Rakon -- good buying or value trap? Plus: NZX, Air NZ and more

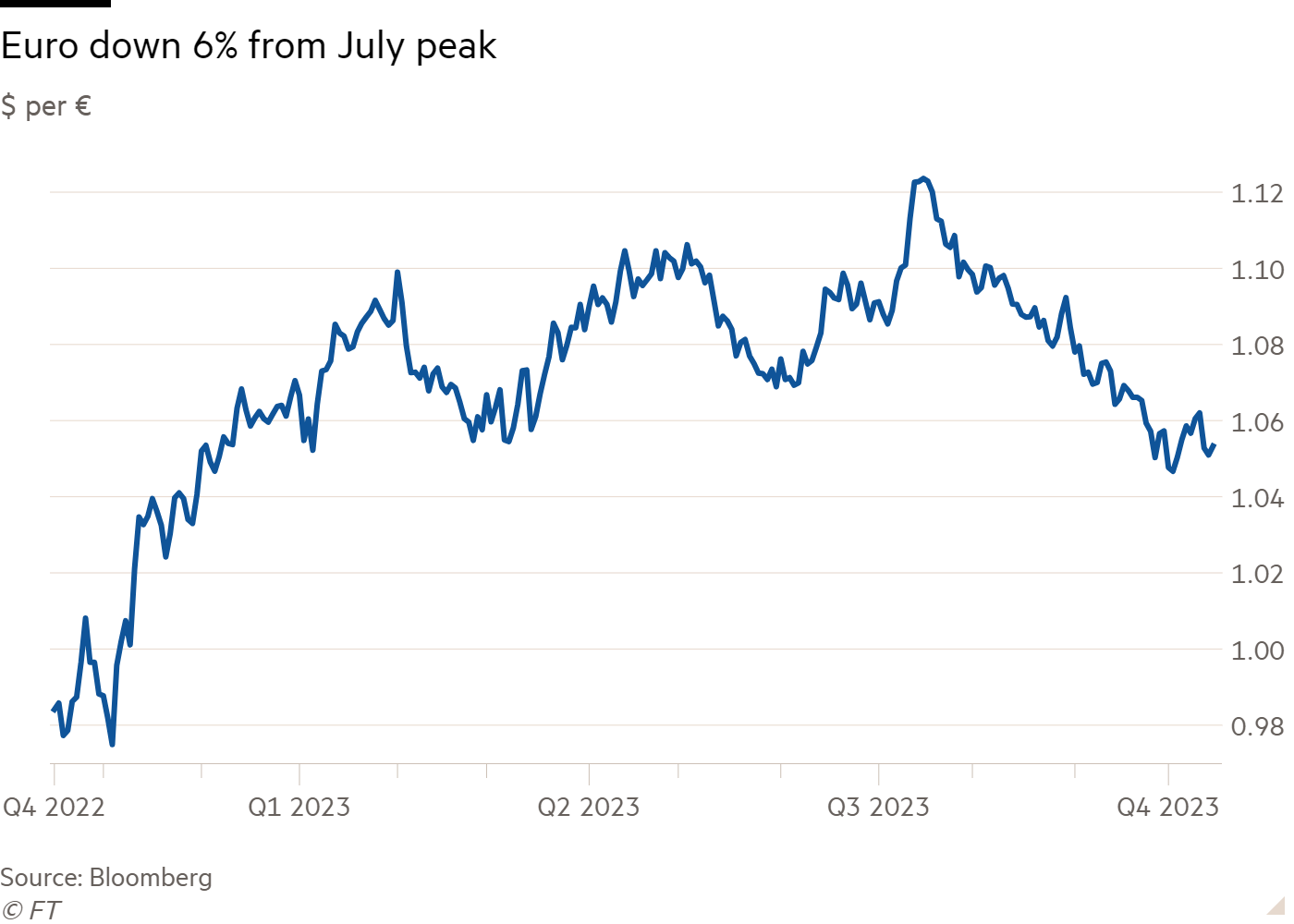

EUR parity

We expect EURUSD to test parity as the USD wrecking ball continues (strong sales data…) and the Eurozone keeps displaying weakness. In particular, we note Italy’s worse-than-expected deficit data and Germany’s incredible shrinking economy. Obviously, long USD is the play…

Copper…reaching highs in China not seen since 2006..

Rakon watch (day ??): This thing is down in the dumps at $1.10…provided you think the acquisition will go ahead, this is a good arb opportunity. If you don’t think the acquisition will go ahead then it is a “value trap”. My opinion — personally I am backing up the truck (this is not financial advice! Rakon is obviously a volatile and unpredictable investment — this is precisely why the arbitrage gap exists — nobody knows what is happening).

I mean, on one hand the way Rakon has been run is a case study in how not to communicate to market. If you a) get a NBIO offer b) proceed to tell nothing to market for over a hundred days and then the age-old Matt Levine question — “who really owns the company?” springs to mind.

This is a fun one; because usually, from a legal perspective, you’d say that the shareholders own the company. That’s very nice and well but it is disproved often in practice: i.e. Shari Redstone’s Paramount has other shareholders who have a substantial equity interest — Buffett was until recently the biggest holder of common stock, while Mario Gabelli has loaded up on more Paramount stock since the takeover offer has been on the table. However, in practice, Paramount is Shari’s company, controlled via her holding company, National Amusements — equity holders be damned. In reality the executives and the board tend to “own” the company in terms of everything other than economic rights over the future cash flows — what suppliers they do business with, what things they acquire, who they hire, etc etc. Of course when it comes to a takeover they eventually need to ask shareholders for approval — but there’s a long stretch of road between a non binding offer and actually asking your “owners” for approval. There’s a lot of trust you put in the people who run your company! This is why — and I am convinced of this more and more — that the single best predictor of success is good management.

Anyway - RAK is $1.10. Do what you will with that information. At this point it feels like throwing darts in the dark given the sustained lack of disclosure from the board. But also — you know — show me the money??

Show me the song money, song man

We talked about Hipgnosis last week — I told you that I was surprised that Blackstone didn’t make a bid for the song rights owner, because they already have a partnership with the company — in the weekend the PE firm offered $1.24 per share, versus Concord’s $1.14. (Big brain thinking — did they wait and see what other folks would pay and then up the bid by just a smidge? Was that Daddy Blackstone’s plan all along?)

Anyway — we all love a bidding war — the Hipgnosis board is recommending the Blackstone offer — will Concord counter with a higher offer? It’s a very fair value for the co, which overpaid (in my opinion) for the bulk of the catalogue. We did well out of buying the shares at around 62p and waiting for a takeover — there are always poachers out looking for a deal.

Air NZ cut their profit forecast

One of the enduring mysteries of life is why New Zealanders love buying stock in Air NZ. Is it out of patriotism? Out of love of the cheesy safety videos? I genuinely have no clue — I just know that New Zealanders flocked to Air NZ when they did a $1.2bn rights offer (again: why??) and that the question I get asked — on an almost weekly basis — is whether they should buy stock in Air NZ.

I always say — just buy some Auckland Airport and be done with it. Airlines never make money. They are efficient burners of money. Inevitably, I then get countered with “but they are so busy! Look at the airports!” — to which I say, just buy the airport, then. It’s a natural monopoly! To the surprise of nobody, Air NZ just cut their profit outlook to $40mn - 50mn for the year (compared with last year’s $412mn). The usual culprits are mentioned — “deteriorating conditions”, “subdued demand”, etc. None of this is new news or particularly surprising — you can only gouge consumers for so long until they look at other options (I have to say though — last time I flew intl I flew via Virgin Atlantic — never again). Air NZ stock is trading at 56 cents.

Other stuff happens in Kiwi Land —

Richard Umbers resigned as CEO of Ryman after a terrible three years. I have sympathy for Umbers (more than I do for Fletchers) — the situation at Ryman was years in the making and he inherited a tough act to follow — Ryman was formerly the golden boy of the NZX; it could do no wrong. Now Ryman trades at a meaningful discount to NTA — $4.31 per share vs. an NTA of $6.83. If you’re willing to hold on for dear life then maybe there’s a bargain in there… ditto OCA, ARV (Oceania, Arvida). You need to discount NTA values by a good chunk (my rule of thumb is 20%) because New Zealanders are still overly optimistic about property values (they don’t just go up). However, if you consider the growing cohort of boomers who are retiring, and the luxury-level accomodations of many of the retirement operators these days…worth a punt? Preference list: OCA, ARV, RYM, SUM.

NZX — quick round up of the coverage following NZX’s ASM last week.

BusinessDesk — Snacks and Snags at the NZX, link. “NZX Directors Mauled in Fee Vote”, link.

NBR — “NZX hopes rest with Andrew Bayly”, link. “Pathetic” NZX’, link. “Never a good time to ask”, link.

I’ve spent the last few months engaging with NZX board, management, market participants, shareholders former and current. One thing everyone agrees on is that there is value in the NZX. The other thing that everyone agrees on is that the value has not been reflected for a very long time. Where people disagree is what the solution should be. I’m suspicious of solutions that pin it on some other regulatory body as if the solution is government “settings” (I note that, astonishingly, the Luxon govt is aiming to make borrowing money easier for people in a time where inflation remains sticky — I don’t need to tell you that this is inflationary by nature. I’m very suspicious of “settings”).

I am also doubtful of the oft-mentioned “it’s a difficult time for markets globally”. We’ve seen rallies not just at the NADAQ. In Europe the luxury stocks have powered markets forward, while Japan is sitting at new highs. New Zealand is moribund by comparison. Here I suggest three possible problems — I don’t think they are insurmountable.

Several possible problems at the NZX

Problem 1: the lack of incentive

Why? Look to the incentive (or lack of). There are many good companies in New Zealand, which are quietly run and completely managed. Look at Hynds — they make pipes and pothole coverings (it’s a glam industry). I've long admired the co — they are family owned, consistent, and from what I can tell, very competently run. Say they were to list — what’s the incentive? Capital? I mean — they could just go to private equity and get a nice payday. Liquidity? If you are not a large company on the NZX, your liquidity is limited. Exposure to institutional investors? Well, that pool too, in New Zealand, is limited…

The prime example here, of course, is the sale of Richies Coachlines to KKR (a fabulous investment, I suspect — New Zealand’s rail network is pallid in comparison — int’l friends are always surprised the biggest public transport option is a bus). It’s a good option for a family-owned business — they get a paycheck, they can then go off on holiday to Rarotonga or something, and that’s that. What is the NZX’s counter to that? Do they have people on the ground, scouting out potential businesses to list? I mean — the last listing on the exchange was — ugh — BeingAI.

Problem 2: liquidity

The other issue is liquidity. If you are a small cap you are at a disadvantage. Here is the volume today, as of writing, for a number of small cap stocks:

Me Today (MEE): $139.39

AoFrio (AOF): $265.98

My Food Bag (MFB): $979.06

As you can see, the liquidity & volume is through the roof. It's over 9000.

Problem 3: Three very different businesses

Finally — most obviously — the NZX has a funds mgmt biz, the core exchange business and the wealth tech segment. While Mark Petersen, the CEO, was very reticent to talk about listing the funds mgmt biz at the ASM, I couldn’t help but wonder how else the co expects to catalyst upon its diverse segments. A partial listing of the funds biz would accomplish this.

I do not think any of these issues are insurmountable. I think the easiest thing to do is sell a chunk of the funds biz or list it and demonstrate the value of that segment (I know it’s not that easy — easy for my to click my fingers and say “sell it!”) but I imagine Blackstone would love to be a buyer of what is, effectively, NZ’s only ETF business). Liquidity requires luring more funds to the table (I imagine it kind of like putting out a trail of biscuits for a wild animal — here, kitty kitty). Luring more funds to the table means listing more quality businesses. To do this there needs to be some kind of compelling reason — ambitious companies looking for access to capital to grow, etc. I don’t know how many people the NZX has got who are scouting deals, but if I were them, I’d be in the South Island looking at businesses where the family is wanting to sell. On the other hand I would be lining up institutional investors who would like to buy into said businesses, and pointing out that we have a Sharesies generation of investors who are arguably the most engaged generation of investors since the 80s. The retail shareholder is alive and well in NZ — take advantage of that.

In brief

ASX listed Cettire’s losing backers, as LHC Capital sells out. Last year LHC capital told the AFR that the luxury retail e-tailer was destined to form a “duopoly” with FarFetch. FarFecth is more or less bust. Link.

Droneshield upped its capital raise to $105mn after strong demand — the Aussie govt is committing an extra $30bn to defence. Link.

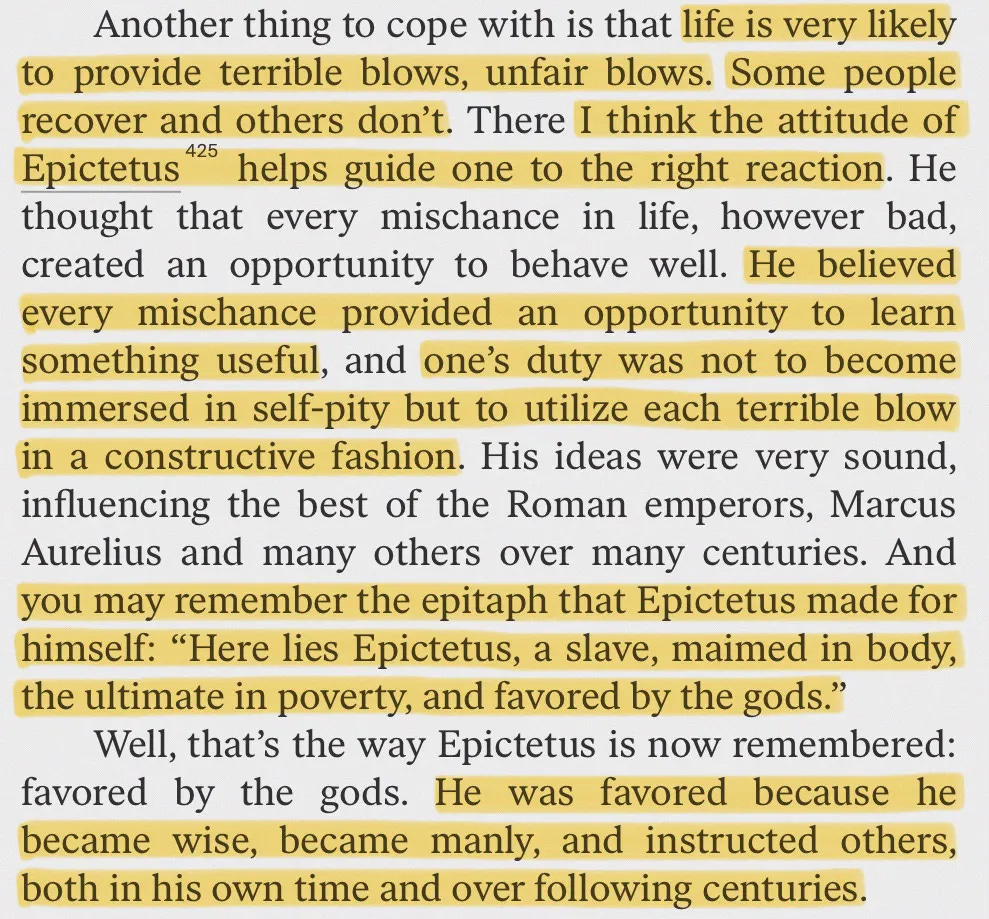

Charlie Munger the Stoic — see below: