What becomes of The Warehouse now?

If you are the recently-made Dame Joan Withers one of the main things on your plate, I suspect, is the chronic underperformance of the company of which you chair — The Warehouse. You got rid of Nick Grayston (sorry — he “stepped aside”) — but you were still the chair of the company! Ultimately, as many readers of my newsletter have written in, governance and responsibility ends up resting with the board. I’m not calling for heads to fly — frankly, I don’t own any of The Warehouse stock and I’m not sure if I will ever — but it’s an interesting question, right? Where does the responsibility lie, and what is the board going to do about it?

I was thinking about this while looking at Kmart in the weekend. They sell products people want. It’s key. There’s no point in — I don’t know, selling a fridge full of butter and 90s-coded drinks and calling it “groceries”. People have to want what you are selling. This seems obvious but somehow The Warehouse lost the plot here — they forgot that crucial part of retailing. If you go to The Warehouse at the atrium, in the CBD, what you’ll have is a singularly depressing experience walking through retirement village slippers and poxy polyester pillows and a badly laid-out floor that feels like a psychological experiment gone wrong. Regardless of the resignation of Grayston, the board still have the core issue: what do they do with all these stores (and stock!) that people don’t want? It’s a real question! You have spent literal years building up an empire of awful product and (by the looks of staff) low morale. What are you going to do?

One answer that I think about is H-E-B, the grocery chain in Texas (after all — The Warehouse had/has aspirations of becoming a grocery chain). H-E-B is a cult favourite in Texas — people love it.

Here’s some of why:

The return of steadfast customers is largely based on trust of the brand, Merrell said. Brand loyalty in grocery retailing extends beyond inclusion of specific items and ingredients to the quality of products taken home. “One of the things that is so unique in food branding, in particular for grocery stores, is that there’s really few things that are more intimate than the food we eat,” Merrell said. “Because of the intimacy, it is easier to create a brand where people are extremely loyal.

Here’s a screenshot of supermarket items The Warehouse is offering this week. Do any of those inspire intimacy or loyalty?

Green’s Chocolate Brownie?? Market Kitchen Coffee Beans? Canola Oil?? Who came up with this? Who is doing the purchasing? This is not serious retailing.

H-E-B is a great case study in responding to hyper-local needs. No one H-E-B is the same. The company is constantly thinking about what its customers in the area want — think about the success of Farro Fresh (where all the well-off housewives shop, after going to Scotties) — they know their audience. Does The Warehouse know theirs? And what's the board going to do?

It’s remarkable listening to what H-E-B management has to say, especially re: employee retention and serving customers. Imagine if Big Grocery operated like this here —

We’d already been investing more in pay and benefits before the pandemic. We make all of our employees owners in the company if they’re over 18 and have worked 500 hours in the prior six months. And so, those things really helped.

But we felt the “Great Resignation” and the surge of people leaving the workforce…To combat that, we not only increased our pay—which we had been doing anyway—we put in place hiring incentives, signing bonuses and attendance bonuses so that once you got hired, you would show up for your shift.

Show me the incentive and I’ll show you the outcome…

And on losing money on eggs (again — imagine if a NZ supermarket did this…!):

On costs, eggs are a great example right now. Our price on eggs was somewhere a little over $1 a year ago. Costs have now gone to over $4 for a dozen large eggs, but we have priced them [to consumers] below $4, which means we are losing millions of dollars a month selling eggs. But we do not feel like we can pass on the skyrocketing egg cost to the average Texas family.

Be more like H-E-B, less like The Warehouse.

NZ

Like to see Don Braid buying more shares in MFT.

SKL directors buying on-market — we like this too.

Zuru toy people worth $20bn sez NBR — if they hit $3bn revenue this year that implies a 6.6x revenue multiple — for reference Hasbro trades at 1.2x P/S, Mattel at 1.3x…). Remember when Lego sued them?

Being AI made an acquisition? I don’t get it — I am too slow to get AI — but you can read about it here.

Aus

Public holiday. But Duratec (DUR) — my favourite — back trading at $1.15. We love to see it. Still think there’s more room for the stock to run — think it’s worth north of $1.25…7x EV/EBIT or 12x P/E and you get a durable business with sticky contracts…IYKYK

Noting De.mem completed its acquisition of Auswater…fully booked cap raise…brings the co closer to break-even. If you understand the tech you understand how much scalability there is in this co — it seems to be picking up steam.

Droneshield at $1.30. Wondering if it’s a bit toppy here… one of the things we are trying to learn to do better is “sell the rallies”

Charts:

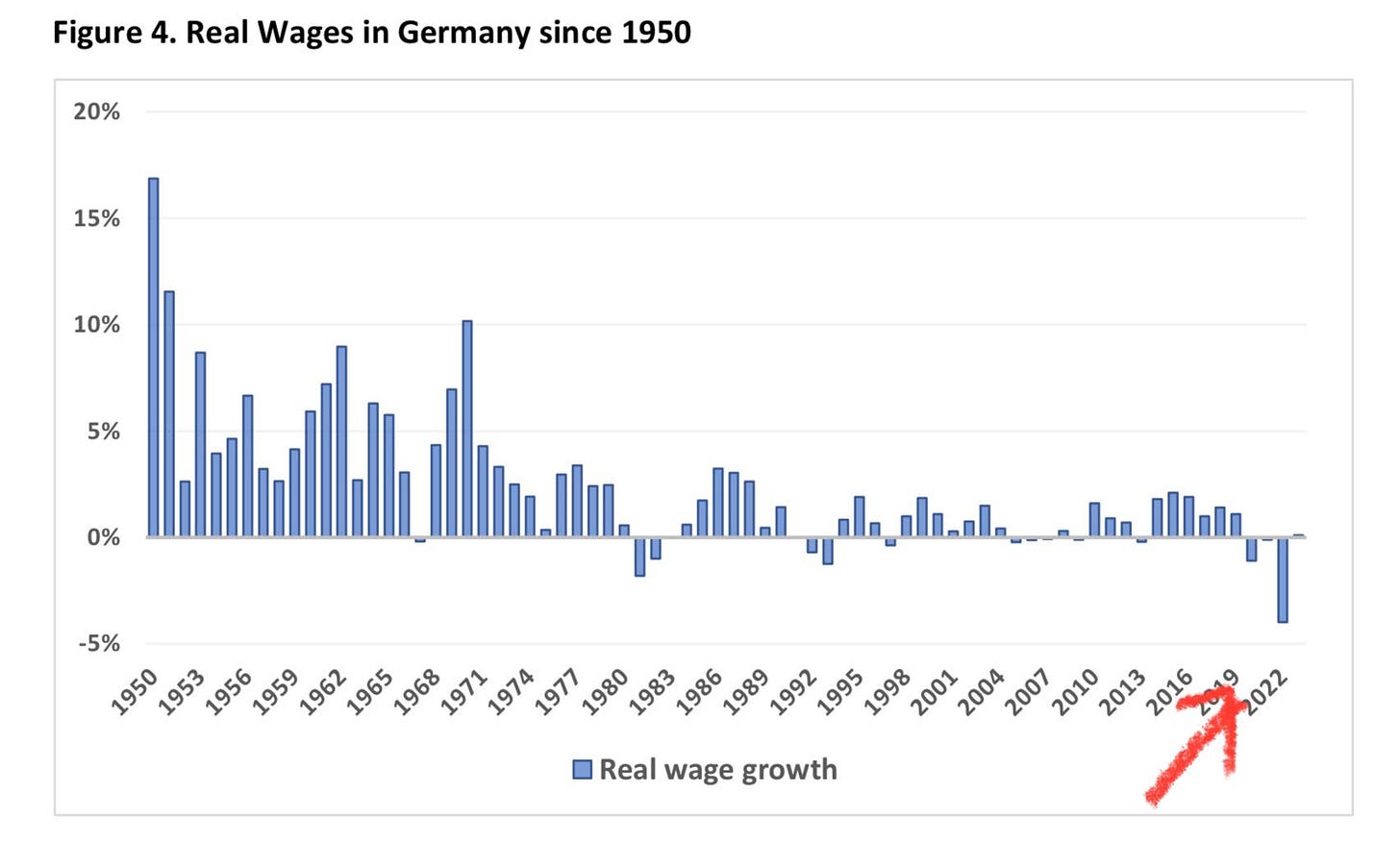

Germany — it’s not looking gut out there…

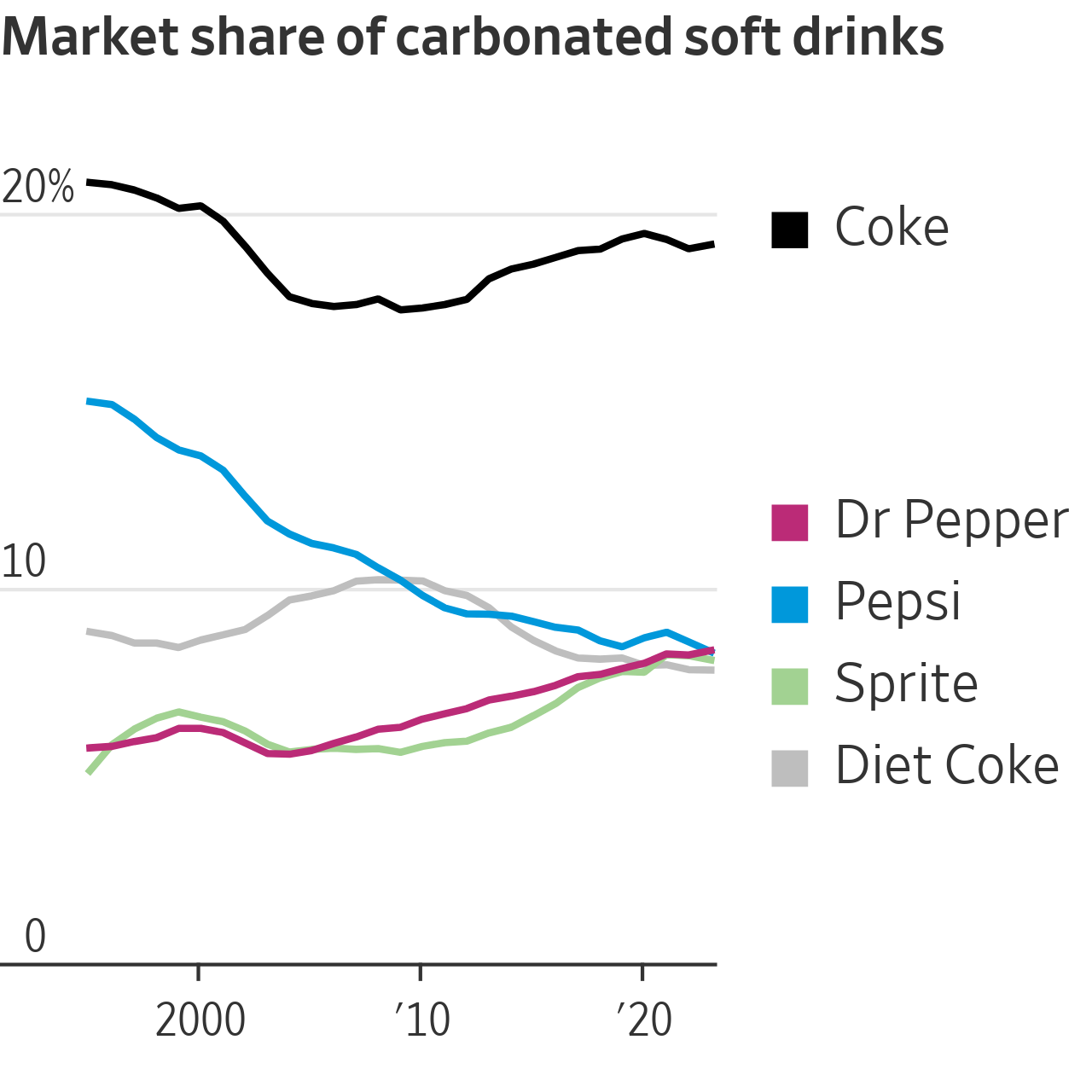

Dr Pepper Supremacy

This is sort of interesting — Dr. Pepper is now the no.2 most popular drink in the States. And look and how much Pepsi has fallen! But Dr. Pepper…? Who is buying all the Dr. Pepper? I’m bemused? (No position in Coke, Pepsi or Keurig Dr Pepper).

What I’m reading & listening to

China’s Luckin’ Coffee is beating Starbucks

Private Equity Titans on Nerves at Lavish Industry Party

Hollywood Super Agent Bryan Lourd

Does playing Civilization make good managers?

Howard Schultz - on the Acquired podcast (he’s not a fan of current management, reader)