Why Xero succeeds and The Warehouse fails

Two different types of business strategy

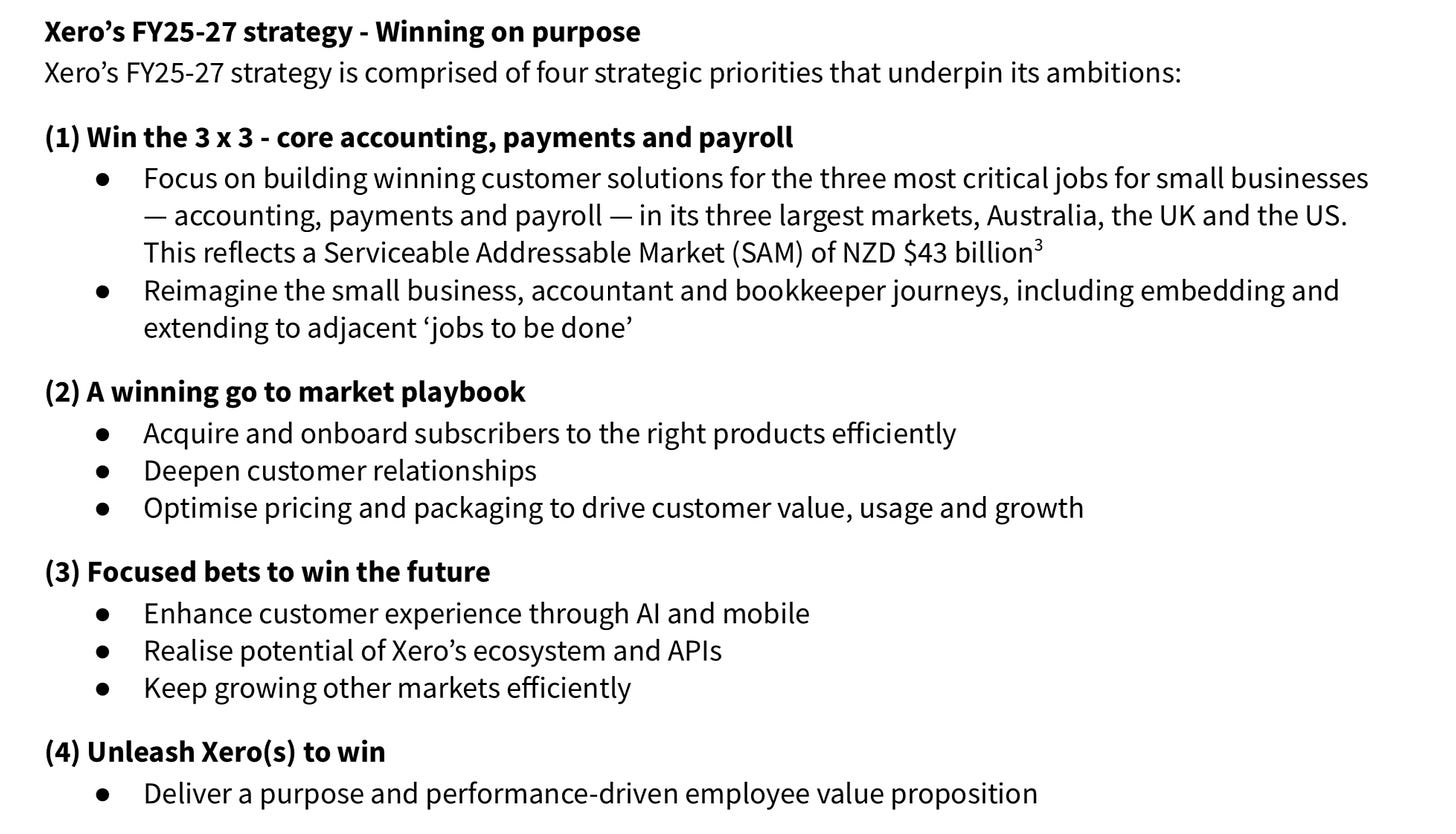

Thinking about this a lot — Xero and their CEO, Sukhinder, are on fire at the moment and an exceptional business. What’s the strategy? 3x3, baby.

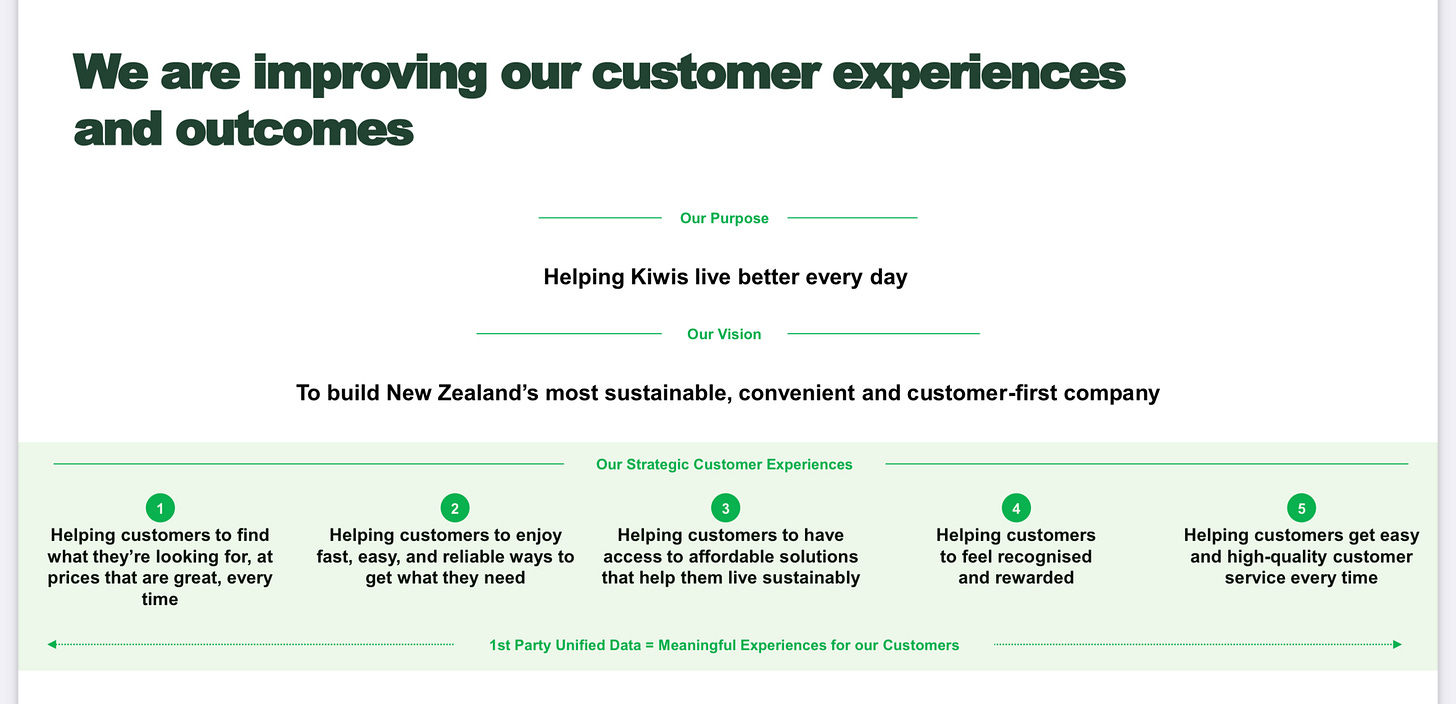

Let's also take a look at a failed strategy, by way of comparison:

What sticks out first? Well, Xero’s tagline is “Winning on purpose”. That’s great. We know what they want to do — win — and we know how — on purpose (not just some happy accident; aka throwing kitchen sink at the wall).

What’s The Warehouse’s statement? “Helping Kiwis Live Better every day”

OK then! Now, we all know the outcome of both of these stories:

What’s the lesson here? Xero’s strategy is concise and easy for everyone (even an idiot like me) to understand. 3x3! The Warehouse’s comes across as customer-centric but as anyone who has been to a red shed lately can tell you they are not customer centric at all — rather, they are a tepid, frustrating, pustule-like experience where you are often served by apathetic staff who are about as enthusiastic a dead slug.

I mean, the lesson to managers, I guess, is: keep is concise. Keep it simple. And say what you mean. The great thing with the Xero playbook is from that one-pager I can understand what Xero does, who their customer is, and how they will grow. You can’t work that out from The Warehouse’s.

P.s. — during my research for this I found a 2018 presentation to shareholders from The Warehouse. Amazingly, they note the threat of Amazon and Kmart. Shame they never did anything about it!

As an addendum — I read Lead and Feathers: The story of Freightways in the weekend. I keep thinking about how Trev Farmer threw a piece of string down on the boardroom table and said “if this piece of string doesn’t fit around the package, we don’t ship it”. That plus $5 standardised shipping revolutionised the business. Keep it simple.

EU equities…

This chart stuck out to me today — I am a hopeless contrarian, so of course I’d say this makes European equities look more attractive. Of course! I’d also say that it's worth noting the relative outperformance of European stocks after a market correction…food for thought. Remember that everything is inherently cyclical and statistically, record underperformance of an index is followed by outperformance.

NZ

WHS — The Red Sheds sitting around $1.00 as of writing. We know why it’s so “cheap”. See above. But, if you still think Tindall wants his baby back (I think he does), then maybe there’s arbitrage to be had there. Is The Warehouse a shitty retail chain? Yeah. Does Tindall want to Make The Warehouse Great Again? Probably.

Move Logistics — New GM of freight and fuel — Jeff Vincent. Watching the turnaround here with interest — as I've noted before, a lot to do…

Steel & Tube — Bad trading update. Bottom of cycle. Etc.

Sanford — David Mair working his magic. Loved his work as Skellerup.

Aus

Cettire — Everyone’s favourite dubious luxury reseller reported weaker than expected results (nobody’s surprised here). I was talking about this y’day to someone — plenty of money to be made in luxury, but very slim pickings in luxury reselling.

Medadvisor — Starting to bounce back… keep an eye on it… it was way oversold…

MineRes — I don’t really care about the scandal there — the AFR has been hysterical about the whole thing; my question is more about where lithium is going. Here is how it’s gone so far… not well!

Right now there is lots of supply of lithium and plenty of competitors mining it. But a lot of these don’t make money. As those competitors gradually go bust and/or are acquired, it figures that the supply of lithium will become more consolidated, and the price normalise somewhat. Again — cycles. No, I am not saying invest in MinRes or lithium, but I am saying that commodities are inherently cyclical and it looks like the bottom of a cycle. You can make good money buying a cycle.