What happens when a Chinese hedge fund makes a LLM (AI) for $6.5mn that is as good as, or outperforms, ChatGPT? Well — this…

Holy meltdown, baby!

I won’t talk to you too long about this — no doubt you have read it everywhere, because, you know, +$500bn being written off the market cap of everyone’s favourite market darling is something to write home about. It’s broad-based, too — NASDAQ down, S&P down, etc. I think Matt Levine said it best: if everyone can have a magic genie in their pocket, and the magic genie is basically free, and the magic genie uses a fraction of the processing power OpenAI uses — then everyone gets a magic genie. (Cue Oprah voice: you get a genie! You get a genie! You get a genie!). DeepSeek (the Chinese-backed AI startup) esentially told the market (and Elon Musk, and OpenAI, and Meta…) that you don’t need to spend billions in CapEx to lead the AI wars. You can, actually, just spend a few million (this isn’t exactly true, because of course the hedge fund behind it spent years and more money developing it. But still — you can run DeepSeek pretty cheaply! You’ve got to wonder — where to now, Stargate? (Trump’s 500 billion dollar initiative with OpenAI)

Read-through — lowering the cost increases ROI on AI (massively) — that’s a bad conclusion for all the power plants being set up to power huge datacentres (I also wonder what the affect will be on the big data centre providers, like CDC in Aussie and Infratil here — remember when they were the “hot new thing”?)

The cool thing is that a model like DeepSeek’s will be able to be run on a new phone in two years or so. You read that right — not from a huge data centre, but a phone. Again — magic genies in our pockets. Bad for power and the gentailers, bad for data centres, and a huge question mark for “math” professions that could see their work be replaced by AI (accountants, consultants…)

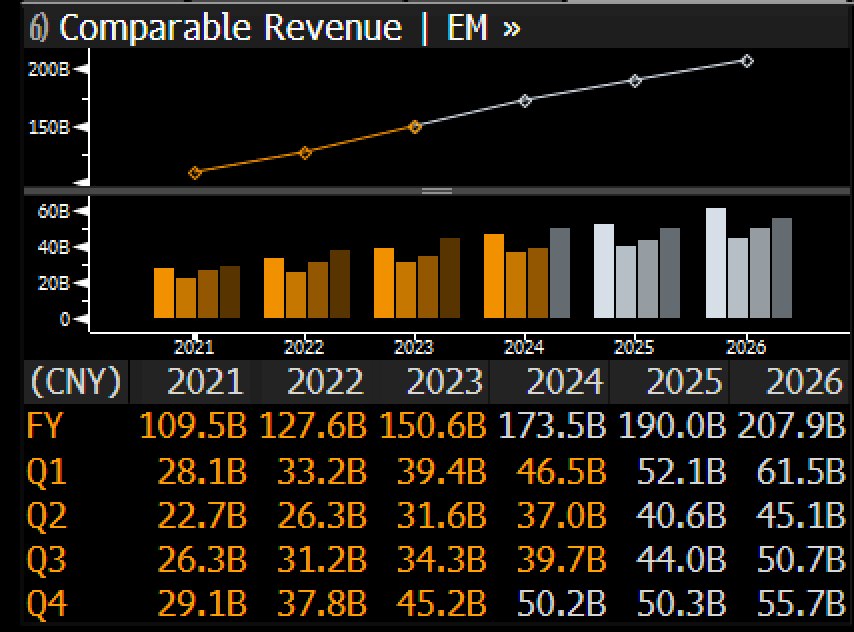

In terms of stocks, I’m looking to China (more on that later). A company like Tencent trades on far more rational multiples than the “Mag 7”, and Tencent has an AI division — as well as being the defacto "toll booth” in China with WeChat. You’re looking at a forward P/E of 15x earnings versus Microsoft’s 33x. But I’m also bullish on China for other reasons…

What I learnt from talking to a bunch of Hong Kong CEOs, ex-fund managers and so on

I spent the week around the country (hi to those of you that read this and who I met), talking with a lot of people and learning about the alcohol industry, Hong Kong, and the general sentiment around China. They were all optimistic on the future, albeit with caveats. One fellow who used to run a private bank told me — look, Eden, China was a great market to make money in the 90s because there were so many inefficiencies. They’re not there as much anymore.

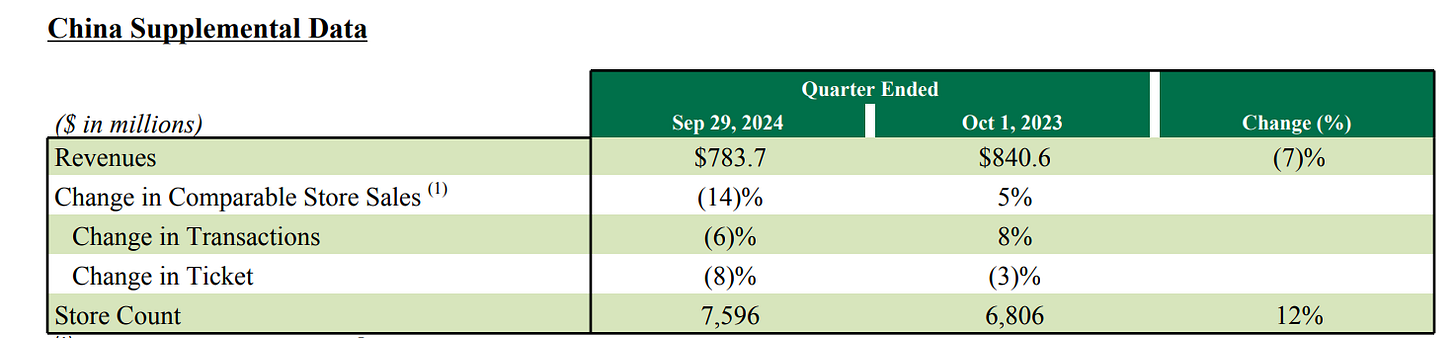

And yet the general sentiment was overall positive — Hong Kong gets slated a lot in the western media but the fact is it always manages to reinvent itself. The wider Asian region also benefits from those economies of sale — both from the production side and on the consumer side. You’ve got squillions of consumers, all of whom are still buying, albeit not western brands with the same gusto. What I mean by that is Chinese consumers would rather shop at Luckin’ Coffee, and not Starbucks. Just look at the numbers:

Check out Starbuck’s latest quarter, for more colour:

Not only are they building more stores; they’re selling less stuff. And I think this is a story we are seeing time and time again with China — they learnt from us westerners and once coveted our products (Nike, Starbucks..) but now they’re all grown up and making their own coffee (and cars, and whatever else you care to name…)

I think this is incredibly tricky territory for those “superbrands” to navigate. Starbucks has a superstar new CEO but it’ll take more than that to outperform Luckin’ — it’s about finding a way to win the hearts and minds of the Chinese consumer once again. Come wander into ye flock…

As for booze, I talked to one fellow from ThaiBev as well as their CEO. What impressed me was their employee retention rate. People don’t leave because they love it (compare that to AB InBev, the booze conglomerate — his description of work these was “competiting against your co-workers and you never know which one will stab you in the back”. Yuck!)

I guess my take is — Chinese “super” companies are positioned to do well, trade at resonable valuations, and a have a government that implictly supports them. The western brands have a harder time, and the luxury read-through is that Hermes and Brunello will be fine, but I think why we’re seeing declining luxury sales in that region — it’s because there’s too much comoddified luxury (another LV bag, really?!)

If you want a rough napkin paper list of what I think may do well this year, given both DeepSeek and the China “good vibes”, may I suggest (not fin advice, I am a monkey typing at a keyboard:

Tencent, Alibaba, China big boys. AI, cheap multiples, Chinese govt all-out on the AI war

Chinese consumables — the most obvious is Luckin’ coffee (but also…I find it hard to invest in given its accounting scandal a few yrs ago), but also don’t forget about Moutai, the disgusting gasoline-tasting drink that all businessmen love over there (see that revenue growth go… who said booze is dead?)

Also, I am starting to look afar to Hong Kong and Singapore. My beloved Shangai and Hong Kong Hotels has seen a minor ressurgence as of late, while over in Singapore I couldn’t help but be impressed with the CE of ThaiBev — soft spoken, focus on growing brands and people, and really understood the story behind the product (ThaiBev has recently bought Cadrona Distillery, and they couldn’t have hoped for a better owner by all acccounts). This stands in sharp contrast to what I’m seeing with your traditional “biggies” — Brown-Forman is shuttering smaller brands and closing its cooperage, while Diageo ought to be listing Guiness but it depends if Deb Crew, their CEO, has the chutzpah to do that. Booze is something I write to you about often — my view at the moment is that the large conglomeretes need to get smaller in order to succed, because it is not the days of “Mad Men” anymore.

Speaking of Burberry…

Check out this chart, boy.

That’s from September, when I last wrote to you about it. I believe my headline was: Burberry: sometimes something is so dirty, nasty and cheap you have to have a look at it

Well, here we are and the stock is up about +90% since my pronouncment from my ivory tower. It’s a classic example of a beaten down British stock on an unloved market (the LSE). Here’s what its problems were:

Why is Burberry so cheap?

They made an error in who their audience is and therefore what image they project (i.e. they should’ve been talking about the “old money lifestyle” so beloved of aristocrats like the Churchills — hunting, horse riding, grouse, old and cold estates, etc).

They stuck with the wrong management and wrong designer for too long. Fatal.

They ran away from their roots — see, error one.

They over-expanded and the entire thing became commodified.

And I liked it for these reasons:

Why do I like it now?

It is very cheap

See point one

It has IP that is irreplaceable — and heritage — heritage is valuable

I think it is likely someone buys it at opportunistically low prices. There are plenty of vultures around (Mike Ashley1, etc).

Britpop mania is back in force. Oasis is back. Cigarettes are back. Kate Moss makeup is back. The Burberry check is back.

New management — Josh Schulman is ex-Michael Kors and Coach. He understands “premium” products that people who watch Married at First Sight can aspire to.

Did I mention it is cheap? It is so cheap. It is in the toilet cheap. It is nasty cheap (I’ve been a nasty Burberry, nasty1).

What’s changed? Well — the company got back to what it does best. Outwear. It’s working. More sales - esp in the US — and outwear is the hit. Note the ad below — classic, British, understated. Anyway — if you bought it Sept you would’ve made some money!