RBNZ - will they cut? | Plus: AOF, Sky's sporting rights, and more

NZ/Aus

Rate cuts — Expecting RBNZ to cut. Could be 50bps, given subdued CPI. Short NZD is the play… (not fin advice I am a monkey at a keyboard). I was a proponent of higher for longer until seeing recent data + heuristics (look at how many closures there are… look at how empty shops are). Expect cuts, fam.

Speaking of pain… Watch index… down down down…. even the 1% are sqouze!

Comvita — So long to CEO Dave Banfield (so long to that NBIO not long ago either). Still sticking to the old adage — never invest in food or milk… commodities!

CSL — Stock down 4%, but earnings were good — profit up 20% to $2.64bn, expecting double digit growth in the medium term. Buy and hold…

AOF — 0.084c as of writing. Let’s light this candle.

Sky TV — I bought this in smalls a while ago, because I figure those sporting rights are valuable (the rest of the business — not so much). Paul writes a good column here re that. Consider the bidding war that’s just gone on between WBD (poor Zaz), the NBA and the rest of the networks… spoiler: WBD lost out. I wouldn’t be surprised if a third party came in and bought Sky TV for those rights…

Property and its discontents — Preference list — NZL (pure-play farmland), Abacus Storage King (storage royalties plus land ownership), Hong Kong Shanghai Hotels Ltd (own The Peninsula Hotels plus prime RE), Kering (yeah, they own Gucci, but have you seen the property they own?)

Retirement Operators — Like SUM, OCA. Recent Arvida transaction obviously gives confidence to retirement market valuations.

Twiggy — Good on Twiggy Forrest, taking on Meta and AI scams — link. I know Facebook is a wasteland now… but your mum still goes on it.

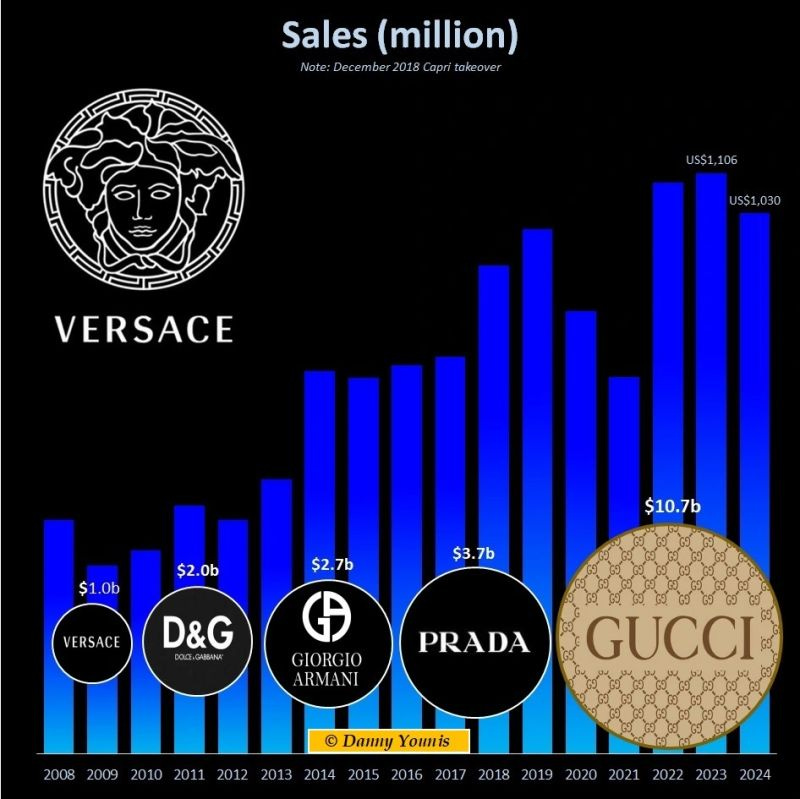

Versace

Love this chart from Danny… Versace only brings in $1.0bn of revenue in spite of its mindshare as a brand. Since Capri bought it sales have remained flat (the co had a target of $2bn). When I was researching Ferragamo, a million years ago, I talked to some people involved with the Versace transaction — they were dismissive of Capri’s ownership — didn’t think they had what it takes. Capri’s other brands include Jimmy Choo and Michael Kors. Michael Kors has always been targeted squarely at the middle-market — slightly better than Walmart, but not much. Jimmy Choo used to be a cultural touch point (Sex and the City), but not so much now. A good example of how stewardship of a luxury brand can go awry…

A theory of where NZ needs to go

Let’s say you are a government. You’re coming into a situation where unemployment has ticked up 20bps to 4.6%, CPI is 3.3%, and sales of houses are heading towards a low for June. Also, for fun, let’s say that your main industries are property (look back to those house sales!) and industries related to servicing property. Your main concern, probably is that unemployment rate — it keeps on ticking up — especially if think about the 185 companies that were placed into liquidation in June alone.

This is NZ, of course — this is the actual situation Luxon and co find themselves in. There’s a few other details, too — your national air carrier (Air NZ) is set to report a loss; you are exporting all your gas overseas (ask NZO); etc. You basically have two choices as a govt — two real levers — the rest is noise. You can tax more or you can spend more. Your central bank is responsible for the cash rate, not you! But you can still spend and/or tax more. Or do both!

You can also increase beneficiary sanctions, as the govt is currently doing. You can even introduce a nifty traffic light system! But this, unfortunately, does not address the issue of unemployment. The great paradox of “jobseeker support” benefits is that there needs to be jobs for people to go to. If unemployment is ticking up, it might suggest, perhaps, that there is less jobs to go to — a catch 22.

We’re currently in this situation. I’m not going to lie to you: it’s not great! I’m not quite sure if the govt has their head screwed on straight! I was not a fan of the Labour govt either! But this is the situation — we have i) an economy which still, overwhelmingly, is addicted to property like some are addicted to their Vape pens. And ii) a clearly slowly down property market, because you need demand to drive ever-increasing property sales. Finally, we have iii) an underperforming capital market that is best described as “moribund” and vi) a culture of stasis rather than innovation, which stymies economic growth. Oh dear.

Here is a very crude recipe for fixing the situation.

Introduce a capital gains tax on property. This will not be popular. It could be small! However, it’s about incentivising investment in other assets — businesses, shares, etc. If there is clearly an incentive to purchase property rather than a productive asset then there is an issue.

Changing regulatory settings to make listing on the NZX easier. This goes hand-in-hand with what I’ve been saying — the NZX needs to be making more of an effort in reaching out to businesses to list. Our fund managers, too, need to be supporting the market — it’s worth considering making a mandatory 5% or so allocation from our KiwiSaver providers in the NZ market. Sam Stubbs at Simplicity has suggested this, too — via private equity — ultimately KiwiSaver is a massive pool of money and so much of it is indexed away in overseas companies.

Incentives for new businesses — if you’re a new business doing something great, let’s encourage that — tax breaks; an accelerated depreciation regime, subsidies. We did this very well with our film industry. I think an accelerated depreciation regime makes sense for everyone.

More govt spending. Kenyesian economics was the great saviour post-1929. Austerity does not work, as has been proved time and time again (look at the pickle Britain is in now). This is partially due to the Chicago/Austrian school of Economics notion that government budgets are like a household budget or a personal budget. Personally, I am unaware of my mother affecting interest rates, printing money, or raising/lowering taxes when she balances the household books. To think the two are the same is ignorance of monetary theory. If govt spending is targeted in areas that need it then you see the results.

A change in the NZ psyche. Someone the other day was asking me where I see NZ in five years. I was honest. We need to change from our tall poppy “yea nah” attitude to a country that is proud to put itself first. Outliers and freaks should be celebrated and encouraged.