It's high time an activist revisited the NZX.

A short history of my engagement with the NZX. Back when I first started writing this newsletter, my thesis was basically “the NZX is undervalued because they have SmartShares and so on, and if you do a sum-of-the-parts the company is worth more than what it trades for”.

And then I engaged with directors and management; we had lunch; and the main thrust of what I wanted (me, the tiny terror of NZ capital markets!) was either i) selling off a portion of SmartShares/the funds mgmt business (and actually catalyse that value!); ii) listing the funds mgmt business, with NZX limited retaining the majority stake; or, iii) selling the whole thing to the ASX and be done with it all — and sell the funds business to whoever wants it (I’m sure there would be willing buyers).

I was initially supportive of the NZX’s plans — I think CFO Graham Law is a man who knows his numbers and understands the business very well. Obviously, I’ve grown less supportive as time has gone on — when the board proposed a frankly outrageous fee pool increase I started to grow disillusioned — a fee pool increase?! For what performance?! PWC wrote a report which said “yes, they definitely should get more money” and so on. As Munger famously said — "I’ve never seen a compensation consultant suggest fees be cut. "

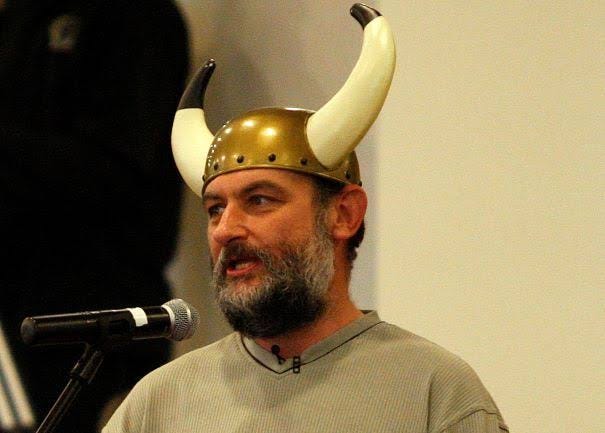

I went to the ASM to protest this point. Their communications guru clasped the microphone tightly when I asked my question, as if allowing me to hold the mic myself might end in some kind of disaster — presumably a rap battle or something of the nature. Since then I’ve thrown the NZX into the “too hard” pile: I don’t believe there is a real desire to change or improve the exchange — there is a lot of waffle about “market conditions” and “THE CYCLE” (“it’s the cycle!”) and a lot of blaming of external factors. There’s not enough doing.

So when I read in the Herald today that NZX CEO Mark Peterson is “eyeing up government assets” — well — I was not enamoured.

The head of the New Zealand Stock Exchange is suggesting the public market is a positive place for the Government to look to if it wishes to sell some of its taxpayer-owned assets, including Kiwibank.

“We’ve certainly been speaking to government about the opportunity,” NZX chief executive Mark Peterson told Markets with Madison.

Peterson has suggested the returns earned from selling down part of all of the Government’s stake in some companies, could help fund other areas of economic importance.

I mean — look. If the best idea our very highly paid capital markets executives can come up with is “idk, maybe the government could pretty please list more assets?? Remember Meridian?? Good times, good times”.

A Kiwibank listing is dull and boring and is more or less waiting on Big Daddy Government to throw ‘em a bone. It is a stunning failure of imagination. We did this before — there’s a lot of businesses the government co-owns on the exchange — the gentailers, Air NZ, etc. It’s a quick fix and a really boring idea — managers shouldn’t have to rely on the government for help.

Why aren't we listing new, innovative businesses? Why aren’t we encouraging that in our market?

I’m wondering if it is high time for an activist to raise their head on the NZX again. They’ve had time and underperformed for a prolonged period. You might as well say “honey, I shrunk the market”, because listings continue to exit like rats leaving a sinking ship. Arvida is as good as gone. Other companies like Just Life and Geneva have delisted or cited their intention to delist, noting high regulatory costs (I don’t think that answers the question entirely — the truth is there’s a chronic lack of liquidity).

Why is Mark Peterson paid a base salary of +$1.2mn for a clearly underperforming business?

Why is the exchange not attracting new listings?

Why is the exchange not out in the South of the country, wooing old family businesses with ageing founders looking for an exit?

Why does NZX wealth technologies continue to burn money with a hope of perhaps breaking even next year?

Why does the exchange rely on its funds management business for income and valuation, and not focus on its core business?

Where is the accountability?

I think it is time for an activist investor to once again ask these questions.

As I wrote in an earlier newsletter, the liquidity problem is a pressing issue. This could be solved by the seeding of a few small and mid-cap funds. It could also be solved by more interaction with our fund managers in the industry actually committing to the exchange and committing to buying small and mid-caps. Otherwise you end up with a dying exchange.

At the ASM, Chair John McMahon tried to argue that you could measure the performance of the exchange with dividends included, and that it is inappropriate to compare it to other exchanges, like the LSE or NASDAQ. Dividends are important to factor in but it is important to remember that the LSE is basically a data business now; NASDAQ is sui generis, and the NZX is a funds business with a small exchange attached.

The NZX should be a monopoly within New Zealand — however, more companies are departing to the USX, while others are simply being bought out by private equity. Even functions the NZX used to have — like providing Fonterra farmers the ability to trade units — have been taken over by Sharesies, who recently won the contract.

Back when I was a small child there were still glass milk bottles. And the saying was “use it or lose it”. I suspect the same goes for our exchange.

Current efforts have been uninspiring - calling for an activist ???