NZ/AUS

Rakon did an AI - We all know that if you put “AI” in your press release stock goes brrrr. It’s science! OpenAI is worth, like, a kajillion dollars because AI. Sam Altman the CEO of OpenAI despite being involved in questionable projects. Anyway, they have a new fancy oscillator and here is the press release if you want to read it. The stock went up to $1.30 for a while. To be honest, the biggest question is when the board will accept the $1.70 takeover offer. AI is cool and all — but we like making money here at BBR at we think the board just needs to take the offer. Remember - RAK was trading down at dirty at 60c before the offer. Continue to be buy-rated…view this as deal arbitrage here…

Inflation — Sitting at 4.7% for the quarter…notably CPI rose 50bps between Sept & December — higher prices for housing and utilities…no surprises there. Viewing rates as higher for longer as per … meanwhile, we noticed this ad, from Avant-backed Wirihana…

We’ve been noticing more interest-rate subsidies cropping up lately…called up Wirihana for comment and they told us the development is near 70% subscribed and is at stage 1…

Reader feedback — a reader writes “does the 400 hours GEO claims it takes for NZX compliance work really pass the sniff test?” [sic]. We leave you to pass your own judgement on that one…worth thinking about…

Our bigger question remains — what is the NZX doing to stimulate new listings that aren’t some moribund line company in Timaru? Or selling off more local/govt assets?

More KFC was eaten but margins are thin — When I was in year 10 a million years ago I had an economics teacher named Mr. Ward and he got us all to write reports on an NZX stock; I think I wrote that it Restaurant Brands was bad because the quality of a franchise like McDonald’s and their system was better (I’d just read The Warren Buffett Way). Anyway, the teacher didn’t like my report (I don’t remember what stock was hot at the time…probably the East India Company) but RBD stock has taken a dive in the last two years.

Same-store sales quite strong in NZ (the Fort St KFC is always busy — doing my due diligence) at +8.3%, but drag from the US as cost of living starts to bite…guided NPAT margin is sitting somewhere in the 1% range ($12-16mn on the back of $1.3bn of revenue)…avoid this one, just buy McDonald’s stock (MCD)…

Falling over Dominos…

Domino’s Aussie (not to be confused with Dominos US, which is a stock we are besotted with) just keeps on sliding, like a reheated pizza from a microwave after a bad hangover…down 29% YTD. Jarden’s Ben Gilbert downgraded it. I had a Domino’s pizza a year or so ago and it was about as appetizing as a seagull upon some cardboard. Tempted to be contrarian on this one…but we think their ROIC of ~11% is paltry (like their pizza), whereas Domino’s US (DPZ) has a ROIC of 55% and has grown net income at a clip of 15% for the last ten years…long DPZ, no view on Domino’s Aussie…we’ve long respected Don Meij as CEO but this is a “show me story”.

A laugh — the boys’ club girls’ club

We had to laugh at this:

Blackbird Ventures-backed start-up Kiki has pivoted away from the subletting business the fund once valued at $42 million, and will develop a New York “girl’s only club” to help Manhattan women “thrive” and “not just live”.

The five men who run Kiki welcomed their first female employee, 25-year-old Caitlin Emiko, who appears to have spearheaded the change, to their New York team late last year.

I don’t know who runs PR at Kiki but this seems like pretty bad PR! I mean, five men, one girl, pivoting a to a girl’s club. Here’s the best part. Revenue strategy? Ptfff. Who needs a revenue strategy?!

Mr Thomas-Smith acknowledged the new business, Girls Who NYC, had not yet developed a revenue strategy, but said he had the support of Blackbird partner Samantha Wong.

A while ago there was a girl’s-only co-working space in NYC called The Wing. It was very hyped and lasted a few years and counted a lot of “cool girl” NYC types as members. It was like Soho house, but for girls! During the era of Millennial pink-everything. It was very pink — it’d even make Barbie blush.

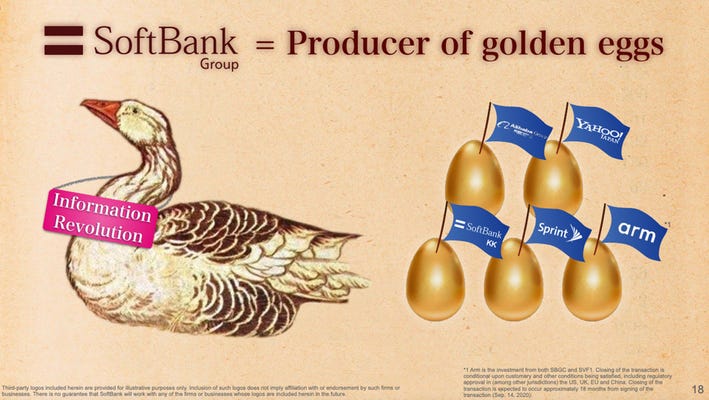

Anyway - The Wing shut down! Read about it here. Another one here. So, uh, Kiki is perhaps trying a business model that already failed? OK then! And revenue? That’s like — so 2023, babes. Perhaps Kiki has been taking inspiration from Softbank’s Masayoshi Son…? (sorry, but I am going to keep hauling out my favourite powerpoint slide deck until the end of time…)