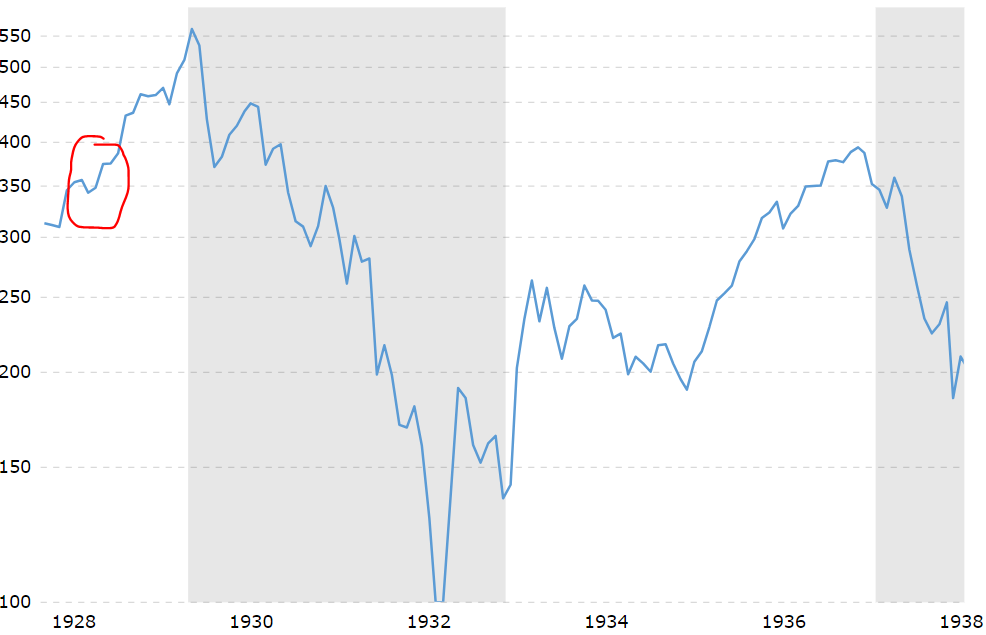

Bubble?

The S&P 500 is within .35% of a 3-year high. Less than 40% of its stocks are above their 10-day avg, fewer than 60% above their 50-day, and fewer than 70% above their 200-day. Since 1928, that's only happened once before: August 8, 1929. (See below, August circled). History doesn’t rhyme, but…

We’ve talked about the desirability of sports streaming — especially linear streaming — for the major streaming players (NFLX, WBD, DIS, etc). I talked about it here and here. There’s a reason why Amazon has invested so much in streaming sports — just a quick recap from AMZN’s earnings call

Increased total viewership for the second season of Thursday Night Football (TNF) on Prime Video by 24% year over year, and had double-digit growth (14%) for the second consecutive season in the hard-to-reach 18–34-year-old demographic, according to Nielsen. The November 30 Seahawks-Cowboys game attracted 15.3 million viewers, becoming Prime Video’s most watched TNF game ever, according to Nielsen.

So, yeah — sports, go sports! Anyway, ESPN, Fox and WBD just announced a joint sports streaming service. That’s big — ESPN, TNT, Fox, FS1 and ABC all have a lot of sports streaming rights and they rely heavily on linear streaming. Amazon’s bet on live sports streaming was a gamble that paid off…now the other networks have put aside their differences to create a viable competitor. This also answers some of the questions Nelson “smiling crocodile” Peltz has posed to Disney’s board during his activist campaign — namely, that they do “more” with ESPN (Peltz hasn’t been wrong, but he didn’t seem to have an answer, either). Here’s an answer: Team Legacy Media: WorldSportsball.

Should encompass about 55% of American sports rights — the lion’s share — our minds wander to the possibility of sports-hungry networks acquiring Sky TV (remember, Sky’s board never disclosed the NBIO figure offered — what’s your number, good lookin’? Sky TV’s main asset, really, is its sports rights). As we have said before — linear-streaming-is-the-new-cable-is-the-new-streaming.

Expect issues to arise — who owns how much? (i.e. the same issue Disney had with Comcast over Hulu) but this feels like a good move overall — it answers the ESPN question and the question of the melting-iceberg of cable TV (partially). Remaining buy on those legacy stocks…WBD, DIS, PARA, etc. Also on the other side — buying sports teams, franchises, etc feels appealing too…

Given Amazon and Netflix’s aggressive pursuit of sports rights and sports-adjacent content, we expect these be extremely accretive for the sports sector in general over the next decade, and we feel like we’re in the middle of a “sports gold rush”.

Oh, snap — Snapchat shares plunged 30% after it missed slightly on earnings — $1.36bn vs. $1.38bn expected. Overreaction, but still making a loss — $248.2mn — I don’t understand how a company which makes an app with a fairly simple proposition (“message each other and view stories”) is still making a loss.

NZ

EBO — Continue to think there’s good buying to be had around the ~$35-36.00 mark.

FBU — Speculation around an equity raise, which they are denying. We don’t like the company. So many liabilities (conference centre, litigation around leaky pipes) and better places to put your money…

NZX — FUM up 31% and Wealth Tech up up 13.3% YoY. Wealth tech has been a white elephant…we see it as breakeven next year. Mkt continually undervaluing this stk which we see as being worth ~$1.36-1.40 per share.

Aussie

Santos and Woodside end talks — on what would’ve been an $80bn merger. Oh, sweet nothings…Santos would be better off splitting off its LNG assets (what Woodside really wanted in the first place) and bringing those to market…UK based Snowcap and Aus based L1 are on the same page — LNG has taken a hit in the past month given ample supply.

Amcor — axing 2000 jobs as it sees less demand for consumer packaging…interestingly, it’s seen a drop off in soft drink sales and meat (the Ozepmic effect??).

Taking another look at Dominos (DMP.ASX)— We couldn’t resist taking a look — down 43% this past yr, had a couple of quarters of bad earnings, mostly in Japan. Trading at a strong discount to its historical EV/EBITDA while CEO Don Meij is a trooper who we think has the nous to fix temporary issues. Topline revenue growth is strong (even without the “covid bump”. We think it’s an interesting proposition and perhaps a buy…like when MFT was sitting at $57 last year (it’s now back at $69). Obviously that net income margin needs work — from ~8.00% to just under 2.00% — no wonder the market punished the stk so much. Yet we think there’s opportunity to re-rate here.

Gold stars — Awarded to DGL (finally hit past the $1.00 mark, at $1.05 as of writing — well done Simon. Also awarded to Duratec, up 4.00% at $1.64. We first started recommending DGL way back in the doldrums of the 60 cent days (not quite fiddy, but close).

Briefly noted

Blackstone mulling a bid for L'Occitane — link. We’re old enough to remember when its biggest shareholder Reinold Geiger mulled taking the company private. This further illustrates the value inherent in beauty - especially skincare — which is why we think Estee Lauder has a lot of work to do…how is it failing in a bull market for skincare? Prefer buying L’Oreal.

Adam Neuman (yes, that Adam Neuman) wants to buy WeWork out of bankruptcy? Plot twist - Dan Loeb’s Third Point is involved as well. Link.