Another one bites the dust on the NZX -- so long Geneva

RAK — One big buyer today…that NBIO is still in play… not out yet…

GEVENA — Geneva Finance noting its intention to delist from the NZX in the wake of Just Life Group. How are NZX directors adding value here? How is the company encouraging new listings? Frankly, I don’t care about feel-good ESG credentials — I just want to see results. We continue to have an exchange that sheds companies like an old fur throw — it’s not a good look — as I have said before, selling the funds business and getting back to their knitting is needed. I don’t want to be a broken record on this but the facts are pretty stark — funds business is great while exchange is broken (also the data fees the NZX charges are outrageous for what they provide … for email alerts they charge +$4,500…p.a… email alerts!)

IFT — Cap raise time — more data centres — +$1.15bn. Met with old friends in the weekend — he is an old-school broker who remembers the 80s (back when the NZX was still poppin’).

“What do you think of IFT?”

“Love it”

“You own that thing forever… bugger the fees paid to Morrison and co”

Amen — you buy it and hold it and own it … don’t trade it1.

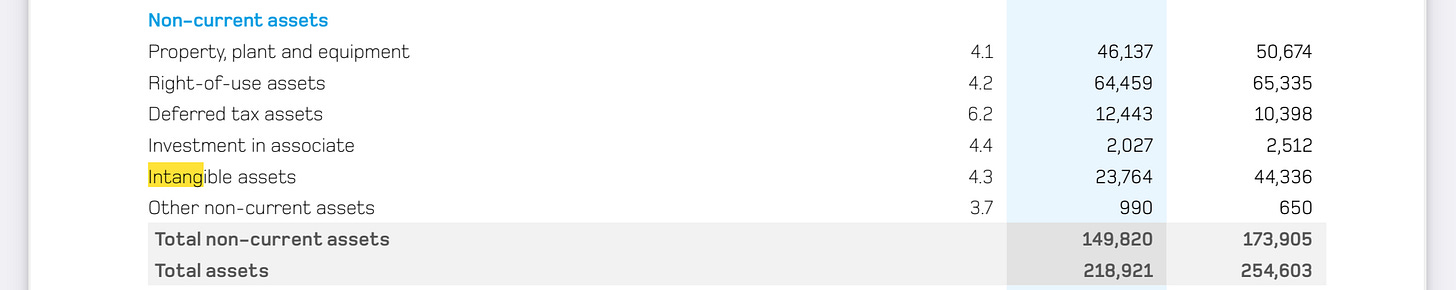

MPG — NBR writes of the embattled glass company — should really be called Metro Shattered Glass. Link. What article could’ve mentioned is MPG’s enormous book of so-called intangible assets on its balance sheet. Effectively fugazi, so ‘real’ book value of the co sits somewhere in the low 20mn range.

Crypto — only $775k remaining of $28mn of assets at one-time exchange Cryptopia. Highest expense was liquidator fees — +$7.7mn. The liquidators always get paid one way or another…

Speaking of — I wrote to you last week of the folly of Bitcoin miners. My example was Riot Platforms, which mines said bitcoins. It makes $238mn of EBITDA. It has to depreciate all those bitcoin mining rigs — to the tune of $225mn! That depreciation is about equal to the EBITDA (hence why EBITDA is such a bad metric!). It doesn’t make any money. I’m short it.

ARV — 92c. That $1.70 NBIO now feels very long ago… preference list — ARV, OCA, SUM (don’t like RYM much). ARV is the least geared and has a good mix of care/residential.

A must read — legendary investor Leon Cooperman on Henry Singleton, one of the best capital allocators of all time. LINK. His record at Teledyne Inc is something all capital allocators should strive to…

Singleton famously bought back shares when they traded at a discount and used the company’s shares as a currency for more acquisitions when they traded above their intrinsic value. This should be a model for more allocators, including those in NZ.

CBD — Stuff dot co dot nz asks is downtown Auckland dead? I work in the CBD — I am around a lot — while reported crime might be “trending down” according to Viv Beck (is it?) , from what I see it’s worse than ever — Queen St has empty shops; Victoria Street is covered in cones as far as the eye can see; the police are nowhere to be seen at night and the question is — who would want to come to the city? I can only think of the cruise ship tourists leaving their ship and coming to Queen St, where they will no doubt see a decrepit, ailing city strewn with debris, empty shops and cones — if they are lucky they might catch a fight outside the Britomart McDonald’s. Welcome to New Zealand! Cc'ing Chloe Swarbrick and Wayne Brown.

JPY — We had a chuckle over this line, from Luxon’s recent trip to Japan.

We have a huge infrastructure deficit in New Zealand and so being able to attract Japanese investors to make joint venture arrangements or make investments in New Zealand

All very good and well — but with most Japanese companies keeping their balance sheets in yen, and with the yen as weak as it is, I wonder if the Japanese have much of an inkling to invest in New Zealand?

The end of the double “G” luxury play

For a long time China was the promised land for luxury. The playbook was — expand to China, sell there, make money. Simple. It was the not-so-secret growth engine that powered sales. A lot of this had to do with China’s rising middle class — what better signifier of newfound status than a double “G” Gucci belt? But now China’s middle class has been extant for some time — a double “G” belt ain’t going to do it. This week, Richemont's Yoox-Net-A-Porter announced that it was pulling out of China and that its joint venture with Alibaba, Feng Mao, was in liquidation. I think luxury in general had a slow reaction to this sea change in China — slapping a logo on something and changing a thousand bucks is just so damn easy.

Here’s the kicker — we’ve been here before. Back in the late 80s and early 90s fashion thought it’d found the solution with licensing. YSL and others were licensed out everywhere — you could buy YSL perfume (made by a third party), men’s shirts (made by a third party), pens and pencils (made by a third party). This diminished brand value hugely — big payday initially — then led to a broken brand.

The opulent double-G era isn’t the same; brands kept things in-house mostly. But luxury moved too slow in China — it needs to adapt to changing consumer tastes and can’t count on selling some belts or monogrammed LV bags to keep things afloat. Kering expects a 10% drop in sales largely due to China. Luxury, as a whole, needs a new playbook there. I think the smaller houses (like Saint Laurent, which is that these days, or Celine, or Loro Piana) are better positioned to pivot in the China space — that’s not to say the order of the day is “quiet luxury” (that is played out, I think) — rather, the order of the day is working out what the Chinese consumer wants.

The rest of the luxury sector is in similar disarray from a retail standpoint (this is where I prefer to own the houses rather than the retailers). Miss Tweed reports that Matches owes suppliers +37mn GBP, while Saks.com is delaying payment to suppliers (it has been for months now). Luxury retailing has never been a great business - but online luxury retailing, in my view, is even worse — there’s no experience for the customer. Miss Tweed posits that a lot of labels will be up for sale as a result. I’m not so sure. Unless it is a brand with cachet (RIP Vampires Wife, favoured label of mid-40s Herne Bay “interior designers”) I don’t see them being picked up. Hell, even JW Anderson is a sub $100mn brand — and even that is barely worth LVMH’s time — it exists because Anderson is so good (and commercial — those puzzle bags!) at Loewe.

Here’s what I think will happen: mostly these small labels will go the way of the dinosaur. The good talent will be picked up by the houses with dry powder — LVMH, Kering, Richemont. The great game of luxury will continue.

But what about Chanel — Quick side-note on this. I increasingly view Marc Jacobs as the likely candidate — and the best — at the label. Think about it — at LV he churned out hit “it” bag after hit “hit” bag, and his collections were constantly in-tune with the zeitgeist.

Going up

DUR.ASX, CSL.ASX, ARV.NZX, RAK.NZX, AVH.ASX (speccy that last one)

US/EUR — SBUX, KER, LULU, WISE

Going down?

DRO.ASX (trimming a little…overbought at these levels)

SKC.NZX, RYM.NZX …

Where most investors go wrong is trading — buying and selling on the hopes that they are clever and see a “technical indicator”. Poppycock. If you manage to have one good investment idea a year you are doing well — why make it harder?