In brief —

There is no recession in New Zealand?

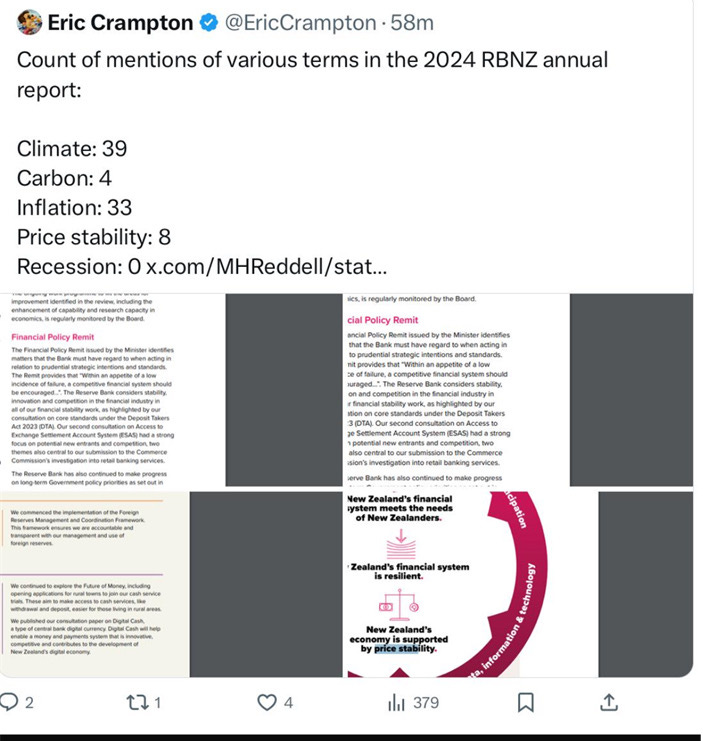

Someone sent me this — and oh how I laughed. You’d think that perhaps the RBNZ would mention the word “recession” in their annual report. That’s where you’d be wrong.

Glad “climate” was mentioned, though. At least Chloe Swarbrick will be happy.

RBA — Signalling rates staying at 4.35% — I saw Shane Solly over at Habour calling for a 50 bps cut in NZ. I’m not so sure about that. Are you?

Stonks

Nice to see MOVE continuing to turn around…selling its vessel, the Atlas Wind, for $1.1mn USD. Still a lot more turnaround work here to be done — I saw a MOVE truck being unloaded outside The Fox in the Viaduct the other day, and I have to say — it was a dirty truck being unloaded without a lot of care. Details matter!

MFT — Estimated revenue for 26 weeks +8.5% to 2.55bn, profit before tax -9.3% to 158.5mn. I particularly liked the Jack Daniel’s and MFT truck in the presentation— two of my favourite things. Thing of beauty. Obviously margins are a bit weaker at MFT — nice to see the Air & Ocean division grow well. Also note growing property footprint.

Finclear — over in Aus — granted a clearing and settlement license. Link. Obviously breaks the ASX’s monopoly… think of the risks it poses to the NZX too… (a lot of feedback from ya’ll re Smart (shares) y’day — and none of it good. Could it be that the NZX and “Smart” has so much arrogance and hubris that it does not listen to market??)

Nintendo — Noting Saudi Wealth fund is looking at upping its stake in Japanese video game companies. We’re long Nintendo (combination of IP + upcoming Switch 2).

KiwiSaver — Enjoyed Jenny’s piece on the KiwiSaver FUM game (it’s an amazing game to be in — just build up funds under management and clip the ticket!). I totally agree with her re the FMA’s dogged obsession with fund manager fees — performance should trump fees… every time. As the great poet Homer Simpson said — “d’oh!”

MyTheresa buys Yoox Net-a-Porter

We're going to call MyTheresa MT and Yoox Net-a-Porter YNAP from now on in this article, ok? Because frankly — I am not typing out that mouthful every time. Anyway, back on May 20 I predicted that MT would be the likely buyer of YNAP (throughout the years, I always get old men who question my ‘skills’ within what I do — here’s a bit of evidence, and the secret is reading every day and not listening to Mike Hosking).

MT is the only profitable online luxury retailer. Online luxury is a hard game, because there’s no experience attached, really (some nice wrapping paper and a handwritten note at best). MT makes money because they are run by a German who prizes efficiency above all else (it seems like ancient history now, but Farfetch was once considered the future of luxury retailing — now it, and its founder, José Neves, are mere footnotes).

The actual specifics of the deal are a kind of win-win for MT (“the winner takes all…?”) — Richemont (YNAP’s previous owner) will recapitalise €555 million, plus a six-year, €100 million line of revolving credit, in exchange for a third of Mytheresa’s shares. MT’s shares as of writing are worth, in total, about 574mn or so — i.e. MT paid 191mn for a company wiped of all debt and 555mn euros on top and a line of credit. That's a good deal! I would take this deal!

That doesn’t make MT a good stock, mind you. You’re still looking at low margins, the integration of multiple systems, and you’re still at the mercy of the big houses (except, I guess, Richemont, who has a vested interest in the success of the business — and of salvaging what is, basically, a failure on their part over years of trying to make the e-commerce thing work).

I guess the other question is — and this is maybe more interesting — is where does that put Richemont? Richemont had the e-commerce nightmare as a stone around its neck — that was an issue — now it doesn’t, though it paid dearly to be rid of it. Richemont still has a bunch of stuff that isn’t that interesting to the big boys — I don’t think anyone is that interested in Dunhill, for instance, but they do have an interesting watch division (Panerai, JLC…) that could probably be hocked off (my guess is Swatch would buy all that in a heartbeat), whereas the fashion division houses Alaia and Chloe — both houses have had extremely strong shows at fashion week recently and Alaia’s “baguette” bag is on the arm of any well-dressed woman you care to name.

But the real prize, of course, is Cartier (and Van Cleef). Those are the powerhouses within Richemont and the things that are implicitly for sale. J Rupert, the CEO, doesn’t have an heir apparent. At the right price, everything is for sale.

Data Centres

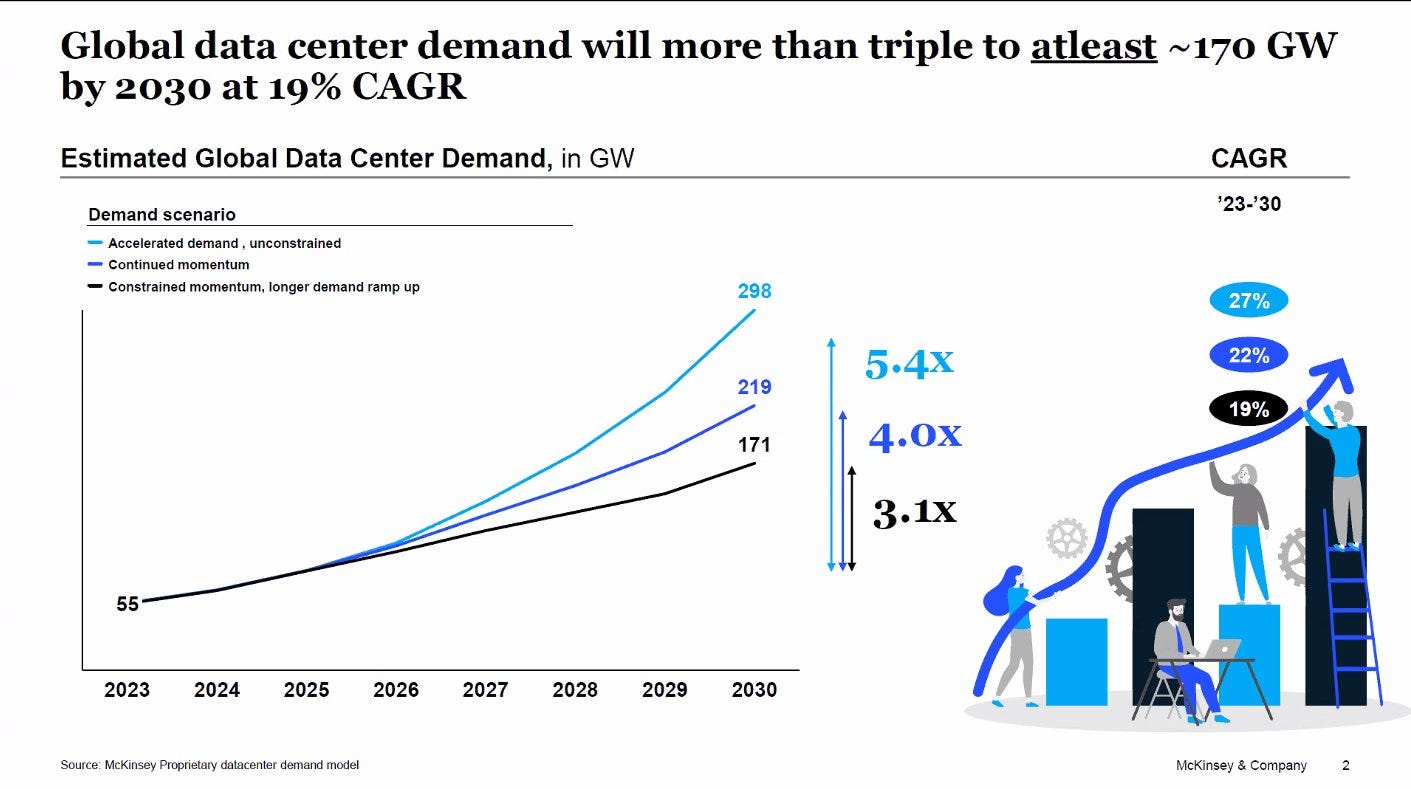

My favourite contra, other than Jim Cramer, is just to do the opposite of what McKinsey says. Here they are talking about data centres and what they expect demand to be in the next 6 years. We have done pretty well with data centres — Infratil and NextDC over in Aus — but I’ve been wondering if the multiples are a bit hot for a while. I mean, I’m getting nervous. Stupid money for data centres is nice and all but there is the need to replace ageing equipment and so on. Anyway, here’s the graphic (what’s with the weird people??).

Infratil is trading at $12.22 and NextDC at $17.66. They are near all-time highs. I love Infratil. I love NextDC. But I am starting to have a feeling (and it’s just a feeling) — maybe this stuff feels a little hot. A little pricey. Remember — AirTrunk was sold for about 21x EBITDA (actually, run-rate, which is more rubbery, but let’s go with EBITDA). You know, anything at 21x EBITDA is a lot to pay.

I’m not closing out either position for myself, personally, but I’m wondering about trimming. This is merely a vibes based position, though dude. It’s all about the vibes.

My hero - Dave Duffield (PeopleSoft and Workday founder) on not retiring

Reminds me of another hero of mine, Allan Pye, who passed away earlier this year.

Misc

How much time people waste trying to look busy