The Circle of L(AI)f

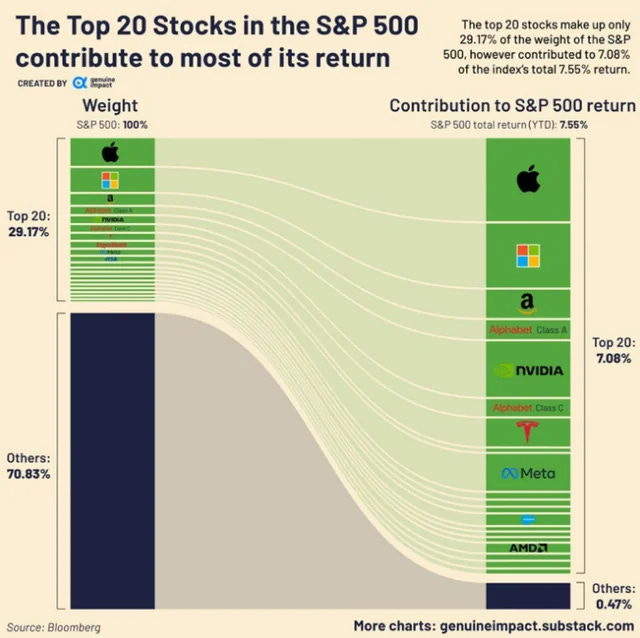

In 2025, AI-linked firms have been responsible for roughly 80% of total gains in US equities. That level of concentration hasn’t been seen since the dot-com era, and it raises a question about sustainability.

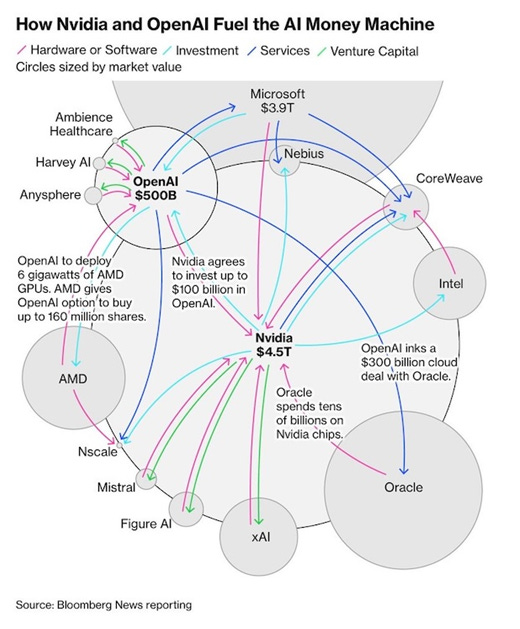

Mixed amongst these technology heavyweights are the most direct AI-plays: OpenAI, NVIDIA, Oracle, Intel, and (more recently) AMD, whose roles overlap in complex (and strategic) ways.

Who’s Who in the Zoo.

· OpenAI develops the large language models powering consumer and enterprise tools.

· NVIDIA designs the GPUs that make large-scale AI computation possible.

· Oracle provides the cloud capacity that keeps these models running.

· Intel supplies CPUs essential for the everyday processing that underpins AI infrastructure.

· AMD competes across both GPU and CPU markets, offering an alternative source of computing power.

The Incestual Entanglement

NVIDIA has reportedly signed a US$100 billion letter of intent to invest in OpenAI over the coming years. To put it in perspective, it’s more than the annual GDP of some countries. The scale of this commitment reflects an effort to extend its reach beyond hardware supply.

OpenAI has also agreed to purchase roughly US$300 billion in cloud computing capacity from Oracle over five years. The goal is to help expand data-centre infrastructure at a pace that matches the computational requirements of AI.

NVIDIA also just put US$5 billion into Intel equity. On paper they’re rivals. So, why invest? The simplest answer is supply-chain risk: securing capacity and influence across the CPU stack.

At the same time, OpenAI finalised a multi-billion-dollar supply agreement with AMD, including warrants for up to 10% of AMD’s shares if performance milestones are met. The arrangement gives OpenAI redundancy in GPU sourcing and leverage in price negotiations.

A Closed Financial Loop

The web of investment between these firms has created what some analysts call a closed financial loop. Each company is simultaneously a supplier, customer, and investor in the others. That structure supports rapid scaling but also raises questions about long-term return on capital if projected demand softens.

The map below illustrates just how circular the AI ecosystem has become.

Show Me the ROI

We’ve seen the money, now show me the ROI!

A sceptic might call this “vendor financing” of future customers, great while growth is roaring but vulnerable if returns disappoint. If the market starts to doubt the payoff, the unwind could be abrupt. It boils down to the trillion-dollar question: will AI deliver enough productivity and revenue to meet lofty expectations?

We know that AI integration sits at the top of many board agendas. They may not know why, and certainly not how, but they do know when, and the answer is now.

If this all feels familiar, it’s because we’ve seen something like this before. During the late ’90s dot-com bubble, everyone rushed to add “.com” to their name. Many of those companies failed. But the period also marked the birth of many corporate giants like Amazon, as the internet evolved into the backbone of modern life.

AI may prove similar. We often misjudge timing. Bill Gates put it best: we overestimate the change that will occur in two years and underestimate the change that will occur in ten. Not every startup, cloud deal, or investment will succeed, but AI is likely to define the next era of business and technology. And it may be that the trillion-dollar question isn’t answered this year, but over the next decade.

From the desk of IGB