David Tepper bought more Chy-na

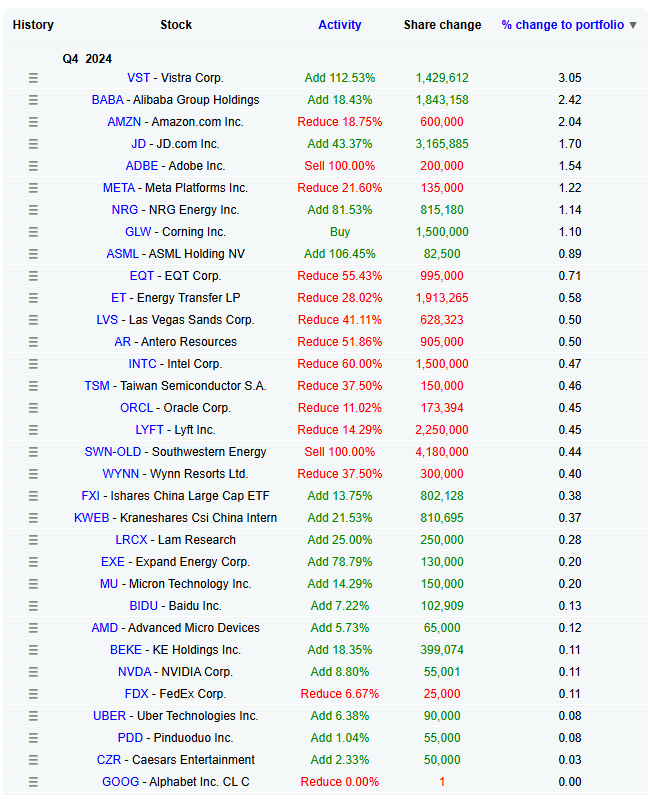

Here’s David Tepper’s latest 13f, which is, uh, quite China heavy!

Noting PDD (the Temu people), Alibaba, JD, China-adjacent TSMC, etc. Tepper’s a China believer!

Regular readers will recall I spent a lot of time speaking with China and HK-adjacent folks down south and they were all universally bullish on China. Here’s more confirmation of that, I guess? (Tepper is much richer than me, and generally pretty smart). I think what everybody’s forgetting is that there’s 1.4bn Chinese people and that middle class is still ascendant — yes, they are buying less western brands — because they have their own. I think that’s a natural progression — from aping western culture to subsuming it, in some way, and making it their own1.

BABA continues to hold a large pile of cash, while JD and PDD feel like a bet on the consumer. When you compare the multiples these things trade on compared to US peers, they’re “good value”. My preference is to look for those smaller companies — Hong Kong Shanghai Hotels, which is up +14% in 6 months, is a good example of that. I’ve also been thinking about ThaiBev (oh wow, Eden writing about a booze stock?!) — East Asia continues to drink, unlike western peers, and the stock trades at 12x earnings — win-win. You know, there’s options! I highly recommend Asian Century Stocks for more insight into Asia — I am but a babe in the woods, here.

NZ

Noting ikeGPS has rejected the NBIO bid — $1.00 — they think it’s worth more. Peer multiples suggest the co should be valued at a ~9x EV/Sales basis, versus a bid that valued it as ~4.8x. This is all very well and fine but it does beg the question — surely something is only worth what people are willing to pay for it? If there’s a large bidder (US based?) I’d suggest mgmt ought to hurry up and find one. Also begs the question — when a company is this tightly controlled by few shareholders on the NZX, why bother being listed at all? Why not go private? (Ditto for MCK, a company I’ve never cared about — who even stays at Millennium hotels? I think I stayed at one once, years ago…a dim and distant memory).

HNW Visas — Finally the govt has hauled ass (a bit too late IMO!) — the new “growth” visa requires an investment of $5mn over three years, while the “balanced” visa will require $10mn investment over five years. All very nice but you’ve got the foreign buyer ban in place, plus the ridiculous FIF tax regime … if you have a threshold for foreign buyers (say, $5mm or so) you’re not putting “ordinary kiwis” out of their overpriced Auckland houses, and you’re encouraging those HNWs to actually have a place to stay and be in NZ. In other words — this goes some of the way, but not enough. Close but no cigar.

Aus

Just processing a bunch of Aussie results — mostly in the consumer space — JB Hi-Fi — not a bad result given the weakening consumer — NI up +8% against estimates and ebit +8.6% to $419.9mn. Look — that’s not bad given the fact we are in a “cost of living crisis”! (Also, obviously, makes The Warehouse’s Noel Leemings segment look a little insipid). Not particularly cheap at 25x earnings, but like Chemist Warehouse and Bunnings, they’re the best of breed in the sector. Nick Scali probably a better read on the ‘Quassie economy … ANZ net profit down 20.7%, and revenue basically flat.

Also thinking about Dominos (the Aus stock, not the US one). Closing 205 stores, mostly in Japan. Market likes the news — I’d been thinking it was perhaps cheap for a while, but not sure the 21% jump in stk price in recent days is a given — you can’t just close stores; you gotta sell more pizza.

Kering theories

We all expect Kering to report fairly awful sales — obviously Gucci has been a disappointment, with designer Sabato de Sarno’s collections falling flat (as the FT reported, you can buy something at Zara for 1/20th of the price). I think it’s worth thinking about the typical trajectory of Gucci’s (rocky) history — they find a superstar designer, then they find a not-so good designer, then they find a trash designer, then another superstar designer. I have made a very professional and well designed chart below, with very helpful emojis.

Tom Ford was fantastic — he bought SEX back to Gucci and the label did incredibly well under him. Frida Gianni’s clothes were dull, though Gucci’s loafers did well under her. The second coming of Gucci came under Alessandro, and then Sabato did a “meh” job. In other words: they need another superstar designer, stat.

In other words: I think Kering’s disappointing sales are largely priced into the stock at 14x earnings. It’s a cheap luxury stock, but you’re going to have to wait for 1+ years to see a return.

Is Calvin Klein BRAT?

I am going to embarrass myself here and tell you that I did not know that PVH was a listed company, and it owns Calvin Klein! D’oh!

They also own Tommy Hilfiger. You may think of CK as mostly a marketer of bras, underwear and so on. But for a while they were a force in American fashion — a kind of utilitarian, Carolyn Bassette-Kennedy vision of sporty chic. They just had their first fashion show in 7 years, and they hired ex-Celine assistant designer Veronica Leoni. The show felt like a retrospective in a sense, and it mostly drew from Raf Simon’s era there — critically praised but didn’t sell. I guess the question though, is, how do the new clothes translate into product? After all, CK has great marketing — and a great brand — but the product, other than bras and undies — is not there.

Remains to be seen. Right now PVH is a bit of a shitshow — I mean, there are fires everywhere:

Not only has China just blacklisted it, they also have their manufacturing agreement with G-III ending in 2027. They’ve said they’d like to onshore, but that’s easier said than done — people forget how integrated China is in the manufacturing process. You can’t just magic up that scale overnight!

In other words, there’s a reason it trades at 6x earnings. Is CK brat? No.

Reminds me of a few other US retail stocks — VF Corp, for one, which makes Vans and The North Face. Fine product, but cyclical as anything — too much of a hostage to retail stores. No margin. Not brat either.

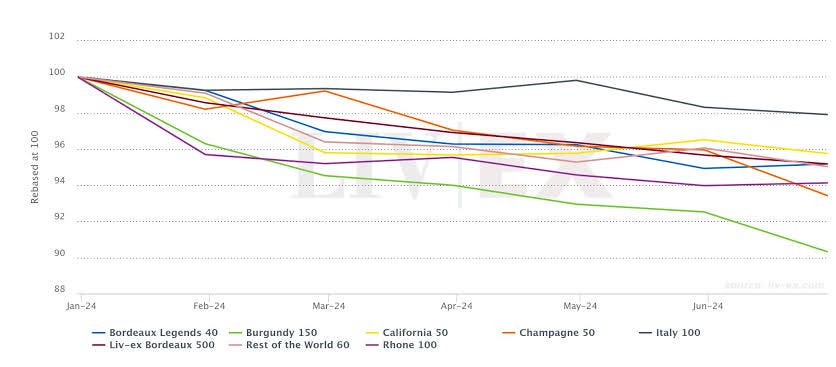

I’ve been thinking a lot about the ascent of first growth wines — Lafite, etc — and how much the Chinese consumer gobbled up in recent years. That’s dropped off — if you’re buying first growth Bordeaux (I know some of you do!) now is the time to buy. See chart below:

But I think, again, this is another example of China finding a prestige product and then the western seller taking the Mickey a bit — selling too much, pricing too high. If you look at western brands that continue to do well in China — i.e. Miu Miu — they’re the ones that have a strong understanding of the consumer and don’t price gouge as much.