Boom Boom Boom Boom-- Macquarie, Rolex, and so-long Bruce

Plus -- Exor, reading bin, and NAV discounts

So long, Bruce, we hardly new ye

Farewell to Bruce Hassall — former Chair of Fletcher Building. He stepped down today — was originally going to stay until the AGM. We’re pretty bored of this story — Fletchers is the horse that just keeps getting flogged. You have to feel (a little!) for Bruce — Fletchers is the victim of a much, much more deep-set culture. I don’t know — I’m a week into sobriety & clean living (it’s great — my swimming time has improved a lot — I hope to be like Phelps — and I’m shedding calories — Kardashian1 eat your heart out) — and frankly Fletchers sits squarely on the “does not make me money” category. Recently I’ve had people asking me about all sorts of the “does not make me money” stocks — Air NZ, Fonterra, Fletchers. There’s only so many hours in our day and as the Chase Coleman figure in Carrie Sun’s recent Private Equity says “how we spend our days is how we spend our lives”. Well, exactly. I’m not spending anymore time on “not making me money” companies.

Speaking of companies that are chronic disappointments — AOF at 0.058 cents today. Greg Balla and co need to start looking into M&A stat. Wasted on the NZX.

Speaking of (speccy) opportunity — Droneshield is currently at 0.61c — we think the sell-off is irrational, given $9.3mn of profit and a pipeline of $510mn — like it or not, the global climate is fractured — the possible election of Trump only inflames this more. Drones continue to be a very credible threat vector, both for warfare and civilians (i.e. airport closures at Gatwick due to drone use). Hardly a “core holding” but an interesting situation.

Reading bin — Enjoying the aforementioned Private Equity by Carrie Sun very much — it’s about her time working for an unnamed billionaire investor (who is obviously Chase Coleman). Often memoirs of ex-finance kiddos end up a little mawkish or preachy; this isn’t. Read most of it the weekend. It’s a good insight into the world of “real” finance in the big apple — think lots of SoulCycle and green juice. Recommended.

End of the watch boom?

The last couple of years saw an unprecedented boom where people paid a lot of money for watches. This is great if you own AP, or Rolex, or Cartier. Now that bubble seems to be deflating — little by little — as consumer tastes move on. See the chart below from the FT.

It’s obvious to anyone that Rolex and Pateks were very expensive in the last couple of years — hype begets hype — I remind you that Bill Gates wears a Casio and DJ DSol of Goldman Sachs wears a Swatch. But what the FT misses is the ascendency of the so-called ‘minor’ brands — yes Richemont saw jewellery sales up +12% (one of our favourite stocks, BTW) and watch sales only up +3%, it’s worth noting that Cartier watches have continued their steady ascendancy.

Don’t get me wrong — Rolex and Pateks are always going to have value, but what I think is happening here is the ascendancy of smaller watch profiles that tend to be more discreet (the most obvious one here is the Cartier Tank — I’ve seen that on a lot of wrists lately). This is again why we continue to maintain a long position on Richemont — its brands, like Cartier, are net beneficiaries of this shift, as are their brands like IWC, JLC, Piaget and Panerai. In other words: I LIKE THIS STOCK (she loves you yeah, yeah, yeah).

Macquarie and private equity valuations

I’ve long been saying that private equity valuations don’t often reflect actual valuations. Someone I know used to work at an unnamed pension scheme in Canada and they simply marked up the value of their investments every year. There were no pesky traders or retail (ugh!) investors to move the valuation around too much, so the returns were a nice graph that just kept going up and up. And most private equity vehicles are closed-end and last for a limited time; so after five years the idea is to pass the parcel to another PE firm or pension fund or whatever. This mostly works because there’s an almost-endless font of passive money waiting to buy the next thing (as my contact at the unnamed pension scheme would say “they bought a hockey team for god’s sake!). It doesn’t always work when things go public — see; Uber, Airbnb, Doc Martens (dirty docs done dirty cheap), etc. It also doesn’t work when a Big Swiss Bank gets angry, like Julius Baer’s CIO Michael Silverton just did — he got very, very mad at Macquarie (MQG). MQG was a minority investor in Byju, an Indian ed-tech platform. While other investors in Byju, like BlackRock, slashed their valuation from $22bn to $1bn (it’s a long way to the bottom…). MQG hasn’t done that! Baer invested about $300mn in the startup via MQG via a feeder fund (finance is deliberately oblique — just imagine Mr. Creosote gobbling all he can). MQG charges on a NAV basis; they’re incentivised to charge on a $22bn valuation of a $300mn investment rather than a $1bn valuation. That’s a 95% drop in NAV, by the way, based on BlackRock’s figures — so that $300mn from ze Swiss is written down to about $15mn. That’s, uh, a whole lot less fees for the silver donut.

Anyway, Baer is not happy (Baer has around $422bn of CHF under management). They wrote:

The frequency and depth fo the qualitative updates from Macquarie Capital — our regular requests for updates often remain unanswered.

And

The management fees continue to be calculated based on a NAV which no longer represents the intrinsic value [sic]

Well, certainly. My point is — this is the trouble with PE — if you’ve got BlackRock saying it’s worth $1bn and MQG going “no, no; it’s $22bn sir” then you’re going to have a problem.

Speaking of NAV discounts…

Here’s another problem (happy Monday!) — if you are a fund and you are listed as a stock you will often trade at a discount to your NAV. For instance, Bill Ackman’s Perishing Square Holdings is a listed investment company which invests in basically the same things that Perishing Square does; however it trades at a chronic discount to its NAV — as of 29 Feb it had a NAV of 53.32 GBP per share, while it traded at 39.90 GBP. To add to the equation consider that most of Ackman’s holdings (unlike his 70-page diatribes) are pretty simple and liquid — they’re mostly common stock in things like Lowe’s, UMG, Hilton Hotels, Chipotle, etc. It’s not like they’re black-box private equity valuations. But the stock still trades at a discount.

There are examples of this throughout the world — RIT Capital Partners (founded by the 4th Baron Rothschild) trades at a 26% discount to NAV, etc. Sometimes these things trade at a discount that’s big enough for an opportunistic investor to come around and go “hey, please wind this stock up — it’s been trading at a discount long enough”.

Saba Capital, which is located in NY, is doing this on a large scale — they’re buying large stakes in listed funds in both the UK and Australia (makes sense — listed funds tend to be undervalued often on both the ASX and the LSE). Good strategy, right?

So let’s pretend there’s a listed fund that trades at a 17% discount to NAV. The value of the investments it holds is $707mn, and there’s a gap of $117mn. Let’s say you are a famously litigious fund, and you have taken legal action over listed fund discounts before. What ya gonna call? Ghostbusters?

But let me throw another spanner in the works — the listed fund is a charity. That makes things — I don’t know — a bit more icky.

This is actually what is happening with Hearts & Minds, an ASX listed fund that actually donates their 1.5% managerial fee to charity — so far it has donated $50mn to charity. That makes the situation a little more difficult — what will Saba capital do?Can Saba wind up a charity? I mean — I don’t have a horse in this — it feels at ‘bad’ to try and wind up a charity? Watching with interest.

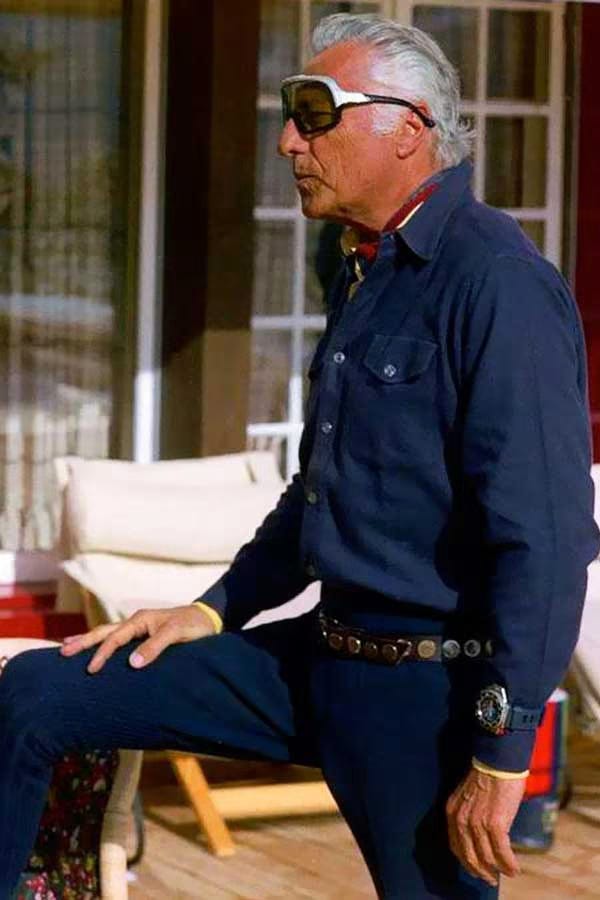

Exor — Gianni Agnelli was one of the world’s best watch wearers (a style icon IMO) and also helmed what is now Exor NV, another one of my favourite European stocks (would you like to buy a family office that trades at a discount to NAV? Here you go).

Long piece in the FT - link - which is well worth reading. Gianni’s daughter Margherita has been engaged in a years-long dispute against children and her mother for years — mama mia! È un affare di famiglia! When Gianni died in 2003 Margherita decided to take a 1.2bn EUR payout and exchange her rights in the family holding company, Dicembre, which is how the family holds its stake in Exor.

Now — that was a terrible decision. It was a world class terrible decision — like being a co-founder of Apple and selling out for a few grand. Margherita still got 1.2bn, though, it’s nothing to sneeze at — But Exor has compounded at a rate of 18.6% since 2009; the holdings of the company have grown 2,700% since the death of Gianni. It’s a cautionary tale on greed and the age-old story about generational wealth.

Exor is a fabulous company — poor Margherita — it often pays to stick to your knitting. The Dumas family have done well by sticking with Hermes, and the rest of the Agnellis have done well sitting with Exor — like Tammy Wynette sings, sometimes it’s good to “stand by your man”.

Another holding we love — Bollere - interview with his son here.

nyaaaaa, as Kim says