Disney War! Iger 1, Peltz Nil. Shari's Sharnomics

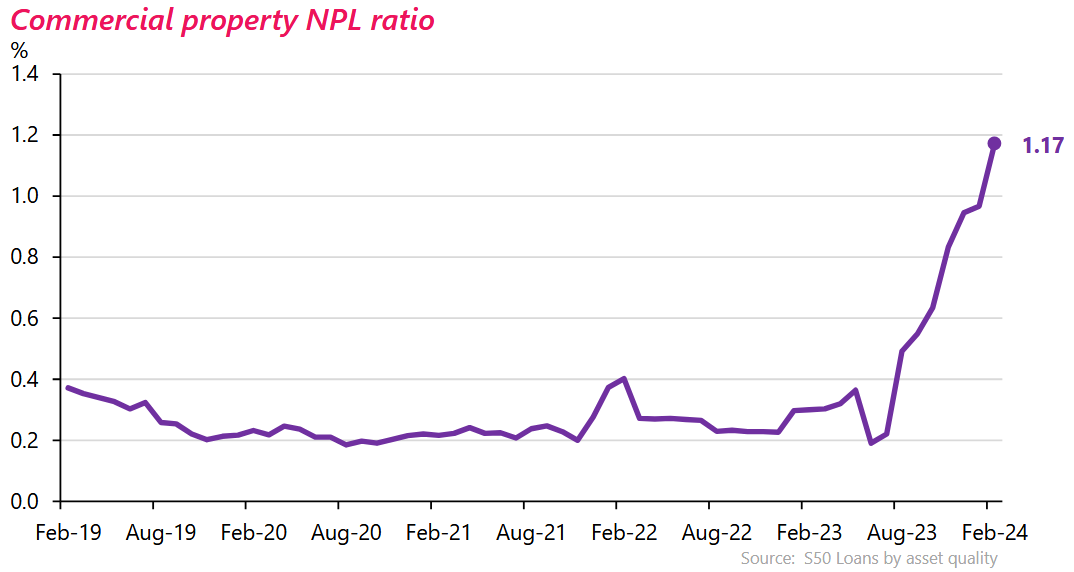

Chart of Interest…NZ non performing commercial loans (see the end of this email for more)

Iger - 1, Peltz - Nil

Nelson Peltz (best known to the Gen Z’s as Brooklyn Beckham’s father in law) failed in his bid to make it to the board of Disney, while Disney’s entire slate of nominated directors was elected. DIS stock down ~3% on the news (Peltz starting to sell off his block? Wouldn’t be surprised). It’s the battle that never was. Now Iger has serious work to do — there’s still the movie segment to fix, because nobody watches Marvel movies anymore; they milked that cow dry. There’s also the question of a successor — Iger needs one. His last hand-picked successor, Bob Chapek, went pretty badly. No pressure, Bob — just all the pressure.

Sharinomics — Paramount stock +15% intraday

If you get the paid version of this newsletter you would’ve read me yesterday complaining about the stock price of Paramount — of course as soon as I send it out something happens. David Ellison (son of Larry) has entered into exclusive talks with our girl Shari to buy National Amusements Inc, Shari’s holding company. Shari has good reason to do this — she owes +$125mn to her advisor, Byron Trott (regular readers will know that Trott is daddy Buffett’s favourite banker). A sale to Ellison of NAI frees Shari of those shackles — remember, NAI has supervoting shares in Paramount that give the co ~77% voting power. An Ellison deal, at this point, would look like i) Ellison buys NAI via his company, SkyDance; ii) Skydance merges with Paramount. iii) Supervoting shares are abolished and Paramount becomes what…ParaSkyMountDance??

This whole thing has felt like the plot of Succession — legacy company has a complicated structure (billionaires love complicated structures) — a sentimental daughter attached to a trainwreck with a lot of debt — a bunch of whacky suitors (Apollo! David Ellison! Zaz!) — a billionaire who owns the most economic interest in the company who has said nothing publicly about it (Buffett)1. Now, maybe, a deal is in sight. I had to laugh at the FT’s comments section:

I don’t actually think the deal is a bad idea — Ellison is cashed up (Larry is worth like, a hundred or so bil) and Skydance has collaborated with Paramount for a long time anyway (Mission Impossible, True Grit, etc).

The question I have is price. Apollo offered $26bn (~$11bn cash + debt). That figures a value per share of $17-19.50. NAI isn’t worth that much — it’s basically a controlling interest in Paramount, some debt, and some ailing cinemas that Shari’s father built a long time ago. The merger cost is a different story. If Ellison is made the new king of NAI with ~77% voting power he can’t just go ahead and say hey, I’d like to buy Paramount for $100 and a cheeseburger, and you have to, because I’m the controlling shareholder. I mean, that’s illegal.

Nobody knows what a merger price will look like. One would assume that it’s within the same ballpark as what Apollo offered for Paramount (if it’s not, they risk shareholders taking Shari and co to court and accusing them of favouring Shari’s interests rather than shareholders). Ellison and Shari have 30 days to come to an agreement. Time’s a ticking.

NZ

BAI —

I can’t stop (won’t stop) talking about Being AI. Sorry not sorry. Today the market cap soared to $130mn (it was ~$90mn y’day) on the back of ~$40k in volume. At this point I’m just laughing - it’s kind of funny — remember when Vietnamese electric car company VinFast (I know — it sounds like a wine delivery service for bored moms) became valued at, roughly, $190bn USD. VinFast obviously floated a tiny portion of stock and benefitted from more demand for the stock than allowed by the very thin and very small float. I’m not saying this is what is happening here. I’m just saying — $130mn market cap for a school on the North Shore and a couple of old tech companies. That…seems like a lot?

Anyway, NZ Reg Co wrote them a letter asking whether the company breached listing rule 3.1.1 (i.e. the requirement to publish material information). The Reg Co had a responsibility to ask this, as the stock has gone from being worth 1.4 cents per share to ~5 cents per share within a couple of days (even though I think the answer is much easier — the co didn’t float enough stock).

Here’s the response from Being AI:

OK.

Comings and goings —

New CEO at NZ Super (link) and CIO Steve Gilmore is departing to the giant CALPers (link). NZ Super has returned ~10.00% over the last 10 yrs, while CALPers has lagged at ~7.1% in same the time period.

The (big) buck stops here — high paid CEOs

I am (famously) disdainful of CEOs who are paid a lot to deliver mediocre returns. EBOS CEO John Cullity is the highest paid CEO of the cohort and I’ve no problem with that — Cullity has led EBOS well. They acquire good businesses at not stupid prices and, alongside Infratil and Mainfreight, represent the “best of the best” on the NZX of the last 20 years — IFT and EBO are basically serial acquirers, while MFT does one thing (freight) and does it extremely well. All three companies have very humble cultures that do not merely “speak” transparency and accountability — they walk the walk. Cullity was remarkably forthcoming at EBOS’ recent ASM, and avoided all forms of corporate double speak that seems to plague the C-Suite class. As the Irish say — “well done that man'“ — Cullity is more than deserving.

Ditto Don at MFT and David at Skellerup — this is competent management being rewarded. However, the fact that the respective CEOs of Fonterra, Fletchers, SkyCity, KMD and The Warehouse have been paid so much is detestable in light of poor performance. Fletchers I have covered ad hominem — the fact that they hired consultants to “fix” their issues is a red flag — the fact that they have a PR firm to deal with the fallout of Taylor and co’s poor performance is another. PR firms and the like waste the money of shareholders — it is a wanton and unjustified expense. Ditto The Warehouse — writing off Torpedo 7 and The Market should write the company’s McKinsey-informed “agile” strategy into the annals of Kiwi history as some of the worst of the last decade or two. Here’s Wazza Buffett, in 2003:

Warren E. Buffett, the billionaire investor, says that companies will not regain investors' trust as long as compensation for chief executives, including stock options, keeps rising while the share prices of their companies fall.

''What really gets the public is when C.E.O.'s get very rich and stay very rich and they get very poor,'' Mr. Buffett told chief executives at a conference on corporate governance on Friday night in Charlotte, N.C.

Here here. I am not some kind of sword-wielding avenger in search of every mediocre CEO — in general we advise our clients to just avoid those companies — but it is remarkable in NZ that we continually host such a clutch of poor performing CEOs. See below — look at those lower three…it’s not exactly inspiring.

Quassie

I always have loved John Hempton. He is irascible and grumpy and difficult — my kind of guy. Here he is betting that more companies are going to go bust:

Bronte’s John Hempton has told his inventors that the so-called junk rally – which this year drove global equities to their best quarter since 2019 – had allowed “very suspect companies to obtain billions of dollars of debt”.

I speak to a lot of lawyers (we love the lawyers) and the ones who work in liquidations and corporate restructurings all tell me — with no uncertainty — that this is the busiest time for them since the GFC. Note the below chart.

No I am not saying that hell is coming, but I am saying — hey, this is interesting.

Yes, I know Berkshire has sold some PARA stock recently.