Trouble at Fletchers...CEO gone? Superbowl Temu! And more...

Condé Nast drama, Farfetch, CSL, and MQG...all this and more

NZ

Quick mention to Synlait Milk (SML) — 1H24 NPAT now expected to be a loss of $17-21m….a further downgrade…no use crying over spilt…?

Big story is Fletchers (FBU), which is in a trading halt as it prepares to finalise earnings guidance, which it expects to vary materially to analyst estimates. Just released — 13/2/2024, 5:31 pm HALT

FBU is considering a number of matters, relevant to information to be released on Wednesday, 14 February 2024, including:

FBU’s half year results, including potential provisions and impairments; earnings guidance for the full year, which FBU has indicated is likely to materially vary from current analyst forecasts;

FBU’s determination of the level of interim dividend or if no dividend will be paid; and information about the position of the CEO of FBU.

(Italics and bold mine…obviously the note re the position of the CEO does not sound good).

The company has lurched from issue to issue — the pipes issue across the ditch, blowout costs from the SkyCity Convention Centre, legacy lawsuits and a Gib crisis which saw preferential treatment given to some. This has been a bad story stock for a while and it’s not the first time — the company has been plagued by issues and a couple of years ago the NZ Shareholders Assc. called for the entire board to resign in the wake of the Gib crisis. It’s nothing new. Yours truly quoted here on Businessdesk alongside Sam Stubbs and others.

Corporate New Zealand is agog at the drama unfolding at Fletcher Building

I said:

Blackbull Research’s Eden Bradfield saw Taylor’s exit as required as he had presided over significant destruction of shareholder value. In a market where property values have doubled across the board, Fletcher had paid reduced dividends, faced bursting pipes in Australia and overseen cost blowouts that make a night out drinking whiskey with former prime minister Rob Muldoon seem tame, he said. “This company has lurched from mediocrity to mediocrity for a long time. Time for Taylor to go to greener pastures (I’m sure the golf course is calling) and time for management to rethink its strategy.” Bradfield said the plasterboard shortage, which caused outrage, was foreseeable. “That preferential access was given out to [plasterboard customers] like VIP tickets to a Taylor Swift concert was a total failure of management. I would not invest in Fletchers or touch it with a ten-foot barge pole right now.” However, he had some sympathy as some factors hadn’t been in Fletcher’s control.

Simplicity’s Sam Stubbs said:

…investors would be “very disappointed” if key board members, including Hassall, don’t tender their resignations this week. “They’ve failed to deliver over the six years since most of them were appointed, so most of them, and most importantly, the chair, should resign. The buck stops there…

While the head of research at ISS said:

The local head of research for global proxy giant Institutional Shareholder Services (ISS), Vas Kolesnikoff, told BusinessDesk in December that no one had been held accountable for a string of performance issues at Fletcher. Out-sized executive pay ISS told clients, including shareholder NZ Super Fund, before Fletcher’s annual general meeting in October that it was a material concern that Taylor's current fixed remuneration was approximately 63% higher than at similar-sized and peer companies.

It’s heartening to know that bigger boys than me share the same concerns (Stubbs, of course, overseas the Kiwisavers of 150,000 or so NZers, while ISS has 4,300 institutional clients. Sometimes when you are writing from the wilds of the jungle as I am you can feel like a lone voice — here the consensus is the same; there’s either a failure of management or governance or both.

As I often write you — five years ago you could’ve put your money into Infratil stock and made 166%, or you could’ve put it into FBU and lost about 20% of your initial investment over the last five years. Or you could’ve bought LVMH, and made 179%. I’m just saying…

Australia

Vail Nick O’Kane - the rainmaker for Macquarie Group — probably best known as the man who took home a near-$58mn paycheck in 2023. But what O’Kane was really responsible being the power behind MQG’s Global Commodities and Markets (GCM) division — which is kind of a black hole of financial magic and jiggery pokery but comes down to being able to offer pension funds to a basket of commodities without exposure to the commodity; or perhaps you are a producer of widgets and you need to hedge your exposure to that widget, or you need to hedge it against a currency, etc. In other words, O’Kane built in ingenious structure which solves complex issues and made the bank a whole lot of money in the process (and himself).

CGM is worth ~45% of MQsG’s profit now — big shoes to fill. We’re still optimistic on Macquarie — solid company with a Goldman Sachs ethos and Aussie know-how. O’Kane is being replaced by Simon Wright — insiders describe him as the “glue” (we hope so!).

CSL — oversold for a second day even as the biotech company saw a +11% increase in net profit. Sell-off was due to a weaker outlook for the company’s recently purchased Vifor therapy unit…we still think it’s a quality co. Kanye’s lyrics apply to CSL here — “I don't care what none of y'all say I still love her”

A story about Temu

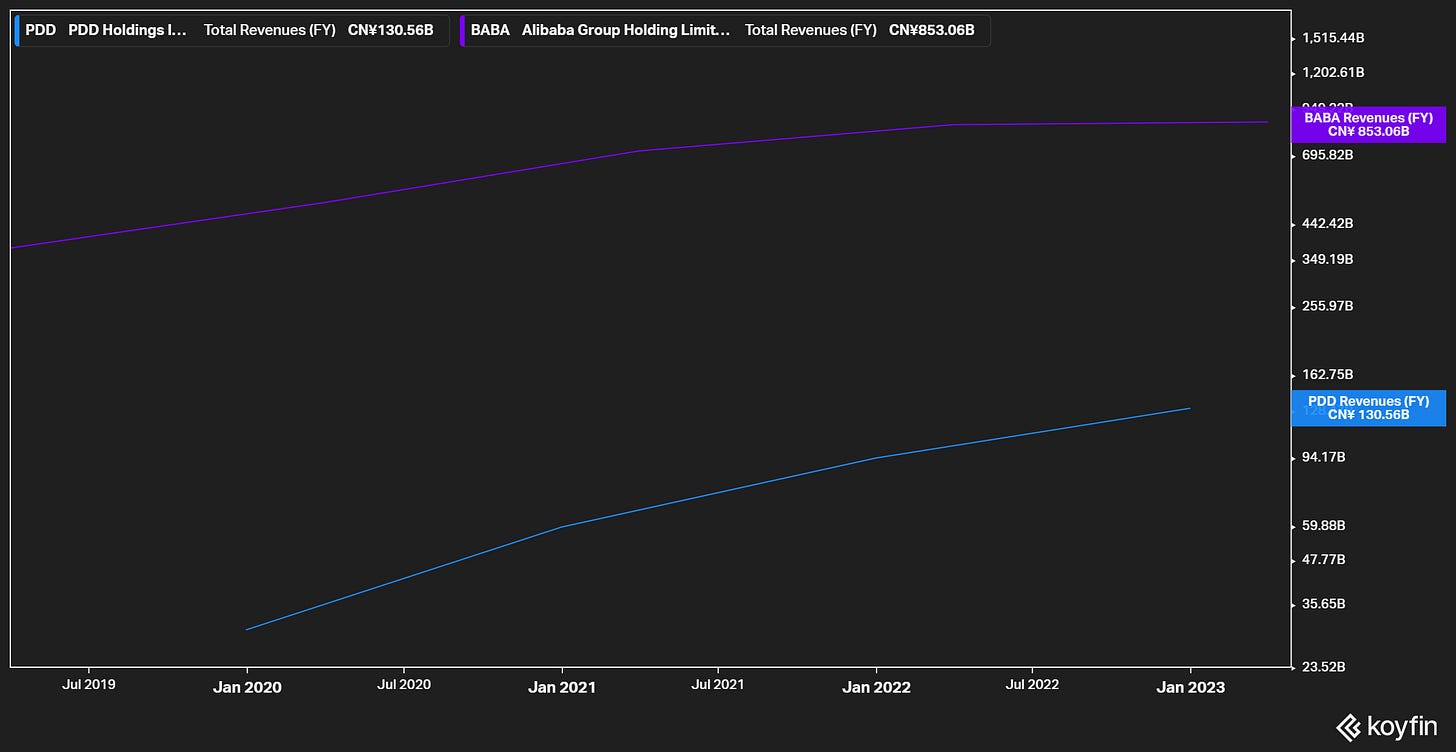

A long time ago I was looking at the portfolio of Li Lu and noticed that a company called Pinduoduo Inc was in his portfolio. Back then PDD was a way for rural Chinese farmers to bring produce to market (or something like that). Li Lu actually exited PDD in 2021 and the stock did very little for a few years. I shrugged my head, thought “oh, Chinese companies I don’t understand!” and forgot about it. And then suddenly it’s 2024 and PDD owns Temu?! You know — the app with the tagline “shop like a billionaire” that maybe your aunty or mum order random badly made Chinese goods from. Ads for Temu seem to be everywhere I look and the company surpassed Alibaba (yes, that Alibaba) in market cap this year:

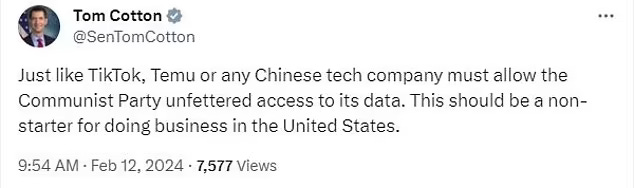

Anyway, the company ran six ads during the Superbowl. Six! Assuming six 30 second ads each, at a cost of $7mn a pop, that’s a cool ~$42mn USD (maybe they got a discount?! Who knows!). Americans, specifically, American politicians are outraged.

I mean — I don’t really get Temu. I don’t know anyone who has bought anything off Temu. What does it even mean to “shop like a billionaire?!” I assume — and this is just an assumption — that Jeff Bezos or the Arnault family are not going on Temu and “shopping like a billionaire”.

Also BABA’s revenues have far, far eclipsed Temu’s — albeit PDD has grown at a rapid clip.

I don’t know what to say here. US senators are always outraged (it’s practically a requirement to be a politician in the US in these times we live in). Do they have a point? Is it CCP Spyware? Again, I don’t know — I just know that’s a big chunk of cash that just won mindshare of a lot of the US of A — whether negative or positive.

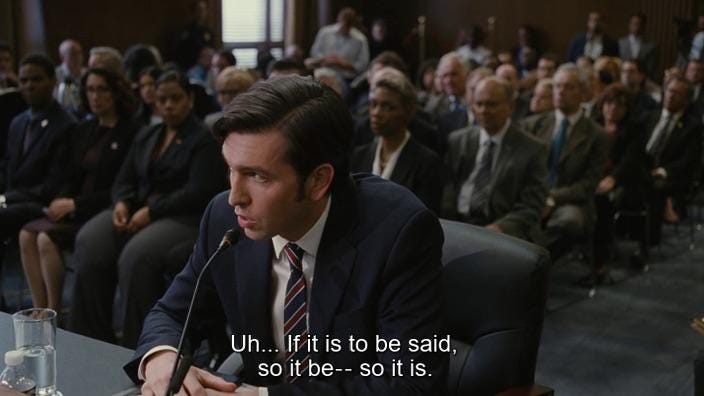

Is TikTok CCP Spyware? Is the iPhone that you might be holding that was likely made in China CCP Spyware? I don’t know — it’s hard to know where to draw the line — and to be clear this is not investment advice — in any way shape or form — it’s merely my absolute bewilderment with Temu. To quote cousin Greg - uh —

Obviously BABA has more value than Temu — they’ve got a ton of cash on their balance sheet, they have a cloud business, etc, etc, but did they buy six ads at the Super Bowl?

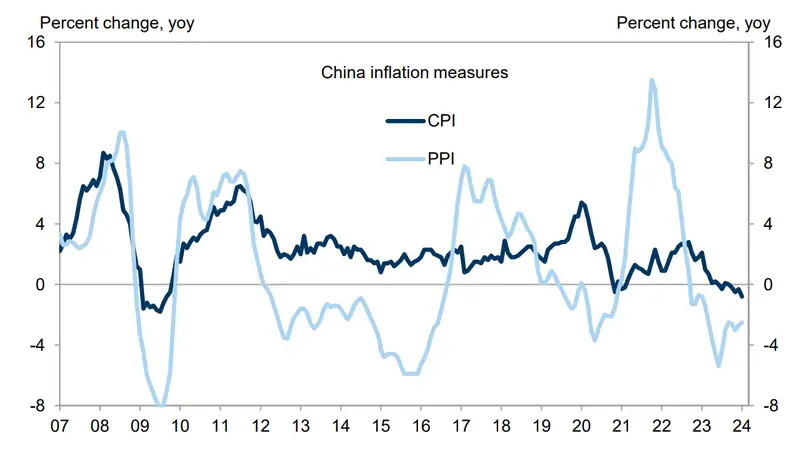

Maybe we live in a world of Superbowl-nomics now, I don’t know. Valuing Chinese companies is so hard precisely because of the CCP — and because deflation has been a persistent issue (see below) and because people are worried about the numbers of Chinese babies being born (and they are betting on the year of the dragon to change it. Roar)

Here’s what I do know about the Superbowl — in total Paramount, which owns the broadcast rights, should net about ~$650mn from the whole affair. Paramount’s market cap is only $9bn as of writing. We think Paramount continues to be in play as a media asset for sale — who or when are two questions nobody seems to know the answer to (I think David Ellison, son of Larry, is the most likely candidate) — the revenue from the Superbowl alone is indicative of the value of the network.

Across the globe

Remember when I speculated about Farfetch, Yoox-NAP, and the possible bidders for parts of the wreckage? One possibility I suggested was Mike Ashley, the booze-and-sports-loving retail magnet. Well, apparently Frasers (an Ashley-controlled business) did take a look at buying Browns, the storied British dept. store that Farfetch had acquired at some point (c.2015) but walked away.

I don’t know who buys it now. Saudis? Qataris? Browns has got clout in the UK, but it doesn’t have the international name say Matches or Yoox/Net-a-Porter has. It’s probably going for a song — someone might buy it. I don’t know how well local fashion multi-brand boutiques are going — Scotties has been run by the same crew since forever and seems to have nailed it, but ghosts like Karen Walker’s The Department Store in Takapuna haunt the memory…multi-brand retail, especially retail, is hard.

Conde Nasty

I know this is super niche and if you’re just interested in our equities coverage stop here — we’re going into the waters of the murky, murky magazine land. But the company more formally known as Condé Nast is reportedly up for sale — well, sort of. Condé Nast owns stakes in everything from WMG to Reddit to, of course, its famed media empire — Vogue, etc. Jonathan Newhouse is reportedly in London, looking to sell the company — they just folded Pitchfork into GQ (a move that makes no sense IMO) and Steven Newhouse is in NY trying to keep the company. It’s basically another Succession plot. Condé has made a number of errors over the years — keeping Anna Wintour as reigning queen has been a mistake, but investing in Reddit was a stroke of genius (and as for WBD, well, we’re all still waiting on that…)

It’s been a long time since the golden years of magazines…perhaps The September Issue enshrined the end of an era. Condé should be avoiding familial squabbles and consolidating — they have enough assets and power to work through this (one hopes!)