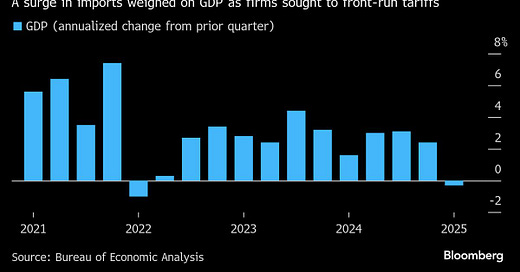

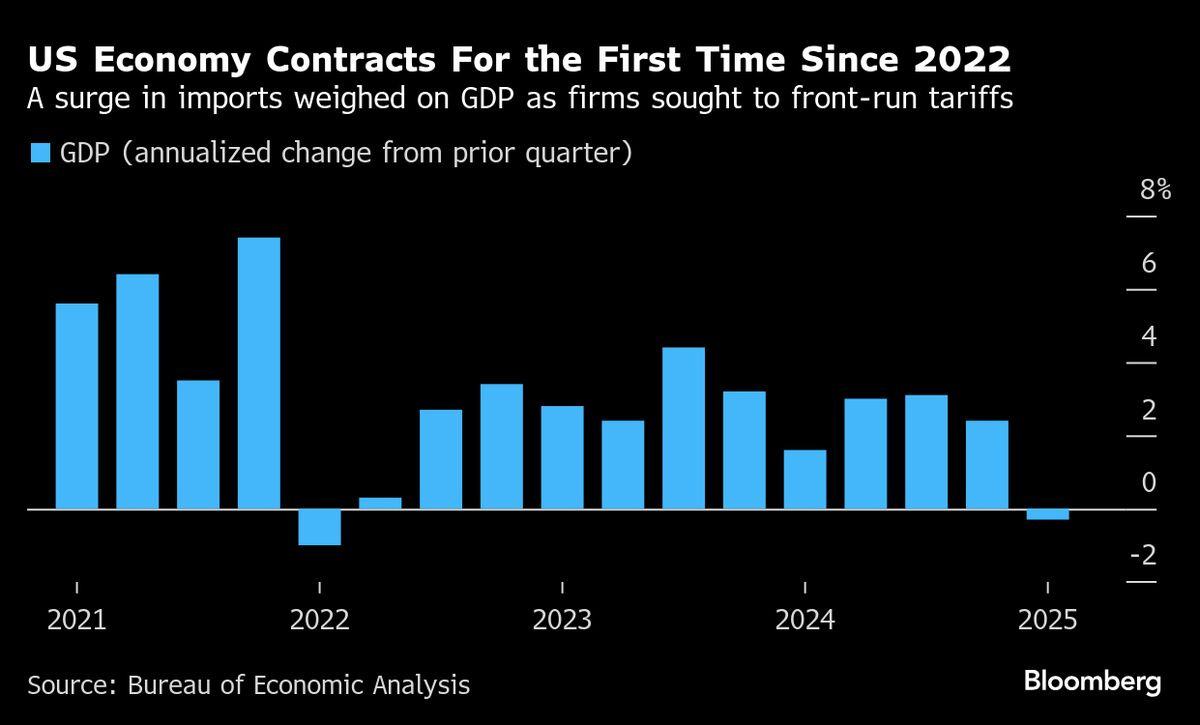

Top of mind — yes, Microsoft had a good quarter and and so did Meta (more on that later). But also GDP contracted for the first time since 2022 — “Make America Great Again”??

I want to also reference the CEO of American Express’s remarks on their latest earnings call —

One thing that has not been associated with our card member spending has either been what’s happened with the stock market or what’s happened with consumer confidence. Our card members may say they don't have any confidence into the economy, but they still continue to spend...”

This is what I have been saying for a while. People are continuing to spend! It’s baffling considering people are saying “they have no confidence in the economy” but they are still spending. Are they “doom” spending? (I.e the world is ending, so spend anyway). Or is there more of a cognitive dissonance going on — i.e. people feel that the economy is bad, but they are also conditioned to spend, spend, spend because that’s what they’ve done since time immemorial.

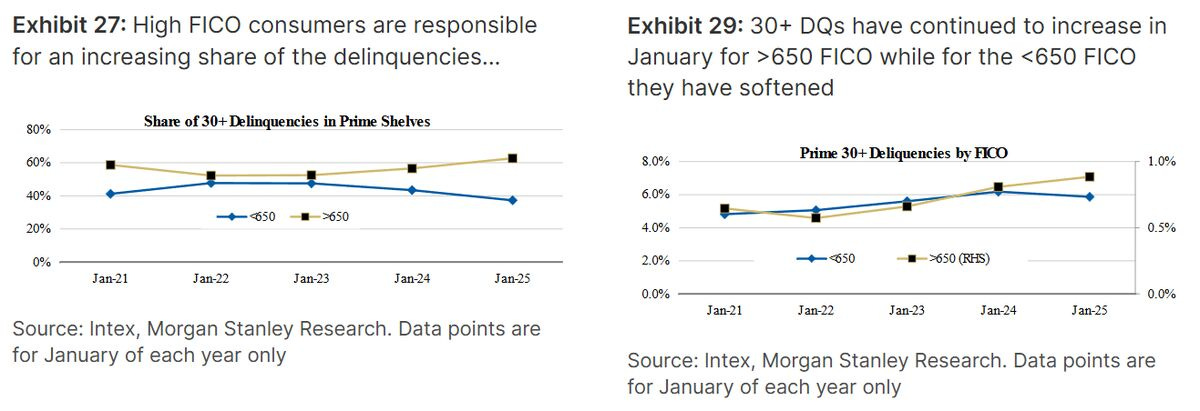

What’s more interesting is the auto loan sector — normally subprime auto loans do badly in a recession, but it’s rarer to see the so-called “prime” auto loans do badly:

You will remember The Big Short and how mortgages were packaged into products that had a lot of subprime in them. Tranches of auto loan products are sold in a similar fashion. I wonder if this is why we are seeing a similar trend here — so-called high FICO scores are increasingly more delinquent, because they’re not that “prime” after all.

I think of the US economy as an increasingly bifurcated set of outcomes. The blue collar consumer, many of whom ironically voted for Trump, are the worst served — much of what they consume is made in China (I wonder how Zuru is doing right now?). On the other hand, there are many companies that are agnostic to the fortunes of the lower-middle class — CME, CBOE, Moody’s, Standard and Poor’s all make money regardless of the economic outlook.

A few caveats here — consensus is that the US is gone, dead. I don’t think that’s true. It has survived many worse crises than this. I’m also doubtful of when the consensus is “the world is ending” because the best money to be made is when everybody thinks that.

The beauty of this is that the market is made up of sellers and buyers. This seems obvious but it amazing how many people act as if the market simply absorbs their buy or sell and it disappears into some ether. If there are many more sellers than buyers, the stock goes down. If everybody is rushing to get out the door, the stock goes down more. Because they are so desperate to sell they are willing to sell you a piece of the business (a stock) at a much lower price. This is when you make money.

But returning to the point from American Express’s earnings call — people are still spending money. Inevitably some people will get wiped out while others will make even more money. The trick here is to pick businesses that will prosper in spite of the circumstances.

So, earnings

We’ve seen earnings from Meta, Microsoft and Alphabet (Google). They were all good. The Alphabet and Meta earnings suggested that ad spend is far from over; in fact, Alphabet in fact increased earnings. Microsoft’s results suggested that their cloud business and Office business is, in fact, still very strong. Visa’s earnings were strong too. There’s a lot to be optimistic about here — if you’re a giant 700 pound gorilla, you’re still going to make money.

Where to from here?

I think the lower-end consumer discretionary businesses are, in a word, screwed. I think those who provide and collateralise auto loans are in for a tough time. Personally, I’d like to avoid those stocks1.

On the other hand, I think that financial infrastructure stocks and companies that are “inevitables” provide opportunity — that’s where I’m hunting.

You can invest alongside me now

Apologies for being a repeating record, but I know sometimes it’s best to repeat things a little because our inboxes get clogged with so much these days.

I’ve acquired an interest in Elevation Capital, and now am a co-portfolio manager of the Elevation Capital Global Shares Fund. You can invest! Simply click below to get started or give me an email — I’m more than happy to have a yarn. To those of you who have invested, thank you very much — it’s an honour. I’ve talked to many of you over the last few days and it’s been an utter pleasure — thank you.

As for this newsletter, if you want daily emails from me (the really good stuff), you’ll need to either invest or pay the piper ($200/yr, free for investors). The new substack is right here — see below.

Not fin advice