Peter Jackson didn't lose as much money as the paper wrote

NZ

Everyone’s favourite AI company-that-also-owns-a-school-and-a-physical-mail company, Being AI, has indicated its intention to buy Solution Dynamics, the mail and communications company (perhaps because Solution indicated they were incorporating “AI” into their product mix?)

BAI stock is down ~15% on the news — acquiring Solution via all scrip would mean an additional 9.34mn shares issued (there’s 186mn or so shares on issue as of now, implies a 5% or so dilution at current market cap).

This is the thing I will say about roll-ups — which BAI is, albeit an “eccentric” one. You can buy things and roll ‘em up, but at some point you need to make it profitable. I’m thinking about WasteCo, which has rolled up a bunch of fairly hum-drum waste disposal businesses in the South Island — it recently booked a loss of ~$4mn (also, WasteCo recently breached some of its banking covenants)

Aus

NextDC — Raising another $550mn at a 3.9% discount or so to its current px. Data centre mania! I have started thinking (given AirTrunk’s enormous valuation) when Infratil starts to look at some kind of partial exit — get the bag, son.

Duratec — is $1.40. I have been telling ya’ll about this since it was $1.00 (and yes, when it was $1.30 last year…). The world’s most boring company continues to excel.

World

OpenAI now aims to raise $5bn at an astonishing $150bn valuation. Just the other week it was valued at $100bn! After I finish my coffee I bet it will be valued at $200bn! What is money, even?!

Spectator — Hedge funder Paul Marshall just paid £100 million for The Spectator, which is a nonsense number when you consider it generates just shy of 3 million quid in EBIT and about 20mn in revenue. But it’s The Spectator, favoured chew toy and pacifier of the British ruling class and toffs everywhere. And as we all know — newspapers aren’t that economic anymore (though, impressive there’s positive EBIT here). The Spectator comes at a hefty premium, apparently — more than a Lordship or Scottish estate will set you back these days.

The bigger prize here, though, is The Telegraph (remember that Jeff Zucker/Redbird tried to acquire both Telegraph and Spectator, almost did, and then were promptly blocked due to concerns about where the money to buy said papers came from — i.e. Abu Dhabi oil money — it’s now Zucker’s to sell). The Telegraph is probably worth in excess of £500 million — it makes about £54mn in profit and has a growing readership base — buying the paper buys mindshare. To quote the inimitable Yes, Prime Minister —

The Daily Mirror is read by people who think they run the country; The Guardian is read by people who think they ought to run the country; The Times is read by the people who actually do run the country; the Daily Mail is read by the wives of the people who run the country; the Financial Times is read by people who own the country; the Morning Star is read by people who think the country ought to be run by another country, and the Daily Telegraph is read by people who think it is.

Peter Jackson didn’t actually lose $190mn at Weta FX.

Peter Jackson, in situ

If you were to read the NZ Herald or other publications this morning, you might have the impression that Peter Jackson (someone I am frequently compared to) might be in dire straights — after all, Weta FX just booked a $190mm loss over two years. As often is the case with reporting of finances there’s a lack of distinction between cash losses and non cash losses. Any casual reader of the paper wouldn’t make the distinction (as no distinction was made) and, I imagine, would think that Peter & Co and booked an enormous almost-quarter-of-a-billion loss.

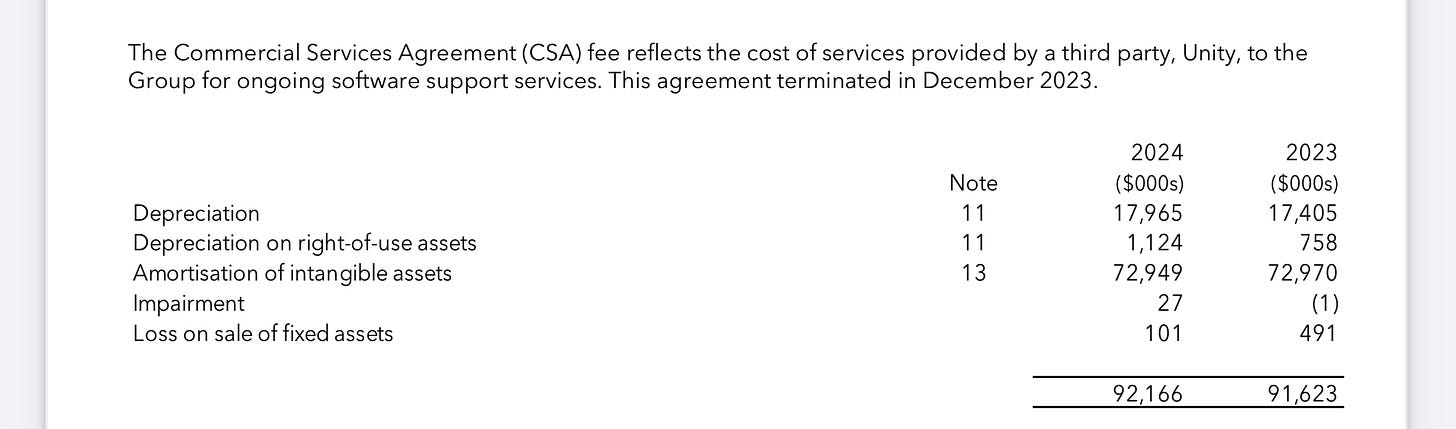

Alas, the reality is a bit less juicy. The culprit here — that requires the Herculean task of going on the Companies Office — is that $72.9mn amortisation charge of intangibles.

Intangibles are precisely that. They are not tangible. They are real, of course, but the vagaries of accounting require they be written down over their “useful life”. This is not very helpful to those analysing a business. Some intangibles like trademarks and IP should only grow in value, while other intangibles — like say, software that will date — is worth very little (nobody is paying good money for Microsoft Office 1994 anymore).

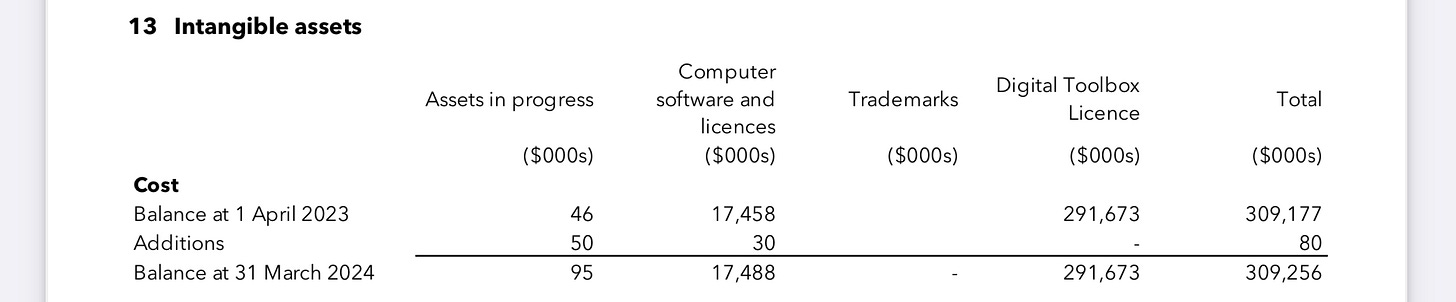

In the case of Weta their largest intangible is the “Digital Toolbox License”. Here it is:

And here’s where it gets weird. Wellywood-heads will recall that Unity paid about $1.6bn for Weta FX in 2021. The centrepiece of the deal was the “Digital Toolbox”, i.e. Weta’s proprietary IP and tools — then Unity did an about-face and sold a perpetual license (i.e. what I take to be the “digital toolbox” license) back to Weta for a lot less ($170mn). Previously the firm had been obliged to pay Unity a $70mn a year fee for the license. Still with me?

I mean — let’s be real — the cost of amortisation is still “real” but it is not future cash flows — it isn’t what the studio is actually capable of making, in cold hard cash. Back of the envelope math gives Weta a cash profit of around $15mn for 2024, and a +$35mn loss for 2023. Not great, but not bad.

Weta has booked losses, which are of course potentially harvestable — Weta’s book-keeper’s write: “While there is still a clear path to utilising previously recognised tax losses in the medium term, the tax losses of [$24.3m] incurred in 2023-24 have not been recognised as deferred tax assets on the balance sheet”

The best (and to my knowledge, only) listed company with this advantage is Allied Farmers, which retains about $186mln of tax losses that are harvestable (oldies will remember Allied was at one point involved with the dreaded Eric Watson — it acquired Hanover and the rest is history — or disaster — depending on your view. Gaynor did a great write up here. But the beautiful thing, now at least, is that the co has a lot of losses it can harvest… a silver lining).

The more important (and bananas) thing, obviously, is that Unity paid $1.2 billion dollars for Weta fx and then effectively sold it back for $170mn. In other words, Unity basically gave Peter Jackson and co one billion dollars. I don’t think anybody is too concerned about those impairments and non-cash items, given that.