Hope you all had a good Christmas — and thank you for the very kind messages from a lot of you. Knowing you enjoy this newsletter means the world and is one of my main joys in life.

Quick few thoughts for ‘25 — we’re back to regular programming. Some thematics I’m looking at for next year —

Sector rotation — Alcohol, consumer goods companies and luxury are all out of favour, some trading around 10 year lows. Looking at companies like Diageo, Remy, Brown Forman, Pernod Ricard (booze), Kering, LVMH, Burberry, Moncler (luxury), Kenvue, Haelon (consumer goods).

NASDAQ dump — Overvalued, esp. the mag 7. I was interested to read that the highest cost of goods sold for NVIDIA is memory, though, so might be interesting to counter-play this thematic by looking at things like Micron, which makes memory and recently sold off after bad earnings.

Stagflation station — Trump tariffs, etc. Expect inflation to come back up a bit, which means the Fed will slow in its rate of cutting.

M&A — Here’s an idea. Find a sector you know well, do a screen for companies with say, less than a 10bn market cap or whatever. Think to yourself: if Linda Khan is gone and Trump is pro-M&A, and there’s cheaper money to be had and some dry powder around — then what would you buy? (My picks — because I know the fashion sector well — I expect something will happen with Burberry, Richemont will likely look at hocking off some of their lesser brands, etc. In NZ there are a bunch of small caps like AoFrio that could appeal to a larger player, while Oceania Healthcare is chronically undervalued).

M&A part two — Don’t forget about the spincos, namely Comcast spinning out its linear assets & Zaz at WarnerBrothersDiscovery dividing WBD’s business into two units — linear and growth. There’s bugger all value to be had from the Comcast spin-off — about +$1.00 per share. The WBD offering, though, is interesting — a linear spinco would likely get loaded up with the bulk of WBD’s gigantic debt, leaving that growth co (HBO, etc). Would Disney be interested in this? Or Netflix? Wouldn’t rule it out.

Bubble pop — Everything about this market feels like every other bubble, only perhaps more so. You know what happens when a bubble ends? It pops. When you Uber driver, hair dresser, and random neighbour from childhood all give you crypto and stock tips — yeah, that’s a bubble.

Search for value in other corners of the world — US is largely well-valued, with a few sector-specific exceptions. Places like Hong Kong, NZ, Europe all feel a bit ignored by outside capital…if there is a bubble pop that will change, as money managers look to find “alpha” (gross word!) elsewhere.

Summer reading

Vanity Fair isn’t much now, but in the past it published a lot of good stuff — a monthly sub is $1.00 or something stupid (you know, that’s the reason there isn’t much good journalism anymore — how insane is it you can get access to 100 yrs of journalism for less than the cost of a Coca Cola?).

Enjoyed —

This piece about the Bancroft family, who formerly controlled Dow Jones

This one , about the falling apart of the Pritzker clan.

This one, about Libet Johnson, the J&J heiress.

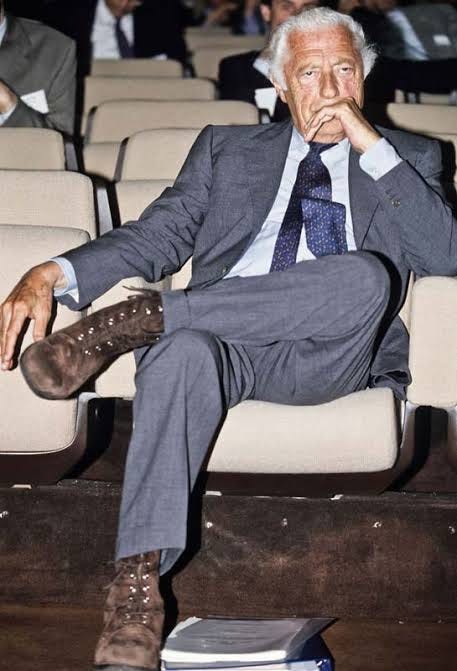

Also this, about Gianni Agnelli, the charismatic former chair of Fiat (now Exor).

Over at the NY’r, enjoyed —

The secret history of risotto

This piece, about Jeremy Grantham, who may be the last bear in a bull market

Cheers,

Eden