They not like us -- THL and Starbucks' new broom

THL went down

OK — I need to admit that I’m not a camper. I don’t camp. My family does camping, and every summer I would float in the water or look forlornly at the burnished, dry ground — dead grass everywhere. I have not been camping since being an “adult”. I don’t intend to start now. The idea of renting one of THL’s campervans and going to Queenstown to cook food on a poxy little stove and explore “nature” and go to one of the overcrowded Queenstown bars and line up to go to Fergburger is anathema to me. Fergburger is not that good!

Anyway - THL is one of those main campervan providers and today it dropped guidance from $75mn to $50mn - $53mn. That’s a big whack. The $75mn guidance was only issued in February and it’s only May now — how did they get it so wrong? Lower forward bookings in the shoulder season aren’t helping, while 50% of decline is attributable to lower sales in the retail dealership division (who wants to buy a camper in a recession?). It sold off today as a result — -37% (!)…closed at $1.79. Ouch!!

Trading at 8x earnings given revision — looks cheap — but I have issue with the $100mn projection for 2026. There’s a long way between $50mn and $100mn — and if you think we’re going into a recession then that $100mn looks a little more dubious.

The reason why I started this letter with “I’m not a camper” is because on a pure numbers basis THL looks cheap. Then I started talking to people about THL, and “people” had a lot to say! All the people. Nobody had much nice to say! I took a look at the reviews - and oh dear:

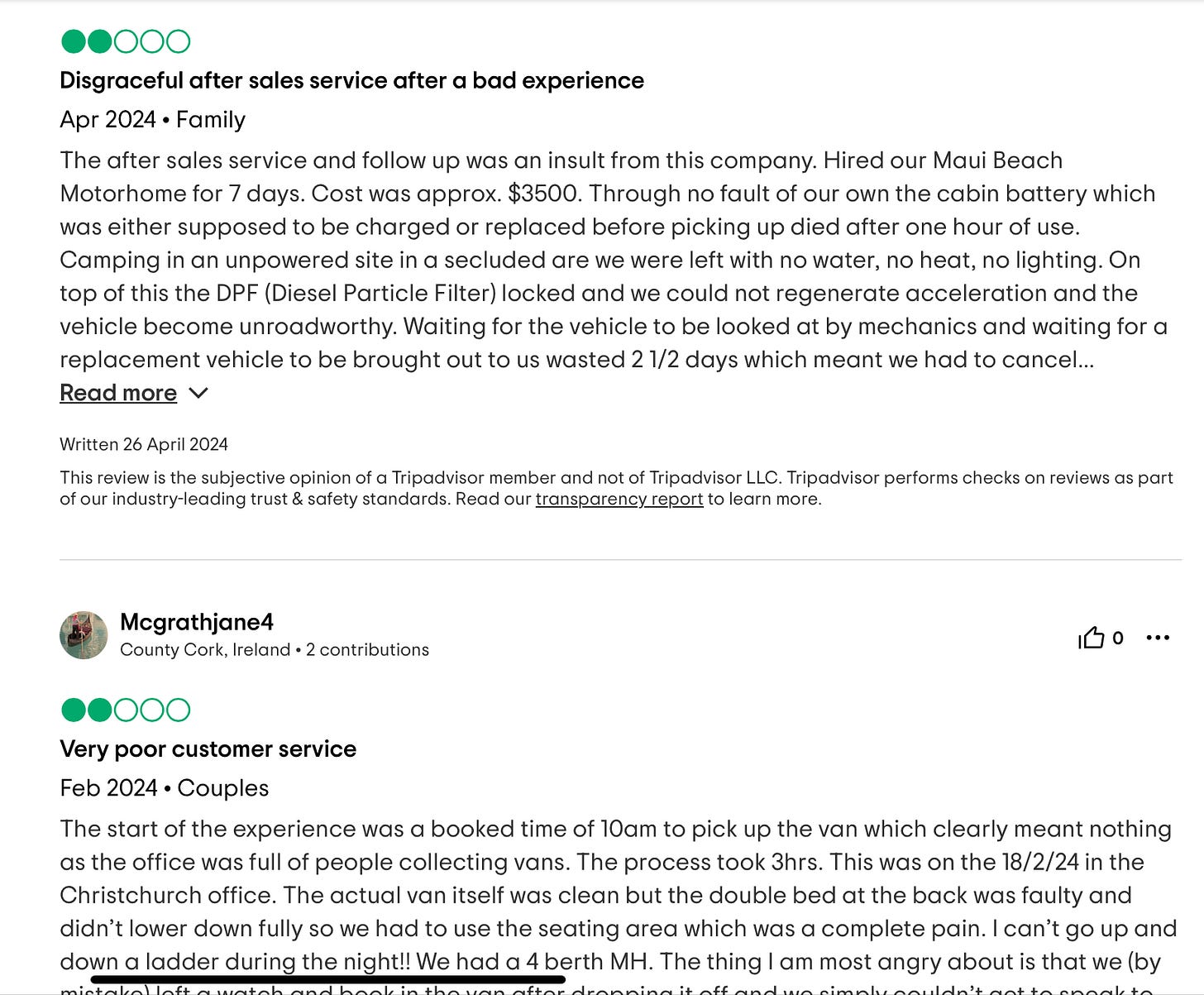

Or TripAdvisor:

I mean — this is kind of an issue? If you keep scrolling through there are many many bad reviews of THL’s various campervan companies. I’m a big proponent of scuttlebutt — on the ground research — and I admit I am not a camping person — so I am looking at these reviews thinking — oh, ok (I know, I know — a campervan is not going to be Hotel Cipriani).

Another brand of THL’s, Mighty, has a 2.5 star review on TrustPilot:

The issues seem to often the same — things take too long, service is bad, and the fleet is old and often dirty. I find it hard to make a bullish investment case there. What is management going to do about this? A business lives and dies by how it treats its customers — shareholder value is a byproduct of this — yes, THL is cheap, but there is obviously work to do on the product. The power of a good customer experience is incredible: why do people buy Apple again and again (it just works); why do they go to CostCo (it’s cheap, consistent, etc.)

Financials don’t matter if you get bad reviews. Anyone with similar experiences, please feel free to email me (just reply to this email) — ditto for any THL management who wish to comment on their plan to remedy their customer satisfaction levels.

We used to write more positively about THL (it was a good COVID buy) and frankly, the first thing I thought when I saw the stock sell-off was how cheap this thing has gotten. Still is cheap, but those reviews worry me. Has anybody had a good experience with a THL campervan lately? Email me.

Speaking of customer experience — Howard Schultz

Starbucks just had pretty bad results. I don’t think they are as bad as everybody else thought (we added a little bit to our model portfolio as a result of the weakness) — global revenues were down 2% while comparable transactions were down 6%. US same-store operating margin declined about 110 bps (also ouch). The language of the press release was the simpish talk of PR-addled mgmt: "In a highly challenged environment, this quarter's results do not reflect the power of our brand, our capabilities or the opportunities ahead,"

An elementary lesson in how not to write to your investors

New CEO Laxman Narasimhan committed a few sins here. He blamed the results not on his management but on a “highly challenged environment”. He then said a few words I am allergic to — “capabilities” and “opportunities” ahead. Listen — I have heard many CEOs say that there are “opportunities ahead” and the bulk of them never seem to find those opportunities — quarterly calls end up being an endless bore where the CEO says “next year will be better”. If they say that — run.

I wrote about how I was skeptical of Laxman early on, and then with daddy Schultz at the helm alongside him I thought hell, I’ll give this highly qualified and much richer than me young man a chance. Here’s a set of results under his management and they’re not impressive. Even Schultz, who no longer sits on the board of Starbucks nor has a mgmt role had something to say. He wrote on the social media platform of boomers, LinkedIn —

Senior leaders—including board members—need to spend more time with those who wear the green apron. One of their first actions should be to reinvent the mobile ordering and payment platform—which Starbucks pioneered—to once again make it the uplifting experience it was designed to be. The go-to-market strategy needs to be overhauled and elevated with coffee-forward innovation that inspires partners, and creates differentiation in the marketplace, reinforcing the company’s premium position. Through it all, focus on being experiential, not transactional

Read that last line again. And also the first line — when management and directors move into the ivory tower world of delusion it does no good for shareholders, though I suspect it may do good for said management’s golf game. You need to be in store. You need to understand what your product is. You need to focus on that customer experience.

I suspect Laxman won’t last. I’m happy to buy stock at a lower multiple while Starbucks goes through a fallow period. I don’t really mind — what I like is that Starbucks has 32.8mn rewards customers (customers who prepay on Starbucks’ own card system). There’s $1.87bn worth of cash stored on those cards to pay for future Starbucks products (up $172mn YoY). There’s an incredibly strong brand and product range with strong economics (1/2 as expensive to open a Starbucks than a Taco Bell, with a higher EBITDA margin - about 30%). I’m satisfied that the strong “mental moat” Starbucks has on consumers will continue. I’m not satisfied that Laxman is the right man to do this.

Let me justify that — Laxman became CEO of Reckitt in 2019. Reckitt makes neurofen, Durex, Strepsils, Lysol and a host of other household names. You would think running a company like that would be easy — just let your managers keep rolling out their product and sit back. Laxman’s predecessor had overstepped Reckitt’s reach and got into a lot of dumb businesses — they bought infant formula business Mead Johnson for $18bn (!) and subsequently were sued for a defective product after their infant formula was alleged to have caused the deaths of a premature infant (there’s a long list of lawsuits before that one). Laxman’s precursor shuffled off by 2019, but by then they already owned Mead Johnson — in addition to that they were seeing slower consumer demand in their “bread and butter” consumer products segment. Laxman stepped in to turn the company around. The plan? Change the name from Reckitt Benckiser to Reckitt.

The plan? Change our name to Reckitt from Reckitt Benckiser

Needless to say, Laxman wasn’t the saviour of Reckitt. Nor do I think he will be the saviour of Starbucks. This is fine. Coca-Cola at one point had management that bought all kinds of things — in 1982 they bought Columbia Pictures. Management sometimes isn’t up to the task — they can always be shown the door. In the meantime I am very happy to buy more.

RAK and the other NBIO companies of the NZX

We last heard from RAK back in Dec. It's May now. Directors have said nada, and company shareholders are in the dark. "Mum and dad" shareholders seem to be losing faith (a common symptom of the NZ stock market) while the RegCo has confirmed to me that they assume the incomplete NBIO negotiations continue to be ongoing given that otherwise ceased negotiations would be material and need to be reported to them. Needless to say, I am still a buyer here at 94c given the upside is +70%. The Berkshire meeting was this weekend. I keep thinking about Buffett — only swing at the pitches you like. Am swinging hard.

Worth thinking about how multiple NBIOs have been rejected by boards this year and last -- E-Road, Arvida, Sky TV, Metro Glass -- E-Road was a complete debacle and probably the worst managed corporate action last year, while Metro was offered 18c by Masfen and co, and almost 100% premium to today's stock price. When a board says "the offer materially undervalues the company" you have to wonder -- undervalues it to whom?

E-Road - NBIO, $1.30 - stock price at close today - 0.84c

Arvida - NBIO, $1.70 - stock price at close today $1.02

MPG - NBIO, 0.18c - stock price at close today 0.089

E-Road was clumsily handled. Management did a capital raise, which acted as a poison pill to the potential acquirer (Constellation Software). Shareholders have not been rewarded as of yet. Nor have Arvida shareholders, and certainly not Metro Glass shareholders. It’s incumbent upon directors of a company to seriously consider these proposals — I wonder if they made the right decision when the takeover offers clearly are at a substantial premium. The justifications are often oblique, and they often mention valuations undertaken by an opaque Big 4 firm. I think it is incumbent upon directors of NZX listed companies to be more transparent with shareholders and explain a ballpark figure of exactly how much said consultants think the current company is worth (i.e. the sum of all future cash flows from now until judgement day, discounted by an appropriate yardstick). There is no use in saying “materially undervalues” when you are giving no idea of what the company is worth. I realise this is not fashionable — we are expected to take directors at their word when they say “no, no, this materially undervalues us!”

On the other hand, we live in a world of realpolitik. An asset is worth what somebody will pay. A rose is a rose is a rose. We know what Masfen and co would pay for MPG (18c). We can ascribe a value to that. The market thinks it is worth around 9 cents. Obviously, these are diverging views. It does not take a genius to work out which the biggest number is.

I question the divergence in recent NBIO offers and the steady rejection of them by their respective company’s boards. When the premium is +70% or +100%, you need to have a might good reason for rejecting that.

Appointment viewing — the best question at this year’s Berkshire tent revival: