Burberry: sometimes something is so dirty, nasty and cheap you have to have a look at it

Plus: Churchills and their money

A quick thank you

I’ve been writing this for about a year now (I am bad with time; ask anyone). I’ve written about 168 letters to you all (aprox. Once every two days), had around 715,000 views, almost 9,000 of your reading me on the daily.

I’ve gotten to know many of you through writing this — it is an absolute pleasure.

Thank you, everyone.

Spark — This is at 8 year lows now. I just have an aversion to buying a company with a painful call centre.

WasteCo — now down 54.55% since listing. As the kids say, “oof”.

Woolworths — Interesting piece in the AFR where a small activist calls for the supermarket giant to divest the NZ business and Big W, their side business in Aus. Quoth —

Mr Bajic was equally critical of Woolworths’ foray into New Zealand.

“It was a bit of ego and arrogance from Australians who think they can do better,” Mr Bajic said. “I haven’t even mentioned Masters [hardware stores] where they dusted a couple of billion dollars when that ego projection happened as well.”

Masters was a hardware chain Woolworths launched in both Australia and NZ to compete with Bunnings. It closed in 2016 after burning about three billion dollars.

Two takeaways from this, then — the first is that even though Woolworths has an astonishingly poor track record of capital allocation, it still manages to make money in NZ out of sheer incompetency because there is so little competition.

The second is that NZ is so poorly served in the grocery sector. I’m telling you nothing new there. But consider this — Croatia has a population of 3.85mn (less than NZ) (we love the Croatians and those who end with a “vich”, etc). There are seven major supermarket chains — to name a few — CBA, Metro, Kaufland, SPAR, and Konzum. Croatia has less people than NZ. NZ has two major chains, which appear to get on by mostly gormlessly. Imagine if they had real competition!'

Toffs and their money — the Churchills

Rewatched The Favourite recently (also, Sideways, which I adore). Sarah Churchill was the defacto power behind the throne and a savvy investor, entirely self-taught. See below:

The Duke, who died in 1722, left an estate of about £1,000,000 managed after his death by trustees, which included his wife. By the time she followed him in 1744 she had increased this to a fortune calculated at a capital value of £4 million with an annual rent roll of £17,000 from her twenty-seven landed estates in twelve counties. This was topped up with £12,500 in annuities. In fact Sarah was the largest single account holder in the Bank of England (£166,855).

She inherited approx. £18,595,840.42 in today’s money from her late husband, and by her death, twenty years late, she had compounded it to £83,645,195.07! Quite well done — especially when you consider the 1700s were largely a bear market for the UK (42 years long!) — the South Sea Bubble (1705-1720) saw a bull run then bust. Afterwards, investors could’ve expected a return anywhere from -0.90% to +2.5%. Sarah Churchill compounded her own wealth at a clip of 8%. Girl had alpha.

Enter Winston

Winston Churchill, who was related to Sarah (separated by a few hundred years, but the family home was still Blenheim Palace, where Sarah lived much, much earlier). Churchill did not have the finesse with money that Sarah had. Oh no — quite the opposite.

Here was Churchill’s liquor order in 1908:

nine-dozen bottles and seven-dozen half-bottles of Pol Roger 1895 vintage champagne, plus four-dozen half-bottles of the 1900 Pol Roger vintage

six-dozen bottles of St Estèphe (red) wine

five-dozen bottles of port

seven-dozen bottles of sparkling Moselle (white) wine

six-dozen bottles of whisky

three-dozen bottles of 20-year-old brandy

three-dozen bottles of vermouth

four bottles of gin

I rather concur with his taste — who doesn’t like Pol Roger? Churchill was also bad at paying his bills — in 1914 and 1936, his wine merchants, Randolph Payne & Sons, wrote him a letter politely asking for payment of his bill (worth around $81,000 USD today).

Churchill was also a horrific trader — he went in and out of stocks like they were going out of fashion — he’d be at lunch with Charlie Chaplin, hear about a furniture company, and invest away (and then sell out). His solution was to write prolifically — another book meant more royalties, which meant more champagne. I wonder what his ancestor Sarah might’ve thought. Cheers!

Burberry

If you are a regular reader of this newsletter you will know that I often voice my distaste for Burberry. This is because it’s been run badly for a number of years — it tried to be high fashion, but wasn’t high enough. It was subverted into British “chav” but didn’t embrace that or make ironic fun of it (something I imagine Balenciaga might’ve).

But — everything at the right price, right? Burberry is now trading down in the dumps. It’s sitting at well over ten year lows (in fact, if you’d bought it in 2014, you’d be down 50% — ouch).

Why is Burberry so cheap?

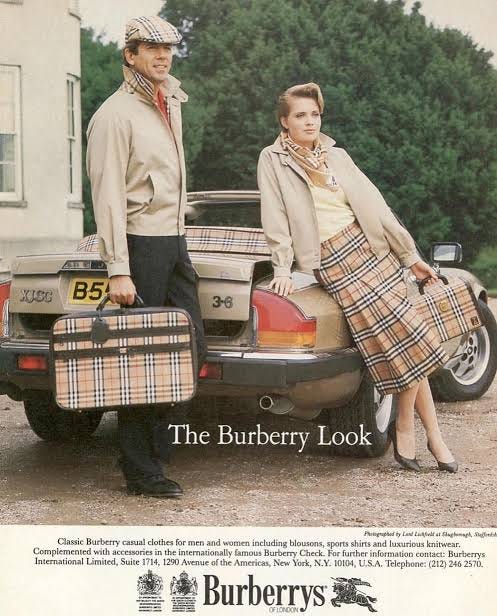

They made an error in who their audience is and therefore what image they project (i.e. they should’ve been talking about the “old money lifestyle” so beloved of aristocrats like the Churchills — hunting, horse riding, grouse, old and cold estates, etc).

They stuck with the wrong management and wrong designer for too long. Fatal.

They ran away from their roots — see, error one.

They over-expanded and the entire thing became commodified.

Why do I like it now?

It is very cheap

See point one

It has IP that is irreplaceable — and heritage — heritage is valuable

I think it is likely someone buys it at opportunistically low prices. There are plenty of vultures around (Mike Ashley1, etc).

Britpop mania is back in force. Oasis is back. Cigarettes are back. Kate Moss makeup is back. The Burberry check is back.

New management — Josh Schulman is ex-Michael Kors and Coach. He understands “premium” products that people who watch Married at First Sight can aspire to.

Did I mention it is cheap? It is so cheap. It is in the toilet cheap. It is nasty cheap (I’ve been a nasty Burberry, nasty).

This is a pretty loose tin pot thesis — but the thing with these things is — when something with actual value (i.e IP) is cheap enough, eventually something happens. Burberry’s been on a long decline. Time for a change. Burberry works when it does what it does best — quality outwear — see the vintage ad below.

That’s what I’m talking about.

From Blue v Ashley — “…Mr Ashley is not an ordinary businessman but is someone who adopts an "unorthodox approach to taking business decisions in informal settings while consuming substantial amounts of alcohol…”

Fantastic as always Eden.