NZ

Bugger all. It’s Jan. Wondering when the deal making machine starts going again — Sky TV always a possibility, and AoFrio still a great bolt-on for a bigger player… Vista isn’t out of the woods in my opinion … yes, the Aussies backed off — but still — if they saw value then surely others will (?)

Stock picks, for what it’s worth … MFT, EBO … quality with great capital allocators. IFT feels a little toppy at this point. SPK probably good value but I just can’t go there — mgmt are idiots in my opinion who apparently can’t make a good decision if they received giant stone tablets from Charlie Munger himself (but again, if you’ve got the stomach for it… flipside is, if you consider the multiples that IFT paid for One NZ… did they overpay?)

VGL, AOF, OCA picks too… I have written to you a lot about AoFrio and Oceania, so no point repeating myself.

Aus

Ditto. Still like WiseTech, DGL, Duratec. Bearish on Droneshield given Gaza truce. Don’t love Resmed given Ozempic (ditto CSL…). MedAdvisor still interesting to me (think of the push to centralise all documents within the health sector in Aus…)

UK and Europe

Ruffer — underperformed a second year in a row. Ruffer has been betting the USD would weaken against the yen (it did not). It is rarely profitable to be a bear at all times, nor does it endear you to the rest of the market. But I do find myself agreeing with Ruffer on what this market feels like:

The conditions today feel similar to two earlier booms. One was the dot.com boom of 1999 where it was the extrapolation of good news, not the good news itself, which proved investors’ undoing: wrong valuations on often great opportunities. The earlier one was the 1987 crash, which was essentially (like today) a maelstrom of soaring markets colliding head-on with protections which, in the event, turned out to be more gun-pointed-at-foot than trusty gun dog. In today’s markets, we sense a lot of leverage, and very few Labradors

Noting vultures are starting to circle UK investment trusts that trade at a discount to their NAV (link).

Brunello — Another good set of results for the “mini-Hermes”. Sales grew 12% in 2024, particularly strong growth in the US … ~18%… $364mn EBITDA. Co expects 10% growth for 2025.

Brown-Forman & TFF

Are you sick of booze stocks yet? I’m not! Brown-Forman (BF.B) cutting ~12% of its workforce and shutting its hometown cooperage. We all know we are in a period where people are drinking less, so it makes sense to cut the workforce, but I’m sad to see the cooperage go — that’s heritage and rare skills… I had to go back in my mind palace some, but I remember Tony at Edelweiss Holdings talking about TFF group, a French cooperage that makes about 30% of wine barrels globally. TFF is almost too boring to talk about — their numbers dutifully trudge along, they are not a “hyper-growth” company, they maintain low debt and a lot of cash — I am getting bored thinking about it!

The point is that TFF is largely family controlled and has adroitly grown its operations and increased its book value while not caring about what the share price does this year or the next. In 1997 they made $32.5mn of revenue. Last year they made $486mn. Again, this is not something to get incredibly excited about but it is a great example of a family business “sitting steady at the wheel” and simply growing a little bit each year while employing little debt (it also makes a profit!) (It also trades around 10x P/E … it’s cheap …)

I mean — given they make 30% of the world’s barrels it’s not a far reaching assumption to think that Brown-Forman might buy from these guys. It also raises a question mark around Brown-Forman, though — TFF can find value in making barrels; why can’t they?

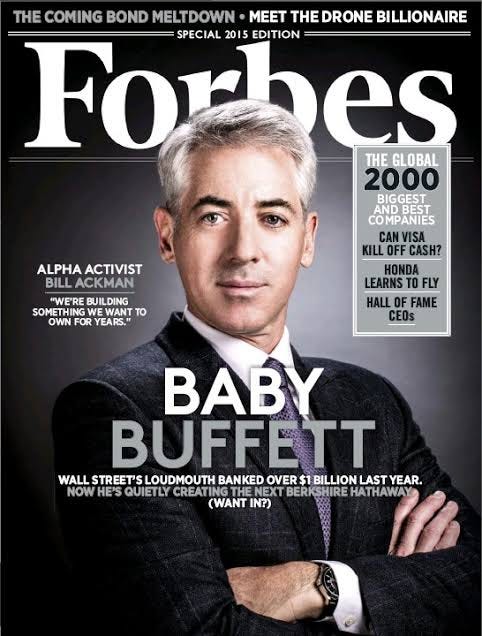

It’s sort of fun to see Elon Musk and Bill Ackman’s business models as the same. They’re not entirely the same, of course, but they have the same aura. Musk’s whole M.O is basically: “look, I am Elon Musk and I am very amazing. And here’s this flying brainchip Mars project that will be ready in two years because I am Elon Musk and I am so amazing”. Ackman, on the other hand, is like “I am Bill Ackman and here is an incredibly long rant on x dot com about something I know nothing about, and also I will build the next Berkshire Hathaway by acquiring this company for less than I previously said it is worth”.

Both guys rely mostly on bravado and they have dedicated online followings, mostly of whom are men, and most who are chronically online. It often can feel like whatever project they are doing mostly acts to service their own egos, and the actual project is secondary (i.e “I am Elon Musk and I will drill a tunnel that goes nowhere”). Both guys (I begrudgingly admit) have accomplished things, but I think more importantly they represent a kind of “new” billionaire, who thrives more on attention than on privacy or discretion.

Bill Ackman would like to buy Howard Hughes Holdings. He’s been involved in HHH since inception, in one form or the other, and his thesis has always been “there is lots of land here and the master planned communities we build are really great, and the stock is totally worth more than $100, you guys”.

Howard Hughes Holdings stock has basically always been disappointing. It’s sat between $50 - $100.00 since listing. They spun out Seaport Entertainment, which owns an oddball collection of assets (478k square feet of mixed-use in lower Manhattan, plus — “…Las Vegas Ballpark in downtown Summerlin, NV; the Las Vegas Aviators, the Triple-A Minor League Baseball Affiliate of the Oakland Athletics; a 25% ownership interest in Jean-Georges Restaurants; and an interest in and to 80% of the air rights above the Fashion Show mall in Las Vegas…”1)

Anyway — Bill Ackman would like to buy HHH for $85 a share. But that’s not all —

Just think about that for a second. The more hyped up the stock is (i.e. if Ackman can utilise his rabid X dot com fanbase), the more Pershing Square Holdco gets paid! Right now HHH has a market cap of 3.9bn, so we can guess that the holdco would be paid about $58.5mn. HHH only makes about $100mn or so each year, so that’s a significant chunk. That’s a great deal for Ackman, a terrible deal for shareholders!

It is also, obviously, not a structure a Berkshire or Buffett organisation would ever do. So much for “next Berkshire Hathaway”. This also kind of illustrates why Musk is more successful — Musk is like “if this company (Tesla) gets to this market cap, you have to give me a ridiculous amount of money” and everyone is like “ok, Elon!”

Ackman is like — “can I pwease have a tiny piece of the piece, pwease??” — he’s not thinking big enough! If it were Elon, he’d say — “OK, I get one hundred billion dollars if I make this ‘new Berkshire’ worth one trillion dollars”. That’s more like it!

Of course, I find this a far more exciting proposition because it’s so weird — I mean, wouldn’t you like me to say that you own a “25% interest in the Jean-Georges Restaurants” and a baseball team nobody has heard of??