetics. It’s worth reading for the discussion of water + power usage of AI alone.

I love Action Bronson, and you should too.