My partner Charlie says there is only three ways a smart person can go broke: liquor, ladies, and leverage — Warren Buffett

Bill Hwang, whose $36bn hedge fund Archegos collapsed in 2021, will likely be convicted by the time I send this email out. Or he will be found innocent! Either or, the closing arguments have been made and it’s now up to the jury.

Hwang was a Tiger Cub who had worked at Julian Robertson’s Tiger, and he had parlayed his money into a significant fortune. Mostly his family office invested in things like Viacom (now Paramount), Discovery, Glaxo and Google. This is the first thing that struck me back in 2021. They were really boring investments — they were not crazy speculative NFTs, or meme stocks — they were boomer stocks — but he used total return swaps (i.e. leverage) to magnify his returns, and losses.

This is a bit spicy but not that crazy, really. Your brokers are going to typically be happy to lend against your stock, especially if it is blue-chip and boring like Google. And especially if you have billions of dollars. I am finally reading the Michael Lewis SBF book — Going Infinite — and what strikes me is that people will put up with a lot if you are a billionaire — Anna Wintour listening to some punk go “yup” while he plays a video game? Sure.

Anyway — we all know what happens next. Archegos got margin called, and all of Archegos’ brokers didn’t seem to know that they were all doing total return swaps. I.e. You ring up UBS. UBS goes, sure — you have lots of blue chip stock — we would love to do a total return swap! You then ring up, I don’t know, Goldmans — and you rinse and repeat. As long as you’ve got enough margin you are golden. But then you get margin called, and each broker is that you somehow have enough margin at the other broker to pay them off. The smart move was to liquidate whatever you had and get the hell out of dodge — at least that is some cash. The bad move, which hilariously was what Goldmans did, was to wait until the next day or whatever. But by that time every other broker had sold stock, and because it was such a quantity, the stock prices of all companies involved had fallen significantly. You’re rushing to get out, and so is everyone else. You’re all rushing for the exit and Rome is burning.

I mean, if you are a broker in this situation, the best response is what the Jefferies CEO did — while waiting for a spicy margarita 🌶:

Jefferies calls CEO Rich Handler, who is on holiday in Turks and Caicos with a spicy margarita on the way. They tell him Archegos isn’t answering their calls. Handler says he’s going to get his cocktail and he wants Archegos positions gone and a tally of losses by the time he comes back. It was one of the few banks that escaped with minimal losses.

The allegations that the prosectors made were twofold. The first was the Hwang and his team deliberately lied to brokers at their respective banks — they went as far as claiming fraud. I wonder if this is too heavy-handed. Was Hwang lying? I don’t know — you’re on margin, and then suddenly a chain reaction is set off and suddenly you’ve got a whole lot of margin calls to answer. I don’t know — it’s not great! — but you’ve been running your business like this for a while; it’s not new. I mean; this doesn’t preclude Doing A Fraud, but also — it’s kind of like, the secret sauce is buying boring stocks on margin to enhance returns — it doesn’t strike me as some kind of Madoff-esque plan; more like too much of a good thing…Buffett on performance enhancers, whatever.

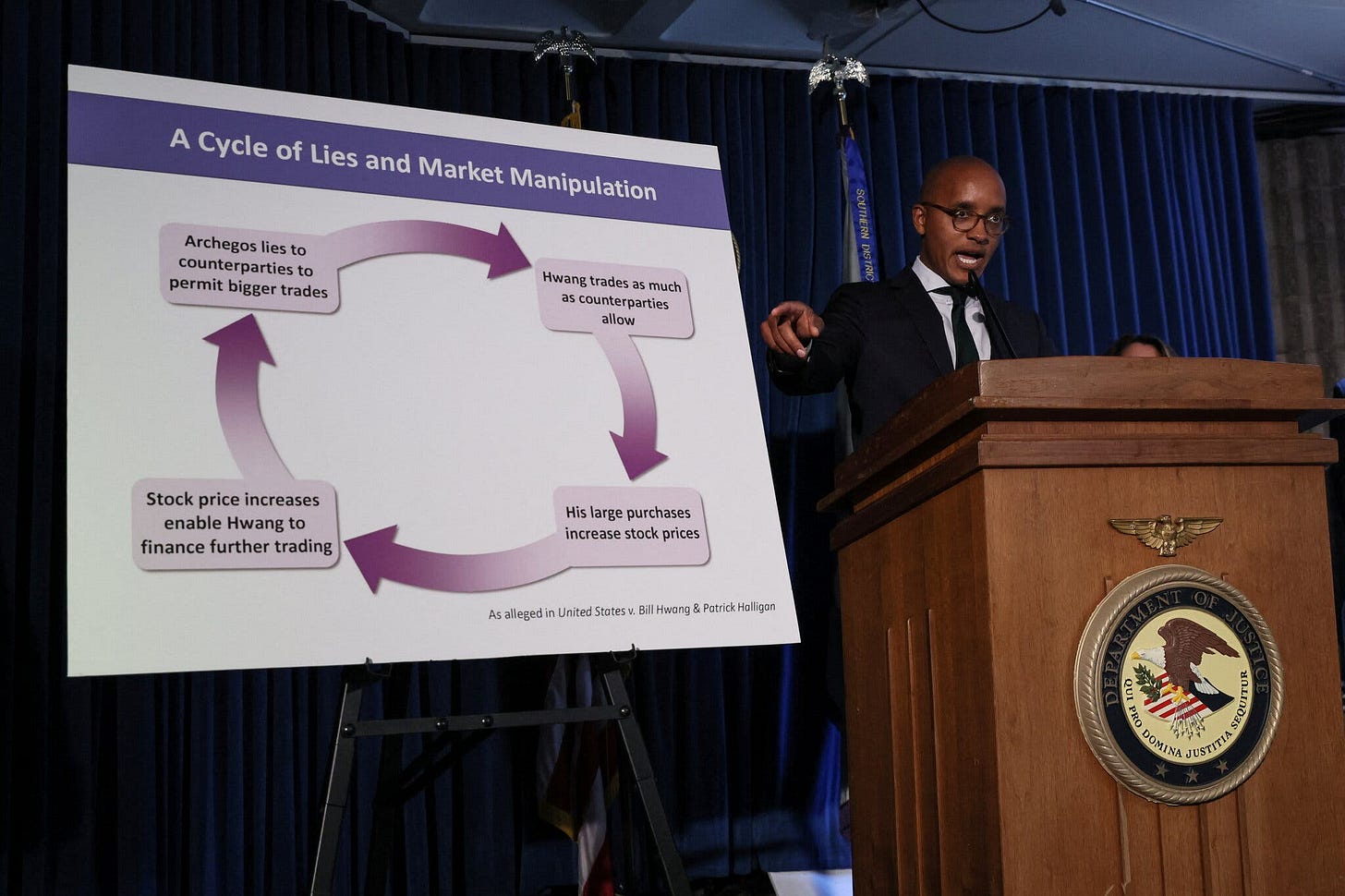

The more damning allegation is that Hwang deliberately manipulated the stocks upwards. The prosecutors even made a chart! It’s helpfully titled “a cycle of lies and market manipulation”! Uh-oh.

The part that isn’t in there is Hwang made the big trades at the end of each trading day, which would push up the stock price of say, Viacom or what have you. This is a big part of the prosecutor’s case. This is pretty normal practice, though — increasingly more trades are done at the end of the day. There’s more liquidity, more cash flowing around, if you’re a large fund like Hwang’s, you’re probably going to trade at the end of the day.

Probably, though, the biggest flaw in the prosecution’s argument is that Hwang never benefitted from these trades. Sure, at one point, Archegos was worth $100bn (nominally, with leverage). He could’ve pushed up a stock with, say, UBS, at the end of one trading day and then sold it with Goldman’s the next and pocketed a profit. But he didn’t! In fact, Hwang kept buying more until it all collapsed!

I don’t know — this seems like A Bad Attempt at Fraud! He didn’t make any money from it! Your conclusions, then, are either i) Hwang was going to keep bidding up prices (forever??) and book a profit at some point (there’s issues with that — he needs to sell a lot to someone else) or ii) Hwang genuinely believed in these companies and was simply using leverage, which a lot of other hedge funds use. And then, of course, it all went wrong.

This is not to say there’s not some element of negligence involved. Of course there is — at some point Hwang and co likely knew they had messed up, and weren’t going to be able to meet a multitude of margin calls. But you know, Hwang worked for Robertson and then for himself — he was not some idiot off the rack with a setup out of a boot in Florida — and he was buying these really boring stocks — I think this is more of a case of Too Much Leverage and making really stupid mistakes.

I am struck by the same kind of open eyed stupidity in the SBF book — I don’t think he really had much use for money, other than the whacko doodle plans he had for effective altruism, etc. SBF lost of lot of money; but uniquely — not through spending of Ferraris or whatever, but though hubris and then a lack of risk management. Maybe — just maybe — the bigger killer than fraud in these cases is just plain old stupidity. I suspect that might be the case for our friend Hwang too.

A Dane goes to Britain

Beer makers are having a tough time. Ten years ago it seemed as if New Zealand was stricken with craft beer-itis — it was hard to go past a bar without seeing a man with a twiddly little beard and mustache extrolling the virtues of fresh hops or what have you. If you were in Wellington the effect was ten-fold. I don’t know what happened to all the craft beer bros: I assume they got married and had children and got mortgages and could no longer afford a $20 can of fresh hop sour Kawakawa pumpkin stout mega beer. Oh well!

Major brewers have also had a tough time. Less people are drinking beer, period. It’s full of carbs and people are on the 'zempy. And pubs have had a tough time too — pubs are one of the main proliferation channels for beer — who has been drinking at pubs lately! A lot less than usual — though the “great pub erasure” post-COVID has stabilised somewhat — people are drinking again, though the number of pubs is a lot less. Pub stocks have reflected that — holding them over the last 3 years is an exercise in pain — like washing your dishes with sandpaper and dirt.

Anyway, brewers have had a similar time. Brewers are a terrible business, for the most part. The margins are thin. You have the cost of bottling and canning. You are selling a thin bitter liquid low in alcohol but high in volume (versus spirits — high in alcohol per volume). There are some OK brewers, like Heineken, but even then you are faced with problems like the cost of aluminium and the cost of wheat and so on. The only brewer that has given a respectable performance in the last four years is Molson Coors — but even then, you’re comparing mediocrity with mediocrity.

Carlsberg is particularly disappointing. They just agreed to buy Britvic for £3.3bn. Britvic — is not a brewer! They make fizzy. They make a bunch of mid-tier British brands of fizzy I have never heard of, as well as are the bottler and licensee of Pepsi in the UK. This is a kind of left field choice for a brewer? I mean — fizzy? OK? It’s not a bad buy — about 2x revenue; 17x earnings; a fairly stable 10% EBIT margin. I estimate a +16% addition to Carlsberg’s EBIT — not insignificant; estimate EBIT margin decreases to +12%. The co says there are “synergies” — whenever I hear the word “synergies” I substitute it with “nonsense” until proven otherwise.

It doesn’t take a crack analyst to work out that Gen Z are drinking less than previous generations. Is this Carlsberg move into the fizzy arena? Courting Gen Z? Honestly — I don’t know. It’s not a bad acquisition, but it’s hardly one of worldbreaking and shocking genius.

Suntory, the Japanese company, has done it better — they’ve done well with BOSS coffee —they have positioned well in so many spaces — canned cocktails; grapefruit strongs; canned coffee; bourbon (they own Jim Beam). Beer isn’t a great business — but I’m unconvinced sugary drinks are better.

I still think the best way to own alcohol is via the spirit makers — Diageo, Brown-Forman, Pernod Ricard, Remy…better margins, higher “premium” value…