We're breaking up the band: end of the "leadership squad"

WHS — The Warehouse is now “laser focused” after successfully torpedoing Torpedo 7, TheMarket dot co dot nz, etc. Stock is up on the news but is small volume (as of writing) — probably just retail hopefuls — the company is still in a land of woe. Six of the nine “leadership squad” roles that Grayston/McKinsey had put together are being disestablished. New appointments are as follows —

• Executive General Manager Operations for TWL/WSL – Ian Carter

• Executive General Manager Merchandise for TWL/WSL – Tania Benyon

• Executive General Manager Supply Chain and Sourcing for TWL/WSL – Mark Anderton

• Chief Operating Officer for Noel Leeming – Jason Bell.

Benyon has worked in sourcing/merch since 2020, so has presumably had a hand in the threadbare leggings and falling apart clothes horses The Warehouse sells (also: orthopedic shoes, toasters that break, etc), while Carter was previously the chief store operations officer. Anderton was appointed to work from the company’s China office in “sustainable” sourcing. In other words, these are still a crew appointed under Grayston’s watch, so any kind of optimism is misplaced. They should just fire the whole lot and start again, and hire from retailers who are competent — i.e. Briscoes, Kmart, Costco.

Also disestablished, I guess, is the leadership “squad”. It’s now just a team. The band is breaking up.

FBU — Another board member out. Martin Brydon. Sorry to see this one go — he is chair of my favourite Aussie company, Duratec. Fletchers, of course, is a disaster, and would probably be best served broken up or radically streamlined.

IFT — Did you get your placement? Still love IFT. You own it, don’t trade it…

EBO — Still looks cheap after index-exit. Again, one you own…

Buy Now, Pay Later — End of the line for LayBuy as they head off to the back shed to enter receivership. A lot of the Aussie small cap lot get excited about Zip, etc (“it goes up!”) — I don’t. First off the cab rank as recession hits are buy now pay later providers — they are really just tinpot payday loan lenders dressed up in swish clothing. (Noting Apple recently closing its own BNPL service…hardly a vote of confidence in the area)

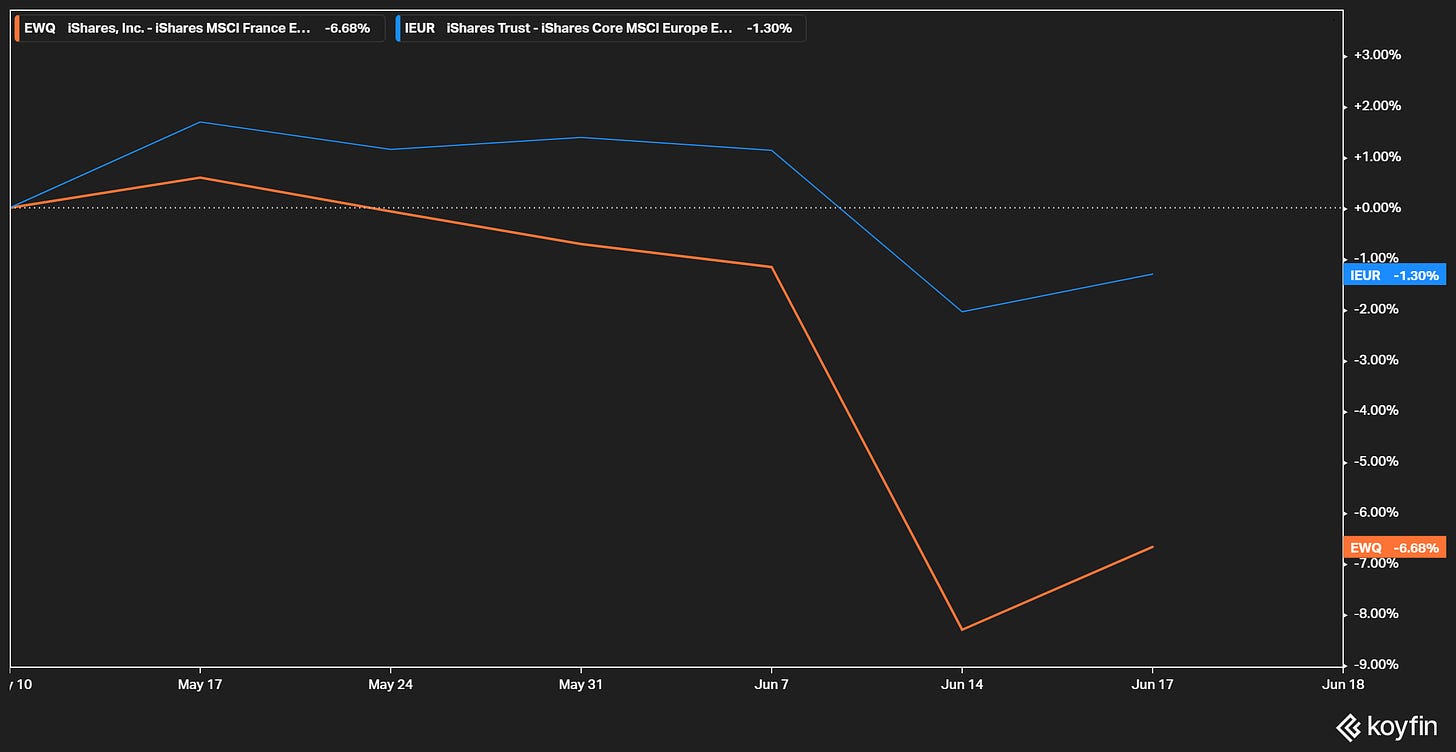

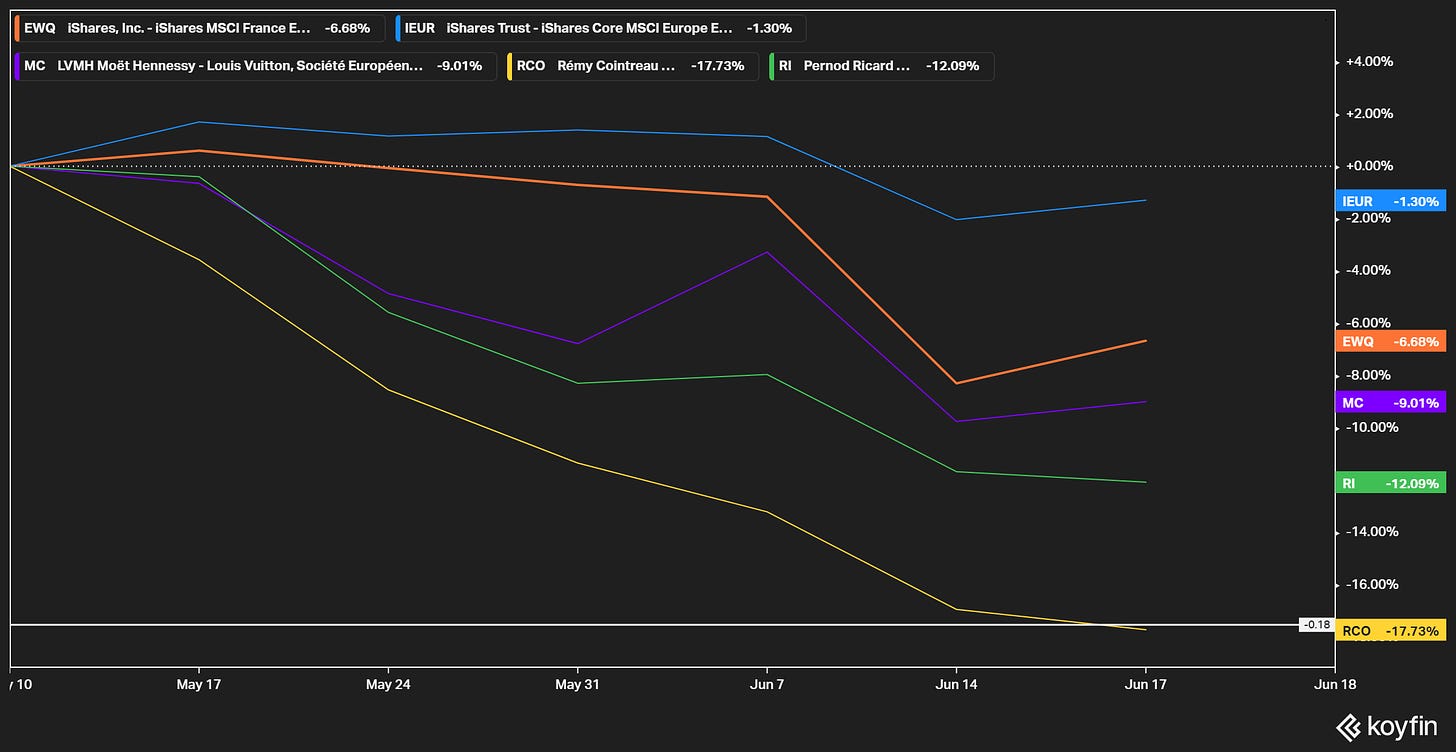

Vive la France…FR/EU stock market differential…

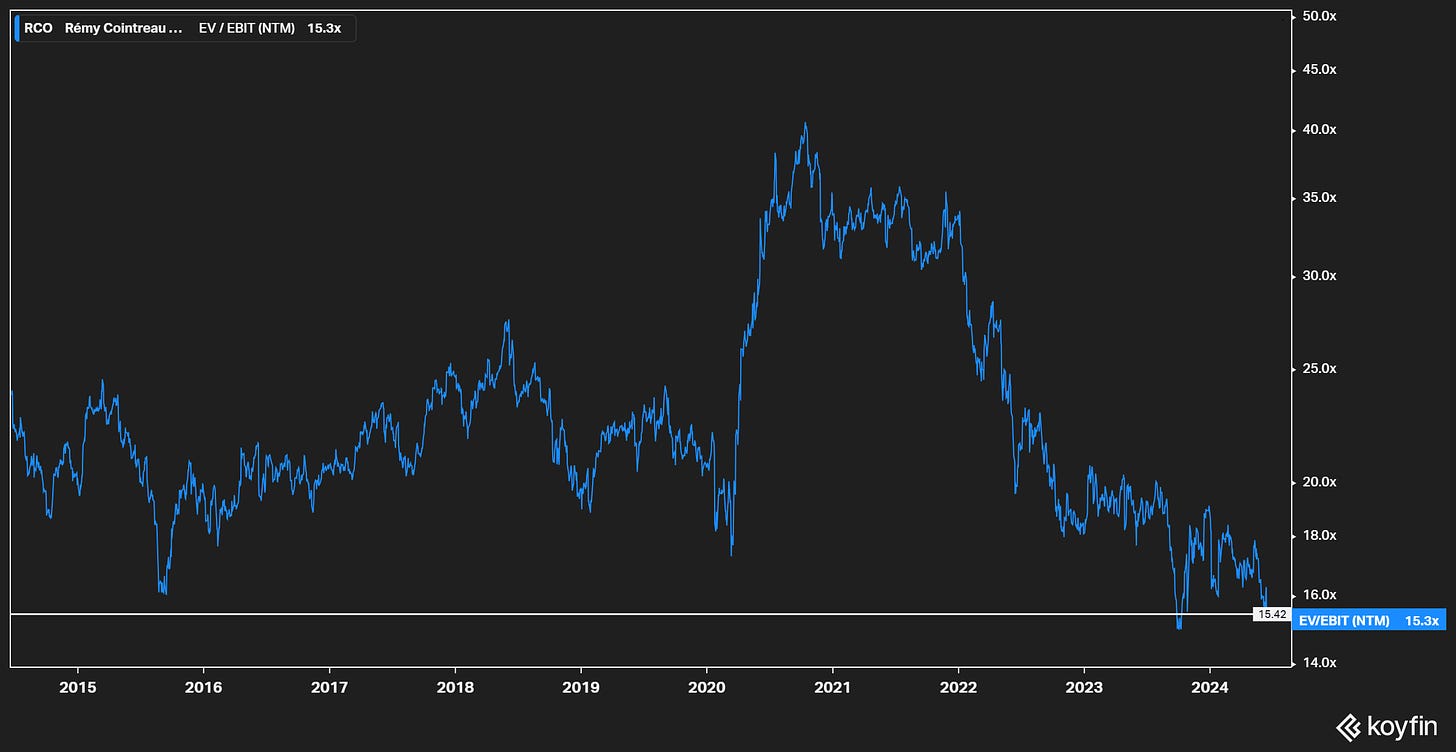

Elections (don’t fear the left) have created a significant gap between where European stocks are trading at and French stocks (5.28%). Rebounded a little overnight but still there’s a big gap…we think there is obvious opportunity here. Markets tend to overestimate political risk. We’ll publish on this in detail tomorrow — but obvious ideas are LVMH, Pernod-Ricard, Rémy Cointreau, etc. See the chart below — Remy Cointreau trading like it’s a second-tier discount retailer.

On a ten year basis, RCO is trading at ten year lows…

I keep telling you this about the booze companies — they are all so cheap. Either people are drastically drinking less alcohol or there is value there. Additional political instability is a bonus — you can buy these all-time French companies at a discount. Noting that RCO’s aged wines and spirits actually go up in value, based on how old they are…

Obviously — risk for RCO is China — less cognac is being sold there. Recent EV tariffs imposed by the EU on China is another risk (so much for the free market?). Risk is likely priced in, in my opinion. I know the booze companies seem fuddy-duddy and not as exciting as AI, but the multiples make sense. For comparison, see the alcohol majors below — all have significantly de-rated from 20/21 highs.