40% of luxury is sold to 2% of customers; but you can buy a burrito in four easy payments

The segmentation of the US economy...

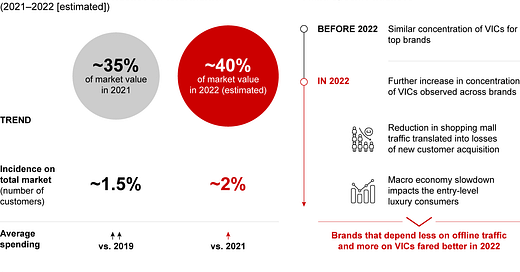

Chart

Admittedly a bit old, but well worth trotting out the old statistic that 2% of luxury customers account for 40% of all luxury spending — you can see this for yourself if you go to Hermès’ flagship boutiques in Paris or Boucheron (a Kering brand — the company does not release individual numbers for each jewellery house, but they stated there was “healthy growth”).

To put it into context: as much as luxury stocks might’ve had some bumps lately from a soft economic climate, that 2% (who, let’s be real, are the 1%) aren’t particularly going to be affected. There’s a reason why we see houses that focus on a high-end clientele, like Brunello Cucinelli and Hermès continue to do so well.

In other words, selling luxury companies like a bunch of headless chickens makes no sense — do you know how much LVMH’s operating income went down during the 2008 GFC? ~300mn EUR (3.6bn, 2008, 3.32bn, 2009). In other words: ‘tis hardly a scratch.

I mean — luxury is not slowing down — here’s Chanel eyeing up a $450mn building on Madison Avenue.

And of course, Prada is eyeing up buying Versace and Jimmy Choo from Capri (that’ll leave Capri with just, uh, Michael Kors? That’ll leave Capri with just north of $3bn in revenue…)

The reason I was thinking about all this is because last night our resident genius Quant sent me this:

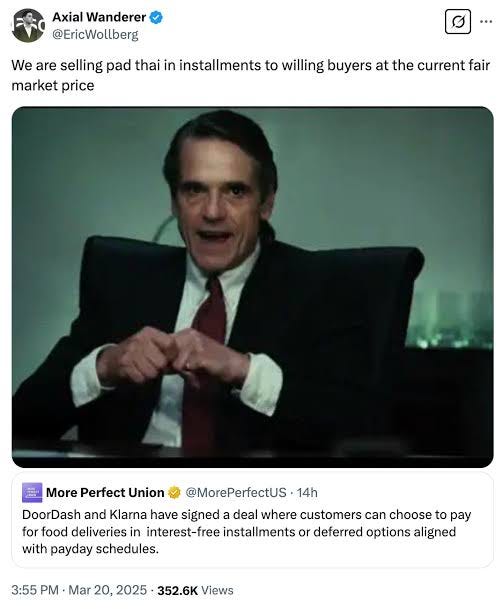

That’s a lot of consumer loans and a lot of high interest — roughly $1 trillion dollars on an average rate of 21%. To put this into a handy meme format, let’s use this:

There are a lot of companies that do not rely on the US consumer. For instance, high-end luxury (and also companies that you need no matter what, like S&P Global, etc). But would I be buying stocks that heavily rely on the consumer — perhaps not. Also, would I be buying those afterpay-type lenders (Affirm, Klarna, etc) — also probably not! Did you know that DoorDash just partnered with Klarna so you can order a burrito and pay it off in four easy payments? I am just going to use someone else’s meme here:

That feels like kind of a worry to me! I don’t know about you!

To recap:

My favourite types of investments are “no brainers” that make money no matter what, or investments that are insulated from the retail consumer (i.e. luxury, Ferrari, Formula One, etc).

My least favourite types of investments are those consumer stocks and the afterpay-type lenders that essentially act as sub-prime loan type lenders. It gets even juicier when you realise that a lot of those lenders (Affirm in particular) actually sell those loans to third parties. Per Affirm’s 2024 annual report:

…The aggregate outstanding balance of loans held by third-party investors and off balance sheet securitizations was $5.1 billion.

For instance, Sixth Street entered into an agreement with Affirm to buy $4bn of its loans over three years1. Now, I’m not going to get all Michael Burry on you here — it’s hardly “the big short” — but you know, it’s interesting — markets are certainly getting more segmented. But look — paying off a burrito or a McDonald’s in four easy payments — if that isn’t capitalism, I don’t know what is!

https://www.wsj.com/articles/affirm-taps-megatrend-of-private-credit-to-sell-more-loans-operating-chief-says-e7cd1705?st=RPcK7K&reflink=article_copyURL_share