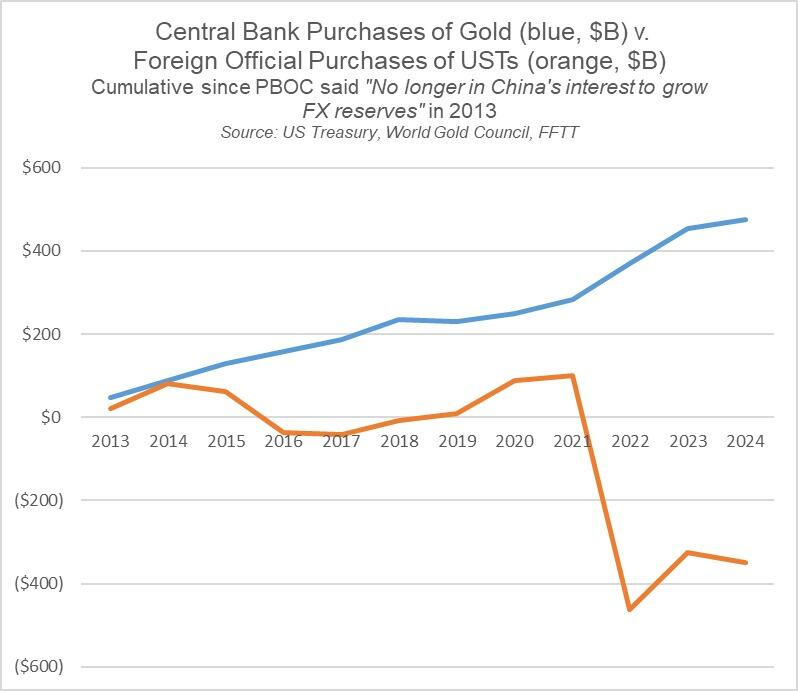

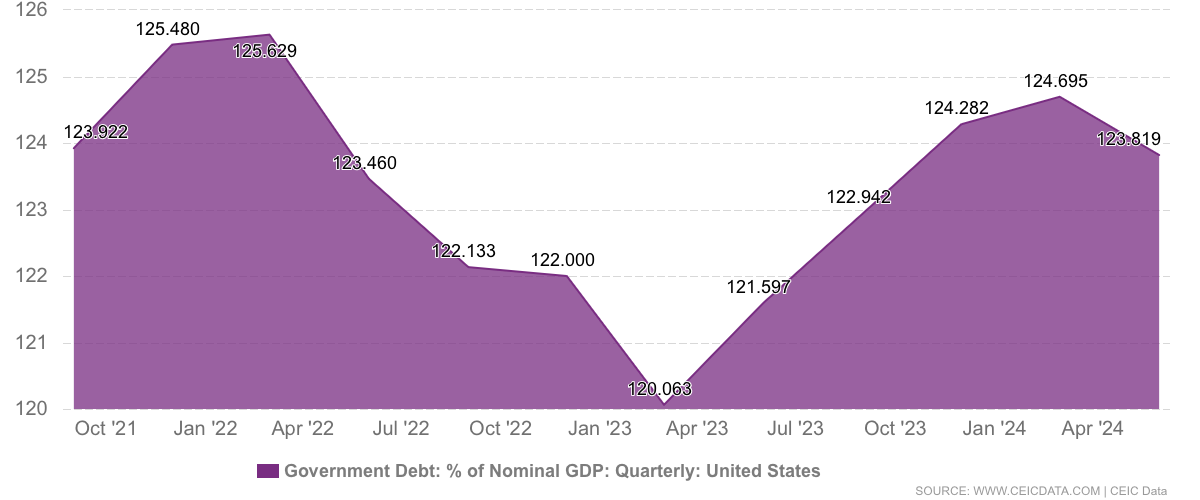

De-dollarisation … if you still think the USD is all-powerful, check out the above. Gold (and its spiking to new all-time highs) is largely driven by non-US countries building up reserves (i.e. China). Remember the US has astonishing levels of debt — see below (debt to nominal GDP)

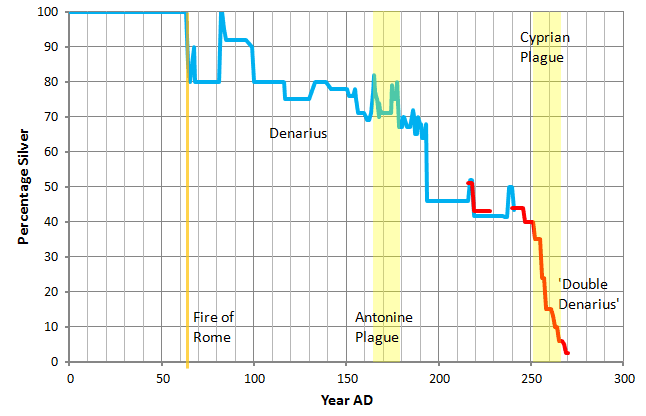

This works as long as you are a reserve currency. You get to dictate the rules of the game because you are issuing the Monopoly money. But! You only get to issue monopoly for so long (i.e be the reserve currency). The Roman denarius is the best example of this — as it was debased over plagues and wars and eventually worthless (worth noting it existed as a reserve currency far long than the USD has, so far).

I think this move to gold is transitory, though (by “transitory”, I mean at least a decade…back of envelope guess). Eventually there needs to be a new reserve currency — that is not gold. I far prefer the USD to the Yuan, don’t you? (Or the Ruble…)

By the way — this is not a rally or piece of fear mongering sell all your USD — it’s still USD (i.e it’s a helluva lot better than anything else we got). But it does signal there’s an intent from trading partners like China to move away from the USD. That’s an issue.

NZ

BAI — Had to laugh at this headline where BAI is ‘allegedly’ going to replace Google (I love BD, but what sort of headline is this? The real story is the “offer” for Solution Dynamics). Link. As of writing, BAI has a market cap of $112,000,000 (NZD). Google has a market cap of approx. $3,222,000,000,000 (NZD). I made a helpful graph for everyone which compares the market capitalisation of each company.

PEB — Up 20% today. Wall Street Bets, that you??

AOF — Sitting nicely at 12c.

MOVE — Moving in the wrong direction … warns of material uncertainties (are we surprised that Lorraine Witten has left the building ... bigger question is what happens with the moribund RAK board?). New CEO is good operator but has a helluva job...Just goes to show why I worship at the altar of Mainfreight. Do it right and do it right every day. (I own a few MOVE and currently am a glutton for punishment).

“Rich Pricks” — I liked this comment from Mainfreight co-founder Bruce Plested on our nation’s rich list (and attitude to it). But I digress with the minister when it comes to NZ building wealth — we need people with more drive and ambition and we need to not be afraid of being tall poppies. Be a tall poppy! Stick your neck out! Try something new! (Otherwise others will)

Rest of world

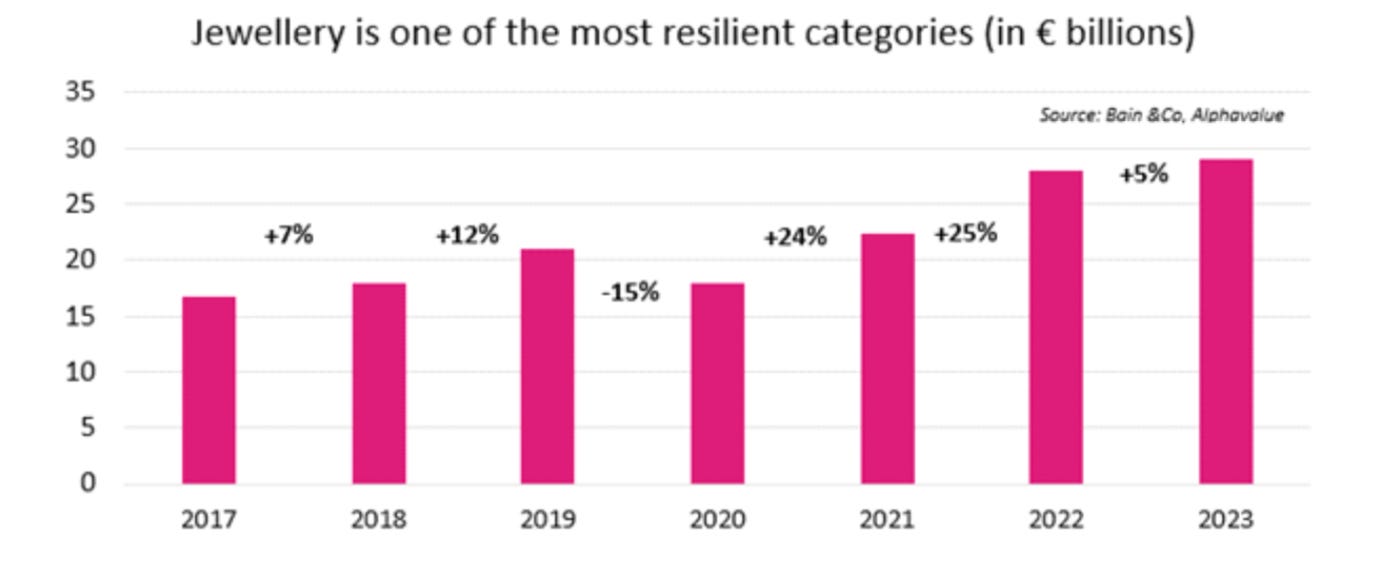

HARD luxury — I have been saying lately that hard luxury (i.e. rings, jewels, necklaces…) is resilient versus the sell-off in bags and watches. More evidence of that below, courtesy of our friends at Baader and Bain & Co.

Richemont best positioned to do well here… they own Cartier. LVMH will do just fine with Tiffany etc (someone was asking me why LVMH vs. Hermes — this is a partial answer. The broader answer is you get what you pay for…LVMH at 21x earnings or Hermes at 45x earnings… choice is obvious1)

Speaking of luxury — Chanel just bought a building on rue Montaigne. Another thing to consider — luxury brands are now a real estate play.

UMG... The world's largest music group said it wanted more paid music streamers (presumably on Spotify or dreaded Apple Music). Projected 7% cagr implies 15bn or so of revs for 2028. Like the stock anywhere below 23 euro. UMG trades at 27x earnings at WMG at 29x (you can buy Sony, the third player, for 15x…but you know, it’s Sony).

Whisky comps — Campari. Buying 14.6% stake in South Africa's Capevin Holdings Proprietary Limited (just rolls of the tongue, doesn't it?). Real prize is whisky ...owns Bunnahabhain, Deanston, Tobermory and Ledaig. Px paid is $91.82mn... point here is that comps owned by rivals (Diageo, etc) are valuable ... regardless of how much whisky is sold, the actual asset and IP is worth $$ and companies are willing to pay up for it.

Campari is still too rich for my tastes — you can find better buying at Brown Forman, Diageo, and Pernod … I think the cycle still takes a couple of years to turn …

Fashion report — I know, I know, but fashion weeks are on right now — Milan is in full force — I’ll be wearing the fabulous silk cape. I really liked Simone Rocha’s collection in London — light, playful, expressive and I think eminently sellable. The more simple looks, like sleek coats and long skirts, felt commercial without being too boring.

I was lucky enough to be in London modelling for Simone — so I am a little biased. Thanks for having me, Simone. Was a pleasure.

This is the bear case for Hermes. It is a fabulous company with fabulous margins, but it trades at a very high multiple. It relies a lot on China. China is economically screwed in many ways, because of high debt and slowly manufacturing — note they are buying less raw materials from Australia.

It is dangerous to rely on China. It’s also dangerous to assume the desire for Birkins exists forever. I like Hermes at a lower multiple. Price is what you pay…value is what you get.